At the moment we will likely be highlighting the details from the finances 2023 that may be most related for the salaried folks.

1. There isn’t a change within the outdated tax regime.

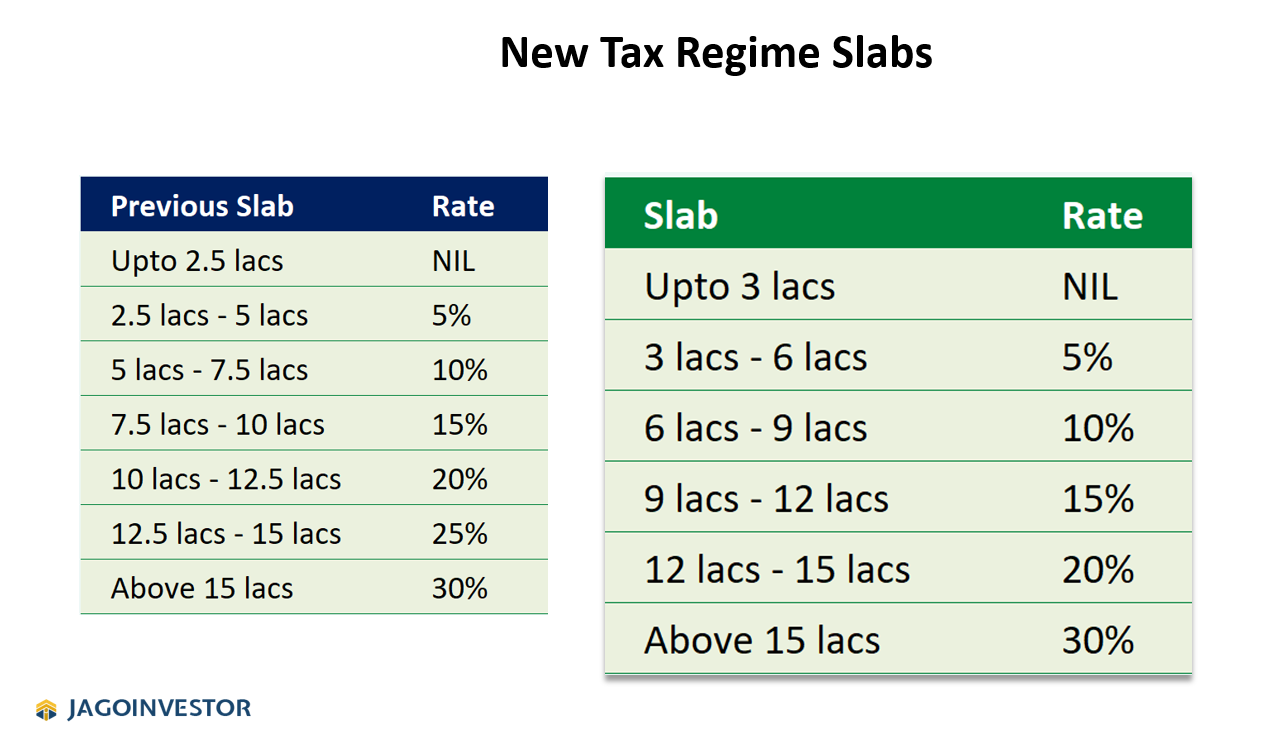

So very first thing to know is that the outdated tax slabs stay unchanged. The slabs are similar like final 12 months that are as follows

2. New tax regime tax slabs made extra engaging

The taxation slabs obtained higher within the new tax regime, that are as follows. The taxation obtained higher for center class and all of the individuals who will select new tax slabs can pay decrease tax. Listed here are the brand new and former slabs

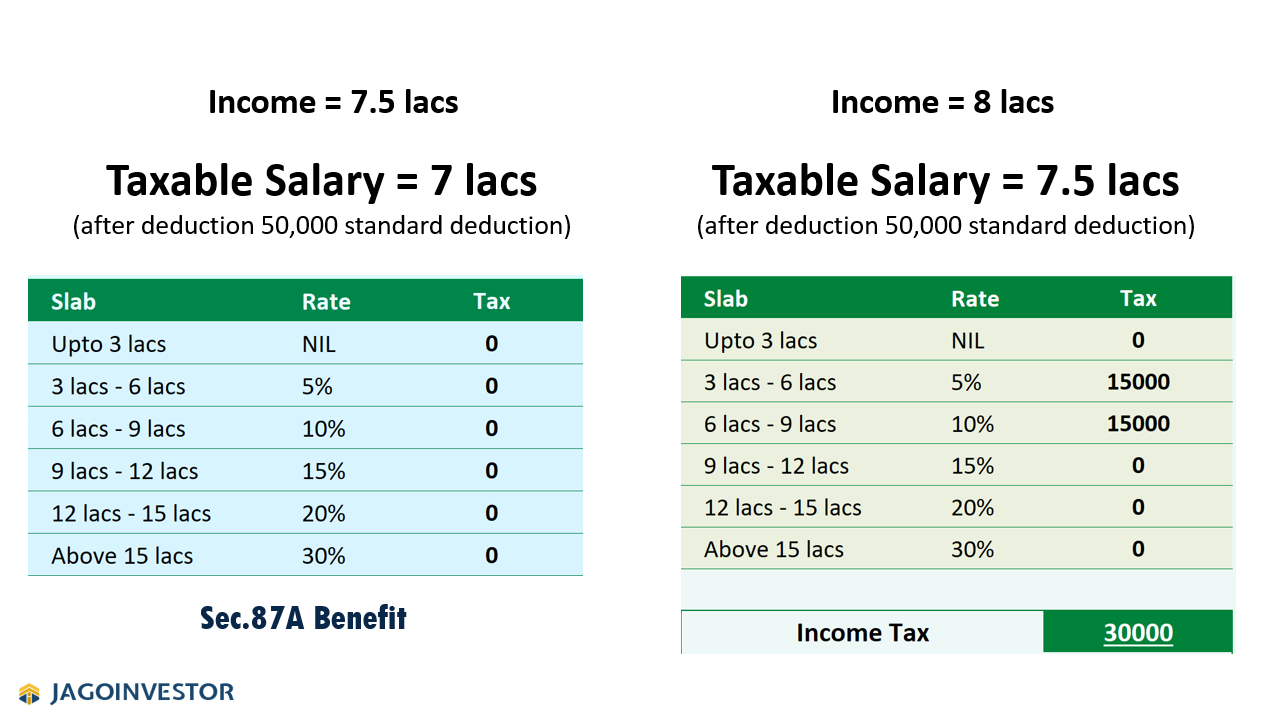

3. Normal Deduction of Rs 50,000 in New Tax Regime

Earliar, the usual deduction of fifty,000 was obtainable just for the outdated tax slab, however on this finances its additionally prolonged to the brand new tax regime. Which signifies that one can immediately cut back their earnings by 50,000 earlier than discovering the taxable wage.

4. No Tax as much as Rs 7 lacs earnings beneath new tax regime

Its time to cheer up, as one is not going to be paying any earnings tax if the taxable wage is upto 7 lacs. This merely signifies that an individual incomes upto 7.5 lacs is not going to pay earnings tax as a result of there will likely be commonplace deduction of fifty,000 now which is able to ensure you come beneath that 7 lacs restrict. right here is an instance the place we present

Primarily based on the data above, when does it make sense to decide on between new and outdated regime?

When to decide on New Tax Regime?

- Earnings is lower than 7.5 lacs

- Your Complete deductions are lower than 2-2.5 lacs (when you declare simply 1.5 lacs in 80C and 50k to 1 lac in different issues)

When to decide on outdated tax regime?

- Your exemptions and deductions are very excessive like 4-5 lacs ( while you declare full 80C, 80D, HRA, LTA and residential mortgage curiosity)

Previous Tax Regime will almost certainly get killed !

Govt has made its thoughts and aiming to maneuver in direction of the straightforward tax construction with minimal compliances. In future there will likely be no 80C , HRA, 80D , house mortgage pursuits or any form of deductions. Slowly New Tax Regime will likely be made engaging and outdated tax regime will likely be abolished.

5. Senior Citizen Saving Scheme Restrict raised to 30 lacs.

The senior residents will really feel extraordinarily glad after this modification because the restrict in Senior Citizen Saving Scheme has now elevated to 30 lacs which was earlier 15 lacs. The present rate of interest is 8% for the Jan-March 2023 quarter

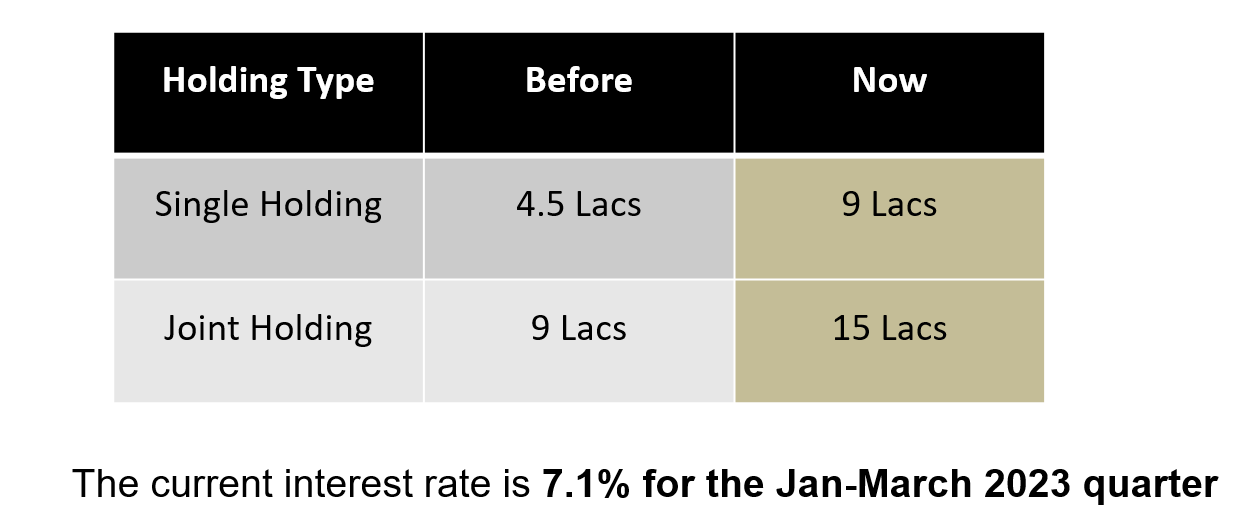

6. Put up workplace MIS restrict raised

This clearly reveals a glimpse that this finances was in favor of the salaried class. Nationwide Financial savings Month-to-month Earnings Account the earlier limits have elevated.

7. Go away Encashment is tax free upto 25 Lacs.

Now one is not going to must pay any earnings tax once they get the go away encashment quantity upto Rs 25 lacs on the time of retirement or leaving their job. This quantity was set at Rs 3 lacs until date which was set lengthy again and was very low. So if one will get 40 lacs as go away encashment, then there wont be any tax upto Rs 25 lacs and relaxation 15 lacs will likely be taxable.

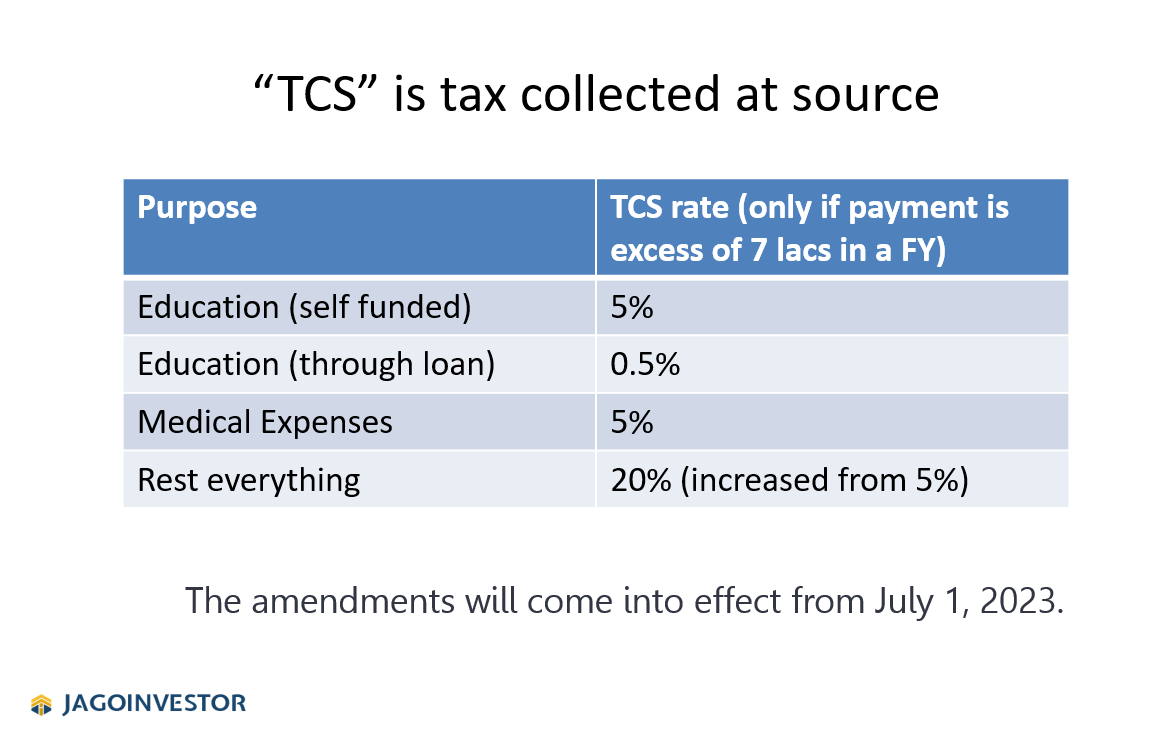

8. 20% TCS on international remittances beneath LRS scheme

Taking a international tour bundle or investing overseas will improve one cashflow, as there’s a 20% TCS price now. which signifies that it’s a must to pay an additional 20% cash which will likely be deposited as advance tax out of your facet to govt while you make any excessive quantity transactions which sends cash to international. That is relevant solely when the quantity is greater than 7 lacs.

Beneath had been the slabs ..

Notice that this TCS quantity isn’t the TAX, however advance tax, which signifies that on the finish of the 12 months you’ll be able to regulate it along with your complete tax payable or declare it again by submitting a refund in your ITR.

9. Conventional Life Insurance coverage insurance policies maturity quantity is taxable if the premium is greater than 5 lakhs

All life insurance coverage insurance policies proceeds as earnings/maturity will likely be now be taxable if mixture premium paid per 12 months by the particular person is greater than 5 lacs. Mixture premium means complete of the premium paid in a 12 months by the particular person in his title from all form of insurance coverage insurance policies

- This rule is relevant just for all insurance policies issued after 1st Apr 2023. All previous insurance policies doesn’t get impacted

- This rule doesn’t apply for demise profit (if somebody dies and household will get the cash, then its tax-free

- This rule additionally doesn’t apply for ULIPS

10. Capital Features exemption on investing in different property is capped at 10 cr

Until now there was no restrict on the capital beneficial properties exemption beneath sec 54 and 54F, which signifies that you might purchase one other property with all of the capital beneficial properties and simply not pay any tax. However now you’ll be able to solely do that until 10 cr.

That is anyhow going to affect solely tremendous HNI who deal in properties price multi crores.

Tell us if in case you have any question on finances 2023. We hope you bought a good concept on all of the adjustments made.