Tax planning is an important side of economic planning and administration that usually will get postponed till the final minute. Many taxpayers scramble to make last-minute investments in March to avoid wasting on taxes, resulting in hasty selections and potential monetary errors. Beginning your tax-saving investments early within the monetary 12 months not solely ensures peace of thoughts but additionally helps you make knowledgeable and strategic decisions that align together with your monetary targets.

Following are the explanations for realizing why it’s best to begin tax planning early:

1. Structured Planning

Early planning provides you ample time to evaluate your monetary scenario and create a well-structured plan. By distributing your investments all year long, you’ll be able to keep away from the monetary burden of creating giant investments in a single go.

2. Wider Vary of Funding Choices

Once you begin early, you’ve a wider vary of funding choices to discover, together with people who require long-term dedication. You’ll be able to select tax-saving devices primarily based on their returns, dangers, and lock-in intervals with out dashing into suboptimal decisions.

3. Compounding Advantages

Beginning early permits your investments extra time to develop and profit from the ability of compounding, particularly for equity-linked financial savings schemes (ELSS) and Public Provident Fund (PPF). Compounding can considerably enhance your wealth over time.

4. Avoiding Final-Minute Errors

Final-minute investments usually result in errors resembling selecting low-return choices, lacking vital documentation, or falling for deceptive schemes. Early planning helps keep away from such pitfalls.

5. Tax-Environment friendly Portfolio Constructing

By planning prematurely, you’ll be able to create a tax-efficient portfolio that aligns together with your danger tolerance and long-term goals. A well-diversified portfolio can optimise returns whereas minimising tax legal responsibility.

Fashionable Tax-Saving Funding Choices

A number of funding avenues present tax advantages underneath varied sections of the Earnings Tax Act, 1961 should you select outdated tax regime. Among the hottest choices embrace:

1. Fairness-Linked Financial savings Scheme (ELSS)

- Tax Profit: Deduction underneath Part 80C as much as ₹1.5 lakh.

- Lock-in Interval: 3 years.

- Returns: Market-linked, traditionally increased than different tax-saving choices.

- Suitability: Supreme for buyers with a better danger urge for food looking for wealth creation.

2. Public Provident Fund (PPF)

- Tax Profit: Deduction underneath Part 80C, and tax-free maturity quantity.

- Lock-in Interval: 15 years (with partial withdrawals allowed after 6 years).

- Returns: Authorities-backed, presently round 7-8% p.a.

- Suitability: Finest for risk-averse buyers in search of assured returns.

3. Nationwide Pension System (NPS)

Tax Profit: Deduction underneath Part 80CCD(1B) as much as ₹50,000 along with 80C.

Lock-in Interval: Until retirement.

Returns: Market-linked, providing publicity to equities, debt, and authorities securities.

Suitability: Supreme for retirement planning with further tax advantages.

4. Workers’ Provident Fund (EPF)

Tax Profit: Deduction underneath Part 80C.

Lock-in Interval: Until retirement (partial withdrawals allowed underneath particular circumstances).

Returns: Authorities-backed, presently round 8% p.a.

Suitability: Appropriate for salaried people.

5. Tax-Saving Fastened Deposits (FDs)

Tax Profit: Deduction underneath Part 80C.

Lock-in Interval: 5 years.

Returns: Fastened, usually round 6-7% p.a.

Suitability: Supreme for risk-averse buyers looking for mounted returns.

6. Sukanya Samriddhi Yojana (SSY)

Tax Profit: Deduction underneath Part 80C.

Lock-in Interval: Until the woman baby turns 21.

Returns: Authorities-backed, round 7.6% p.a.

Suitability: Finest for fogeys of woman youngsters trying to safe their future.

7. Unit-Linked Insurance coverage Plans (ULIPs)

Tax Profit: Deduction underneath Part 80C.

Lock-in Interval: 5 years.

Returns: Market-linked, combining insurance coverage and funding.

Suitability: Appropriate for these in search of twin advantages.

8. Nationwide Financial savings Certificates (NSC)

Tax Profit: Deduction underneath Part 80C.

Lock-in Interval: 5 years.

Returns: reviewed and assured quarterly by authorities, presently round 7.7% p.a.

Suitability: Low-risk choice for conservative buyers.

Aside from Part 80C, the Earnings Tax Act gives deductions underneath different sections, together with:

- Part 80D: Deduction for medical insurance coverage premiums (as much as ₹50,000 for senior residents).

- Part 80E: Deduction for curiosity on training loans (no higher restrict).

- Part 80G: Deduction for donations to charitable establishments (50% or 100% relying on the fund).

- Part 80GG: Deduction for home lease paid.

- Part 80TTA: Deduction for curiosity on financial savings accounts (as much as ₹10,000).

- Part 80TTB: Deduction for curiosity on deposits for senior residents (as much as ₹50,000).

- Part 80U: Deduction for individuals with disabilities (as much as ₹1,25,000 for extreme incapacity).

- Part 80DDB: Deduction for medical therapy of specified ailments (as much as ₹1,00,000 for senior residents).

- Part 80GGC: Deduction for contributions to political events.

Correct documentation and adherence to the desired circumstances underneath every part are important to say these deductions. For the most recent updates, confer with the official Earnings Tax Division sources or seek the advice of a tax skilled.

With the above Steps to Begin Tax Planning Now

1. Assess Your Tax Legal responsibility

Decide your whole earnings and potential tax legal responsibility to estimate how a lot it is advisable to make investments to maximise deductions.

2. Set Clear Monetary Targets

Outline your short-term and long-term monetary targets to align your investments accordingly. Whether or not it’s wealth creation, retirement planning, or baby training, tax-saving devices ought to match into your broader monetary plan.

3. Diversify Your Investments

Select a mixture of tax-saving choices to steadiness danger and returns. A diversified portfolio together with ELSS, PPF, and NPS can present each progress and stability.

4. Automate Your Investments

Organising systematic funding plans (SIPs) for tax-saving mutual funds (ELSS) may also help you make investments constantly and not using a monetary burden.

5. Keep Up to date with Tax Legal guidelines

Tax rules could change yearly, affecting deductions and advantages. Staying knowledgeable helps you make the perfect funding selections.

6. Seek the advice of a Monetary Advisor

For those who’re uncertain about the perfect choices, looking for recommendation from a monetary planner can present personalised suggestions primarily based in your monetary profile.

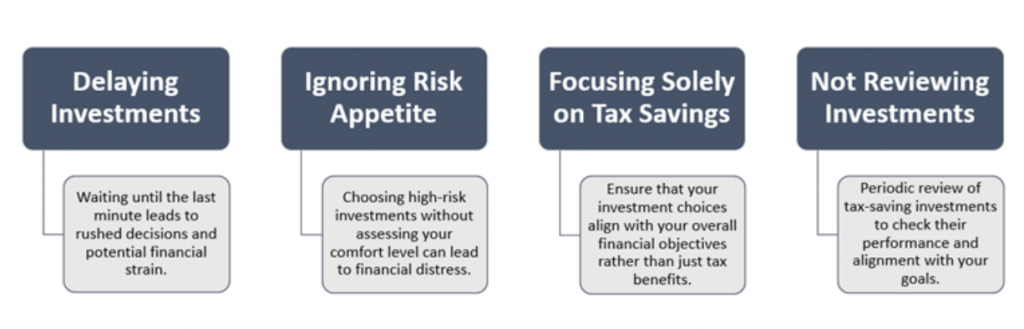

Widespread Errors to Keep away from

Wrapping Up

Early tax planning allows structured monetary administration, gives numerous funding choices, and leverages the advantages of compounding. It helps keep away from last-minute errors and ensures the creation of a tax-efficient portfolio aligned with long-term targets. Numerous tax-saving devices resembling ELSS, PPF, NPS, EPF, Tax-Saving FDs, SSY, ULIPs, and NSC present distinctive advantages primarily based on particular person monetary goals and danger tolerance. To start out, assess tax legal responsibility, set clear monetary targets, diversify investments, automate contributions, keep up to date with tax legal guidelines, and seek the advice of a monetary advisor. Avoiding frequent errors like procrastination, neglecting danger tolerance, focusing solely on tax financial savings, and failing to evaluate investments results in higher monetary planning and tax effectivity. Therefore, Don’t look forward to March; take management of your tax planning in the present day and benefit from the out there alternatives to safe your monetary future.

Involved in how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Rebalancing for Mutual Fund Buyers