Bharat Electronics Ltd – Empowering the Nation’s Defence Forces

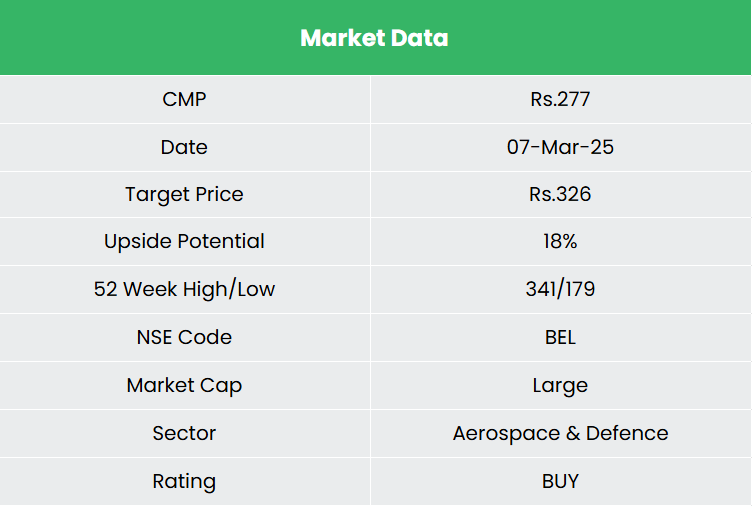

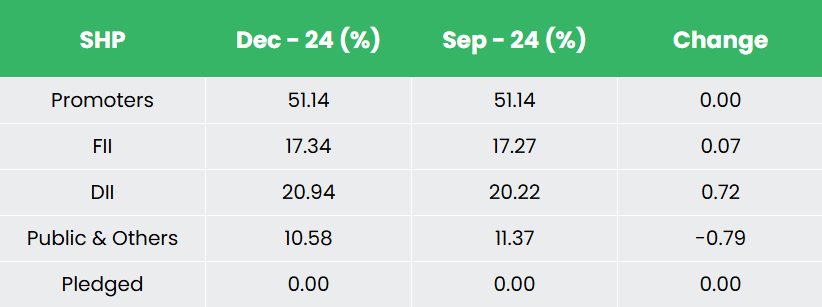

Established in 1954, Bharat Electronics Ltd. (BEL) is a Navratna Public Sector Endeavor primarily engaged in growing electronics expertise options for the defence and civilian segments. It holds a distinguished place within the Indian Defence phase with ongoing growth into worldwide defence and civil markets. Headquartered in Bengaluru, it has 9 manufacturing models, 2 analysis models and 29 strategic enterprise models (SBU). The Authorities of India (GoI) stays the most important shareholder of BEL with the shareholding of 51.14% as on 31 December 2024.

Merchandise and Providers

The corporate majorly capabilities in defence and non-defence enterprise segments. Defence merchandise comprise of navigation methods, communication merchandise, land-based radars, naval methods, digital warfare methods, avionics, electro optics, weapon methods, shelters and masts, arms and ammunition, seekers and missiles, and so on. Non-defence consists of services for cyber safety, e-mobility, railways/metro/airport options, e-governance methods, photo voltaic cells/energy crops, homeland safety, civilian radars and so on.

Subsidiaries: As of FY24, the corporate has 2 subsidiaries and a pair of affiliate corporations.

Funding Rationale

- Progress methods – The corporate has included 5 new strategic enterprise models (SBUs) throughout H1FY25. First one is EW (Digital Warfare) land methods at Hyderabad with a Rs.1,500 crore turnover anticipated in FY25. Different SBUs are for RF and IR seekers, arms and ammunition, community and cybersecurity and unmanned methods which the corporate anticipates contributing Rs.1,000+ crore income from subsequent 2-3 years. The corporate is setting 5 new factories for numerous operations that features superior evening imaginative and prescient, EW methods for land, weapon system and integration, fuse complicated and explosives, airborne gear and missiles. The corporate has additionally signed an MoU with Safran Electronics & Defence, France to create a Joint Enterprise for manufacturing, customising, gross sales and upkeep of HAMMER, a precision guided air-to-ground weapon, in India.

- Increasing order ebook – The corporate has secured order price Rs.1,220 crore from Indian Coast Guard for supplying software program outlined radios. It has additionally received one other contract at Rs.610 crore to provide Electro-Optic Fireplace Management System (EOFCS) to the Indian Navy. It has received extra orders price Rs.577 crore for airborne digital warfare merchandise, a sophisticated composite communication system for submarines, Doppler climate radar, prepare communication methods, radar upgrades, spares, and companies, taking the order ebook to ~Rs.14,000 crore received in FY25 as of present date. Throughout FY26, the corporate is anticipating main orders together with QRSAM (valued at Rs.25,000 crore – Rs.30,000 crore), NGC (valued at Rs.14,000 to Rs.15,000 crore) and extra 5/6 orders within the vary of Rs.2,000 crore to Rs.3,000 crore. Majority of those orders are to be executed inside a timeframe of 2-5 years.

- Q3FY25 – In the course of the quarter, the corporate earned income of Rs.5,771 crore, a rise of 39% in comparison with the Rs.4,162 crore of Q3FY24. EBITDA improved by 56% from Rs.1,072 crore of Q3FY24 to Rs.1,669 crore of the present quarter. The corporate reported internet revenue of Rs.1,312 crore, a progress of 53% in comparison with the corresponding interval within the earlier yr.

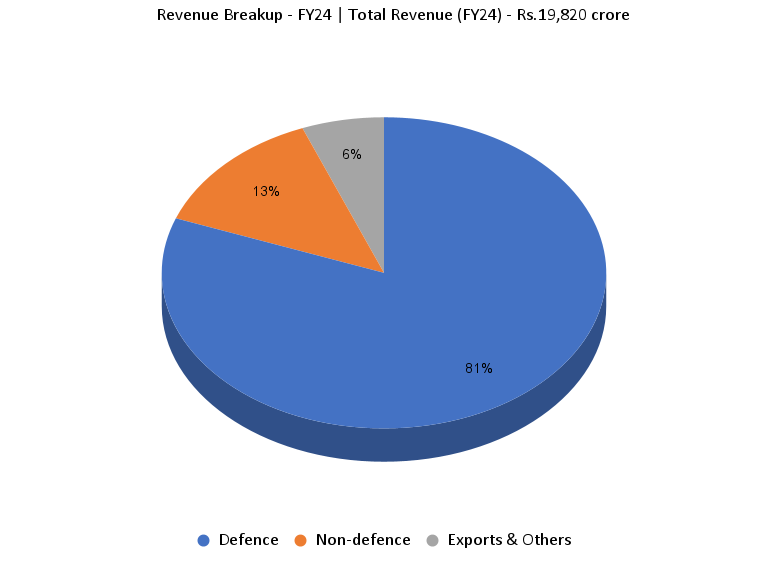

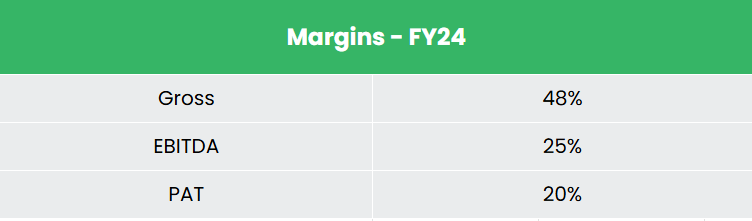

- FY24 – The corporate generated income of Rs.19,820 crore throughout FY24, a rise of 14% in comparison with the FY23 income. EBITDA was at Rs.4,998 crore, up by 23% YoY. An improved product combine has enabled the corporate to earn larger income. The corporate reported internet revenue of Rs.4,020 crore, a rise of 34% YoY.

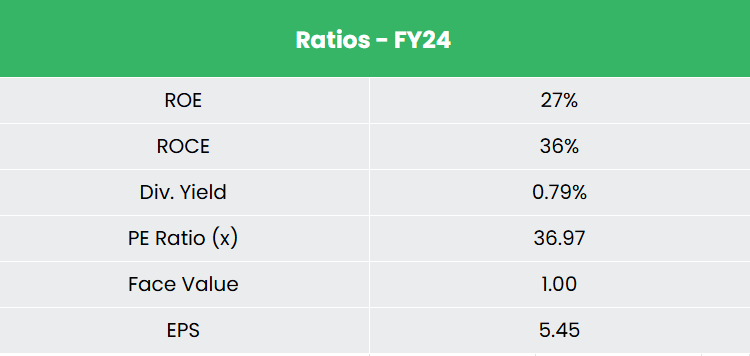

- Monetary Efficiency – The corporate has generated income and internet revenue CAGR of 13% and 24% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 23% and 31% for FY21-24 interval. The corporate has sturdy steadiness sheet with none debt in its capital construction.

Business

India is likely one of the strongest army forces on this planet and the trade holds a spot of strategic significance for the Indian authorities. The nation’s defence manufacturing sector is quickly increasing, fuelled by substantial authorities funding, rising exports, and insurance policies that foster self-reliance and technological innovation. The federal government has prioritized the Defence and Aerospace sector as a part of the ‘Aatmanirbhar Bharat’ (Self-Reliant India) initiative, with a powerful concentrate on establishing indigenous manufacturing capabilities supported by a sturdy analysis and improvement ecosystem. To modernize its armed forces and scale back reliance on exterior defence procurement, the federal government has launched a number of initiatives to advertise ‘Make in India’ actions by coverage assist. Moreover, India has set an bold goal of attaining US$ 6.02 billion (Rs. 50,000 crore) in annual defence exports by 2028-29.

Progress Drivers

- In 2025-26 the central authorities has allotted Rs.6,81,210 crore for the Ministry of Defence which is 6% larger than the earlier yr.

- Rising demand for defence manufacturing given the rising issues of nationwide safety.

- Provision for 100% International Direct Funding (FDI) by Authorities route and 74% by Computerized route into the defence sector.

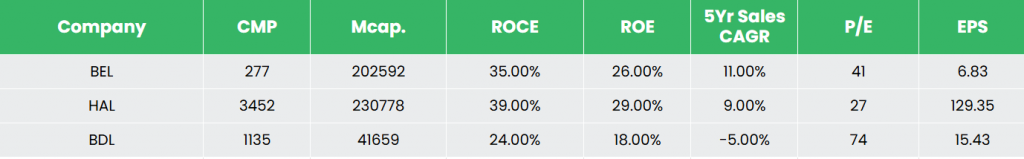

Peer Evaluation

Opponents: Hindustan Aeronautics Ltd, Bharat Dynamics Ltd, and so on.

In comparison with the above rivals, BEL has generated steady return ratios consistent with the expansion within the gross sales. This means the corporate’s potential to generate higher income for the capital invested.

Outlook

The corporate anticipates receiving an order influx of Rs.25,000 crore in FY25 and between Rs.25,000 crore and Rs.50,000 crore in FY26. For FY25, it has set a income progress goal of 15%, gross margin vary of 42%-44% and EBITDA margin vary of 23%-25%. In FY24, the corporate invested Rs.1,236 crore in R&D. The administration is assured about securing vital orders from the Ministry of Defence (MoD). Moreover, the corporate plans to steadily improve its non-defence income share over the medium time period, aiming to boost it from the present 8%-10% to 10%-15%, and finally to twenty%-25% in the long run. With a stronger product combine and as a number one participant in defence, geared up with numerous technological competencies, a sturdy innovation technique, a well-capitalized steadiness sheet, and a diversified product portfolio, we anticipate the corporate to efficiently meet its targets.

Valuation

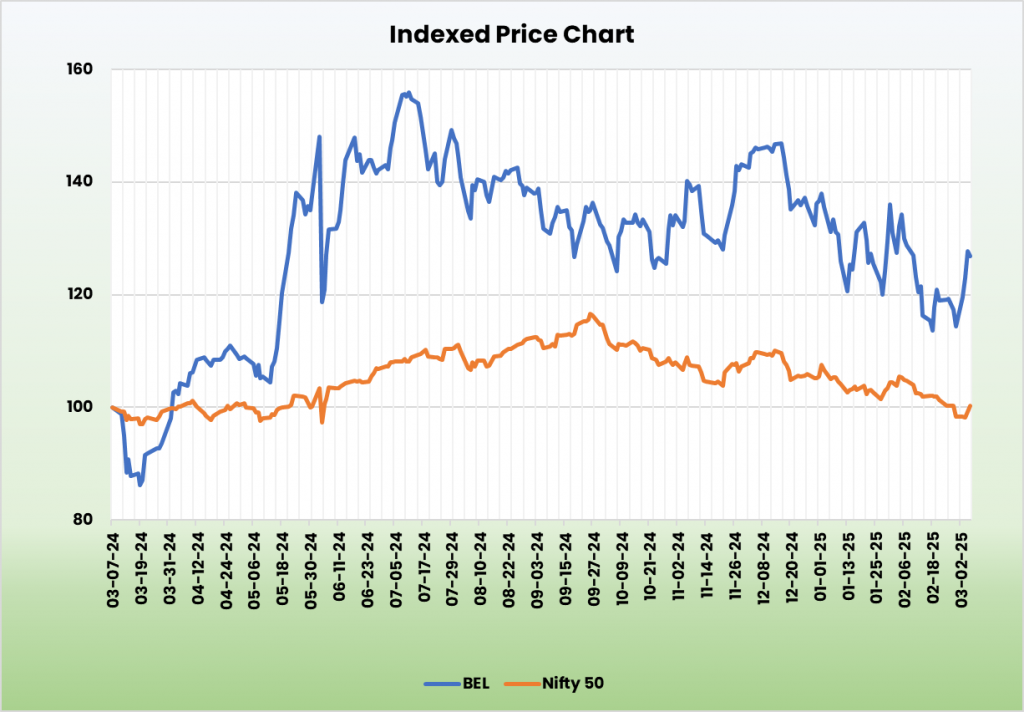

Given the sturdy monetary profile, increasing order ebook and powerful execution capabilities, we imagine that BEL will additional solidify its strategic place as a dominant provider of digital gear to India defence forces. We suggest a BUY ranking within the inventory with the goal worth (TP) of Rs.326, 36x FY26E EPS.

Danger

- Shopper Focus Danger – BEL is deriving greater than 80% of its income from the Indian defence sector. Any main lower within the defence spending by the Authorities will considerably affect the order ebook and thereby income.

- Enter price variations – Potential delays in receiving enter supplies and parts because of provide chain discontinuities, lengthy lead instances, and vendor defaults attributable to elevated uncooked materials costs may affect operations.

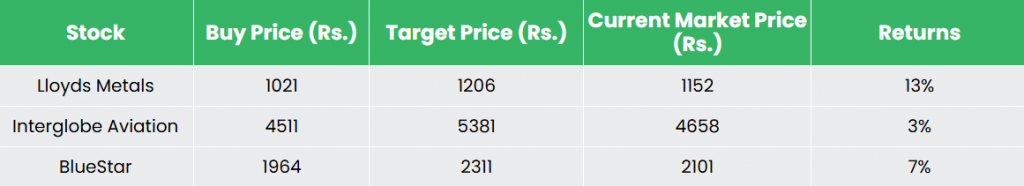

Recap of our earlier suggestions (As on 07 March 2025)

Lloyds Metals & Power Ltd

Interglobe Aviation Ltd

Blue Star Ltd

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork fastidiously earlier than investing. Securities quoted listed here are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please observe that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing. Registration granted by SEBI, and certification from NISM under no circumstances assure the efficiency of the middleman or present any assurance of returns to traders.

For extra particulars, please learn the disclaimer.

Different articles you might like

Publish Views:

36