Picture supply: Getty Photographs

Alternate-traded funds (ETFs) listed on the London Inventory Alternate are a improbable strategy to put money into themes inside an ISA. In addition they give on the spot publicity to a wide array of corporations, thereby serving to to unfold threat by means of diversification.

Listed below are three ETFs spanning cybersecurity, synthetic intelligence (AI) and defence I feel have tons of potential and are value additional analysis.

Now not a luxurious

First up is L&G Cyber Safety UCITS ETF (LSE: ISPY). This fund holds 41 shares throughout the more and more related cybersecurity business. In current weeks, Marks and Spencer, Co-op and Harrods have all been hit by cyber assaults.

On 27 Could, Adidas was the most recent agency to have prospects’ private data stolen. This highlights how cybersecurity spending is now a necessity quite than a luxurious for organisations of all sizes.

The fund holds many high shares within the area, together with CrowdStrike, Cloudflare, and Palo Alto Networks. To this point in 2025, CrowdStrike and Cloudflare are up 37% and 50% respectively.

The ETF’s share worth is up 56% over the previous two years. Nonetheless, one consequence is that valuations are fairly excessive throughout a lot of the portfolio. A threat right here then is that the inventory market pulls again, decreasing the ETF’s worth within the close to time period.

Over the long run although, I feel it’s arrange for additional features. AI’s creating an escalating arms race between cyber attackers (teams and nation states) and the defending corporations on this ETF.

AI innovation

Sticking with AI, I feel the iShares AI Innovation Lively UCITS ETF (LSE: IART) is effectively value contemplating. In accordance with McKinsey International Institute, AI software program and companies alone are projected to generate $15.5trn-$22.9trn in annual financial worth by 2040!

Because the title suggests, this ETF’s invested in corporations doing plenty of AI innovation right now. High holdings embody chip king Nvidia, Microsoft, which has a big stake in ChatGPT maker OpenAI, and Meta, the social media big that’s utilizing AI to enhance focused advertisements on Fb and Instagram.

Now, one factor value mentioning is that this actively-managed ETF was solely launched in January. So there’s no monitor file of outperformance to go on, which provides a little bit of threat.

Nonetheless, I like that among the many 39 holdings there are some smaller modern names in there. These have the potential to finally grow to be tech giants in their very own proper. Examples embody cloud-based information agency Snowflake, gaming platform Roblox, and Cloudflare (once more).

Twin focus

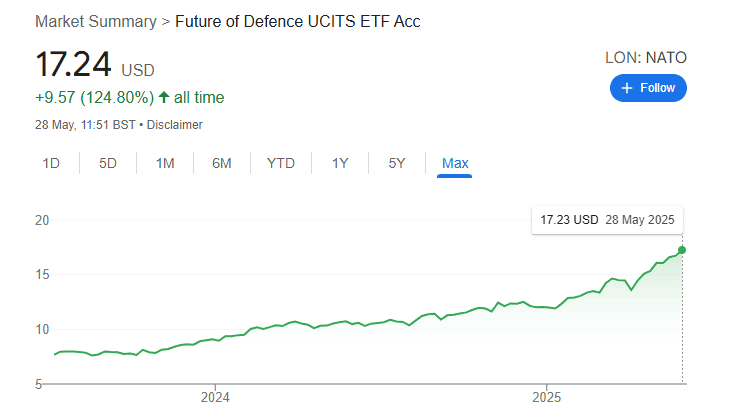

The third fund is the HANetf Way forward for Defence ETF (LSE: NATO). Since launching in mid-2023, the share worth has greater than doubled.

This ETF has a twin focus. It gives publicity to corporations benefitting from each NATO navy and cyber defence spending. High holdings embody Germany’s Rheinmetall, the UK’s BAE Techniques, and AI software program big Palantir.

Whereas these shares have been on hearth lately, a reduce to the US defence funds may harm their upwards trajectory. In the meantime, a world recession may result in decrease progress and earnings for some corporations within the portfolio.

Alternatively, European nations are actually dedicated to spending a whole lot of billions on constructing their long-neglected defence capabilities. It is a highly effective multi-decade development that’s prone to push the ETF greater, over time.