Immediately we’ll speak about rates of interest and inflation, the 2 sizzling matters of dialog within the funding world. I’ll attempt to simplify these two matters in a easy approach and hyperlink it along with your monetary life.

The overwhelming majority of views that we learn in newspapers and blogs provide some type of asset allocation recommendation based mostly on these 2 parameters. A easy retail investor such as you and me will certainly get confused.

“To complicate is easy, to simplify is difficult. All people is ready to complicate. Only some can simplify.” ~ Bruno Munari

Earlier than we focus on rates of interest and inflation, a narrative involves thoughts.

My spouse and I actually wish to go for lengthy drives. It simply relaxes each of us. In reality, it’s the one frequent curiosity between the each of us.

For these lengthy drives, we do some fundamental checks with the automotive and atmosphere – whether or not it’s raining or not, meals, water and comfy clothes. Since music is now streamed by way of the Web, we don’t want to fret about CDs or cassettes, and so on. Sorted.

Now after we begin the automotive, Google Maps tells us that we’ll attain a specific vacation spot within the subsequent 7 hours with a mean velocity of 80 kmph based mostly on the visitors. So we merely add a few hours of relaxation, washroom breaks and a few lunch or dinner alongside the way in which. Successfully our journey turns into 8.5 to 9 hours.

These of us who continually drive on highways know the unpredictability of accidents. It’s like you might be strolling and all of the sudden there’s an entire lot of visitors that you need to sit via. The loopy half is that there’s simply no washroom or meals mall accessible. So you might be caught in visitors listening to music and praying to God that the visitors clears in a short time.

Some uncles who’re strolling round in such conditions usually turn into the messengers of unhealthy information. It’s their obligation to replace each automotive whether or not there’s an accident, a fireplace, arrival of the ambulance, or police after which go away us with the hope that the visitors will get cleared rapidly.

These unpredictable occasions lead us to a delay in reaching our vacation spot and if we aren’t cautious, these occasions additionally trigger a little bit of psychological instability that results in irritation.

However when the visitors clears, we drive as if our faculty’s final bell has rung and it’s time to go residence. That feeling of aid. A few of us even wish to cowl the time wasted by driving at ridiculous speeds. It’s simply totally different strokes for various people. However if you happen to simply drive, you’ll attain your vacation spot. It’s not rocket science.

Rocket science is what you do along with your peace throughout these unpredictable occasions. That defines the happiness of your journey, not the vacation spot.

Equally, when you might have deliberate your monetary journey of life, there’s a vacation spot set in your thoughts. Our monetary independence is after we are not anxious about taking care of the bills of our residence and fulfilling the expectations of our family members.

There’ll at all times be some unpredictable occasions that may trigger you to rethink your total funding technique. My humble request right here is to grasp the gravity of the state of affairs earlier than leaping into an entire restructuring of our monetary plans. As a result of typically, the state of affairs is made to sound much more horrible than it truly is.

Please hold an open thoughts and permit me to simplify these ideas to one of the best of my capacity.

Inflation

This time period has turn into essentially the most used and extremely abused on this planet of funding right now.

Some individuals speak about it as an end-of-the-world apocalypse within the making. It’s then linked to shopper spending and the way issues which can be getting costly received’t be consumed, so let’s steer clear of the fast-moving shopper items (FMCG) sector, and so forth and so forth. It’s hilarious and disturbing on the similar time.

So let’s perceive what inflation actually is and what it means to frequent individuals such as you and me.

Merely, inflation is known as a easy rise within the worth of a specific commodity or service. Suppose, the worth of milk goes up from Rs. 75 per litre to Rs. 80 per litre, the additional Rs. 5 is attributable to inflation. In case you add human intervention to it, equivalent to placing the milk in a bottle and charging additional received’t be thought-about as inflation.

To trace inflation, the Reserve Financial institution of India (RBI) makes use of the metric of the Client Worth Index (CPI). The thought is to seize the rise in worth skilled by roughly 140 crore Indians. It’s a troublesome job, to be sincere. That’s exactly the rationale why such macroeconomic numbers ought to at all times be seen with a pinch of salt.

Within the chart under, we seize the final 10 12 months’s journey of India’s CPI inflation. RBI has set a mandate to maintain the CPI within the vary of 4% to six%.

Presently, CPI is inching in the direction of 8% which is out of RBI’s consolation zone of 4% to six%. There are a number of explanations for this and in my view, each clarification is legitimate. As a result of in macroeconomics, information is at all times supported by a narrative that we create.

Nevertheless, if you happen to come to consider it, our yearly bills don’t rise by a mere 4%. They are usually nicely above 18-20%. We name this luxurious inflation.

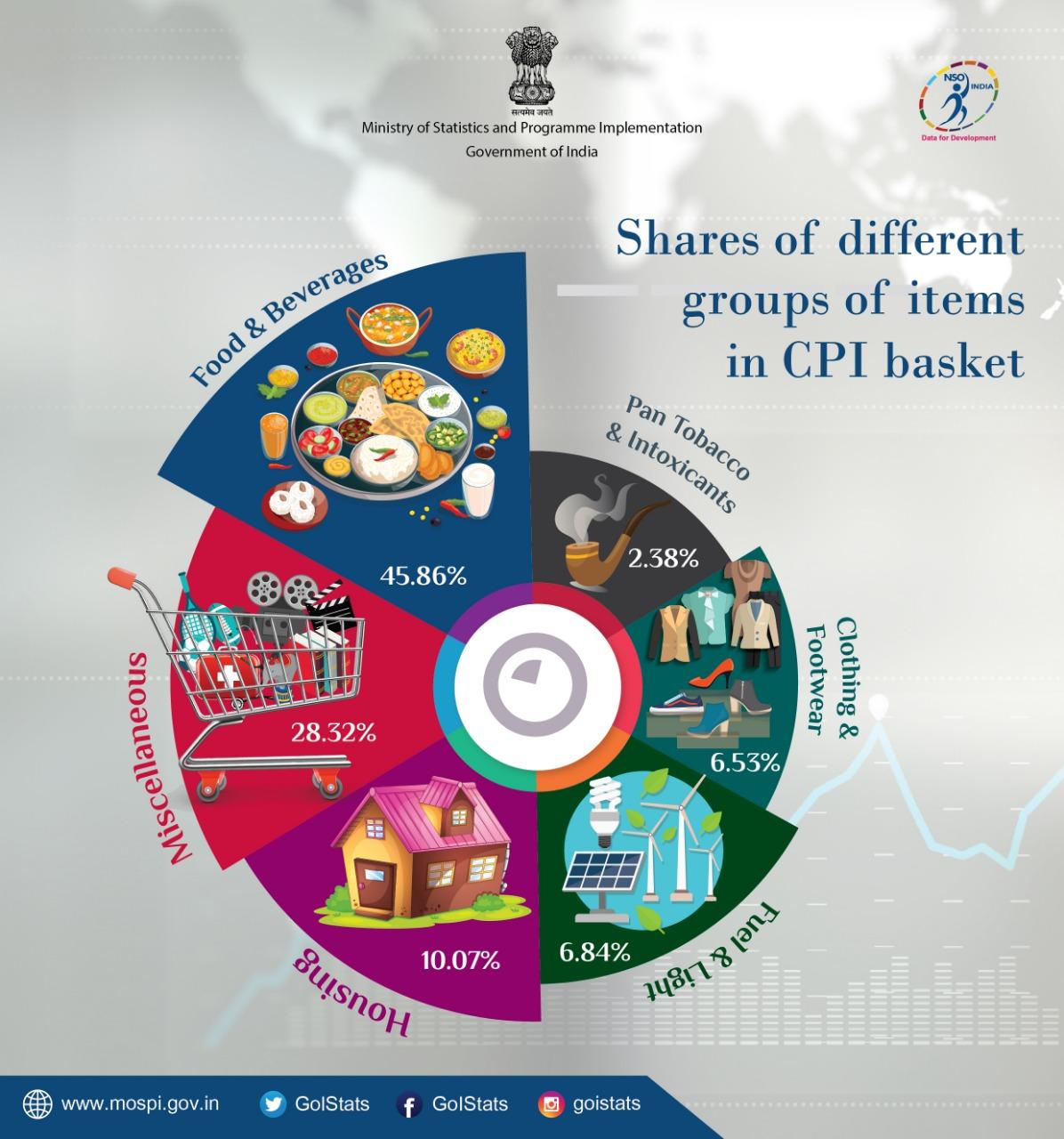

RBI constructs its CPI with the next constituents.

Don’t be stunned! That is how the RBI budgets itself. Our family budgets are totally different.

The key pie of the CPI basket falls into Meals and drinks. It constitutes a superb 45.86%. So any uncommon worth hikes in onions, tomatoes, and so on. have a direct influence on the inflation price. Housing is 10.07% which is essentially steady in worth.

We don’t see large fluctuations in a matter of some months. Gasoline & Gentle does have a variety of influence on our wallets however for RBI’s CPI it’s barely 6.84%. So a whopping rise in petrol costs won’t straight have an effect on the inflation price a lot.

So it’s protected to say that RBI’s expectation of the inflation price and the inflation price that we expertise are two separate issues. But, we give a variety of significance to inflation and base our funding selections on it too.

We should always actually rethink it.

Subsequent in line is Curiosity Charges!

Curiosity Charges

When an funding skilled speaks about rates of interest, he typically refers back to the Repo price revealed by the RBI in its Financial Coverage Assembly.

In layman’s phrases, the Repo price influences our fastened deposit rate of interest that we obtain from the banks and the mortgage rate of interest that we take for a home, enterprise, automotive or bike.

Inflation and rates of interest are interdependent. When the inflation price goes excessive, RBI typically prefers to hike the rate of interest. When the inflation price is low, RBI prefers to deliver the rate of interest down.

Why does this occur?

Take into consideration RBI as a head of the household, somebody like a grandfather who takes care of the whole household’s finances. He’s continually strategizing about which little one of his ought to exit on his personal and which little one will keep collectively. Plus, enterprise selections even when they’re independently run by his youngsters, he’s there to maintain guiding continually.

Suppose our month-to-month finances is Rs. 3 lakhs for a household of 10 individuals, and all of the sudden the whole household needs to go for a small trip.

How will he do it?

There are 2 choices, to both tighten the family finances for a number of months in order that he doesn’t must withdraw from investments or ongoing enterprise. Or he’ll borrow from the financial institution to fund the small trip and recuperate it later from the investments or enterprise.

Within the first case, the whole household should undergo a troublesome part as a result of their bills will turn into much less for some time. Within the second case, there shall be an excessive amount of stress on the grandfather and his youngsters to recuperate the cash.

Related is the case with RBI. When inflation goes out of its consolation zone, like a grandfather, it has the choice to restrict the provision of cash within the economic system so that folks spend much less. Or it has the choice to print extra money that should be repaid at a later date to keep away from forex depreciation.

In a nutshell, at any time when we see rates of interest going excessive, we have now to imagine that inflation is larger too and vice versa.

Let’s have a look at a short historical past of RBI’s Repo charges (rates of interest).

Proper from 2014, rates of interest have been slowly coming down as inflation eased. Nevertheless, in the previous couple of months, we have now seen them going again up. Residence loans have turn into a bit costly and so have our day-to-day bills. However they don’t seem to be so vital as to have an effect on our budgets. If the worth of tomatoes goes up, we’ll eat a bit much less. It’s not a life-and-death state of affairs for us.

Even when the curiosity on a house mortgage or automotive mortgage will get costly by a few proportion factors, most of us merely yawn. It’s not a fabric influence.

We aren’t macroeconomic forecasters who will inform you what will occur sooner or later. The intention of this text is totally different.

But, we take these 2 numbers critically when contemplating our investments. Isn’t it so?

When rates of interest are excessive, banks provide a really excessive fastened deposit price. So we have a tendency to maneuver our cash from fairness to fastened deposits.

Opposite, when the rates of interest are low, we transfer our cash from fastened deposits to the fairness market.

We overlook an important precept right here.

The fairness market is a very totally different beast to beat. Fastened deposit is a very totally different monetary instrument. They aren’t speculated to be interchanged on account of some short-term financial elements.

What’s an fairness market then?

In easy phrases, the fairness market is a spot the place you get possession of a enterprise. So suppose, you wish to personal the expansion of Reliance Industries. You’ll go to the fairness market and purchase some shares of the corporate. And if you wish to promote since you don’t see any additional progress in the identical, then you possibly can go and do this.

Firms like Zerodha, Upstox, and so on. merely provide a platform to allow such a transaction. They aren’t the fairness market themselves. They’re merely enablers.

The elements that make you purchase or promote a specific firm’s inventory is a very totally different dialogue that we’ll hold for a later date.

The most important mistake that we see buyers making right now is solely transferring their cash out of fastened deposits and pumping it into fairness markets. In case you ask them why? That’s as a result of fairness markets will make higher returns than the rates of interest on fastened deposits.

Sure, we agree that fairness markets will at all times make higher funding returns than fastened deposits. Right here’s a query I wish to go away you with.

Will these rates of interest and inflation make you a greater investor?

Give it some thought.

Trace – We’ll cowl this reply within the subsequent article. Keep hooked.

The article is written by Jinay Savla, Jagoinvestor.