By Manusha Rao

You could have seen that markets typically stay calm for weeks after which swing wildly for a couple of days. That’s volatility in motion. It measures how a lot costs transfer—and it’s an enormous deal in buying and selling and investing as a result of it displays threat. However right here’s the catch: estimating volatility is not simple.

A 2% drop usually sparks extra headlines than a 2% acquire. That’s uneven volatility—and it is what conventional fashions miss.

Enter the GJR-GARCH mannequin!

Stipulations

This weblog focuses on volatility forecasting utilizing the GJR-GARCH mannequin, with a sensible Python implementation based mostly on the NIFTY 50 index. It explains the idea of uneven volatility, the way it differs from the normal GARCH mannequin, and offers instruments for evaluating forecast high quality by means of visualizations and diagnostics.

To grasp and apply the GJR-GARCH mannequin successfully, it is essential to begin with the fundamentals of time sequence evaluation. Start with Introduction to Time Sequence to get aware of development, seasonality, and autocorrelation. If you happen to’re exploring how deep studying compares to conventional fashions, learn Time Sequence vs LSTM Fashions for a conceptual comparability.

Since GARCH and GJR-GARCH fashions depend on stationary time sequence, examine Stationarity to learn to put together your knowledge. Improve this information by studying The Hurst Exponent for insights into long-term reminiscence in time sequence and Imply Reversion in Time Sequence for understanding mean-reverting habits—usually linked with volatility clusters.

You also needs to be aware of the ARMA household of fashions, that are foundational to ARIMA and GARCH. For this, check with the ARMA Mannequin Information and its companion weblog ARMA Implementation in Python. Lastly, to understand the terminology and idea behind GARCH, the Quantra glossary entries on GARCH and Volatility Forecasting utilizing GARCH are important assets.

On this weblog, we’ll discover the next:

Distinction between GARCH and GJR-GARCH fashions

The GARCH mannequin captures volatility clustering however assumes that optimistic and destructive shocks have a symmetric impact on future volatility. In distinction, the GJR-GARCH mannequin accounts for asymmetry by giving extra weight to destructive shocks, which displays the leverage impact generally noticed in monetary markets. Why? As a result of worry drives sooner and stronger reactions than optimism in monetary markets.

GJR-GARCH introduces a further parameter that prompts when previous returns are destructive. This makes it extra appropriate for modelling real-world inventory knowledge, the place unhealthy information sometimes causes larger volatility.

For instance, in the course of the COVID-19 market crash in March 2020, the NIFTY 50 noticed sharp declines and sudden spikes in volatility pushed by panic promoting proven beneath.

Supply: TradingView

A GARCH mannequin would understate this asymmetry, whereas GJR-GARCH captures the heightened volatility following destructive shocks extra precisely. Total, GJR-GARCH is a extra versatile and lifelike extension of the usual GARCH mannequin.

A short take a look at the GARCH mannequin

The GARCH (Generalized Autoregressive Conditional Heteroskedasticity) mannequin is a well-liked statistical device for forecasting monetary market volatility. Developed by Tim Bollerslev in 1986 as an extension of the ARCH mannequin, GARCH captures the tendency of volatility to cluster over time—which means intervals of excessive volatility are typically adopted by intervals of excessive volatility, and intervals of calm are adopted by extra intervals of calm.

In essence, the GARCH mannequin assumes that as we speak’s volatility relies upon not solely on previous squared returns (as in ARCH) but in addition on previous volatility estimates. This makes it particularly helpful for modelling time sequence knowledge with altering variance, comparable to asset returns.

The final equation for a GARCH(p, q) mannequin, which fashions conditional variance, is:

- σ2t: Represents the conditional variance of the time sequence at time ‘t’.

- ω: A continuing time period representing the long-run or common variance.

- Σ(αi * ε2t−i): The ARCH element, capturing the impact of previous squared errors on the present variance.

- Σ(βj * σ2t−j): The GARCH element, capturing the impact of previous conditional variances on the present variance.

Word: GARCH(1,1) is the best type of the GARCH mannequin:

σ2t = ω + α1 ε2t−1 + β1 σ2t−1

With solely three parameters (fixed, ARCH time period, and GARCH time period), it is simple to estimate and interpret—ultimate for monetary knowledge the place too many parameters will be unstable.

Introduction to the GJR-GARCH mannequin

The GJR-GARCH mannequin, proposed by Glosten, Jagannathan, and Runkle (1993), is an extension of the usual GARCH mannequin designed to seize the uneven results of stories on volatility.

The GJR-GARCH(1,1) system is given by:

σ2t = ω + α1 ε2t−1 + γ ε2t−1 It−1 + β1 σ2t−1

The place,

γ : Represents the extra affect of destructive shocks (leverage impact)

ε2t−1 It−1

: Represents the indicator operate that prompts when the earlier return shock is destructive

Interpretation:

-

When the earlier shock

εt−1

is optimistic:

σt2 = ω + α εt−12 + β σt−12 -

When the earlier shock

εt−1

is destructive:

σt2 = ω + (α + γ) εt−12 + β σt−12 -

So, destructive shocks enhance volatility extra by the quantity

γ

Now that we perceive the GJR-GARCH mannequin system and its instinct, let’s implement it in Python. We’ll use the arch package deal, which presents a easy but highly effective interface to specify and estimate GARCH-family fashions. Utilizing historic NIFTY 50 returns knowledge, we’ll match a GJR-GARCH(1,1) mannequin, generate rolling volatility forecasts, and consider how properly the mannequin captures market habits, particularly throughout turbulent intervals.

Volatility Forecasting on NIFTY 50 Utilizing GJR-GARCH in Python

Step 1: Import the required libraries

The tqdm library is used to indicate a progress bar when your code is doing one thing that takes time — like operating a loop with lots of steps.

It helps you see how a lot is completed and the way a lot is left, so that you don’t must guess in case your code remains to be operating or caught.

Step 2: Obtain NIFTY50 knowledge

Right here we’re utilizing NIFTY 50 knowledge from 2020 to 2025.

Subsequent, calculate the day by day log returns and categorical in share phrases. Fashions like GARCH work higher when the enter numbers are usually not too tiny (like 0.0012), as very small values could make it more durable for the optimizer to converge throughout mannequin becoming.

Step 3: Specify the GJR-GARCH mannequin

To mannequin a GJR-GARCH mannequin in Python,the arch package deal is used. Use Scholar’s t-distribution for residuals, which captures fats tails usually noticed in monetary returns. Be happy to make use of the distribution that most closely fits your buying and selling wants or knowledge distribution.

Right here,

p = 1

Variety of lags of previous squared returns (ARCH time period)

o = 1

Variety of lags for asymmetry time period – this permits the GJR-GARCH (or GARCH with leverage impact)

q = 1

Variety of lags of previous variances (GARCH time period)

Step 4: Match the mannequin

The output is as follows:

- The ARCH time period (alpha[1]), which measures the affect of previous shocks, is important on the 5% stage, although comparatively small (0.0123).

- The GARCH time period (beta[1]) is excessive at 0.9052, implying that volatility is extremely persistent over time.

- The leverage impact (gamma[1] = 0.1330) is important, confirming the presence of asymmetry—destructive shocks enhance volatility greater than optimistic ones, a typical characteristic in fairness market knowledge.

- The estimated levels of freedom (nu = 7.6) for the Scholar’s t-distribution counsel the information displays fats tails, justifying the selection of this distribution to seize excessive returns extra precisely.

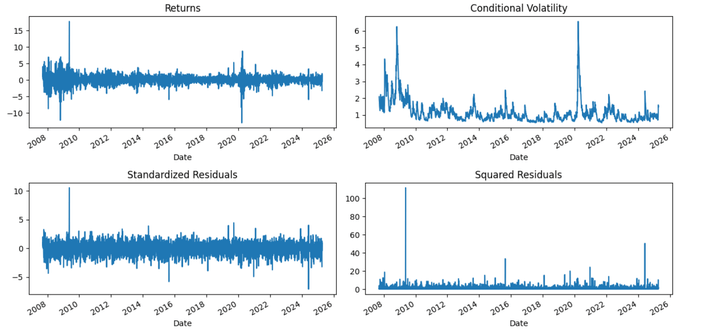

Step 5: Residual diagnostics

This block of code is for residual diagnostics after becoming your GJR-GARCH mannequin. It helps you visually assess how properly the mannequin has captured volatility dynamics.

The GJR-GARCH mannequin performs properly in capturing volatility dynamics throughout main market occasions, particularly intervals of monetary misery. Notable spikes in conditional volatility are noticed in the course of the 2008 international monetary disaster and the 2020 COVID-19 pandemic. The asymmetry element (gamma) performs a key position right here, amplifying volatility predictions in response to destructive returns—mirroring real-world investor habits the place worry and unhealthy information drive sharper market reactions than optimism.

Step 6: Make rolling forecasts of volatility

A extra sensible strategy to forecast volatility is to make one-step-ahead predictions utilizing info out there as much as time t, after which replace the mannequin in actual time as every new knowledge level turns into out there (i.e., as t progresses to t+1, t+2, and many others.). In easy phrases, every day we incorporate the newest noticed return to forecast the subsequent day’s volatility.

Right here we take prepare the mannequin on 500 days of previous returns, to forecast 1-day forward volatility, repeated day by day.

Now you’ll wish to examine GARCH’s 1-day forecast to some observable precise volatility.

The same old methodology is to compute realized day by day volatility as a rolling customary deviation.

Nonetheless, in case you’re forecasting for 1 day, the realized volatility you need to ideally examine it to is:

the precise return (i.e., squared return of the subsequent day), or a smoothed proxy like a 5-day rolling customary deviation (if you wish to take away noise).

As illustrated within the plot beneath, intervals of elevated market uncertainty, comparable to mid-2024, exhibit vital spikes within the 1-day forward forecasted volatility, reflecting heightened threat notion. Conversely, calmer intervals like early 2023 present lowered volatility expectations. This strategy allows merchants and threat managers to adaptively modify publicity and hedging methods in response to anticipated market situations.

The GJR-GARCH mannequin proves particularly priceless for its means to react sensitively to draw back shocks. It’s a sturdy device for short-term volatility forecasting in index-level knowledge just like the NIFTY 50 or inventory knowledge.

Now allow us to test the correlation between the realized and forecasted volatility.

Output:

Correlation between Forecasted and Realized Volatility: 0.7443

The noticed correlation of 0.74 between the 5-day rolling realized volatility and the GJR-GARCH forecasted volatility signifies that the mannequin successfully captures the dynamics of market volatility.

Particularly, the GJR-GARCH mannequin, which accounts for uneven responses to optimistic and destructive shocks (i.e., volatility reacts extra to destructive information), aligns properly with the precise realized volatility. A robust correlation like this implies that the mannequin can forecast intervals of excessive or low volatility in a directionally correct means.

Conclusion

Market volatility isn’t simply numbers—it displays human psychology. The GJR-GARCH mannequin goes a step past conventional volatility estimators by recognizing that worry has a stronger market affect than optimism. By modelling this behaviour explicitly, it offers a extra correct and behaviourally sound option to forecast volatility in varied property.

Subsequent Steps

When you’re comfy with the GARCH household, you may transfer on to extra complicated volatility modeling methods. An excellent subsequent learn is Time-Various-Parameter VAR (TVP-VAR), which introduces fashions that deal with stochastic volatility and structural modifications over time.

You too can discover ARFIMA fashions for dealing with long-memory processes, that are frequent in monetary market volatility. Understanding these fashions will make it easier to create extra sturdy, adaptable forecasting programs.

To develop efficient buying and selling methods, transcend modeling. Mix your GJR-GARCH insights with sensible strategies from Technical Evaluation to detect developments and momentum, use Buying and selling Threat Administration to guard in opposition to losses, discover Pairs Buying and selling for market-neutral methods, and perceive Market Microstructure to account for execution and liquidity dynamics.

Lastly, for a structured and complete journey into algorithmic buying and selling, contemplate enrolling within the Govt Programme in Algorithmic Buying and selling (EPAT). EPAT covers superior subjects comparable to stationarity, ACF/PACF, ARIMA, ARCH, GARCH, and extra, with sensible coaching in Python technique growth, statistical arbitrage, and alternate knowledge. It’s the right subsequent step for these prepared to use their quantitative abilities in actual markets.

File within the obtain:

GJR GARCH Python Pocket book

Disclaimer: All investments and buying and selling within the inventory market contain threat. Any determination to position trades within the monetary markets, together with buying and selling in inventory or choices or different monetary devices is a private determination that ought to solely be made after thorough analysis, together with a private threat and monetary evaluation and the engagement {of professional} help to the extent you consider mandatory. The buying and selling methods or associated info talked about on this article is for informational functions solely.