We simply entered 2020, and I believed let me pen down some observations of the final decade.

I had began running a blog from the final 12 yrs and it’s been fairly an extended and wonderful journey. From a small weblog, we at the moment are one of many greatest private finance web sites in India with tens of millions of readers benefitting from our work.

We had carried out dozens of workshops, interacted with hundreds of buyers and offered paid providers to tons of buyers throughout India and overseas.

So I believed that I’ll share what adjustments I’ve seen within the final 10 yrs within the private finance trade and what are some adjustments I’m anticipating within the coming decade.

1. Folks wish to purchase “time period plan” now

Again in 2009-2010, the idea of the time period plan was simply launched. Aegon Religare was the primary entrant within the area and only a few folks had heard about time period plan. A variety of my time and vitality went into convincing folks within the feedback part to purchase a time period plan and never a money-back plan.

Not like as we speak, the ads on TV additionally didn’t point out the phrase “time period plan”.

Within the final 10 yrs, time period plans have grow to be fairly well-known and the default alternative for developed buyers for his or her insurance coverage wants. Now everybody “is aware of” that time period plan must be purchased for insurance coverage functions.

Similar is true for Medical health insurance additionally

2. Enormous consciousness about “Mutual funds”

It’s been round 25 yrs when mutual funds have been correctly launched in India (not contemplating UTI-64), so even in 2009-10, mutual funds have been fairly previous merchandise, however even throughout these occasions, they weren’t very well-known merchandise. It was a giant PUSH Product, which signifies that varied advisors and distributors had to spend so much of vitality into sharing about mutual funds and the way in which it labored.

No TV adverts ever talked about about mutual funds. Even using know-how was fairly sluggish, so there was no idea of on-line investing, on-line redemptions, and so forth, and processing of KYC used to take months.

With the “Mutual fund Sahi hai” marketing campaign for the previous few years, mutual funds have grow to be a buzz phrase and everybody has at the very least heard about “mutual funds”. Now buyers flock to on-line apps and are prepared to spend money on mutual funds. From Rs 5 lacs crore AUM in 2010, the present AUM is 27 lacs crore in mutual funds. That’s a powerful 18% CAGR progress.

3. Belief points with ULIPS

Again in 2010, there have been horror tales of ULIP misselling. I used to get so many feedback about how folks have been missold ULIPs product and so they weren’t getting again their cash.

Someplace in 2014-15 that episode ended and buyers simply stopped even touching ULIPS. Now ULIPS have made a comeback with a lot better buildings and they’re approach higher than what they have been was.

Now should you purchase ULIPS, they aren’t that unhealthy, nonetheless, I nonetheless don’t purchase the argument that ULIPS are nice merchandise now (extra on that later). Subra has executed a fantastic write up on ULIP’s right here

4. Dependence on Loans has elevated

In comparison with the final decade, we are able to clearly see the utilization of credit score for varied issues in life. Begin from holidays, vehicles, homes, furnishings, and even cellphones. You title it and it’s all out there on credit score.

You may even purchase a Rs 4,000 saree in Varanasi retailers and pay in 6 straightforward installments. Bajaj finance has made certain that it’s potential now. You may clearly see the pattern of over-dependence on credit score in such a approach that the inventory costs of Bajaj finance have gone up.

5. Monetary Planning + Targets Planning turning into well-known

The excitement about “monetary objectives” and “monetary planning” is extra now. Again in 2010, monetary planning was an alien phrase. It regarded like somebody is making an attempt to cheat you and earn cash with out offering something invaluable. However the monetary planning neighborhood has made certain that the phrase “Monetary planning” reaches increasingly folks.

Right now’s city buyers are pondering of varied objectives and now to “plan” for it. It’s quite common to listen to folks saying that they wish to make investments for the longer term training of their kids” and “retirement”.

6. Extra Selections and confusion for buyers

In comparison with the final 10 yrs, now we’ve too many services and products, and many individuals claiming to work for investor’s pursuits. We’ve got superior merchandise like Robo advisory, small case, and whatnot.

The world of non-public finance has grow to be extra complicated now in comparison with the previous which additionally will increase the probabilities of an investor making extra errors and on the similar time additionally decide higher choices for themselves if they’ve correct understanding.

7. Extra spending on life-style

I keep in mind, in 2010 I used to be in Bangalore and I saved near 60% of my earnings. There have been only a few avenues to spend and the utmost, I did watch motion pictures within the theatre and went on treks.

Buyers have additionally moved from the class of “savers” to “spender’s first, then savers later”. We now have on-line purchasing, meals on supply, worldwide holidays on EMI’s, and so forth ..

Actually all the pieces is out there to you should you can afford to pay the “EMI” (not the product). Do learn my article 7 Unimaginable the explanation why you spend extra money every month & how one can management it associated to spending.

8. Shifting from Bodily belongings to Monetary Belongings

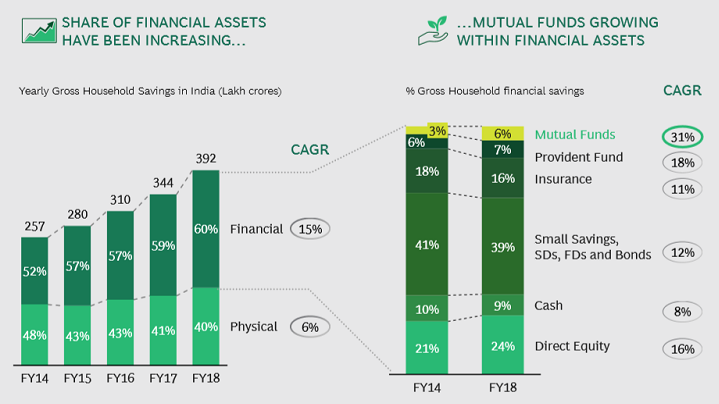

Whereas the tempo is sluggish now and we nonetheless have an extended approach to go. Persons are shifting from bodily belongings (gold + actual property) to Monetary belongings (fairness mutual funds, shares, PPF, FD). As per a Karvy report, in 2014 round 48% of belongings held by Indians have been bodily, however in 2018, it got here all the way down to 40%.

The mutual funds itself has gained from 3% to six%, and direct fairness went up from 21% to 24%, nonetheless, we nonetheless have an extended approach to go on this area

9. On-line Wallets + Money backs are a lifestyle

Within the final 10 yrs, I noticed the emergence of on-line purchasing web sites like Amazon and homegrown Flipkart. We noticed uber and ola in our lives and are additionally seeing how swiggy and Zomato are altering the way in which we’re having our meals.

All these apps introduced the idea of on-line wallets and cashback which in my view is doing extra hurt to us than serving to us. It’s extra of a advertising and marketing tactic and ensuring that shoppers are at all times within the maze of amassing factors/money again to spend it for the subsequent order.

A lot of the web sites have stopped giving “reductions” and as an alternative give “cashbacks” which is nothing however a future low cost. Which means you’ll have to once more spend and in whole, the quantity of profit for you is usually lower than what your thoughts perceives. And cease pondering that you simply “discovered” an superior coupon, it’s really given to you by corporations to be sure to really feel higher whereas transactions. It’s simply pampering!

10. On-line Frauds and Scams have elevated manifold

On-line transactions like internet banking, cell funds, and use of debit and bank card has elevated in lots of folds in India within the final decade. Which additionally gave rise to on-line frauds and scams. Probably the most weak have been the senior residents and people individuals who had very much less understanding of how banks and insurance coverage corporations work.

Many individuals obtained a name within the title of RBI, IRDA and SBI financial institution the place the fraudster tried to realize entry to their OTP and different important particulars and many individuals misplaced a giant quantity to those frauds.

I even created a video on this.

Right now in 2020, the fraudsters at the moment are utilizing google pay to cheat folks.

11. Introduction of Robo-Advisory

In previous couple of years, there are platforms which can be selling the idea of Robo-advisory. I feel delivering recommendation by means of algorithms is an concept value making an attempt and appears cool. There are actually some elements of recommendation that may be delivered by means of automation, however there’ll at all times be some elements of advisory which would want a human component.

Right here is Robo-advisor definition from Investopedia

“Robo advisors are digital platforms that present automated, algorithm-driven monetary planning providers with little to no human supervision. A typical robo advisor collects info from shoppers about their monetary state of affairs and future objectives by means of a web based survey, after which makes use of the information to supply recommendation and/or mechanically make investments consumer belongings.”

In spite of everything, buyers are people and so they have emotions. We’d like somebody to speak to, share our insecurities and likewise take human-advice. Robo-advisory is nice in all elements that are pure formulation primarily based, however wherever human feelings will come, you would want a human there, except you your self are a robotic!

What do I anticipate within the subsequent decade?

I’m not an skilled in predictions, however nonetheless, I’ll strive it out. Right here are some things which my intestine feeling says might occur within the subsequent decade (learn round 2030)

- Rise of Skilled Recommendation – The extra we work together with individuals who go away their inquiry with us for monetary planning, we’re very satisfied that persons are not in a position to handle their very own monetary lives. They want skilled assist as soon as they’ve reached a sure internet value. You may be having a Rs 10 lacs portfolio as we speak and also you may be managing it, however as soon as it turns into Rs 1 crore portfolio, you’ll be able to perceive that it may have been 1.5 crores with skilled assist.

- Rise of materialism – We as a rustic haven’t seen large spendings at house and we’ve been historically savers. We at the moment are opening as much as spending and I can see we’re additionally having fun with it. Whereas the incomes are growing, the avenues to spend are additionally going up and I can sense that we are going to be spending an excessive amount of on manufacturers, enjoyment, consuming out, worldwide holidays and whatnot. We are going to rejoice possessions increasingly within the come decade. Right here I’m speaking in regards to the general nation as a complete.

- Retirement Time-bomb – In my newest discuss with Subra, he talked about that the retirement disaster is correct in entrance of us even now, not simply sooner or later. We’ve got a penniless guardian to care for even now, however it’s not seen as a result of they’re dwelling with the earnings of their son/daughter and it’s not seen. With households getting increasingly fragmented sooner or later, we’ll see increasingly senior residents with out a lot of retirement financial savings and it’ll ring an alarm bell-like no earlier than.

- Mutual Funds shall be a giant factor – Mutual funds revolution has simply begun in India. Even proper now, the quantity of people that spend money on equities is simply 2-3% of the entire inhabitants. A giant a part of our inhabitants has to nonetheless make investments and when that occurs, we’ll see huge progress in mutual funds (and different area too).

- Heavy adjustments in Financial system and Infrastructure – We’re standing as we speak on the similar place, the place China was within the ’90s. We’ve got very large potential relating to Infrastructure constructing and we’re already on it, although it’s not stepping into a easy approach as in comparison with China. We are going to see much more freeway’s, Metro, rural infrastructure developing and far greater and excessive rise buildings in all places. Our financial system is already close to the J-curve and over the subsequent decade we’ll see great progress as the subsequent lot of inhabitants will enter into jobs and transfer from small villages/cities to larger ones.

As of now, I may consider these 4 factors – however I wish to hear from you about your opinion on what all we’ll see within the coming decade!