“Cash by no means sleeps,” mentioned Gordon Gekko within the 1987 movie ‘Wall Avenue’. Similar goes for India’s mutual fund market. It isn’t simply awake, it’s sprinting. July’s numbers from the Affiliation of Mutual Funds in India (AMFI) are right here and the fairness mutual fund inflows hit a record-breaking ₹427.02 billion. That is an 81% surge from June, marking the 53rd consecutive month of good points.

However why?

For one, alternative met timing. The US-India tariff battle and gradual company earnings induced a market dip. Retail buyers noticed a sale on Dalal Avenue and SIP inflows stored rising.

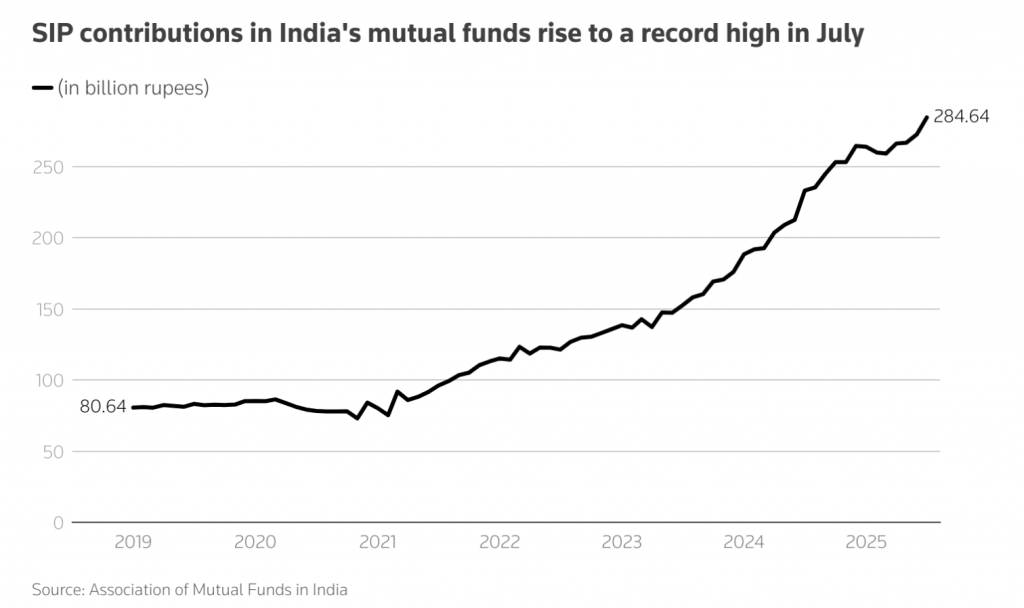

Fairness SIP Inflows

July’s SIP contributions hit an all-time excessive of ₹284.64 billion, up from ₹80.64 billion in 2019. That’s a 3.5x soar in simply six years. The variety of lively SIP accounts additionally climbed to 91.1 million, from 86.4 million in June.

This isn’t simply disciplined investing, it’s a sample.

Practically 92% of India’s under-30 buyers make month-to-month SIP contributions, which is ₹1000 per transaction. They might be investing smaller quantities than the over-30 crowd (by 18%), however they’re doing it usually.

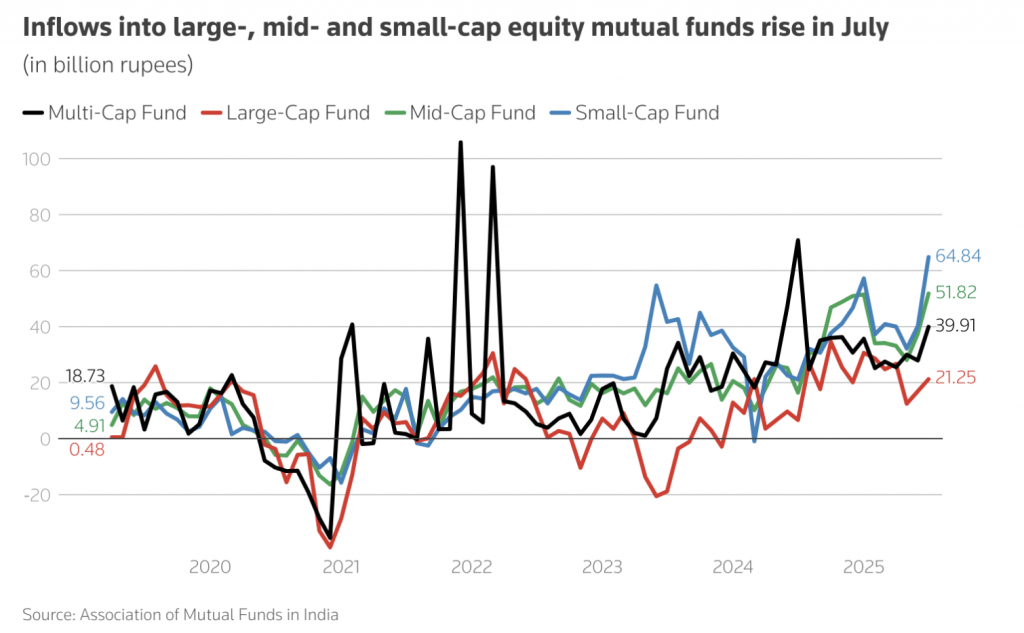

Mid and Small Caps

The information clearly reveals an urge for food for higher-risk and higher-reward performs. As A. Balasubramanian of Aditya Birla Solar Life AMC put it, “The rise in mid-cap, small-cap, and sectoral fund participation alerts a rising urge for food for diversified progress.”

Gen Z

Practically 48% of India’s mutual fund buyers are between 18 and 30 years outdated. In response to a report by Share.Market on India’s younger buyers in Mutual Funds on Worldwide Youth Day, 95% of Gen Z buyers start their mutual fund journey with fairness. Subsequently, they’re bypassing comparatively low-yield financial savings in favour of long-term compounding potential.

One other report by AMFI says that 81% of those younger buyers come from B30 cities. B30 cities are the cities past the highest Indian cities like Jodhpur, Raipur, Visakhapatnam, Gorakhpur, Mysore, Jamshedpur, Kolhapur and lots of others. These cities show that monetary literacy and market participation are now not simply restricted to the highest cities.

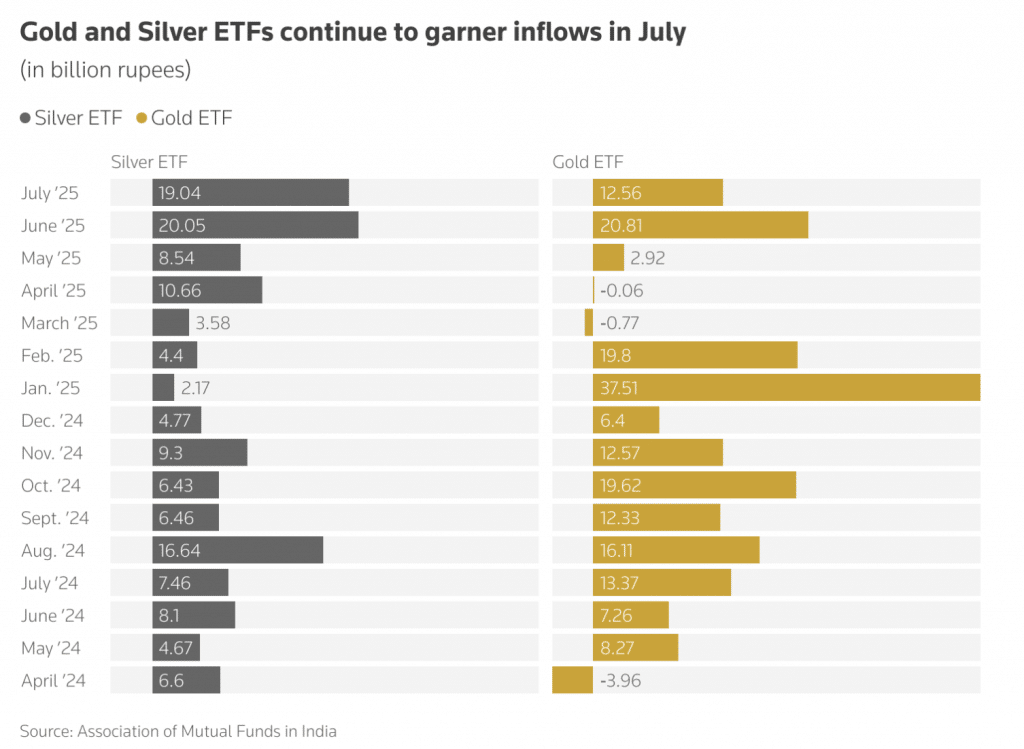

Gold and Silver ETFs

Whereas equities dominate, different property are quietly spreading their affect as nicely. Gold ETFs noticed inflows of ₹12.56 billion in July, silver ETFs drew ₹19.04 billion.

SEBI on Transaction Expenses

SEBI has scrapped transaction fees for mutual fund distributors. Asset administration corporations (AMCs) can now not cost any charges. Earlier, distributors had been eligible for such fees in the event that they introduced in a minimal subscription quantity of ₹10,000 as per SEBI. The choice adopted public consultations in Might 2023 and trade discussions in June 2025. SEBI noticed that distributors, being brokers of AMCs, are already remunerated by way of commissions, making extra transaction fees as pointless.

To Sum It Up

Regardless of risky earnings cycles, worldwide commerce tensions, and international investor pullouts, which totaled $2 billion in July, buyers are nonetheless rising within the mutual funds market. The report of ₹75.36 trillion within the Mutual Fund AUM signifies that retail buyers in India have grown extra affected person and assured.

Fascinated about how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Investing in Passive Funds