Be a part of Our Telegram channel to remain updated on breaking information protection

An altcoin season might take off later this 12 months, pushed by the SEC’s anticipated approval of ETFs for smaller-cap tokens and a rebound in Bitcoin ETF inflows.

That’s in keeping with researchers at Bitfinex, who stated in analysis notice that such a “rising tide lifts all boats’ setting” is poised for later within the 12 months.

As soon as new crypto ETFs and Bitcoin ETFS begin to acquire momentum, they’re more likely to generate sustained demand, the researchers stated, including that this might create the situations “for a broader re-rating throughout the digital asset advanced.”

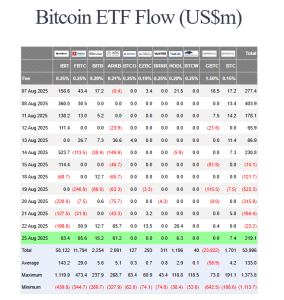

That’s as US spot Bitcoin ETFs ended a multi-day outflows streak with $219.1 million inflows on Aug. 25, knowledge from Farside Buyers exhibits. Prior to those optimistic flows, the funds had posted web each day outflows day by day final week.

US spot Bitcoin ETF flows (Supply: Farside Buyers)

The largest withdrawals for that interval occurred on Aug. 19, when buyers pulled $523.3 million out of the merchandise.

Crypto Buyers Displaying Softer Urge for food For Threat

The Bitfinex analysts additionally stated that buyers are presently exhibiting a “softer urge for food for danger.”

“Whereas capital inflows stay optimistic, the muted trajectory displays a extra cautious investor base, contrasting with the aggressive demand that characterised earlier ATH surges,” they wrote.

The researchers did, nonetheless, say that every one alerts available in the market level to “a wholesome longer timeframe” backdrop.

They went on to foretell that capital inflows will initially go in the direction of ETH, earlier than turning to a “broader set” of altcoins in “due course.”

“Altcoins are starting to see rotating liquidity flows, although we consider extra vital capital rotation into higher-risk property will solely emerge later within the cycle,” the researchers wrote.

Current flows for spot ETH ETFs assist that commentary. On the identical day that the US spot BTC ETFs broke their outflows streak, the ETH funds prolonged their optimistic flows streak to 3 days.

That’s after buyers poured $443.9 million into the funds collectively yesterday. BlackRock’s ETHA led the cost with $314.9 million inflows, whereas Grayscale’s ETHE was the one one to undergo outflows on the day.

Bloomberg Analysts Predicts “ETF Summer season” For Altcoins

Spot Bitcoin and spot Ethereum ETFs launched final 12 months, and have since seen billions of {dollars} in cumulative inflows. With this success in thoughts, issuers have now began exploring related funding merchandise for smaller tokens.

Bloomberg ETF analysts Eric Balchunas and James Seyffart have famous energetic engagement between the SEC and bidding issuers, main them to boost their odds that merchandise for altcoins will get authorized quickly.

Again in June, Seyffart and his colleague subsequently raised their approval odds “for the overwhelming majority of the spot crypto ETF filings to 90% or larger,” including that these funds getting the greenlight is not a matter of if, however when.

NEW: @EricBalchunas & I are elevating our odds for the overwhelming majority of the spot crypto ETF filings to 90% or larger. Engagement from the SEC is a really optimistic register our opinion pic.twitter.com/5dh8G8rK6Y

— James Seyffart (@JSeyff) June 20, 2025

The analysts then revised their odds for which altcoin ETFs will doubtless get authorized first. In a follow-up X publish, they predicted that merchandise for a basket of altcoins, Litecoin (LTC), Solana (SOL), XRP, and Dogecoin (DOGE) have a 95% success likelihood of getting the regulatory nod.

“We count on a wave of recent ETFs on this second half of 2025,’ they added.

That’s after Balchunas stated buyers ought to prepare for a possible “Alt Coin ETF Summer season,” with SOL doubtless main the way in which.

VanEck, 21Shares, Bitwise, Grayscale, Canary Capital, Franklin Templeton, Constancy and CoinShares have all filed with the SEC for their very own spot Solana ETFs. Many of those filings additionally included amended S-1 kinds, which helps Balchunas and Seyffart’s commentary that there was energetic engagement between the SEC and bidding issuers.

Other than SOL merchandise, there have additionally been quite a few filings for spot XRP ETFs following the closing of the yearslong case between Ripple and the SEC. Firms which have filed for these XRP merchandise embody Grayscale, Bitwise, Canary Capital, CoinShares, Franklin Templeton, WisdomTree, 21Shares, ProShares, RexShares/Rex‑Osprey, and Volatility Shares.

Comparable merchandise have additionally been filed for Cardano (ADA), Avalanche (AVAX), Polkadot (DOT), Aptos (APT), Sui (SUI), and Dogecoin (DOGE), in addition to meme cash similar to Official Trump (TRUMP) and Bonk (BONK).

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection