TIPS Music Ltd – The Should Have HITS

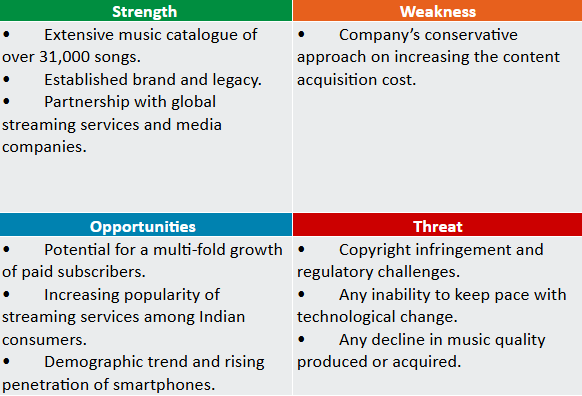

Included in 1996 and headquartered in Mumbai, TIPS Music Ltd. is among the main leisure corporations in India. The corporate is engaged within the enterprise of creation, acquisition and exploitation of audio-visual content material of music libraries in India and abroad by means of licensing on numerous platforms. The music library of the corporate is among the most exhaustive within the business comprising a group of 31,000+ songs, which can be found for streaming and obtain throughout main digital marketplaces like iTunes and Google Play, in addition to well-liked streaming platforms like YouTube, Spotify, Jio Saavn, Resso, Apple Music, and so on.

Merchandise and Providers

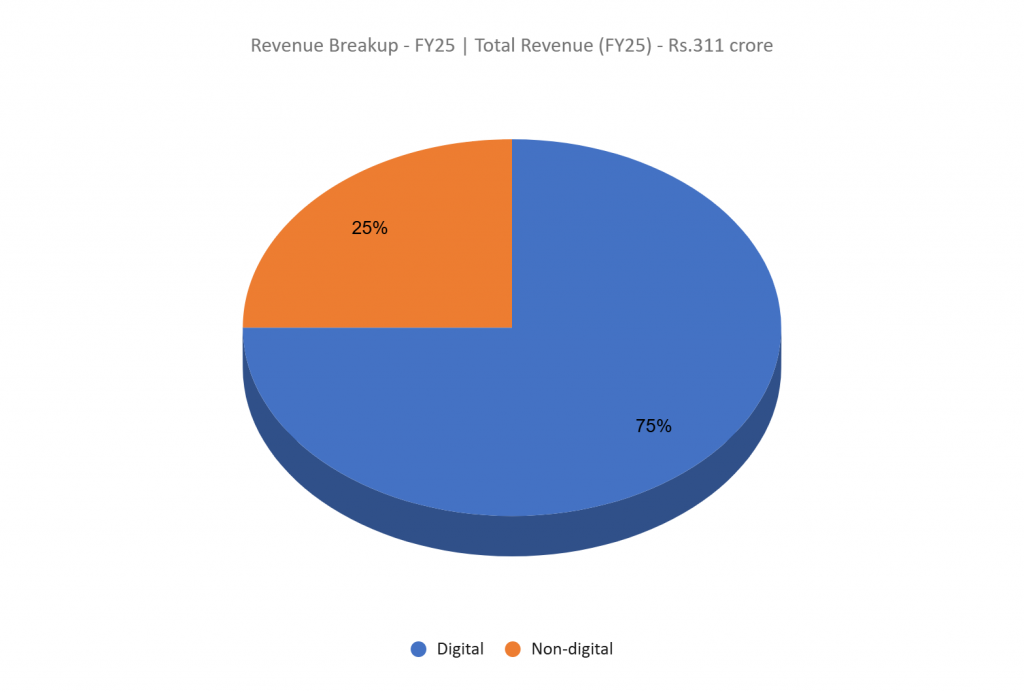

The corporate operates within the digital content material enterprise, specializing in the creation and acquisition of audio-visual music content material and the digital monetization of its content material library by means of licensing throughout numerous platforms in India and overseas.

Subsidiaries: As of FY24, the corporate doesn’t have any subsidiary, affiliate and three way partnership firm.

Funding Rationale

- Established place – TIPS owns a various music catalogue of over 31,000 songs spanning all main genres and languages, from 90s classics to modern hits, obtainable on a number of platforms worldwide. In FY25, the corporate launched 105 new songs—37 from movies and 68 non-film tracks. As of FY25, TIPS has 117.1 million YouTube subscribers, reflecting a 22% CAGR over the previous three years. The corporate has established partnerships with over 25 media entities. Wanting forward, TIPS stays targeted on sustained long-term development throughout platforms, pushed by its in depth catalogue and continued acquisitions from each movies and impartial music.

- Development methods – In FY25, the corporate partnered with TikTok to broaden the worldwide attain of its music, aiming to capitalize on the rising demand for Indian music, significantly within the USA, Canada, the Gulf, the UK, Australia, and New Zealand. TIPS additionally expanded its world publishing settlement with Sony Music Publishing to incorporate YouTube (excluding India), enhancing worldwide monetization of its in depth catalogue. Moreover, the corporate deepened its collaboration with Warner Music. Shifting ahead, the main focus stays on producing high-quality songs with robust potential for repeat viewership.

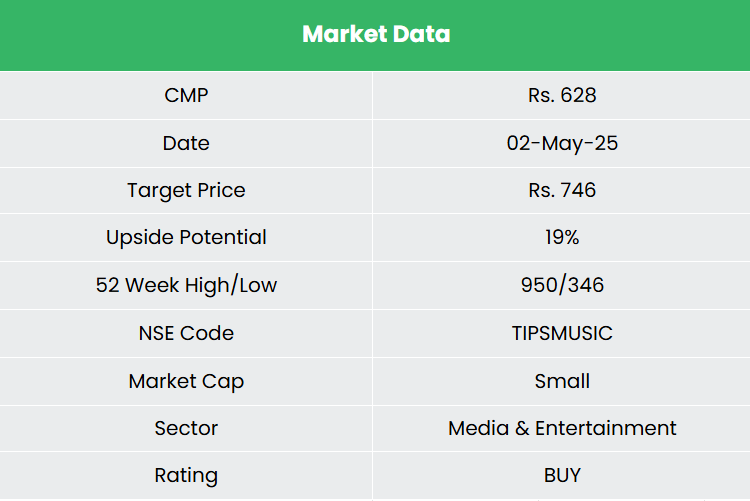

- Q4FY25 – Throughout Q4FY25, the corporate generated a income of Rs.79 crore, attaining a rise of 25% as in comparison with the Rs.63 crore of Q4FY24. The content material value has elevated by 25% YoY, from Rs.24 crore to Rs.30 crore. Working revenue improved by 23% YoY, from Rs.30 crore to Rs.37 crore. Web revenue stood at Rs.31 crore, a rise of 19% from Rs.26 crore of Q4FY24. Throughout the interval, wholesome consumption of content material was seen in YouTube, Spotify, Meta, Amazon, Apple, Gaana, Sawan, Snapchat and so on.

- FY25 – The corporate generated income of Rs.311 crore, a rise of 29% in comparison with FY24 income. Working revenue is at Rs.207 crore, up by 30% YoY. The corporate posted web revenue of Rs.168 crore, a soar of 32% YoY. The corporate’s working revenue margin has improved marginally from 66% to 67% and web revenue margin has elevated from 52% to 54%. As of the top of FY25, the corporate holds Rs.271 crore in money and investments.

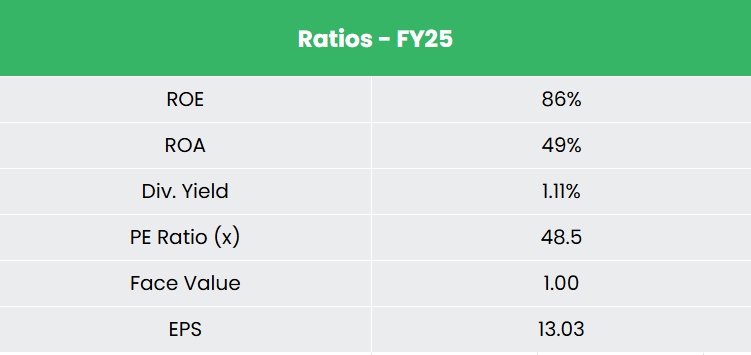

- Monetary Efficiency – The corporate has generated income and web revenue CAGR of 32% and 37% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 78% and 101% for FY21-24 interval. The corporate has a debt-to-equity ratio of 0.02.

Trade

India’s Media and Leisure (M&E) business presents a compelling funding alternative, pushed by robust development projections and transformative digital developments. With a projected annual development price of 9.7% to succeed in US$ 73.6 billion by 2027, the sector is outpacing world averages resulting from components corresponding to fast web penetration, rising disposable incomes, and a tech-savvy inhabitants. The growth of OTT platforms, rural digital adoption, and improvements like 5G and 8K streaming are unlocking new markets and client segments. India’s youthful demographic and its booming digital infrastructure place it as a worldwide hub for content material creation, distribution, and consumption—making it a high-potential business.

Development Drivers

- The rise of social media and rising person generated content material that permits customers to create and share their very own music covers, remixes and authentic compositions.

- The scope to monetise music content material a number of occasions.

- Rising inhabitants and a quickly rising web penetration price and smartphone utilization.

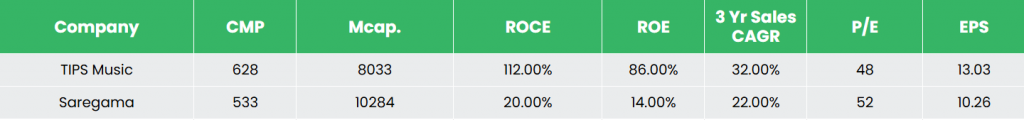

Peer Evaluation

Opponents: Saregama India Ltd.

In comparison with its competitor, the corporate is delivering stronger returns on invested capital, supported by regular income development – highlighting efficient capital allocation and stable revenue-generating means.

Outlook

With India being the fastest-growing market by quantity, there may be substantial potential for monetizing this rising demand within the movie and music business. For FY26, the corporate has given top-line and bottom-line development steering of 30% every. It has additionally given working margin steering of 64%-67% for FY26. It has additionally put aside 25-26% of its income for brand new content material acquisition, which might account for ~Rs.95-120 crore. The corporate continues to emphasise high quality over amount, anticipating greater per-unit prices however a stronger success price.

Valuation

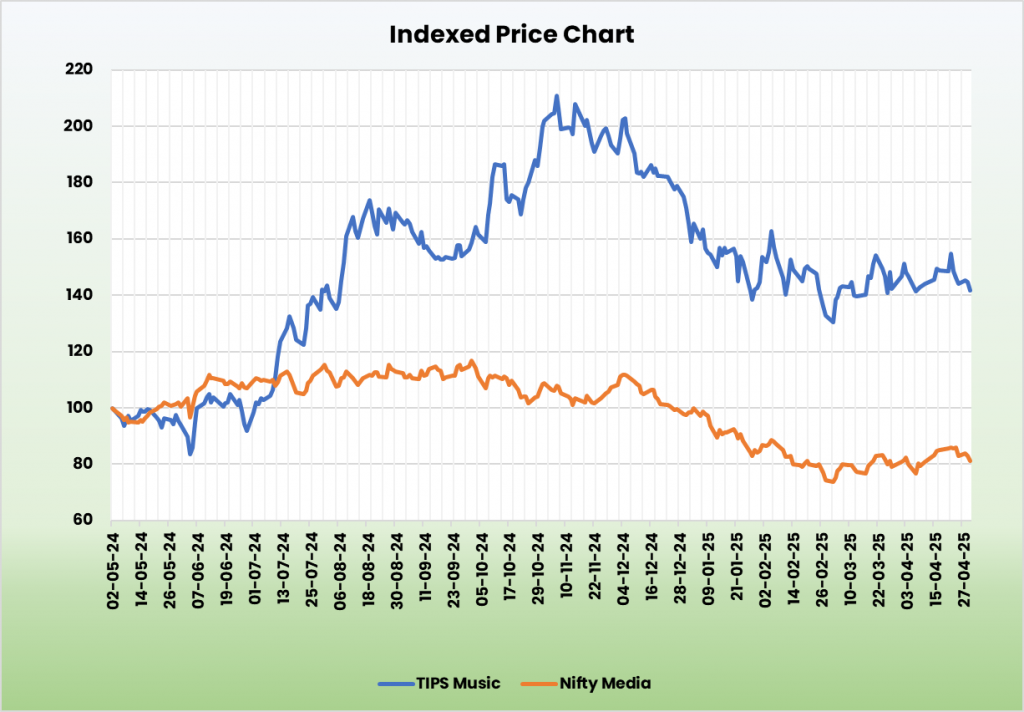

We imagine the corporate’s development is being pushed by a number of key components: a rising variety of paid subscribers on streaming platforms, longer quick video durations that open up larger promoting alternatives, the renewed recognition and profitable relaunch of older songs, rising remuneration income from a rising variety of stage performances, and better publishing earnings from worldwide partnerships. We suggest a BUY ranking within the inventory with the goal worth (TP) of Rs.746, 36x FY27E EPS.

SWOT Evaluation

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork fastidiously earlier than investing. Securities quoted listed here are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please word that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing. Registration granted by SEBI, and certification from NISM under no circumstances assure the efficiency of the middleman or present any assurance of returns to traders.

For extra particulars, please learn the disclaimer.

Different articles chances are you’ll like

Put up Views:

44