Picture supply: Getty Pictures

For me, investing in UK shares with a Shares and Shares ISA and/or a Self-Invested Private Pension (SIPP) is a no brainer.

Information from cash comparability web site Moneyfacts exhibits why. Over the past 10 years, the common annual return on a Shares and Shares ISA has been a formidable 9.64%. By comparability, the yearly common on Money ISAs sits approach again at 1.21%.

That’s to not say that financial savings accounts don’t play an essential position. I personally use one to stability danger in my portfolio and to carry cash for a wet day. However the overwhelming majority of my capital is tied up in shares, funds, and trusts.

This fashion, I believe I’ve a a lot better likelihood of hitting my retirement objectives.

A transparent path

Let’s say somebody invested £400 a month in a Shares and Shares ISA and one other £100 in a Money ISA. If these price of returns of the previous decade remained unchanged, after 30 years our investor would have a portfolio of £880,996 to fund their retirement.

They may then use that cash to purchase an annuity, buy dividend shares, or make a daily drawdown for a wholesome passive revenue.

In the event that they selected to place the total £500 month-to-month sum right into a Money ISA as a substitute, they’d have made simply £216,879 over the identical timeframe to retire on. I doubt this is able to give them anyplace close to the £43,100 that the Pension and Lifetime Financial savings Affiliation (PLSA) says that single individuals have to retire on every year.

As I’ve already alluded to, investing in shares includes extra hazard than parking one’s money in a financial savings account. Nevertheless, by investing in a variety of various shares, people can cut back the chance they face whereas nonetheless focusing on sturdy portfolio development.

275 shares for a successful ISA

Shares and Shares ISA holders can simply and cheaply construct a diversified portfolio with an funding belief or exchange-traded fund (ETF). These pooled investments usually maintain dozens, or a whole bunch, and even 1000’s of belongings to seize totally different funding alternatives and unfold danger.

The JP Morgan American Funding Belief (LSE:JAM) is one such car I believe calls for critical consideration. With a mean annualised return of 14.48% since 2015, shareholder positive aspects right here have outstripped what the common Shares and Shares ISA investor has loved over that timeframe.

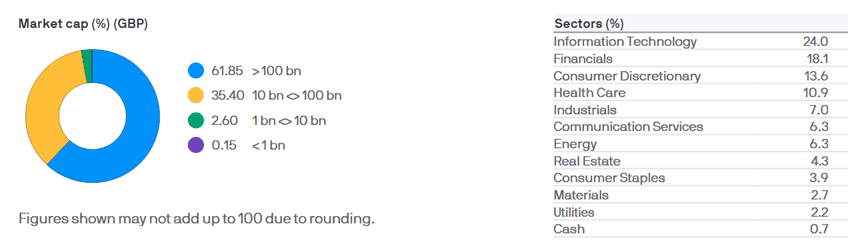

In complete, this belief has holdings in 275 totally different US equities unfold throughout each cyclical and defensive sectors. This offers it power all through the financial cycle. What’s extra, round 93% of its capital is tied up in large-cap corporations (these with market caps of £10bn and extra), giving buyers giant publicity to strong, market-leading corporations with cash-rich stability sheets.

Main holdings right here embody Microsoft, Amazon, Berkshire Hathaway, Nvidia, and Mastercard.

Whereas decreasing danger, this funding belief doesn’t eradicate hazard solely. As an illustration, returns right here may disappoint wanting forward if financial situations within the US worsen and/or international commerce tensions worsen.

However, for my part, the long-term resilience of the US inventory market means this belief nonetheless deserves critical consideration from ISA buyers.