Picture supply: Getty Photographs

I believe these UK-listed dividend shares are amongst to essentially the most fascinating passive revenue shares at current. As an added bonus to traders, I really feel additionally they supply good worth for cash.

Right here’s why I see them as value consideration proper now.

It’s essential to keep in mind that dividends are by no means, ever assured. Even essentially the most reliable dividend inventory can ship poor returns once in a while.

The JPMorgan Claverhouse Funding Belief (LSE:JCH) helps scale back a few of this threat. By spreading traders’ capital throughout 60-80 completely different firms — and with a give attention to secure large-cap UK shares too — it will probably present a strong second revenue, even when one or two firms dividend shares disappoint.

Claverhouse has greater than proved this robustness over time, with dividends rising yearly because the early Nineteen Seventies.

Right now, the funding belief carries a market-beating 4.8% dividend yield. It additionally trades at a 5.7% low cost to its internet asset worth, that means it provides tasty all-round worth.

Nonetheless, a give attention to British shares leaves it extra susceptible to regional shocks, however I nonetheless assume it’s a dividend share to think about.

Authorized & Basic — giant yields and constant development?

At 9.1%, Authorized & Basic (LSE:LGEN) shares carry one of many largest dividend yields on the FTSE 100 right now.

Investing in high-yield shares can typically appeal to hassle for traders. Tremendous-sized dividends can point out an organization that’s doling out unsustainable dividends to masks different issues.

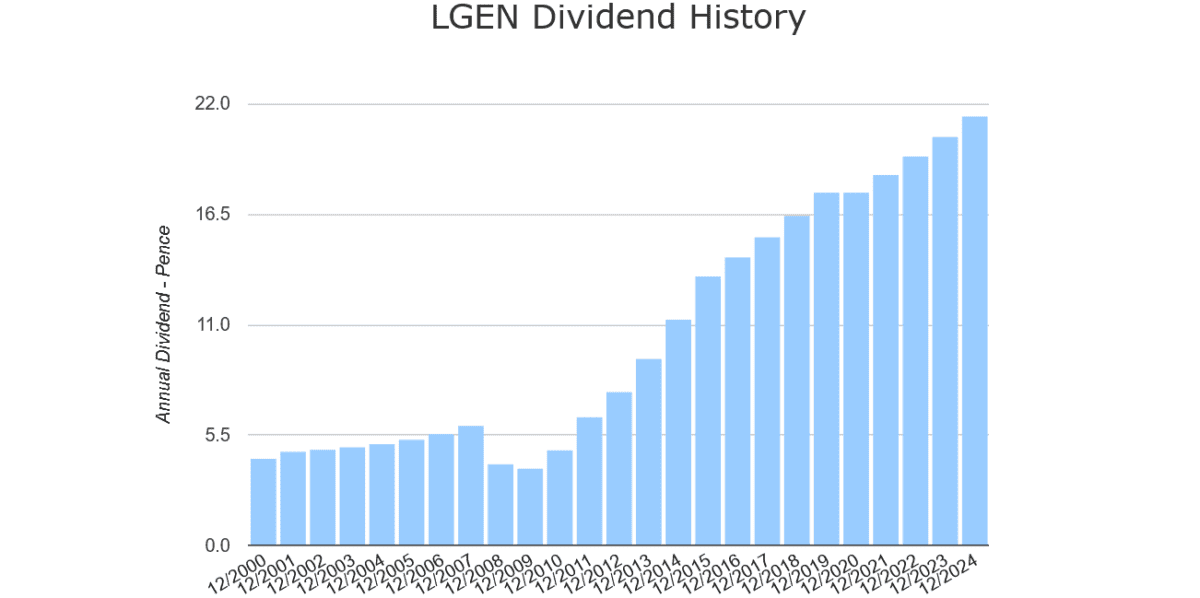

But that is removed from the case with Authorized & Basic. Dividends have grown yearly (bar 2020) since 2009. They usually’ve provided market-leading yields since then:

Previous efficiency isn’t a dependable information to future returns. However I’m anticipating the enterprise to stay a high passive revenue share over the lengthy haul. Regardless of aggressive threats, it has substantial scope to develop earnings as demographic modifications drive demand for retirement and wealth merchandise.

The monetary companies big additionally has strong monetary foundations to maintain paying giant and rising dividends. Its Solvency II capital ratio was a shocking 232% as of December.

Authorized & Basic shares presently commerce on a price-to-earnings (P/E) ratio of simply 10.4 instances. Their corresponding price-to-earnings development (PEG) a number of is at 0.1 too, under the accepted worth watermark of 1.

At present costs, I believe it’s good and may not less than be thought-about.

Vodafone — worth for cash?

Throughout all kinds of metrics, I additionally imagine Vodafone‘s (LSE:LGEN) one of many FTSE 100’s worth shares value taking a look at.

A contrarian decide perhaps, however like Authorized & Basic, its ahead dividend yield sails previous the three.7% common for UK blue-chip shares, at 6.4%.

The telecoms titan additionally appears to be like like a discount based mostly on anticipated income. Its P/E ratio for 2025’s an undemanding 9.4 instances, whereas its corresponding PEG studying’s 0.8.

Lastly, Vodafone’s price-to-book (P/B) ratio, at 0.3, additionally sits under the worth yardstick of 1. This means it trades at a reduction to the worth of its property.

It’s essential to notice that Vodafone lower dividends final yr to rebuild its steadiness sheet. And debt ranges stay excessive. However I’m optimistic that payouts can get well over time as restructuring to chop prices and enhance earnings rolls on. Surging gross sales in its African markets also needs to help rising dividends.