Ather Vitality IPO 2025

Ather Vitality, one in every of India’s pioneering electrical two-wheeler producers, is ready to launch its Preliminary Public Providing (IPO) with a revised valuation of as much as $1.4 billion, a big 44% discount from its earlier goal. The corporate goals to boost roughly ₹3,000 crore, making it the third-largest public share sale in India for 2025. This IPO contains a contemporary challenge of ₹ 2,626crore and a proposal on the market (OFS) of 1.1 crore fairness shares by present shareholders, together with founders and early traders.

As Ather prepares to enter the general public markets, traders are eager to grasp the corporate’s monetary well being, development prospects, and the dangers concerned. This evaluation delves into Ather’s historic monetary efficiency, key monetary ratios, earnings traits, utilization of IPO proceeds, and threat elements, and supplies an funding advice. Allow us to do an in depth Ather Vitality IPO evaluation.

Ather Vitality IPO evaluation

Monetary Efficiency (FY2022–FY2024)

Ather Vitality has demonstrated spectacular income development over the previous three fiscal years:

- FY2022: ₹1,309 million

- FY2023: ₹5,078 million

- FY2024: ₹18,353 million

This trajectory displays a compound annual development charge (CAGR) of over 200%, underscoring the corporate’s fast market enlargement.

Nonetheless, profitability stays elusive:

- Gross Margin: Improved from 2% in FY2022 to 9% in FY2023 however declined to 7% in FY2024.

- Working Losses: Widened to ₹10,597 million in FY2024.

- Internet Losses: Persistently excessive, with a web loss margin of -60.42% in FY2024.

- Money Movement: Destructive working money flows throughout all three years, indicating substantial money burn.

Whereas the income development is commendable, the persistent losses spotlight the challenges Ather faces in reaching operational effectivity and profitability.

Key Monetary Ratios and Business Comparability

Analyzing Ather’s monetary ratios supplies deeper insights into its monetary well being:

- Debt-to-Fairness Ratio: 0.88 in FY2024, down from 1.09 in FY2023, indicating a discount in leverage.

- Present Ratio: 1.14 in FY2024, suggesting reasonable liquidity.

- Internet Revenue Margin: -60.42% in FY2024, reflecting important web losses.

- Return on Fairness (ROE): -183% in FY2024, indicating destructive returns for shareholders.

In comparison with business friends like Ola Electrical, TVS Motor, and Bajaj Auto, Ather lags in profitability and return metrics. As an example, TVS Motor reported a web revenue margin of roughly 7% and an ROE of round 20% in the identical interval.

Earnings Per Share (EPS)

Ather’s EPS has remained destructive over the previous three years:

- FY2022: ₹(27)

- FY2023: ₹(48)

- FY2024: ₹(47)

The dearth of enchancment in EPS, regardless of income development, means that elevated gross sales haven’t translated into profitability. This pattern raises considerations in regards to the firm’s scalability and value administration methods.

Ather Vitality IPO Particulars

| Ather vitality IPO date | April 28, 2025 to April 30, 2025 |

| Itemizing Date | |

| Face Worth | ₹1 per share |

| Challenge Worth Band | ₹304 to ₹321 per share |

| Lot Measurement | 46 Shares |

| Ather vitality IPO Measurement | 9,28,58,599 shares (aggregating as much as ₹2,980.76 Cr) |

| Contemporary Challenge | 8,18,06,853 shares (aggregating as much as ₹2,626.00 Cr) |

| Provide for Sale | 1,10,51,746 shares of ₹1 (aggregating as much as ₹354.76 Cr) |

| IPO Open Date | Mon, Apr 28, 2025 |

| IPO Shut Date | Wed, Apr 30, 2025 |

| Tentative Allotment | Fri, Might 2, 2025 |

| Initiation of Refunds | Mon, Might 5, 2025 |

| Credit score of Shares to Demat | Mon, Might 5, 2025 |

| Tentative Itemizing Date | Tue, Might 6, 2025 |

Utilization of Ather Vitality IPO Proceeds

In line with the Ather Vitality IPO prospectus, Ather plans to allocate the ₹ 2,626crore from the contemporary challenge as follows:

- ₹927.2 crore: Institution of a brand new electrical two-wheeler manufacturing facility in Maharashtra.

- ₹40 crore: Reimbursement or pre-payment of sure borrowings.

- ₹750 crore: Funding in analysis and improvement over 5 years.

- ₹300 crore: Advertising and branding initiatives over three years.

- Remaining Funds: Basic company functions.

This allocation aligns with Ather’s development technique to broaden manufacturing capability, improve technological capabilities, and strengthen market presence.

Knowledge Heart Associated Articles

Threat Elements of Ather Vitality IPO 2025

- Operational Dangers: Dependence on the adoption charge of electrical automobiles in India and potential manufacturing disruptions.

- Regulatory Dangers: Adjustments in authorities insurance policies, equivalent to modifications to the FAME II incentives, may influence profitability.

- Monetary Dangers: Continued losses and destructive money flows might necessitate extra funding.

- Market Dangers: Intense competitors from established gamers like Ola Electrical, TVS Motor, and Bajaj Auto.

- Reputational Dangers: Previous points, such because the off-board charger refunds, spotlight potential compliance challenges.

Moreover:

- Buyer Focus: Heavy reliance on just a few fashions, such because the 450X, may pose dangers if demand shifts.

- Worth Sensitivity: Premium pricing might restrict market share in a price-sensitive market.

- Technological Obsolescence: Speedy developments by opponents may render Ather’s merchandise outdated.

- Execution Dangers: Challenges in scaling operations whereas sustaining high quality and managing prices.

Ather Vitality IPO Funding Particulars

| Utility | Heaps | Shares | Quantity |

| Retail (Min) | 1 | 46 | ₹14,766 |

| Retail (Max) | 13 | 598 | ₹1,91,958 |

| S-HNI (Min) | 14 | 644 | ₹2,06,724 |

| S-HNI (Max) | 67 | 3,082 | ₹9,89,322 |

Business Overview

Electrical Two-Wheeler Market in India

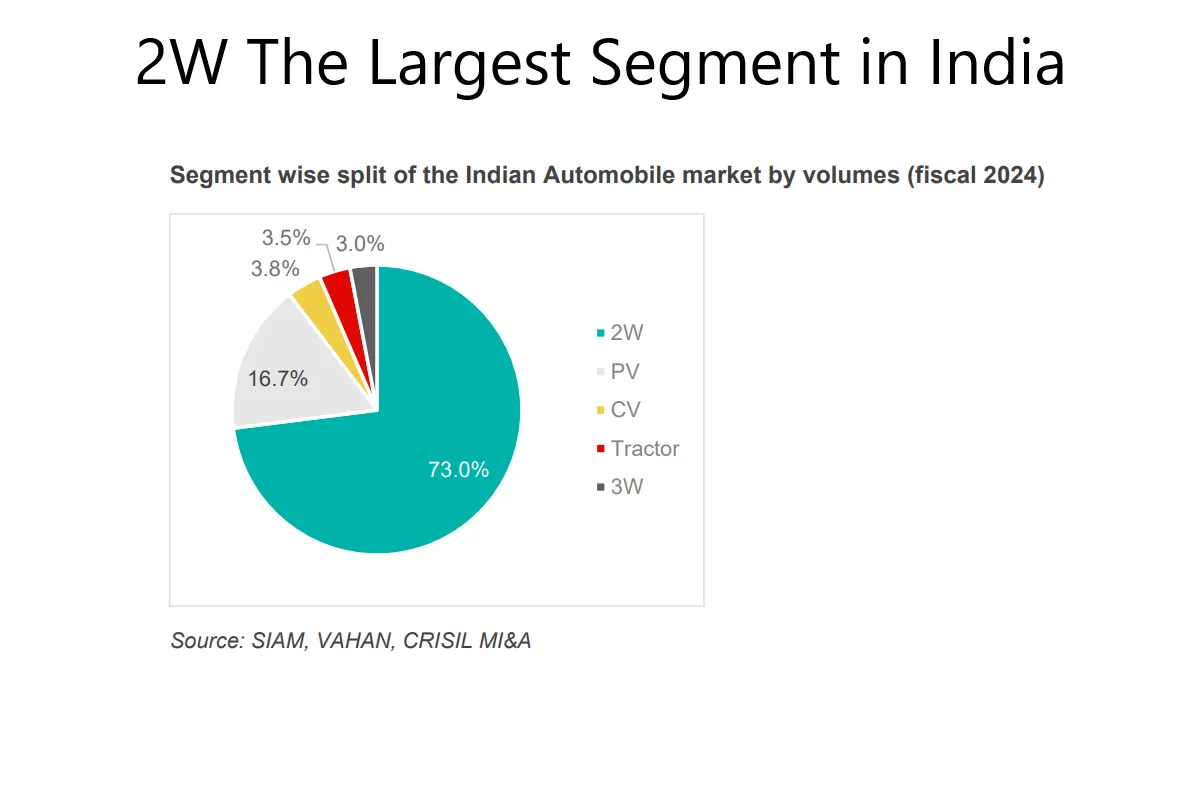

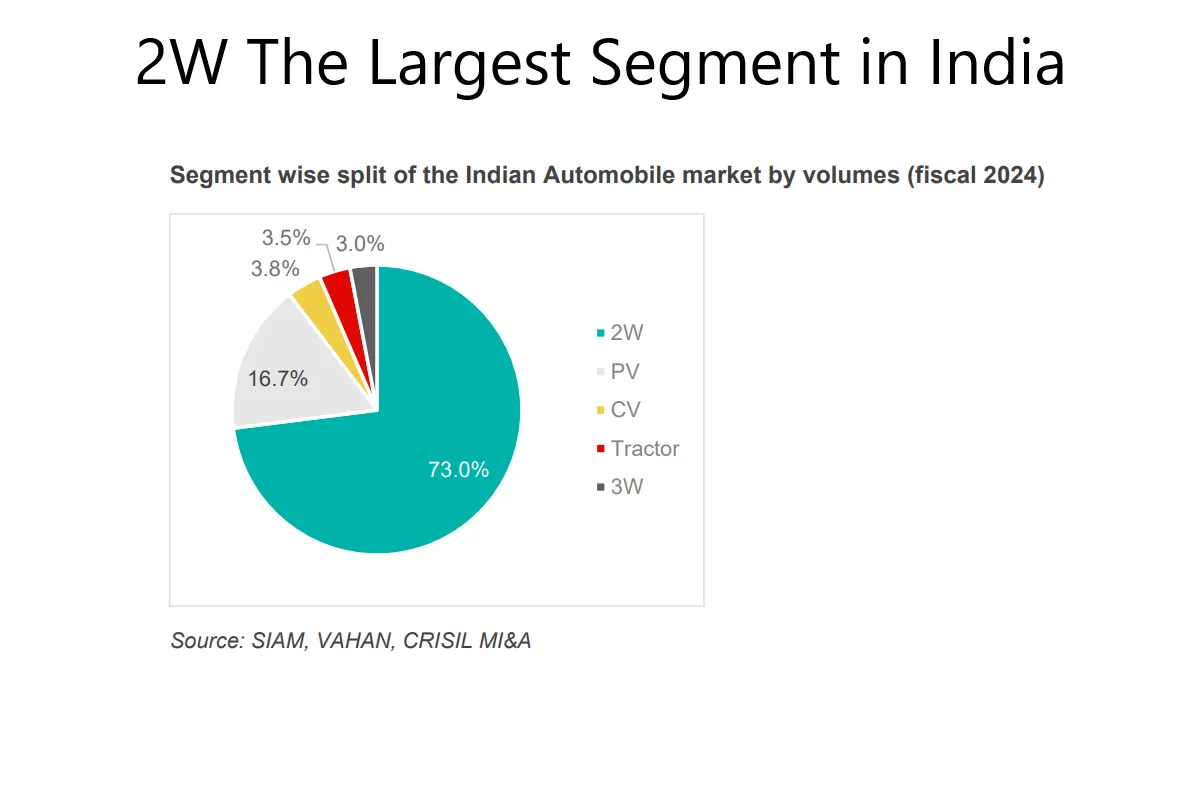

India stands because the world’s largest marketplace for motorized two-wheelers, with 18.4 million models offered domestically in FY2024. Amid this large business, a transformative shift is underway: the rise of electrical two-wheelers (E2Ws). The sector is transitioning quickly from inside combustion engines (ICE) to electrical mobility, pushed by authorities insurance policies, altering shopper conduct, and fast innovation in EV expertise.

The E2W phase is projected to develop at a compound annual development charge (CAGR) of 41–44%, reaching 10.2–12.2 million models by FY2031, which might characterize 35–40% penetration of the general two-wheeler market. This development is anticipated regardless of headwinds equivalent to regulatory uncertainty and provide chain challenges. Drivers of this momentum embrace:

- Declining battery costs, which scale back the entire value of possession.

- Authorities help, particularly by way of schemes like FAME II.

- Shopper shift towards cleaner, smarter, and extra economical transportation choices.

- Increasing EV product portfolios by each new entrants and conventional OEMs.

Aggressive Panorama for Ather Vitality IPO

The market is at the moment dominated by just a few key gamers:

- Ola Electrical: Market chief with over 35% share in FY2024, identified for fast scale-up and value aggression.

- TVS Motor (iQube) and Bajaj Auto (Chetak): Legacy ICE gamers now deepening their EV push.

- Ather Vitality: Positioned as a premium model with high-tech, performance-driven scooters.

Notably, Ather was the third-largest E2W participant by quantity in FY2024, with over 109,000 models offered. Not like many opponents, Ather emphasizes in-house improvement, a vertically built-in mannequin, and proprietary expertise equivalent to AtherStack software program and the Ather Grid charging community.

Coverage Surroundings and Incentives

The Indian authorities has been instrumental in catalyzing the EV motion. Key coverage levers embrace:

- FAME II (Sooner Adoption and Manufacturing of Electrical Autos in India): Presents upfront buy incentives and help for charging infrastructure.

- PLI Schemes: Manufacturing-linked incentives for superior automotive and battery applied sciences.

- State-level subsidies and EV insurance policies in markets like Maharashtra, Tamil Nadu, and Delhi.

Nonetheless, current adjustments in FAME II subsidy constructions have led to short-term volatility, underscoring the regulatory dangers that firms like Ather should navigate.

Last phrases on Ather Vitality IPO evaluation.

- Sturdy product and model recognition.

- Strong development in car volumes (294% YoY in FY23, 19% in FY24).

- Funding in tech and infrastructure may yield long-term returns.

Nonetheless

- Heavy, sustained losses with no quick profitability.

- Destructive EPS and high-risk profile in execution and compliance.

- IPO pricing (₹304–₹321 per share) suggests aggressive valuation, particularly when in comparison with worthwhile incumbents like TVS or Bajaj.

Extra Details about the Ather Vitality IPO