Be part of Our Telegram channel to remain updated on breaking information protection

The US Commodity Futures Buying and selling Fee (CFTC) has launched a brand new part of its “Crypto Dash” initiative whereas lawmakers have slipped an anti-CBDC provision right into a “must-pass” protection invoice.

Performing CFTC Chair Caroline D. Pham mentioned in an announcement that the regulator will start “stakeholder engagement” on all the suggestions made in a 166-page report launched by the President’s crypto working group, and can now take public enter from crypto market members.

“The Administration has made it clear that enabling rapid buying and selling of digital property on the Federal degree is a prime precedence,” Pham mentioned within the assertion. “The general public suggestions will help the CFTC in rigorously contemplating related points for leveraged, margined or financed retail buying and selling on a CFTC-registered change as we implement the President’s directive,” she added.

CFTC To Assist Ship Trump’s Promise To “Win On Crypto”

“The Trump Administration has ushered in a brand new daybreak for crypto, and it’s as much as market members to grab this chance to be part of the Golden Age of innovation,” Pham mentioned.

“I’m starting stakeholder engagement on all different report suggestions for the CFTC with the total assist of the President’s Working Group on Digital Asset Markets to operationalize President Trump’s promise to win on crypto.”.

Earlier this month, the CFTC launched the primary a part of its “Crypto Dash” initiative, which explored how the buying and selling of spot crypto asset contracts may very well be enabled on CFTC-regulated futures exchanges. It got here a few week after the White Home launched the report with suggestions about how digital property may very well be regulated within the US.

President’s Working Group Made 18 Suggestions To The CFTC

The President’s crypto working group made a complete of 18 suggestions to the CFTC. Two of those suggestions are involved immediately with the commodities regulator.

The primary direct steering requested the CFTC to offer clear steering on how cryptos may probably be thought-about as commodities, which crypto-related actions entities regulated by the CFTC can interact in, and the way decentralized finance (DeFi) companies can adjust to registration necessities.

The report then additionally requested the CFTC to contemplate how guidelines could be amended to accommodate blockchain-based derivatives.

The remaining 16 suggestions in regards to the regulator concerned different businesses such because the US Treasury and the Securities and Alternate Fee (SEC).

It’s a brand new day. Onwards 🇺🇸🫡 #ProjectCrypto @SECPaulSAtkins @SECGov @CFTC @A1Policy pic.twitter.com/kChRm036Mg

— Caroline D. Pham (@CarolineDPham) July 31, 2025

The SEC has additionally began appearing on the White Home’s crypto coverage suggestions. Final month, it launched its personal “Mission Crypto” initiative, which SEC Chair Paul Atkins mentioned would modernize guidelines and rules round securities to “allow America’s monetary markets to maneuver on-chain.”

US Home Amends Protection Coverage Invoice To Ban CBDC

Whereas the CFTC and different businesses transfer towards implementing the adjustments from the White Home’s report, the US Home has added a provision to the nation’s protection coverage for the 2026 fiscal yr that bans the Federal Reserve (Fed) from issuing a central financial institution digital forex (CBDC).

The Home’s model of a invoice implementing the Nationwide Protection Authorization Act was shared by the Home Rule Committee on Thursday, and contains sweeping language that bans any research round or the creation of a digital forex by the Fed.

It does, nevertheless, enable the continued exploration of stablecoins and doesn’t prohibit “any dollar-denominated forex that’s open, permissionless, and personal.”

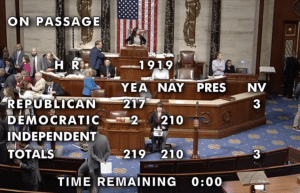

That’s after the Home handed the Republican-backed Anti-CBDC Surveillance State Act in July with a slim vote of 219-210.

Home Anti-CBDC invoice vote (Supply: US Home)

Normally, payments associated to army spending are “must-pass” as a result of they’re involved with how the US funds its protection funds. With this being the case, lawmakers typically slip non-defense-related provisions within the invoice as a result of they’ve a a lot increased probability of turning into legislation this fashion.

Because the standalone Anti-CBDC legislation now faces an unsure future within the US Senate, lawmakers have connected the legislation to the protection funds.

Home Republicans have been making an attempt to ban CBDCs for some time now, and tried to go a model of the CBDC-banning invoice within the final Congressional session. Launched by Consultant Tom Emmer in early 2023, this invoice didn’t advance and died on the final Congress.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection