Picture supply: Getty Photographs

With a £20,000 annual restrict, the Shares and Shares ISA gives an efficient manner for many buyers to focus on a passive revenue in retirement.

Due to the large tax financial savings the ISA gives — to not point out the numerous compound beneficial properties share investing can ship — somebody who maxes out their £20k allowance may ultimately sit again and revel in an annual second revenue above £15,000.

Considering long run

However how real looking is that this goal? ‘Very’ is the easy reply, primarily based on the long-term returns of the worldwide inventory market.

Previous efficiency isn’t all the time a dependable information to the longer term. Nonetheless, the 8% to 10% common yearly return that share buyers have loved over the many years is a reasonably encouraging omen in my ebook.

Let’s break up the distinction, and say an investor with £20,000 of their Shares and Shares ISA can get a mean annual return of 9%. After 25 years, they might have a portfolio of £188,168, which — in the event that they invested in 8%-yielding dividend shares — ought to throw off an annual passive revenue of £15,053.

Choosing dividend shares

In fact, dividends are by no means, ever assured. However a diversified portfolio of, say, 20 or extra dividend shares can shield towards any company-specific shocks and assist to ship a steady second revenue over time.

Selecting corporations with sturdy stability sheets, market-leading positions, and a various vary of income streams also can assist buyers meet their passive revenue targets. It will also be a good suggestion to pick out corporations in rising industries alongside ones in additional mature, defensive sectors, as this could result in wholesome dividend development over time.

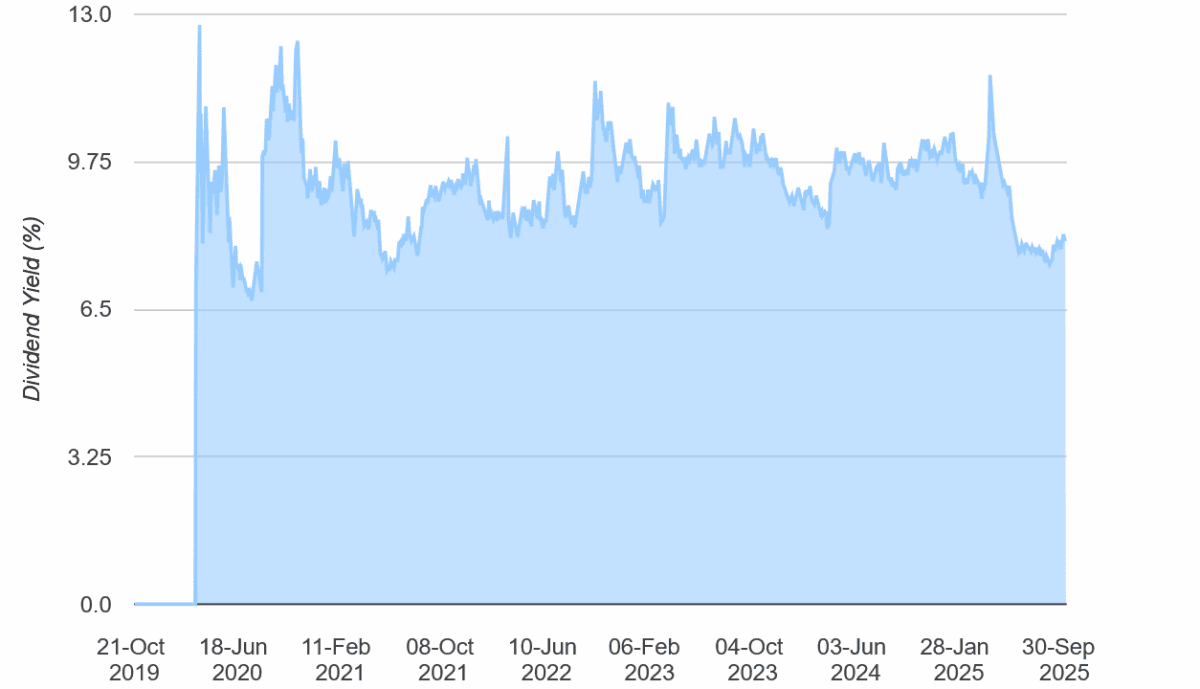

For example, M&G (LSE:MNG) is a UK dividend share I feel people ought to contemplate for a passive revenue. It’s raised annual payouts yearly because it listed on the FTSE 100 in 2019. And because the graph beneath reveals, its dividend yields have comfortably crushed the Footsie‘s long-term common of three% to 4%.

For 2025, its dividend yield is a gigantic 8.1%. And for 2026 and 2027, this improves to eight.4% and eight.7%.

A prime FTSE 100 share

Dividends may disappoint if financial situations worsen, dampening demand for M&G’s monetary merchandise. Nonetheless, the chance of additional rate of interest cuts may assist gross sales maintain up in an in any other case robust surroundings.

In addition to, the FTSE 100 firm’s robust stability ought to proceed giving it the arrogance to pay giant and rising dividends. As of June, its Solvency II capital ratio was a formidable 230%, greater than double regulatory necessities.

Over the long run, I’m assured earnings and dividends right here will rise strongly, pushed by ageing populations in its markets and a rising want for private monetary planning. As a part of a diversified portfolio, I’m assured M&G may assist ship the passive revenue of £15,000 — or maybe much more — {that a} £20,000 lump sum in a Shares and Shares ISA may generate.