Picture supply: Getty Photographs

The minimal holding interval I take into consideration after I purchase FTSE 100 (or any) shares is at the very least 5 years. That doesn’t imply I gained’t promote earlier than if one thing goes unsuitable (aggressive pressures, fraud, hostile regulation, and so forth).

Conversely, when issues go effectively, I’m keen to carry indefinitely. Listed below are two Footsie progress shares I’ve owned for years, however that I at present intend to maintain holding until at the very least 2030.

At first look, Video games Workshop (LSE: GAW) may not look like a progress inventory. The corporate sells tabletop wargames, notably Warhammer, and related miniatures. It has been doing so for many years.

Nevertheless, the truth that the inventory’s up practically 200% in 5 years and now a member of the FTSE 100 index tells its personal story.

The corporate’s fundamentals are elite degree. It sports activities a 40% working margin, generates an extremely excessive return on capital, and possesses a pristine steadiness sheet. With a lot surplus money sloshing about, dividends are sometimes beneficiant.

In March, Video games Workshop mentioned buying and selling had been glorious in January and February, giving it confidence that pre-tax income for the complete yr (ending 1 June) would are available in greater than anticipated.

As AJ Bell funding director Russ Mould identified on the time: “Video games Workshop is displaying resilience within the face of a troublesome market backdrop and it’s spectacular the way it has prospered this yr.”

Talking of a tough backdrop, the corporate does face the prospect of potential US tariffs. In the meantime, a recession would pose a threat to progress if prospects tighten purse strings.

Wanting additional out although, I anticipate Video games Workshop to continue to grow its international fan base, particularly in Asia. And there must be extra exploitation of its wealthy mental property, notably by way of Warhammer TV content material in partnership with Amazon Prime Video.

In contrast to Video games Workshop, Scottish Mortgage Funding Belief (LSE: SMT) might be thought of a little bit of a FTSE 100 stalwart. It hasn’t appeared again since becoming a member of in 2017, and now has a £10.6bn market-cap after a 150% share worth rise.

Nevertheless, the inventory stays 42% beneath a late-2021 peak. So it definitely hasn’t all been plain crusing (it hardly ever is with Scottish Mortgage!).

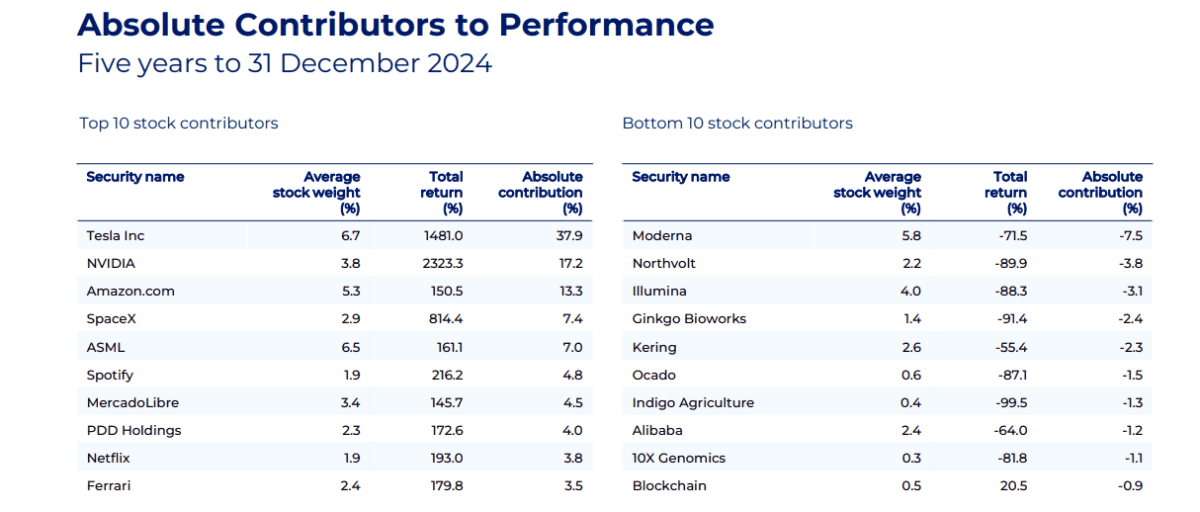

Plus, the managers don’t all the time make the fitting calls. They backed NIO as a substitute of BYD, Gucci proprietor Kering as a substitute of Hermès, and Northvolt as a substitute of anybody else (it went bust).

In the meantime, Scottish Mortgage has a doubtful observe file with biotechs. Within the 5 years to 31 December, half of the ten worst-performing shares had been biotechs. But the belief simply invested in one other one known as Enveda Therapeutics. So there’s a threat that the managers are venturing past their circle of competence, to make use of a Warren Buffett phrase.

As will also be seen although, the laggards are simply offset by huge winners. For instance, Nvidia had gained 2,323% within the 5 years to the tip of 2024. Non-public holding SpaceX was up greater than 800%!

Wanting on the portfolio at present, I see a number of shares that might generate sizeable future returns and drive the Scottish Mortgage share worth greater. These embrace e-commerce chief MercadoLibre, streaming large Spotify, and Netflix, which goals to greater than double in dimension and develop into a $1trn firm by 2030.