Over the previous couple of years, ITC (learn as Indian Tobacco Firm) has been within the information, because it strikes to demerge the resort enterprise from different core operations of the corporate. For retail traders such as you and me, it is a mega occasion as a result of ITC is a behemoth and after they determine to separate their companies, we get to study much more about investing by learning them reasonably than listening to ‘10 finest funding picks this 12 months’ from some fin-influencer.

It is a detailed account of my ideas on the inventory.

However first, an sincere confession.

The primary draft of this text was absolute bullshit. Since, I used to be extra considering drum beating about my funding prowess of shopping for the inventory when nobody wished and maintaining it within the portfolio for the final 3 years during which the inventory has almost tripled in worth.

That’s the place Mr Nandish Desai jogged my memory that I didn’t merely maintain it as a result of I didn’t have anything to purchase. I held it as a result of I used to be utterly positive in regards to the worth and potential of the enterprise. And demerger was an effective way to unlock it. Like an elder brother, he advised me that our job is to share our learnings and never chest-thumping.

With out losing a lot of your time, I’ll begin with the article now. There are particular sections the place you may really feel that you just already know this info, in that case, be happy to skip that part and transfer on to the following.

The intention of this text is to create a masterclass in understanding demergers by way of ITC.

ITC a Behemoth – A Transient Historical past

The corporate’s roots might be traced again to the common-or-garden streets of Kolkata again in 1910. In these days, Kolkata was the hub of companies as a result of its shut proximity to the Bay of Bengal because it enabled abroad commerce.

Spanning over 115 years, the corporate has expanded its product portfolio from cigarettes to resorts to agriculture to magnificence merchandise. The corporate

Supply: Jagoinvestor, ITC

Only a few firms might be related for 100+ years. This prolonged time interval speaks so much in regards to the firm’s administration and the best way it’s being run.

Typically as traders, we get utterly blindsided with the sort of work it takes to maintain such a big firm transferring. We’re all the time considering our cash rising and there’s nothing mistaken with it. It’s our expectations which are utterly incorrect to such a level that we count on a big cap to maneuver like a small cap.

We search for 30% to 40% progress in such firms 12 months on 12 months. Effectively, let me be sincere with you, it’s not doable in any respect. No matter which fin-fluencer says, it’s merely not doable.

Visionary firms don’t simply stick to 1 product line alongside the best way, they diversify. There’s a college of thought in lots of seasoned traders that diversification must be in associated industries solely. Else, it turns into a money guzzler of types.

However right here’s the distinction.

India’s economic system opened up in 1992. Meaning, Indian firms needed to be below License Raj from 1947 to 1992. These had been powerful instances. In contrast to at this time, when any founder from the Rural elements of India can problem a big establishment primarily based on his or her personal deserves. We don’t want household names anymore with a purpose to transfer forward.

You don’t must be an Ambani or Birla to disrupt any specific sector anymore. Have a look at how Mr Deepinder Goyal of Zomato has disrupted how we expertise meals and grocery supply. Similar goes for Mr Bhavish Agarwal who’s redefining Ola from a transport firm to an auto producer and slowly placing his toes into the evolving semiconductor trade.

It’s humorous how Mr Rajiv Bajaj of Bajaj Auto isn’t capable of reconcile with this modification, since they’re the companies of a era that thrived when there was merely zero competitors.

ITC in its personal manner is in a really lengthy battle. Proper from resorts and agriculture to IT and private care merchandise, this firm is dealing with a large quantity of competitors.

It’s the Cigarettes enterprise which is the money cow of the corporate that’s serving to to struggle these battles on a number of fronts.

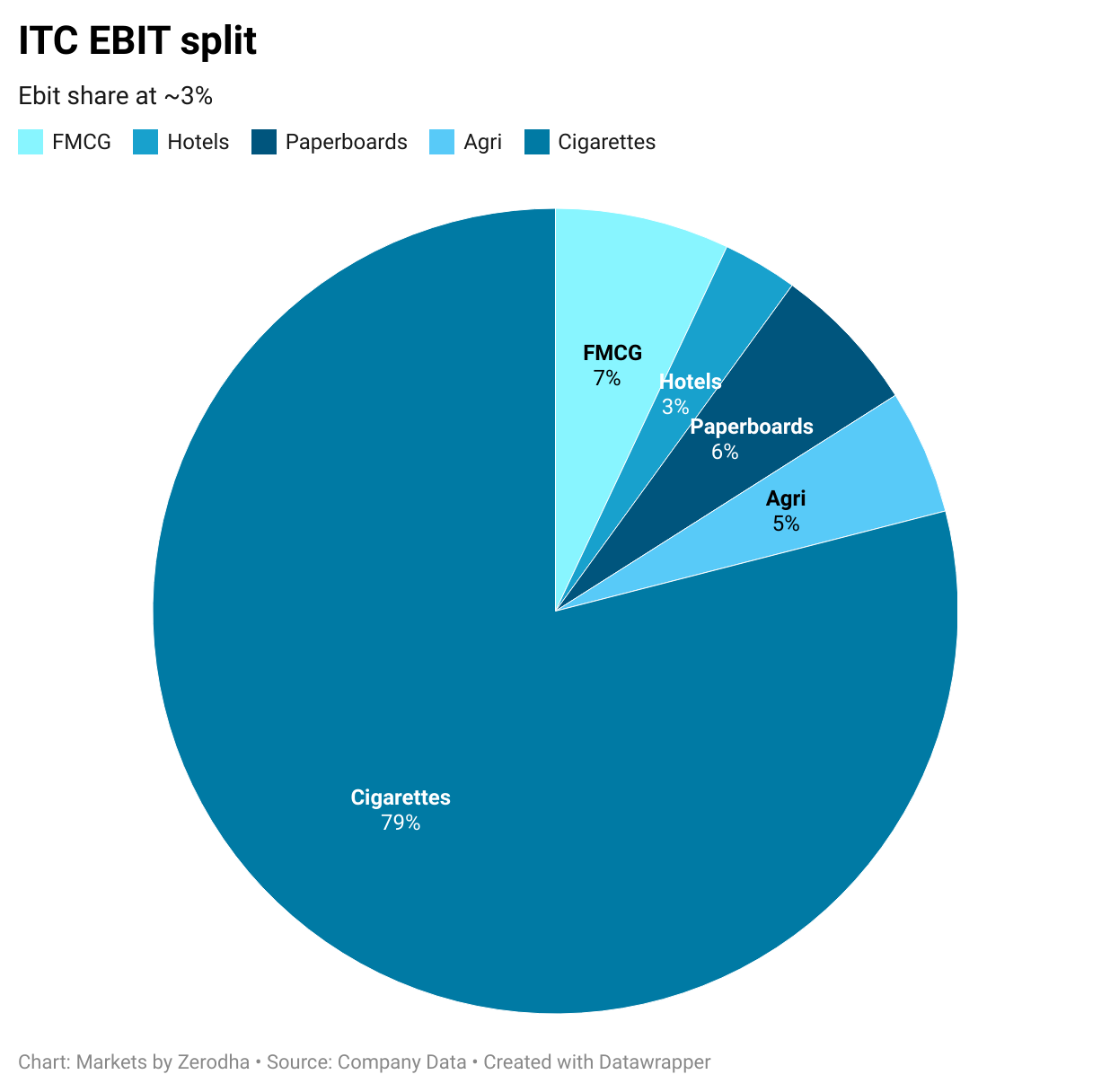

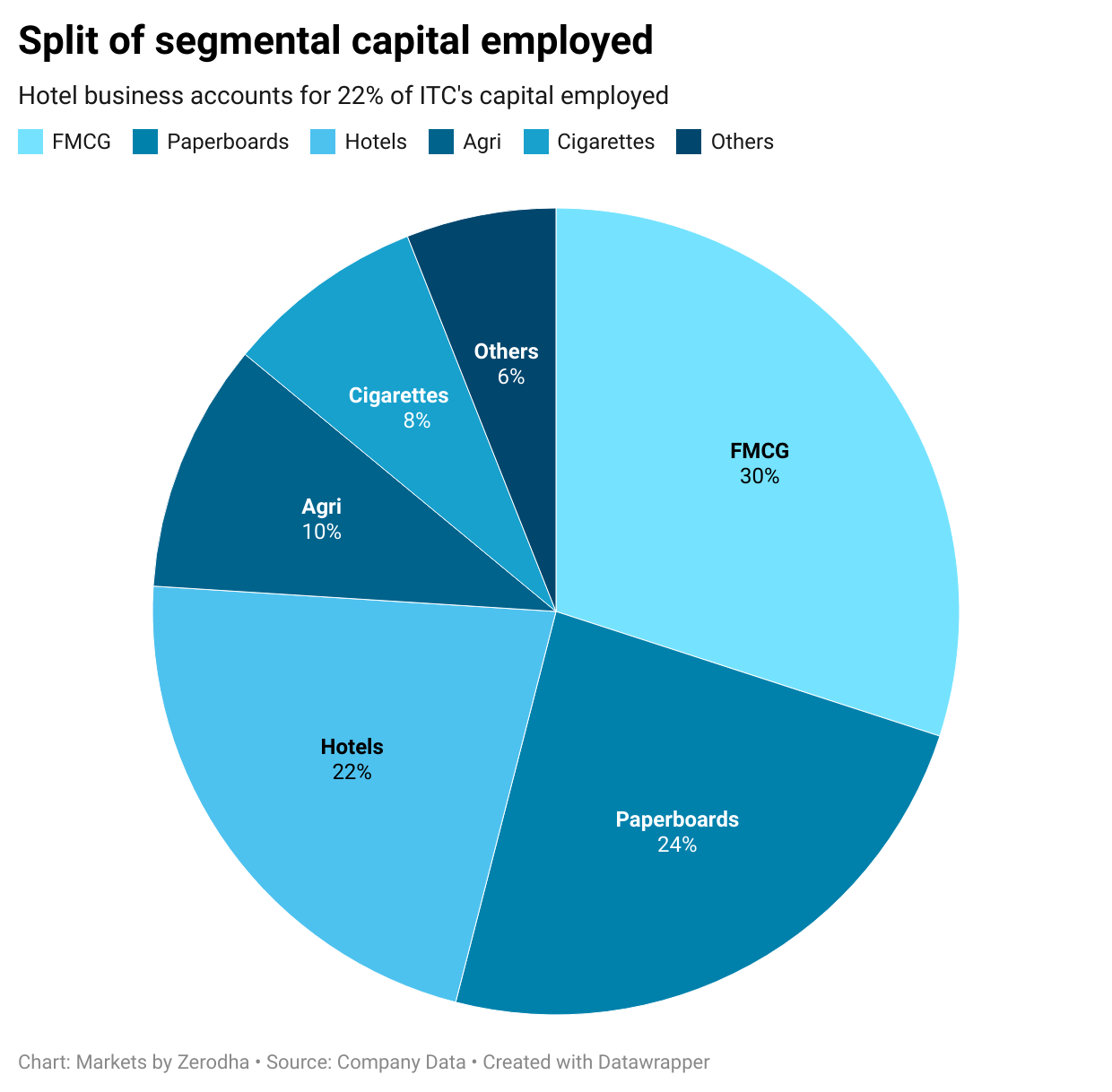

Give it some thought – the cigarette enterprise is chargeable for near 80% of working income (or EBIT) of the corporate. And but, it wants simply 8% of capital yearly to maintain it going.

Suppose this 12 months the corporate did a sale of Rs 10 lakhs. Out of this Rs 8 lakhs comes from cigarettes enterprise alone. And the way a lot does this enterprise division require to run itself?

Simply Rs 80 thousand solely.

With Rs 80 thousand or as I wrote earlier – 8% of capital, the corporate is ready to function its plant, provide its merchandise to the top shoppers, pay for his or her salaries and the whole lot.

However right here’s an attention-grabbing take on this – Accommodations enterprise

In related gentle, Accommodations eat near 22% of capital yearly however solely contribute 3% of working income (or EBIT) for the corporate.

These should not simply numbers, it’s some extent at which an investor’s blood ought to boil.

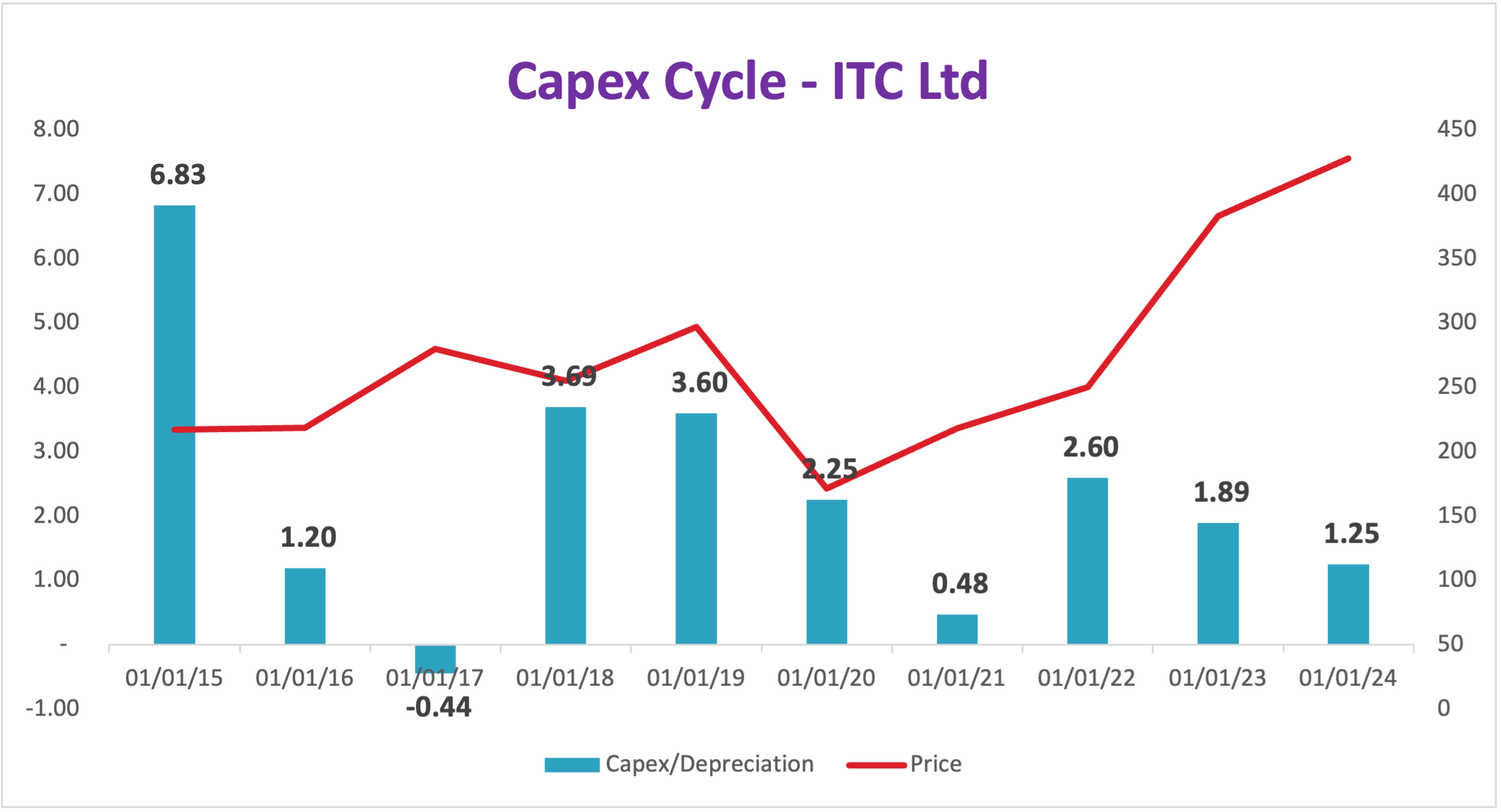

As a result of ITC has been doing large capital growth (‘capex’) for the final 10 years. Right here’s a chart so that you can take a look at.

Supply: Jagoinvestor, screener.in

It is a bit technical, if you happen to don’t want to learn it – please skip to the following part.

In Capex we outline cash that’s left after for purchasing and promoting of mounted belongings similar to land, constructing, plant & equipment, buying new companies and another chosen investing objects from the Steadiness Sheet.

So yearly, the cash that’s used for growth of enterprise is taken into consideration and divided by ‘depreciation’ which is put on and tear on these belongings.

If this capex / depreciation = 1, then each new addition is the same as the one that’s changed.

When it’s round 2, then it means some actual capacities are being added.

However first, a fast phrase on ‘depreciation’.

While you purchase your self a pleasant automobile, you’ll not promote it for a similar worth proper. Suppose you acquire a Maruti automobile for Rs 10 lakhs and after 3 years of driving it for 50,000 odd kms, you’ll promote it for Rs 6 lakhs.

Basic math tells you that the automobile misplaced Rs 4 lakhs in worth.

NO.

Basic math doesn’t apply right here. Within the accounting framework, we get the invisible hand of depreciation that accounts to your use of the automobile, restore and upkeep work, and so forth – in brief put on and tear.

So, after 3 years, after depreciation when your automobile’s worth is Rs 5 lakhs, then you could have made a achieve of Rs 1 lakh on the sale of your automobile. Fact be advised, you’ll be TAXED!!

Now again to ITC’s chart.

Within the final 10 years, ITC has been on a capital growth spree. And most of this cash has gone into constructing its world class resorts which has resulted in little or no income progress for the corporate.

Pouring an excessive amount of cash to earn little or no is the explanation why most Institutional Traders stayed away from the inventory.

Right here’s the proof.

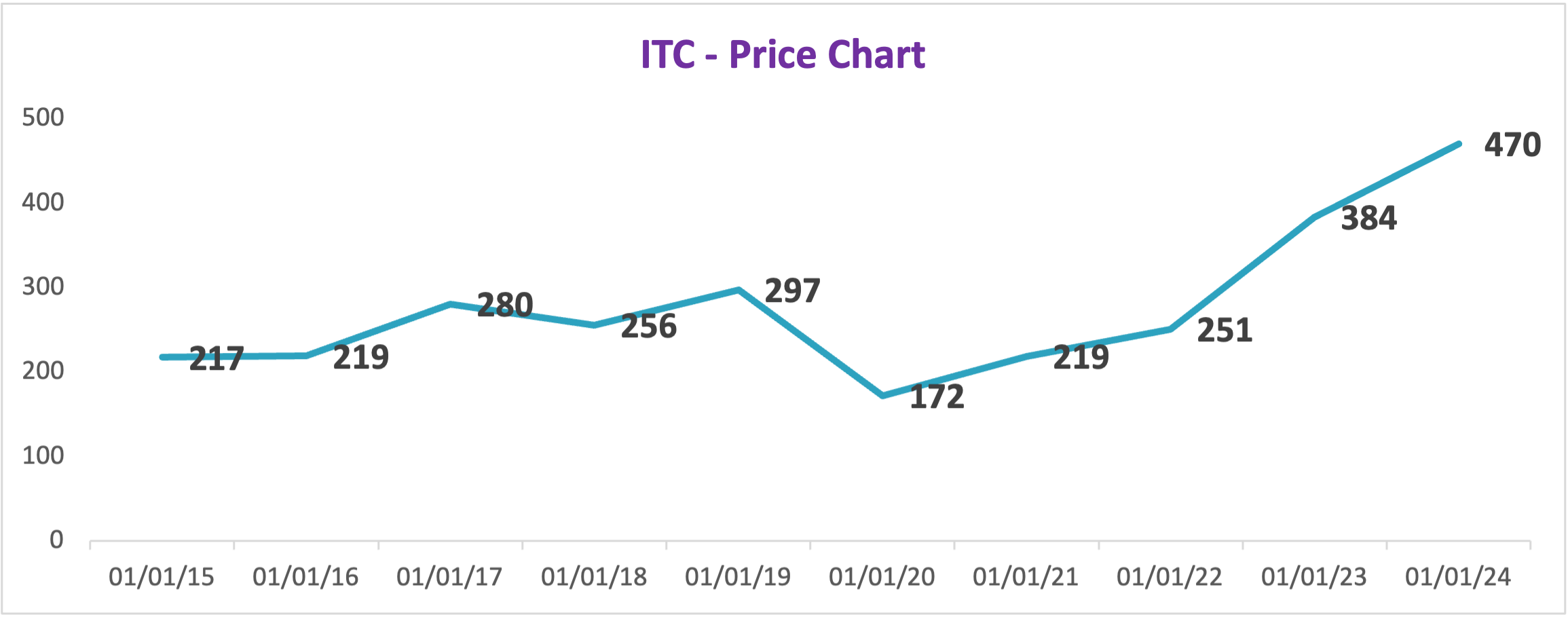

From 2015 to 2021-22, return on the inventory was 0. 7 years and the inventory worth return = 0.

After which one thing occurred!

The rumours of demerger started. The Accommodations enterprise was going to now be separated from the opposite companies of the corporate.

The inventory worth slowly began transferring up.

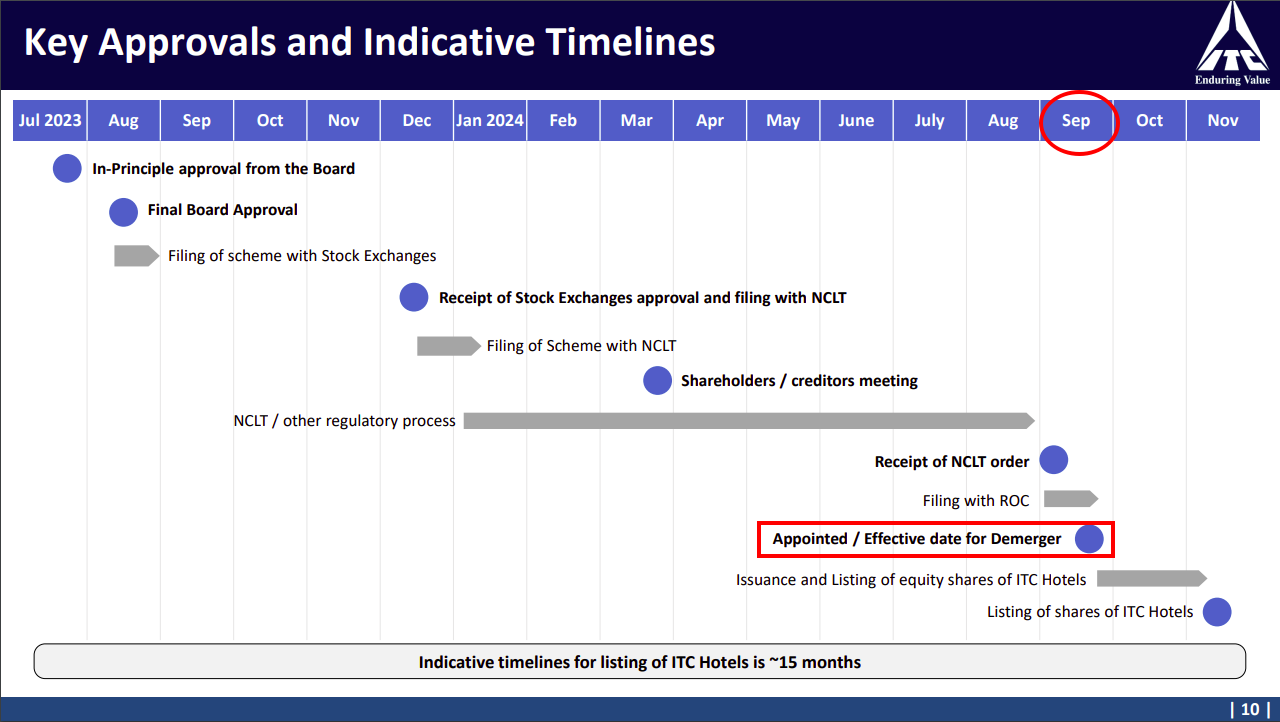

In July 2023, Board of Administrators of ITC Ltd, authorized of this demerger. And this was a mega occasion. One thing that everybody was ready for.

Supply: Jagoinvestor, ITC Presentation

Following this information one thing else too modified. Let’s have a look.

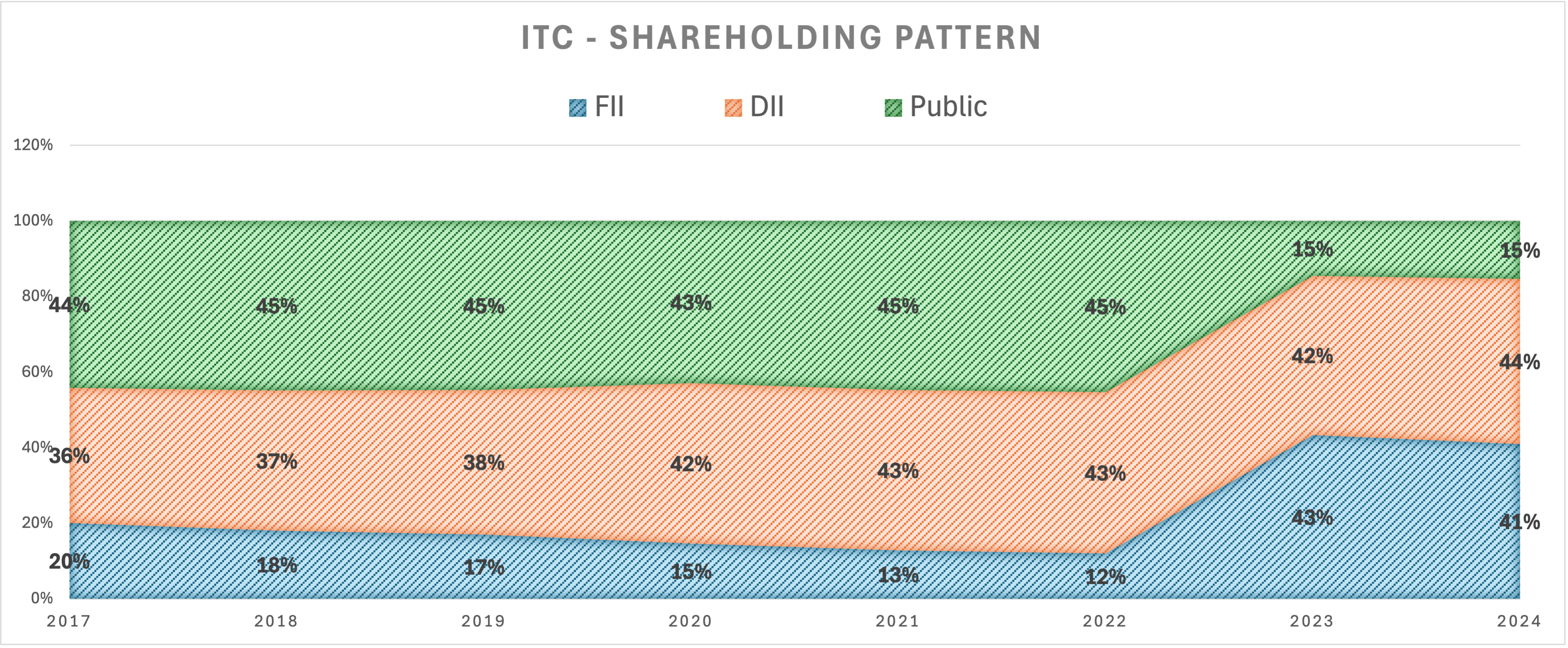

International (FII) and Home (DII) Institutional Traders jumped at this chance. The inventory started its motion after 7 years of stagnation.

It prompted many retail traders to simply promote the inventory and exit. As a result of they weren’t drained and bored of holding this inventory of their portfolio. For them, it was a everlasting worth lure. Therefore, as quickly as they obtained some good achieve, they exited.

At the moment, the Indian fairness market was in the midst of a small and mid-cap increase. So retail traders had been extra considering cashing that chance out and consequently their shareholding which was 45% earlier than the announcement dropped to a mere 15%. Whereas FII went up from 12% to 43%. DII largely remained the identical.

The inventory worth jumped from Rs 200 to almost touching Rs 500 in a matter of two years.

The explanation why FII purchased the inventory is as a result of Demerger unlocks Worth.

ITC’s non-hotels enterprise consists of Cigarettes, FMCG similar to Ashirvaad Atta, and so forth., paper trade, agriculture and IT are large money producing machines. When they are going to be accounted for individually, they may dish out good income that can profit the shareholders over the long run.

Accommodations enterprise however will now be subjected to a litmus check of efficiency. So the administration will now need to be very cautious about how a lot cash they’re investing and to what extent they’re making income.

The true check for Accommodations will start now. Whereas the opposite companies might be free from having to hold the burden on their shoulders.

Conclusion

As retail shareholders, we regularly miss the purpose of demergers. Perhaps as a result of we don’t absolutely perceive the sort of inventory worth return it might probably generate for us.

Plus, demergers are lengthy drawn company actions that take a few years to fructify. In such a time, it’s our impatience that tends to get in the best way. One thing else is all the time going up and somebody is all the time making extra money. We simply miss out on our portfolio that may compound massively.

As retail traders, we should always all the time examine for these particular conditions and search for an incremental institutional possession. If that occurs, all of them we have to do is fasten our seat belts and benefit from the trip!

Jinay Savla, Jagoinvestor