WACC Calculator

Discover WACC Purposes

Click on on a state of affairs to learn the way WACC is utilized in real-world monetary choices.

WACC serves as a reduction charge to evaluate new initiatives. For a undertaking to be viable, its anticipated return should exceed your WACC. Attempt tweaking the fairness or debt values above to see how WACC impacts undertaking feasibility.

WACC is used to low cost future money flows in firm valuation. A decrease WACC will increase an organization’s current worth, whereas a better WACC reduces it. Experiment with the calculator to discover valuation impacts.

Corporations use WACC to optimize their debt-to-equity ratio. A decrease WACC suggests a balanced capital construction. Alter debt and fairness values to see how they have an effect on your WACC and financing technique.

Introduction

This text supplies real-world examples and purposes of the WACC. It’s a vital idea utilized by corporations in funding decision-making. As an investor, you’ll acquire beneficial insights on use WACC to guage funding alternatives and make knowledgeable choices.

The Weighted Common Value of Capital (WACC) is a monetary idea. It highlights the minimal acceptable return that an organization should earn on its funding initiatives to satisfy its buyers and lenders expectations. WACC represents the common value of finance for an organization. The supply of funds can embody each debt and fairness.

Let’s begin with the fundamentals of WACC after which regularly we’ll go into the main points:

Learn how to calculate WACC

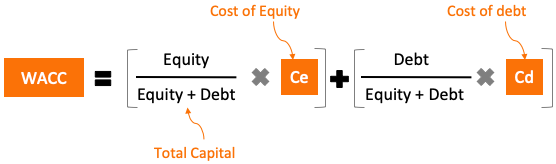

WACC is calculated by taking the weighted common of the price of fairness and the price of debt, with every value being weighted by its respective proportion within the firm’s total capital construction. The system for WACC is:

- Fairness = market worth of the corporate’s fairness

- Debt = market worth of the corporate’s debt

- Fairness + Debt = complete market worth of the corporate’s debt

- Ce = value of fairness

- Cd = value of debt

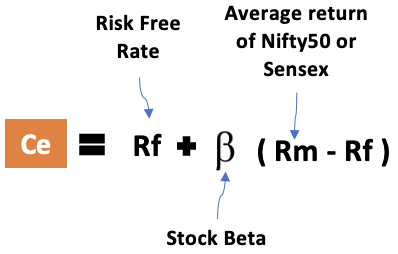

The value of fairness (Ce) is usually calculated utilizing the Capital Asset Pricing Mannequin (CAPM), which takes into consideration the risk-free charge, the anticipated market return, and the corporate’s beta.

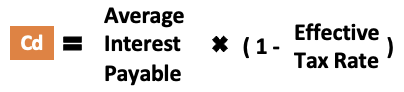

The value of debt (Cd) is calculated utilizing the yield to maturity on the corporate’s debt, adjusted for taxes. The general value of debt can also be adjusted for any financing prices related to the debt.

The calculation of WACC is complicated. However it’s a essential monetary metric that’s used to find out the minimal charge of return required on funding initiatives. This data is essential, each for the corporate and likewise for the analysts and buyers.

With this understanding of the system, one is best geared up to use WACC in real-world eventualities and make knowledgeable monetary choices. So let’s have a look at a number of WACC examples to get a greater maintain of the subject.

Examples of WACC of Totally different Corporations

On this part, we’ll calculate the WACC of some Indian corporations. These examples will exhibit how WACC may be calculated and used to guage the monetary viability of potential investments. Inventory analysts also can use the WACC values as a reduction charge quantity.

WACC is the common value of capital of an organization. It will also be understood as a minimal acceptable return the corporate earns to fulfill its buyers and lenders. This data tells the corporate about allocate capital and be sure that a enough ROI is yielding.

Let’s delve into the main points of WACC examples with calculations.

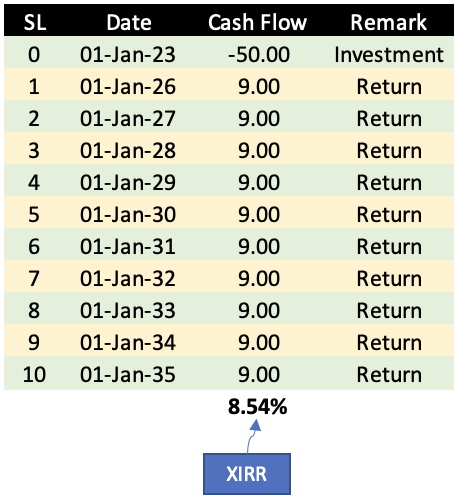

Instance #1: Dr. Lal PathLabs

Suppose, Dr. Lal PathLabs is contemplating investing in a brand new diagnostic heart. The price of the undertaking is estimated to be Rs. 50 crore (in 01-Jan-2023). The anticipated return of Rs.9 crore is predicted from 01-Jan-2026. This cash-in move will proceed for the subsequent 10 years until the 12 months 01-Jan-2035 (see under desk). Utilizing these numbers as our foundation, the anticipated return on funding (ROI each year) for the corporate is about 8.54% each year.

The corporate needs to guage whether or not to go forward with this funding (undertaking) or not. To get the reply, the corporate should examine its WACC with the undertaking’s ROI. So, let’s calculate the WACC of Dr. lal PathLabs.

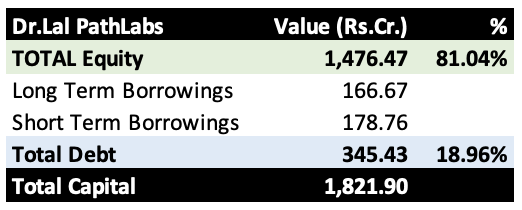

Capital Construction

The corporate’s present capital construction as of March 2022 is 81% fairness and 19% debt.

Value of Fairness (Ce)

Let’s estimate the value of fairness (Ce) of the corporate. Following might be our assumptions:

- Threat-Free Price (Rf) = 7.1% each year.

- Inventory Beta = 0.54

- Common Return available on the market = 12% each year.

Utilizing these numbers let’s calculate the price of fairness (Ce) for the Dr. Lal PathLabs.

Ce = Rf + Beta x (Rm – Rf)

Ce = 7.1 + 0.54 x (12 – 7.1) = 9.75%

Value of Debt (Cd)

Let’s estimate the value of debt (Cd) of the corporate. Following might be our assumptions:

- Common curiosity payable: 10% each year.

- Efficient Tax Price: 35%

Utilizing these numbers let’s calculate the price of debt (Cd) for the Dr. Lal PathLabs.

Cd = Common Curiosity Price x (1 – Eff. tax charge)

Cd = 10 x (1 – 35%) = 6.5%

WACC

To find out whether or not this undertaking is financially viable, the corporate must calculate its WACC.

Utilizing the above numbers of Dr. Lal PathLabs, let’s calculate the WACC of the corporate:

WACC = Fairness% x Ce + Debt% x Cd

WACC = 81% x 9.75 + 19% x 6.5 = 9.13% each year.

The WACC of 9.13% is the minimal acceptable return that the corporate should earn on the undertaking to fulfill its buyers and lenders.

Inference: Because the anticipated return on funding (8.54%) is lower than the corporate’s WACC – the price of capital (9.13%), the undertaking is not financially viable.

Instance #2: Hindustan Zinc vs Balaji Amines

Suppose an investor needs to put money into corporations having a excessive ROCE. He did his analysis and located that Hindustan Zinc and Balaji Amines are two corporations with excessive ROCE numbers of about 50%. Now he ought to choose both of the 2 for investing.

On what foundation he ought to choose his inventory? He can calculate the WACC of each corporations. For a similar ROCE, the corporate with a decrease WACC turns into a preferable alternative.

So, let’s calculate the WACC of each corporations:

Value of Fairness (Ce)

We’ll begin with the price of fairness. I’m assuming the risk-free charge of seven.1% each year. It’s the worth taken from the yield of a 10-year authorities bond. I’m additionally assuming the common market return of 12% each year taking a clue from the historic development of Nifty50 (learn this report).

| Description | Hindustan Zinc | Balaji Amines |

| Threat-Free Price (Rf) p.a. | 7.10% | 7.10% |

| Inventory Beta | 0.64 | 0.93 |

| Common Market Return (p.a.) | 12% | 12% |

| Value of Fairness (Ce) | 10.24% | 11.66% |

Out of the 2 shares, as Hindustan Zinc’s beta is decrease, its value of fairness can also be decrease at 10.24%. Balaji Amines value of eqity is 11.66% as per CAPM mannequin.

Value of Debt (Cd)

Now we’ll take up the price of debt. I’m assuming that, as Hindustan Zinc is a a lot larger company than Balaji Amines, its curiosity value might be decrease at 9% each year. I’ve assumed Balaji Amines’ curiosity value of 10% each year.

| Description | Hindustan Zinc | Balaji Amines |

| Common Value of Debt | 9.00% | 10.00% |

| – Tax Expense Rs.Cr. – A | 4,777.00 | 115.20 |

| – Revenue Earlier than Tax Rs.Cr. – B | 15,297.00 | 423.14 |

| Efficient Tax Price (=A/B) | 31.23% | 27.23% |

| Value of Debt (Cd) | 6.19% | 7.28% |

After contemplating the impact of the efficient tax charge, the price of debt (Cd) of Hindustan Zinc is 6.19% and that of Balaji Amines is 7.28%.

WACC

Lastly, we’ll estimate the WACC for each corporations. However to do it, we should learn about their capital construction.

| Description | Hindustan Zinc | Balaji Amines |

| Shareholders’ Fairness Rs.Cr. | 12,942.00 | 1,192.39 |

| – Brief-Time period Borrowing Rs.Cr. (A) | 10,362.00 | 0.00 |

| – Lengthy-Time period Borrowing Rs.Cr. (B) | 1,519.00 | 0.00 |

| Complete Debt Rs.Cr. (A+B) | 11881.00 | 0.00 |

| Complete Capital | 24823.00 | 1192.39 |

| Fairness (%) | 52.14% | 100.00% |

| Debt (%) | 47.86% | 0.00% |

Now that we have now the capital construction of each corporations, we calculate their WACC (value of capital) utilizing the WACC system:

| Description | Hindustan Zinc | Balaji Amines |

| Fairness % | 52.14% | 100.00% |

| Value of Fairness (Ce) | 10.24% | 11.66% |

| Debt % | 47.86% | 0.00% |

| Value of Debt (Cd) | 6.19% | 7.28% |

| WACC | 8.30% | 11.66% |

Inference

For the sake of simplicity, I’m simply assuming all different elements are equal for each corporations. Nonetheless, it is very important think about different elements reminiscent of administration high quality, aggressive benefits, trade developments, and valuation earlier than investing choice.

The investor can conclude that Hindustan Zinc is a greater funding possibility as in comparison with Balaji Amines. It’s because each corporations have the identical ROCE, which signifies that they’re producing the identical quantity of return on their employed capital.

Nonetheless, Hindustan Zinc has a decrease WACC, which implies that the price of capital for the corporate is decrease. Therefore, it could generate extra ROE for its shareholders.

However, Balaji Amines has a better WACC, which implies that it’s incurring increased prices to finance its operations and development. It might not have the ability to generate as a lot ROE for its shareholders.

Limitations of Utilizing WACC

Whereas WACC is a generally used metric for evaluating funding alternatives, it isn’t with out its limitations and challenges.

- Virtually All Values Are Assumed: An analyst can assume loads of future values for an organization whereas calculating the WACC. The assumptions may be like risk-free charge, inventory beta, common market returns, efficient tax charge, the common curiosity paid on debt, and many others. Adjustments to those assumptions can considerably impression the calculated WACC. Therefore, as analysts change, the WACC of an organization will even change. It makes WACC a much less dependable metric for decision-making.

- Inappropriate Threat Evaluation: Value of fairness (Ce) is the theoretical return an organization shall pay to its shareholders for the danger they’re taking by investing within the inventory. What’s the measure of the danger? It’s inventory beta. However the potential threat of loss for an investor can’t be quantified solely by the inventory beta.

These above assumptions can impression the ultimate WACC quantity and the decision-making. The precise value of capital of the corporate could also be low, however an analyst’s flawed assumptions make inflate it. The inflated value means a better threat of loss for the buyers. So many individuals might find yourself not investing within the firm for the sake of excessive WACC which isn’t the case. An inverse of this logic can also be true.

Eventualities and WACC

In a bullish market, the analyst might assume a increased common market return. Because of this, the calculated value of fairness (Ce) of the corporate might be increased. Assuming that there aren’t any adjustments within the firm’s fundamentals, assuming a better WACC for an organization sounds unfair, proper?

Equally, in a rising rate of interest state of affairs, the analyst might assume a increased rate of interest paid on borrowed cash. Because of this, the calculated value of debt (Cd) of the corporate might be increased. In a falling rate of interest state of affairs, the price of debt will come out as decrease. Although in actuality, there may not be any change in the price of debt for the corporate.

Regardless of these challenges, WACC stays a broadly used metric for estimating the price of capital of corporations. So far as I do know, there aren’t any different monetary fashions that may do the work extra effectively than WACC.

Conclusion

WACC is a vital instrument for buyers and corporations seeking to make knowledgeable funding choices. By the calculation of the weighted common value of capital (WACC), buyers can use the WACC metric to match the return potential of an organization. Two corporations are anticipated to yield the identical returns sooner or later, however the one with a decrease WACC would entice extra buyers.

This text has supplied an summary of calculate WACC. We’ve additionally seen WACC examples of some real-world corporations. The examples have been posed as queries that higher clarify the utility of WACC for corporations and for buyers.

The article additionally highlighted the restrictions and challenges of utilizing WACC. Within the calculation of WACC, there are far too many assumptions that make WACC a much less dependable metric. However for knowledgeable and skilled analysts, WACC works fairly advantageous.

Have a contented investing.