Immediately we are going to talk about how one can persuade your mother and father (assuming senior citizen) into mutual funds to get higher returns on their investments with decrease danger.

I’m not saying that each guardian must put money into mutual funds. However I’ve seen many mother and father retiring with inadequate corpus and investing that cash in a really method. It’s not tax-optimized and in addition earns the least return attainable – all in the identical of “Security”

I perceive that not all senior residents need excessive returns, however in a lot of the instances, I’ve seen that there’s some allocation which might be made in mutual funds.

We come throughout many buyers, who’re investing in mutual funds and so they have a very good understanding of the product. They’ve full confidence in mutual funds investments, however their very own mother and father are caught within the outdated conventional approach of investments. And these youngsters should not capable of persuade their mother and father to speculate their cash in mutual funds or something carefully linked to inventory markets, just because mother and father include the bags of outdated beliefs about fairness markets and poor understanding of the idea of Threat!

Outdated habits by no means go!

Many of the mother and father have all their life invested in Mounted Deposits, LIC insurance policies, PPF, NSC and postal schemes which had been easy and assured return merchandise. Their focus was at all times on “peace of thoughts” and “security”. They weren’t obsessive about returns like we do right this moment!

Dad and mom outright reject the thought of investing in mutual funds or shares the second they arrive to know that its not a assured returns product and there may be RISK concerned in these items.

To get some concept on this topic, I requested on our telegram group how their mother and father react for the investments in shares and mutual funds, and listed below are 2-3 responses I obtained!

I do know it’s going to be very very robust to persuade them for investing in mutual funds, and most people will fail on this!. Nevertheless, that is my small try to offer some tips that could you on how one can begin the dialog together with your mother and father on this challenge. Possibly it’ll be just right for you.

So listed below are easy issues we are able to do.

#1 – Introduce them to Debt Mutual Funds

The very first thing you are able to do is to not introduce the phrase “Mutual funds” on to your mother and father. Inform them that there’s one funding product which is analogous to Mounted deposits, and the returns it has given over final a few years have been just a little higher than Mounted deposits and has very much less taxation (we see tax half in level #2 quickly)

Inform them how this new “funding product” works very very like financial institution deposits. It additionally lends cash to others and will get returns. However not like financial institution fastened deposits, it doesn’t give a decrease however fastened return.

As a substitute, it retains a small-fees and returns all of the returns to its buyers (which signifies that its a market-linked returns). There’s its personal share of dangers which must be effectively understood and dealt with.

The subsequent step is to indicate them how these debt funds have carried out over the previous few years like 5/10 yrs.

Begin with Banking and PSU Class

You can begin with a debt fund which comes from “Banking and PSU Fund” class as a result of I’ve seen many senior residents are very comfy with the portfolio of that type of debt fund/

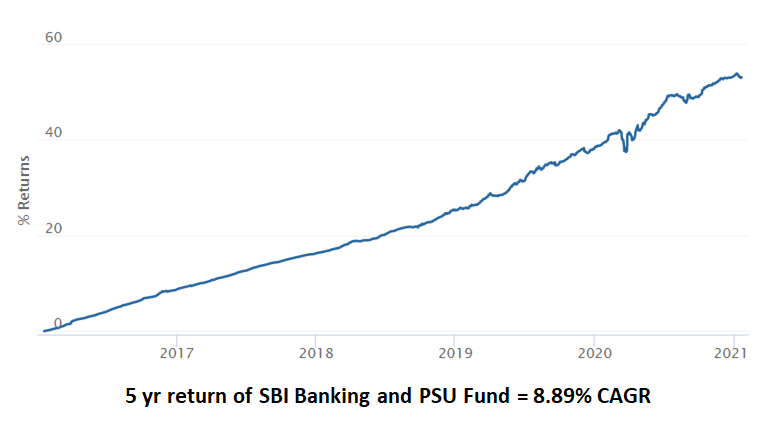

Take for instance SBI Banking and PSU Funds

Its a debt fund from SBI Mutual fund which invests an enormous portion of its cash in bonds issued by varied banks & PSU corporations in India. The definition itself will likely be price consideration and oldsters could pay attention due to the phrase SBI (possibly!!)

That fund has given 8.89% returns within the final 5 yrs. The Journey for a fund has not been as a straight line, but it surely’s not wild like an fairness fund. To a senior citizen who’s struggling to get a 6% return in FD could also be taken with trying on the previous returns of this fund.

Aside from Banking and PSU class, you can too inform them about brief time period debt fund in case they need to make investments their cash for brief time period like a couple of months to a couple years.

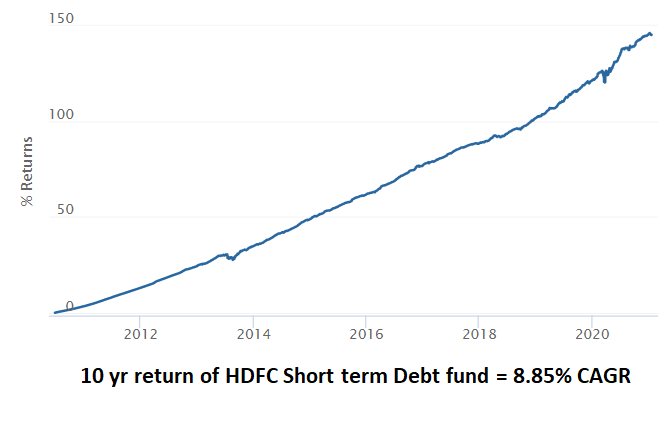

The soundness of returns for brief time period debt funds class is kind of sturdy as they put money into brief time period debt papers (incase that is technical for you, dont fear, you must find out about debt funds)

Right here is an instance of HDFC Brief time period debt fund which has given fairly steady returns over a few years. Its return within the final 10 yrs is round 8.85% cagr! . Little question that the fund is little unstable in brief time period, however over lengthy intervals you may see the road going up and up!

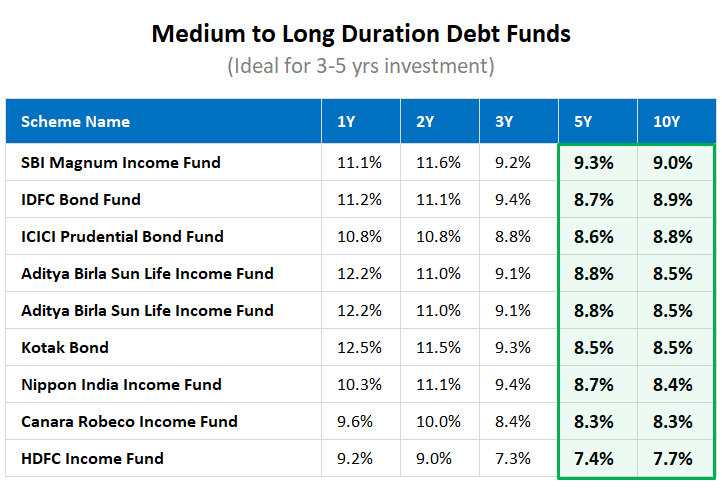

Yet one more class is of Medium to Long run funds that are appropriate for 3-5 yrs funding interval and one can count on an 8-8.5% returns based mostly on historic efficiency solely (previous returns should not a assure for future returns)

Here’s a desk exhibiting what has occurred within the final a few years (Some funds with very low AUM is faraway from the desk and solely greater manufacturers are taken)

In order step one simply present them these returns and low volatility of debt funds. This would be the basis step.

Disclaimer: Debt funds should not so simple as what you’re seeing above. There’s credit score danger and rates of interest danger due to which the returns might be fluctuating. Nevertheless, I’m not going into the main points of how debt fund works because it’s out of the scope of this text. If you’re not clear on how debt fund works or chosen, its beneficial to search for an advisor.

#2 – Present them the impression of taxation

One of the vital neglected points of investments is Taxation.

Folks don’t suppose a lot about optimizing their tax-outgo whereas making investments. Buyers nonetheless speak by way of “Returns” and never “Publish-tax Returns”.

If you put money into Mounted Deposits, Senior Citizen Saving Scheme, Saving Financial institution and so on, you pay the tax on the slab charge. Which signifies that for very excessive quantities the tax will likely be at 30% charge for buyers within the highest tax bracket. The worst is with FD, the place you pay the tax on your entire 12 months Mounted Deposits curiosity, not on how a lot you’ve gotten redeemed!.

Are you able to imagine that this tax might be lowered to 10% or 5% and typically even 2-3% for longer tenure investments (some instances). It is because the returns you get from debt funds should not categorised as “Curiosity Revenue”, however capital positive factors.

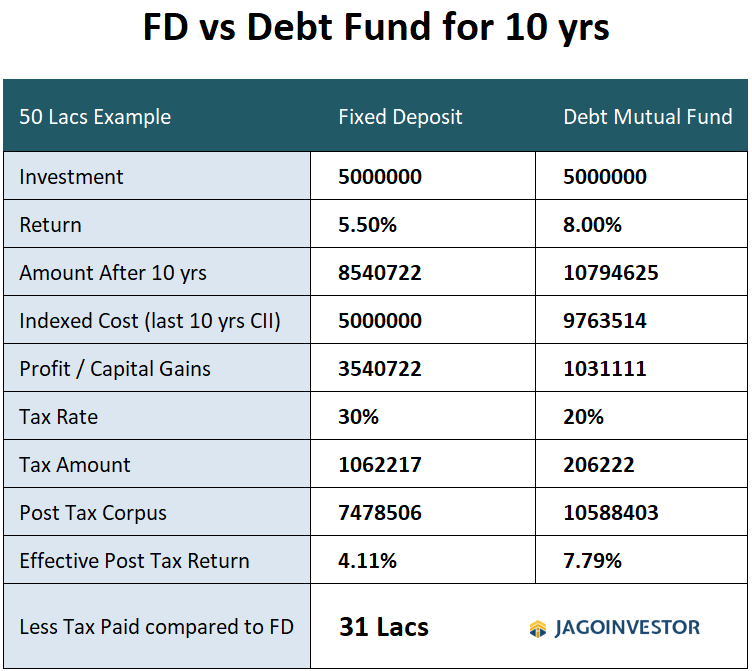

Let me present you a easy instance of what occurs when a Rs 50 lacs of cash is invested for 10 yrs in a hard and fast deposit vs a debt fund. I’ve taken FD charge as 5.5% and debt fund returns at 8% as per the present state of affairs and I’ve taken the final 10 yrs inflation numbers from CII Index.

You may clearly see that your FD turns into 85 lacs and Debt fund turns into 1.07 crores (indicative, however historic returns), Nonetheless, you pay 5 occasions extra tax in FD than debt funds merely due to Indexation profit.

The debt funds are certainly not as predictable as a hard and fast deposit, however over 10 yr interval, you may certainly create a really sturdy portfolio and in addition diversify your investments throughout some high quality debt funds. I feel it’s price taking that further danger for the sake of creating 31 lacs extra!.

It’s not a small quantity, it may well imply 5 yrs more money for retirement.

Many of the poorly designed portfolios lag on taxation. In case you can simply repair that half, that itself can imply alpha of 2-3% typically.

Here’s a tweet I did a couple of weeks again the place I used to be sharing how somebody who retired with an enormous corpus (let’s say with 10 crores) pays taxes in fairness/debt fund/ FD

Energy of deferring #taxes

Think about 10 crores invested for 1 yr & withdrawal of 40 lacs in 1 yr (4% corpus)

Assume the final 12 months returns as

~ Fairness Fund: 10%

~ Debt Fund: 7%

~ Financial institution Mounted Deposit: 5.5%Tax Paid

~ Fairness Fund : 26,000

~ Debt Fund : 78,000

~ Financial institution FD: 15 Lacs pic.twitter.com/XkfOk0u34V— jagoinvestor.com (@jagoinvestor_) January 20, 2021

Nevertheless, be aware {that a} smaller corpus might be nonetheless divided between husband and spouse after which the taxation could also be NIL or much less because of the revenue not reaching the taxable limits. What I’m referring to is principally for giant corpus.

#3 – Educate them about mutual funds generally

In case you fail within the 1st and 2nd step talked about above and in case your mother and father are nonetheless adamant about not altering their mindset of sticking with Mounted deposits or LIC insurance policies and so on, I need to say you may’t do a lot and also you misplaced the sport.

Nevertheless, when you really feel they’re exhibiting some curiosity and can hear extra on this topic, then its time to sit down with them and educate them first about mutual funds generally.

I feel most people who simply reject mutual funds dont have a very good understanding of the product and the way it works. Listed below are 33 myths about mutual funds incase you need to have a look at them. Is time to teach them a bit about mutual funds trade and the way established it’s.

I really feel there has not been a very good try to teach senior residents about mutual funds in the correct approach. Inform them a couple of issues like.

a) Mutual Funds doesn’t at all times imply the inventory market

Firstly, inform them that not all mutual funds put money into the inventory market.

There exists one thing known as “Debt mutual funds” which don’t put money into shares and solely invests within the debt market (bonds of corporations and govt securities). Use the phrase “Bond” and “Debentures” as they may have heard these phrases and may relate to those.

Inform them that there are GILT funds (which solely put money into govt securities) after which there are Company Bond Funds (which invests in large corporates) and in a approach, they’re akin to company fastened deposits

b) Inform them about mutual fund trade measurement

Do you your self know that Indian Mutual fund trade is one-fourth measurement of the banking trade? Sure – now we have round Rs 30 lakh crore of belongings invested in mutual funds which may be very very large in itself.

Numerous senior residents nonetheless really feel that mutual funds are some type of rip-off or not a well-regulated product. It’s your job to inform them that it’s a 25 yr outdated trade (truly a lot older when you look within the US and different counties) and a really effectively designed and well-regulated trade. Crores of buyers make investments by way of mutual funds now in our nation and its rising at an excellent velocity.

Over the subsequent few a long time, my guess is the mutual fund trade will likely be greater than retain banking Business.

Dont power your ideas on them at this level and simply hear them out. If they’ve any apprehensions or points with any level, do discover the reply and return and share with them about it. It will possibly take them a number of time to digest all this. No rush!

#4 – Inform them their corpus might not be sufficient for future

Not many individuals are retiring with enormous corpus as of late. Many of the mother and father are retiring with a smaller corpus than what they really want for his or her lengthy retirement. (Learn why one wants 30 occasions their bills as retirement corpus)

In your individual approach, you must convey to them that their cash might not be sufficient for future, and a few a part of their portfolio (if not all) must be invested in fairness too.

Numerous senior residents are investing cash in a approach that it’s giving them horrible post-tax returns due to excessive taxes and low returns. All this within the title of “security”. I do know individuals who have put all their cash in pension plans or simply saved it in FD. They dont take into consideration issues just like the liquidity of cash or low-post-tax returns.

One challenge is that in our nation folks suppose that after they cross 60 yrs, they’ve to simply transfer each little bit of their cash into 100% protected merchandise. This isn’t true for a lot of the instances.

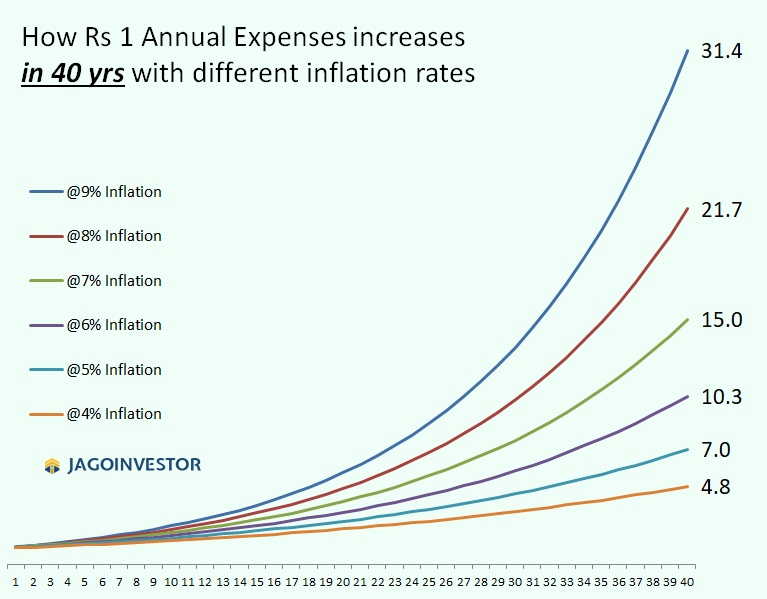

A 60 yr outdated individual can reside as much as 100 yrs additionally and meaning they might have 30-40 yrs of life forward. IF they make dangerous investments selections which aren’t taxed optimized and don’t create a constructive actual return, the wealth could get consumed fairly quickly then they realise on account of inflation.

So, if a retired individual has Rs 30,000 bills per 30 days at age of 60 yrs, then by the point they flip 70 yrs, it’ll improve to 65,000 per 30 days. Nevertheless, a human thoughts is just not capable of entry the impression of inflation over lengthy intervals of time.

Briefly, you must convey that they should generate a better return on their funding and must have a stability between security and returns. Sure, some bills could go down, however many different bills could come up too. That is extra true for these whose youngsters don’t reside with them and so they could find yourself residing all by themselves.

Numerous senior residents might not be fascinated with these factors.

#5 – Get them began with a really small quantity

The subsequent step is to get them began with a really small quantity.

If they’ve 50 lacs of wealth, possibly you may make investments simply Rs 1-2 lacs in a brief time period debt fund and allow them to see the way it’s shifting in subsequent 1-2 yrs. Present them the statements each 3-6 months to strengthen the thought that mutual funds are one of many choices and so they can diversify some a part of their portfolio in debt mutual funds too.

I did the identical factor when my mom in regulation wished to speculate a really small quantity. She advised me that she desires to place a small sum in Mounted Deposit and I advised her that I’ll select one thing higher for her. I invested it in dynamic bond funds as the cash to be put for the long run. Proper now the fund CAGR in final 4 yrs have been round 8.8% CAGR.

Why Youngsters ought to Educate their mother and father?

I additionally need to convey two factors to you (the youngsters) on why it’s best to educate your mother and father about mutual funds.

1. Dad and mom cash might not be sufficient

In case your guardian’s cash is just not sufficient and invested in a unsuitable method, then the cash will end off prior to they think about and that might imply that you may be dipping into your individual corpus to fund their retirement wants after 10-15 yrs.

Nothing unsuitable in that, as our mother and father have raised us and we’re all profitable due to their blessings, however when its attainable to do higher than what they’re doing at present, there is no such thing as a hurt in pushing a bit into proper retirement planning. A sturdy and tax-optimized portfolio shall be created which additionally generates higher pension for them.

We at Jagoinvestor has been serving to many retired or near retirement shoppers (with corpus in vary of 1-5 crores) to design and handle their retirement cash. You may try our retirement companies brochure to know extra

2. Legacy will come again to you

Lots of people don’t get inheritance because the wealth is mismanaged by mother and father and isn’t put to the correct use. In case you ensure that your guardian’s wealth is correctly invested, that additionally signifies that part of it might come again to you as an inheritance. And this will imply your individual retirement corpus could get a bump.

If you’re in your 30’s or 40’s proper now, then your guardian’s wealth will come to you as an inheritance after one other 30-40 yrs and people a few years of compounding can do wonders to your individual retirement planning.

Conclusion – It’s not straightforward, however price a strive!

I do know it is a robust nut to crack and many individuals might not be profitable, however nonetheless, you may give it a strive.

You by no means know if mother and father could also be okay to speculate some half in mutual funds. Simply keep away from asking them to shift all their investments to high-risk funds. As and after they get comfy with mutual funds idea

Do let me know what are your ideas on this and when you can share any tip on how one can persuade your mother and father to check out mutual funds investments?