Picture supply: Getty Pictures

Pacific Horizon Funding Belief (LSE: PHI) is an Asia-focused FTSE 250 funding firm that hasn’t been setting the world on hearth. Actually, it’s down 5% this 12 months and 42% since late 2021.

However is the inventory now value contemplating for long-term buyers? Let’s discover.

At a look

Pacific Horizon’s managed by Baillie Gifford and invests in high-growth firms throughout the Asia Pacific area (excluding Japan). It takes a long-term method and isn’t afraid to again rising firms that it thinks might be potential disruptors.

Having mentioned that, the portfolio’s largest holdings at the moment are primarily heavyweights. These embody Taiwan Semiconductor (TSMC), Tencent, Samsung Electronics, and TikTok proprietor ByteDance.

As much as 15% of complete belongings could be invested in non-public firms, similar to ByteDance. In March, Pacific Horizon held 5 unlisted corporations, which collectively accounted for 8.5% of the portfolio.

| High 10 holdings (March 2025) | % of complete belongings |

|---|---|

| TSMC | 8.4% |

| Tencent | 7.4% |

| Samsung Electronics | 5.3% |

| ByteDance | 4.3% |

| Sea Restricted | 3.4% |

| Every day Hunt | 3.3% |

| Zijin Mining | 3.2% |

| PDD Holdings | 2.5% |

| Equinox India Developments | 2.4% |

| Meituan | 2.4% |

Half-year outcomes

Not too long ago, the belief launched underwhelming interim outcomes for the six months to 31 January. Whereas its internet asset worth (NAV) rose 3%, the share worth fell 4%, with the NAV low cost widening from 7.8% to 14.2%. This meant it underperformed the MSCI Asia ex Japan Index (6.7%).

China carried out strongly, as the federal government moved aggressively to help the financial system. Nevertheless, the belief’s lack of Chinese language banks weighed on returns, as did restricted publicity to top-performing Chinese language tech shares like Xiaomi, Meituan and Alibaba.

Elsewhere, Taiwan’s semiconductor sector benefitted from surging AI demand, whereas its holding in Sea Restricted (proprietor of the Shopee app and Free Fireplace recreation) surged over 90%. Sadly although, losses in South Korea (particularly Samsung Electronics) and India harm efficiency.

Longer-term horizon

As a long-term investor, I don’t learn an excessive amount of into six-month intervals. Chinese language banks aren’t the form of shares I’d count on to see within the growth-oriented portfolio.

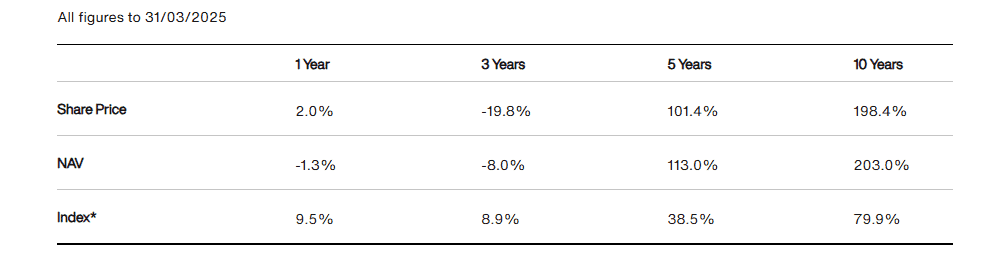

That mentioned, the returns over one and three years are additionally beneath the benchmark. So longer-term underperformance appears to be like to be creeping in.

Zooming additional out although, the five- and 10-year returns are greater than double the index’s (as much as 31 March). However a return to type is required quickly earlier than buyers begin shedding religion.

Tariffs uncertainty

Pacific Horizon has practically 34% of belongings in China and round 16% in India. It thinks China has huge long-term potential attributable to very low valuations and greater than $10trn in Chinese language family financial savings collected because the pandemic.

It additionally mentioned that “Vietnam stays the very best structural progress story in Asia, pushed by its profitable export manufacturing base“. The weighting to Vietnam is roughly 10%.

Nevertheless, a full-blown international commerce conflict will surely trigger ache all spherical, particularly for Vietnam and Pacific Horizon’s portfolio. So there are many near-term dangers.

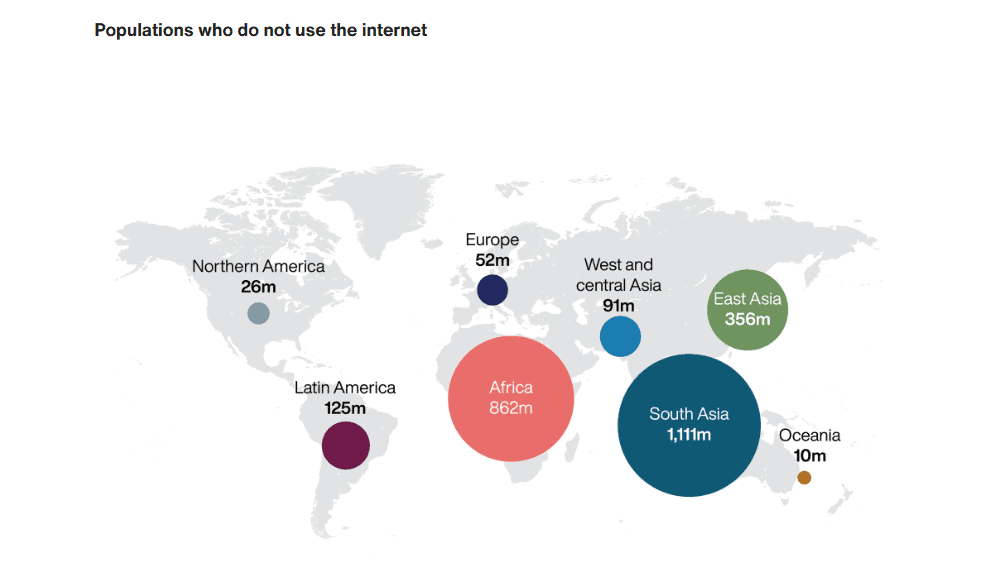

Nonetheless, 1.1bn individuals in South Asia alone are but to entry the web! And in only one era, Asia’s center class is about to be bigger than your entire populations of Europe and the US mixed.

Whether or not it’s TikTok in social media, BYD in electrical automobiles, or DeepSeek with AI, Asian firms are gaining in international prominence. I don’t suppose Trump’s tariffs will cease this development from persevering with long run.

With the inventory down 42% since late 2021, and now buying and selling at a 9.5% low cost to NAV, I believe Pacific Horizon’s value contemplating for affected person buyers.