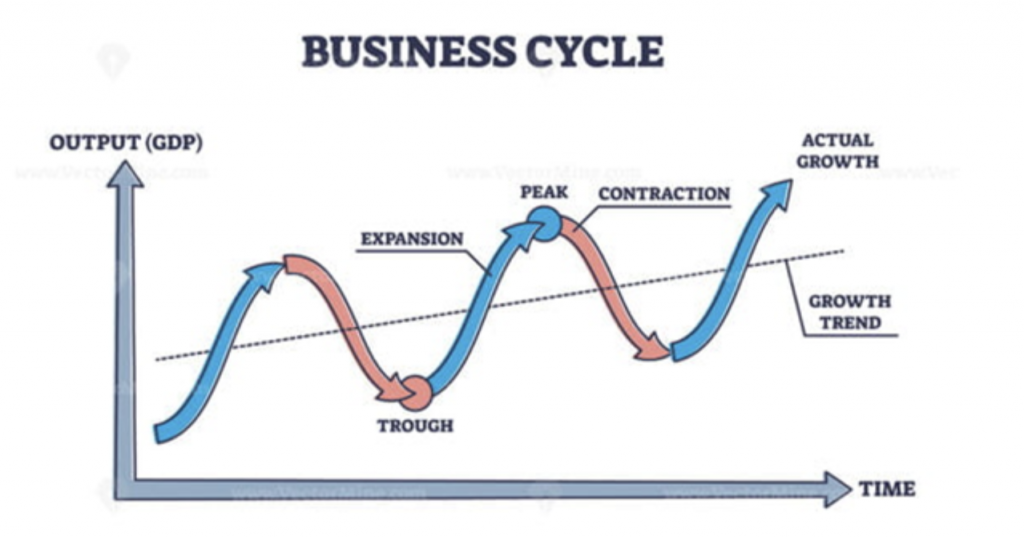

Enterprise cycles, also referred to as financial cycles, discuss with the fluctuations in financial exercise that an financial system experiences over time. These cycles include intervals of growth (development) and contraction (recession) and are basic features of contemporary economies (as proven within the image under).

Understanding the causes and results of enterprise cycles is essential for traders navigating financial uncertainties. One efficient technique to mitigate the antagonistic impacts of those cycles is the adoption of Systematic Funding Plans (SIPs).

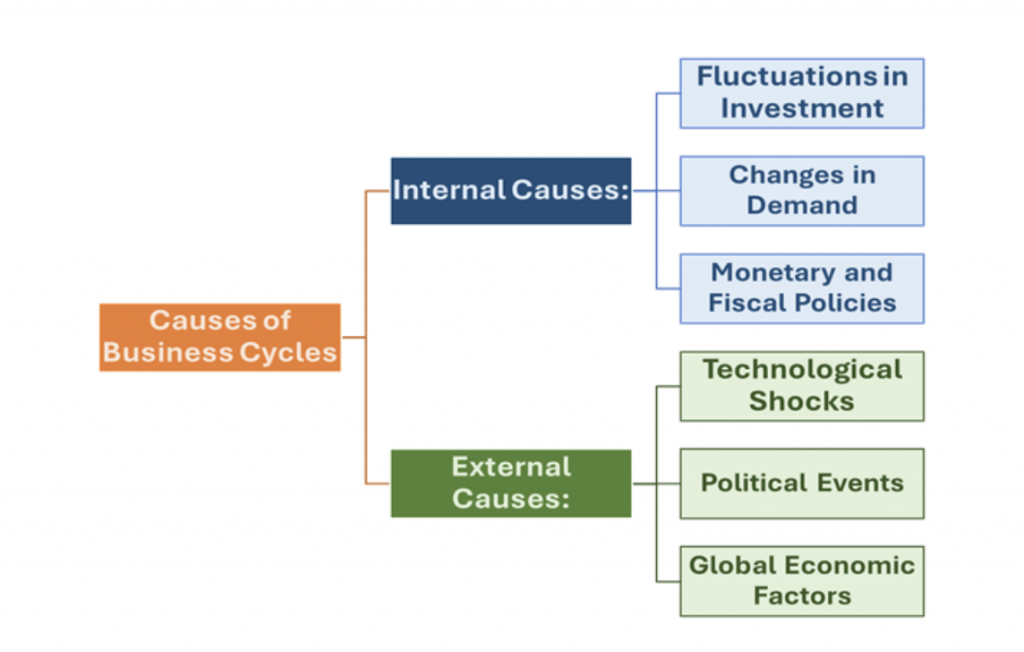

Causes of Enterprise Cycles

Allow us to take a look on the causes of enterprise cycles, that are multifaceted, involving each inside (endogenous) and exterior (exogenous) elements.

Inside elements embrace fluctuations in funding ranges influenced by rates of interest, entrepreneurial confidence, and revenue expectations, resulting in both financial growth or recession. Adjustments in demand for items and providers additionally play a big function; a rise in demand can enhance manufacturing and employment, whereas a lower could trigger layoffs and diminished output. Moreover, fiscal and financial insurance policies can both stimulate or decelerate financial development.

Exterior elements embrace technological developments, which may drive productiveness and development or result in downturns by rendering industries out of date. Political occasions and instability, in addition to world financial elements like worldwide commerce and monetary crises, additionally considerably impression the enterprise cycle.

Influence of Enterprise Cycles on Securities Markets

Enterprise cycles have a profound impression on securities markets, influencing investor sentiment, company earnings, and market valuations. The securities market (together with equities, bonds, and different monetary devices) tends to replicate the broader financial surroundings, experiencing booms and downturns in response to totally different phases of the enterprise cycle. The impression of the enterprise cycle on securities markets is described as follows:

1. Enlargement Section

- Inventory Market: Rising company earnings result in increased valuations, elevated shopping for exercise, and bullish developments. Development and cyclical shares are likely to outperform.

- Bond Market: Rates of interest could rise as central banks tighten financial coverage, resulting in falling bond costs.

- Different Investments: Actual property and commodities sometimes admire as a consequence of rising demand and financial exercise.

2. Peak Section

- Inventory Market: Markets could grow to be overvalued, resulting in volatility and sector rotations towards defensive shares.

- Bond Market: Rates of interest peak, making short-term bonds extra engaging.

3. Contraction Section (Recession)

- Inventory Market: Falling company earnings end in bearish developments, with defensive sectors like healthcare performing higher.

- Bond Market: Central banks could decrease rates of interest, boosting bond costs and demand for safe-haven belongings.

- Different Investments: Commodities and actual property could decline, whereas treasured metals admire.

4. Trough Section (Restoration)

- Inventory Market: Optimism returns, and early-stage restoration sectors begin to carry out nicely.

- Bond Market: Decrease rates of interest assist financial restoration, resulting in potential reallocation to equities.

Investor Behaviour Throughout Enterprise Cycles

- Danger Urge for food: Traders take extra dangers throughout expansions and grow to be risk-averse throughout recessions.

- Herd Mentality: Optimism drives herd behaviour throughout booms, whereas concern results in panic promoting in downturns.

- Asset Allocation Shifts: Portfolios shift between equities, bonds, and different investments based mostly on cycle phases.

- Market Timing Methods: Some traders try to maneuver to money or defensive belongings earlier than anticipated downturns.

Function of Coverage Interventions

- Financial Coverage: Central financial institution actions like rate of interest changes affect market behaviour.

- Fiscal Coverage: Authorities stimulus throughout downturns can enhance market efficiency and investor confidence.

Indian Securities Market Traits (2025)

As of January 26, 2025, the Indian securities markets exhibit developments aligning with typical enterprise cycle dynamics:

1. Fairness Market

(a) General Efficiency

The Indian inventory market has demonstrated resilience, with key indices such because the BSE Sensex rising by 8.17% and the NSE Nifty50 climbing 8.8% in 2024, regardless of challenges like international investor promoting and geopolitical tensions. The pattern has seen a contractionary part amid geopolitical dynamics with the onset of 2025. (mint)

(b) Sectoral Highlights

- Data Expertise (IT): The IT sector has been a big contributor to market beneficial properties, pushed by sturdy earnings and world demand for know-how providers. (Enterprise Commonplace)

- Banking: Whereas some banks have confronted challenges as a consequence of regulatory measures and elevated provisions for dangerous loans, others like Kotak Mahindra Financial institution have reported sturdy earnings, bolstering the sector’s efficiency. (Monetary Instances, reuters.com)

- Cars: The auto sector has proven resilience, with indices reflecting constructive investor sentiment.

2. Bond Market

- Authorities Bonds: The ten-year Indian authorities bond yield stood at 6.76% as of January 22, 2025, with expectations of continued efficiency pushed by anticipated charge cuts and powerful home demand.

- Company Bonds: The market stays steady, with corporations leveraging beneficial rates of interest for capital elevating.

3. Investor Sentiment and Exterior Components

- Overseas Portfolio Traders (FPIs): FPIs have bought roughly $6.7 billion in Indian equities as a consequence of world uncertainties.

- Home Institutional Traders (DIIs): DIIs proceed to soak up FPI outflows, sustaining market stability.

These observations illustrate how totally different segments of the Indian securities market are responding to present financial circumstances, reflecting typical patterns noticed throughout varied phases of the enterprise cycle.

Allow us to now take a look on the Systematic Funding Plans (SIPs) as mitigation technique for enterprise cycles.

An SIP includes investing a hard and fast sum of money at common intervals, sometimes in mutual funds. This disciplined method affords a number of benefits:

1. Rupee Value Averaging

By investing a constant quantity frequently, traders buy extra items when costs are low and fewer items when costs are excessive. This averaging of buy prices over time can scale back the impression of market volatility.

2. Compounding Advantages

Common investments allow traders to profit from compounding returns, the place the earnings on investments generate their very own earnings over time, resulting in potential exponential development.

3. Disciplined Investing

SIPs encourage a disciplined funding behavior, decreasing the temptation to time the market, which may be significantly difficult throughout risky intervals related to totally different phases of the enterprise cycle.

4. Flexibility and Affordability

SIPs enable traders to start out with modest quantities, making it accessible for people with various monetary capacities. This flexibility ensures that investing turns into a behavior, no matter market circumstances.

5. Number of Fund Choices

SIPs supply a spread of fund decisions, together with fairness, debt, hybrid, and sectoral funds, permitting traders to diversify their portfolios and align investments with totally different phases of the enterprise cycle, thereby mitigating dangers successfully.

Wrapping Up

Enterprise cycles considerably impression securities market investments by affecting investor sentiments, company earnings, and financial circumstances. Understanding these cycles helps traders handle dangers and seize alternatives. Disciplined methods, equivalent to Systematic Funding Plans (SIPs), can assist mitigate the damaging results of financial fluctuations and guarantee regular long-term monetary development.

Serious about how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Rebalancing for Mutual Fund Traders