Picture supply: The Motley Idiot

It’s not usually that hyper-growth shares are talked about in the identical breath as Warren Buffett. The funding portfolio of his holding firm, Berkshire Hathaway, tends to primarily purchase mature blue-chips.

So it’s protected to say that Nu Holdings (NYSE: NU) is a little bit of an outlier in Berkshire’s portfolio. The agency is a fast-growing digital disruptor shaking up the standard banking system throughout Latin America.

Admittedly, it is a small holding and we are able to’t make certain that Buffett purchased it himself. Extra seemingly, it was considered one of his two investing lieutenants, Todd Combs and Ted Weschler, who took a stake within the Brazilian neobank again in 2021.

However, the inventory has been on hearth, rising 33% in 2025 and over 200% because the begin of 2023. But I feel it has much more progress within the tank and is due to this fact price contemplating. Right here’s why.

The rise of digital banking throughout Latin America

Nubank, because it’s identified, is the biggest digital financial institution in Latin America and one of many fastest-growing on-line platforms on the planet. Its purple bank cards are ubiquitous in its native Brazil, the place it has over 100m prospects (greater than half of the grownup inhabitants).

Why are so many shoppers flocking to the agency? Nicely, the area’s conventional banks are infamous for his or her outrageous charges and horrible customer support. Even in the present day, they usually cost charges for almost each transaction, together with ATM withdrawals, on-line transfers, and even account inquiries.

This has created alternatives for fintech firms like Nubank, which supply easy-to-use on-line banking options with far decrease charges and vastly superior customer support.

Certainly, founder and CEO David Vélez has mentioned that the corporate selected to make its debit and bank cards purple as a result of it needed to be “probably the most anti-bank potential.”

Whereas the agency’s providing providers to lower-income populations in Brazil, Mexico and Colombia, it’s more and more attracting higher-income prospects from legacy banks.

Progress machine

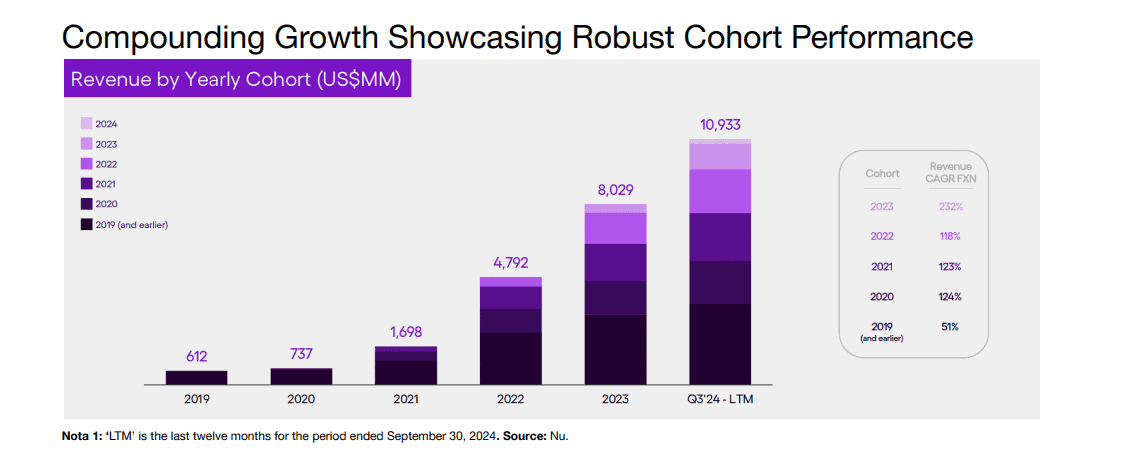

Income progress’s been nothing in need of mind-blowing, rising from $612m in 2019 to an anticipated $11.8bn final 12 months.

However that is no cash-incinerating start-up. Nu’s common income per lively buyer has grown from $3.50 initially of 2021 to $11 by the top of September final 12 months. And web earnings is anticipated to have surged 84% to $2.2bn in 2024.

Wanting forward, income is forecast to motor previous $20bn by 2027, with earnings rising by a mean of 48% in that point.

Enticing valuation

However how a lot to pay to speculate on this high-growth inventory? Not as a lot as may be suspected, with the inventory sporting a worth/earnings-to-growth (PEG) ratio of 0.7.

For context, a PEG ratio under one suggests {that a} inventory may be undervalued relative to its earnings progress potential. I strongly consider that to be the case right here, which is why I’m trying to purchase extra shares.

That mentioned, I’ll be maintaining a tally of Nu’s rising non-performing loans. In Q3, 90+ day delinquencies rose to 7.2% from 6.1% the 12 months earlier than, a pattern which will result in extra mortgage loss provisions and decrease earnings.

Long run although, I’m very bullish right here. Nu’s quickly increasing digital ecosystem ought to lead to profitable cross-selling alternatives, whereas additional enlargement throughout Latin America and past seems very seemingly.