Picture supply: Getty Photos

Warren Buffett’s funding philosophy is famously grounded in simplicity and high quality, however he doesn’t put money into UK shares usually. He appears to be like for corporations with sturdy financial benefits — moats — that defend their earnings over time.

In accordance with Buffett, the best enterprise earns robust returns on fairness, operates via cycles with constant profitability, and is run by reliable, succesful administration.

He insists on cheap valuation. Shares ought to commerce under or pretty close to intrinsic worth, offering a margin of security. There are a number of methods to establish an organization’s honest worth, and Buffett may have his personal system. However any investor can search to construct their very own mannequin.

Buffett additionally emphasises sticking to at least one’s circle of competence. He tells us to put money into what we perceive, not fads or opaque industries. Lastly, he values endurance above all. He buys high-quality companies at wise costs and holds them for years, or ideally a long time. That is on the coronary heart of long-term compounding.

Does Melrose meet Buffett’s standards?

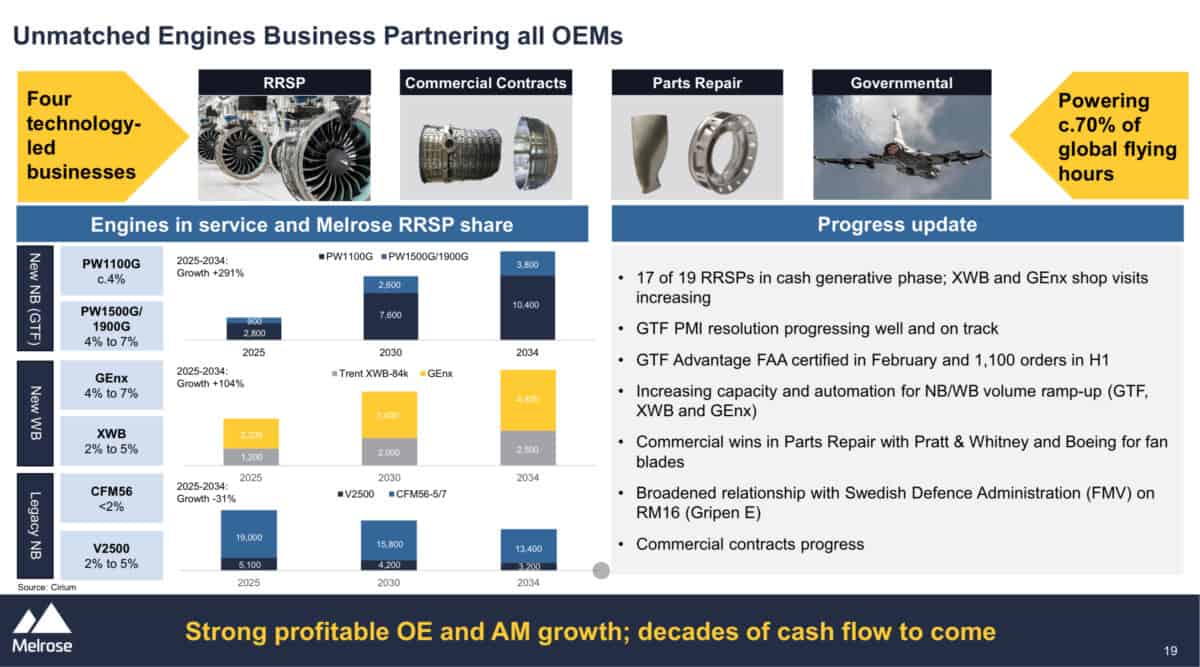

I believe Melrose Industries (LSE:MRO) might share a number of the standards that Buffett values extremely. Proper now, it trades at a ahead price-to-earnings (P/E) of 15.1. That’s actually not notably costly given the corporate is aiming to develop earnings by greater than 20% yearly via to 2029. Within the first half of 2025, adjusted diluted earnings per share rose 30% to fifteen.1p, powered by strong demand in aerospace, particularly via its GKN Aerospace subsidiary.

This provides us a P/E-to-growth (PEG) ratio round 0.75. That’s extremely low-cost in comparison with business friends like Rolls-Royce and GE. Each of those commerce with PEG ratios above two and P/E ratios near 40 occasions.

The corporate’s give attention to aerospace, a sector with excessive boundaries to entry and long-term contracts, contributes to a structural aggressive benefit. Its adjusted working margin enhancements reveal operational execution. It additionally boasts a sole-source provider place on 70% of its gross sales. That’s one hell of a moat.

Melrose additionally engages in lively capital allocation. Administration has pursued restructuring, share buybacks, and reinvestment into development areas, echoing Buffett’s desire for disciplined capital deployment.

Nonetheless, dangers stay. Its internet debt stood at £1.4bn on the finish of H1 2025. That is one in all my few considerations concerning the firm. It’s modest in dimension however sufficient that it nonetheless warrants monitoring as debt may turn into a drag on efficiency if rates of interest stick or if money movement falters.

The aerospace sector can also be delicate to produce chain disruptions, regulatory shifts, and cyclical downturns. If demand in defence or industrial aviation slows, earnings targets might come beneath stress.

All in all, Melrose combines enticing valuation, real development prospects, and an amazing financial moat. These are key Buffett-style hallmarks. Whereas not with out dangers, the corporate might characterize a UK-listed enterprise worthy of consideration for traders in search of long-term, high quality compounding. It’s now my high holding.