Why do sensible individuals make dumb monetary selections?

I generally surprise why individuals can’t foresee how their monetary future will look?

- Don’t individuals know that there might be a day when the paycheck will cease?

- Don’t they notice that at some point they may turn out to be out of date, bodily or professionally?

- That their well being will decline? That emergencies will come up?

- Cant they see that they should have wealth at age 60 to outlive the remainder of their life?

And don’t they see that inflation is actual — silently eroding their buying energy 12 months after 12 months?

Don’t they see?

However the reply, sadly, is NO.

Folks can’t see far sufficient.

After years of working with 1000’s of purchasers, observing their habits and decision-making patterns, I’ve come to a stark realization:

Most individuals function with a short-term mindset.

The truth is that most individuals don’t function with a long run mindset!

- They dwell year-to-year.

- Wage-to-salary.

- Milestone-to-milestone.

Sure, deep down they’ve a obscure concept of what the longer term holds, however their actions hardly ever mirror that understanding

And it’s this lack of ability to suppose past the fast that’s slowly making a retirement time bomb in India.

Tens of millions of individuals will hit age 60 with out a significant corpus. No monetary cushion. No peace of thoughts. Simply dependence — both on their youngsters, or on a damaged authorities system, or on hope.

Right now, I wish to discuss on 4 errors which individuals have to right of their life to maneuver ahead and create a greater monetary future.

Mistake #1 : Instantaneous gratification

The need to really feel good now, even at the price of the longer term is known as Instantaneous Gratification. That is the basis explanation for why most individuals have unhealthy monetary lives.

Their focus is a lot on making their NOW higher and superb that they fail to notice if its impacting their future badly.

- Have you ever seen individuals blindly purchase ineffective insurance coverage insurance policies simply to “save tax” for the present 12 months — with out even understanding how that product helps them in the long term

- Swiping your bank card for belongings you want however can’t afford, then paying simply the minimal as a consequence of “survive the month in peace” — it looks like a fast repair as we speak, however all you’re doing is piling up curiosity and penalties, silently pushing your self deeper right into a future debt entice.

- Or those that register property at a decrease worth (by paying a part of it in money) to cut back registration expenses now, solely to comprehend years later that they’ll face large capital good points tax — as a result of on paper, their revenue seems a lot increased?

- Then there are those that postpone shopping for medical health insurance of their 30s pondering they’re match, solely to be denied protection later or hit with an enormous hospital invoice they need to pay out of pocket.

- And maybe the commonest — individuals who don’t save sufficient of their early years, pondering they’ll “begin later,” after which discover themselves of their mid-40s or 50s, burdened and anxious, questioning how will I ever retire?

Instantaneous gratification is tempting. However the associated fee is silent, invisible, and irreversible.

If you wish to construct wealth, you should grasp the artwork of delayed gratification — the ability of claiming no as we speak so that you could say sure to one thing far larger, later.

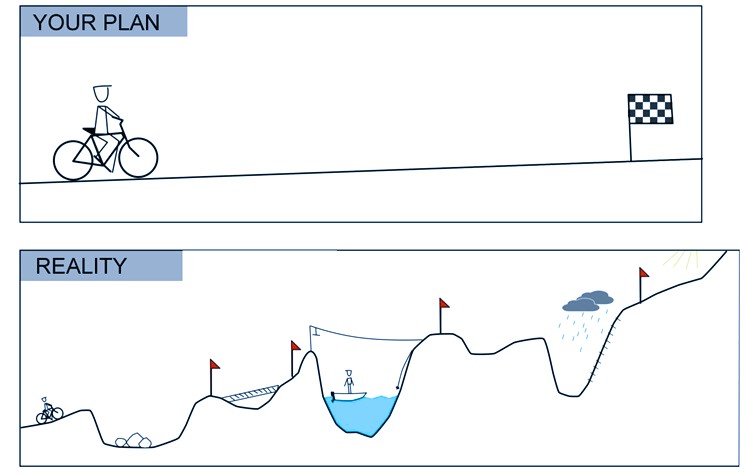

Mistake #2: Blindly Extrapolating the Current

Some of the harmful monetary habits is assuming that the present good occasions will merely proceed eternally — as if life follows a straight line upward.

Folks confuse a short-term win with a long-term sample. They anchor their future on latest success with out factoring in uncertainty, volatility, or change. And this isn’t optimism — it’s delusion dressed up as confidence.

Your mind is wired to prioritize the current—what’s working now looks like what’s going to at all times work

I typically hear issues like:

- “I’ve by no means had a well being emergency — I don’t suppose I want medical health insurance but.”

- “I simply bought a giant wage hike — I’ll purchase a luxurious automotive on EMI”, assuming that the earnings will continue to grow like this eternally.

- “My crypto investments doubled within the final two years, so I’m going to tug all my cash out of mutual funds and put all the things into crypto”

However right here’s the reality: simply because one thing labored this 12 months doesn’t imply it is going to work subsequent 12 months. Development is rarely linear, and neither are careers, inventory markets, or life itself.

That mentioned, taking dangers primarily based on cautious evaluation and a transparent understanding of potential outcomes is a special story. Calculated dangers can repay and are a part of sensible wealth-building.

The issue is blind extrapolation — making massive strikes primarily based solely on short-term outcomes or hope, with out contingency plans or room for error.

While you assume that as we speak’s highs are tomorrow’s norms, you cease planning for danger, cease saving conservatively, and cease making ready for the chance that issues may decelerate, plateau — and even reverse.

Good phases will not be ensures — they’re alternatives. Use them to construct buffers, not fantasies.

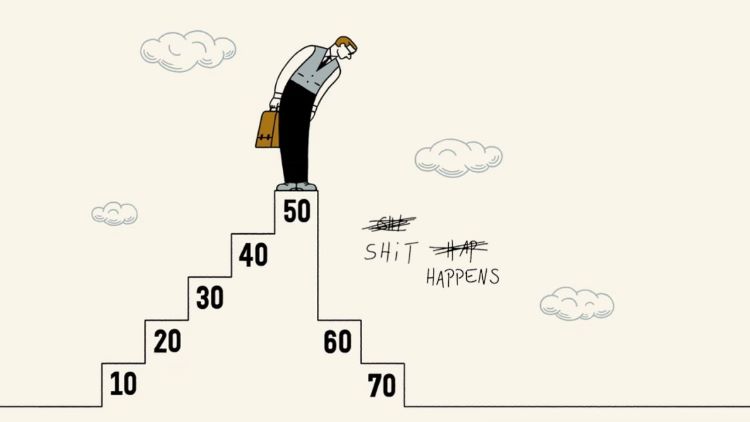

Mistake #3 : Overconfidence of Future Earnings

Some of the delicate — but harmful errors individuals make is over-relying on their future earnings. They assume that salaries will at all times rise, bonuses will maintain coming, and promotions might be predictable. This assumption provides them hope — a comforting phantasm that even when they’re not saving sufficient as we speak, their future self will one way or the other repair all of it.

- “I’ll begin saving extra as soon as I hit the earnings of 25 lakhs each year.”

- “My subsequent bonus will handle my bank card excellent debt.”

- “I’ll purchase that home now, and handle the EMI simply when my wage will increase.”

I gained’t say you shouldn’t be optimistic, however if you happen to’ve had a historical past of monetary struggles, these aren’t plans — they’re monetary fantasies

The issue? Life doesn’t at all times go as anticipated.

Profession progress isn’t assured. Industries evolve, firms downsize, and roles turn out to be out of date. The excessive performer of as we speak can turn out to be irrelevant tomorrow in the event that they cease studying or the financial system shifts. A promising startup job might vanish. A high-flying function might all of a sudden include burnout or well being points.

Well being points can derail careers. Accidents, psychological well being struggles, or persistent circumstances can drive individuals to decelerate — or cease altogether.

It’s essential to study to count on ugly surprises in life. Shit occurs!

Based mostly on 1000’s of shopper experiences, I can confidently say I’ve seen a number of instances… the place mid-career professionals needed to take lengthy breaks and even stop due to private or household well being crises. After a degree, an amazing profession can stagnate and there could also be much less to no progress in salaries. There could also be fixed medical bills which may eat out all of the bonuses and wage rise.

Household tasks develop. Aged dad and mom may have assist, youngsters’s schooling prices might skyrocket, or a single earnings might all of a sudden need to assist two generations.

In actual life, your bills rise quicker than your earnings. However most individuals construct their way of life on optimistic assumptions about raises, value determinations, and windfalls. They enhance spending the second earnings rises — and plan long-term liabilities like loans primarily based on best-case wage eventualities.

This mindset creates a harmful suggestions loop:

- You don’t save sufficient now since you consider the longer term will handle itself.

- However when the longer term arrives, it’s messier, costlier, and extra unsure than anticipated.

- And since you didn’t put together, your future self is left scrambling — with out buffers, with out choices.

Overconfidence in future earnings is a type of monetary procrastination. It provides you a false sense of management, whereas quietly eroding your actual management over your future.

The answer?

Plan on your future primarily based on reasonable assumptions — not wishful pondering. Construct your way of life primarily based in your present earnings, not projected progress. And deal with any earnings soar or bonus as a possibility to speed up your targets, not inflate your way of life.

True monetary freedom comes not from incomes extra — however from utilizing what you earn properly, deliberately, and with foresight.

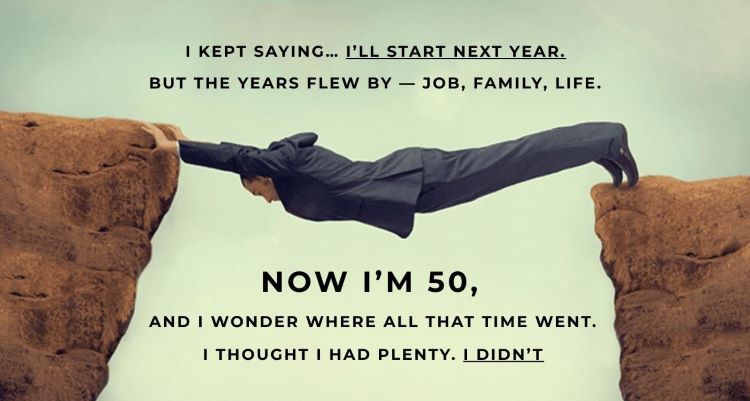

Mistake #4 : Fantasy of “Loads of Time”

Once we’re younger — say, 25 years outdated and simply beginning our careers — retirement looks like a distant, virtually imaginary occasion. Bursting with power and optimism, you’re feeling like time stretches endlessly earlier than you.

There are such a lot of extra thrilling priorities: romance, journey, spontaneous journeys with mates, and all the primary tastes of true independence. You’re lastly free—incomes your personal cash, making your personal selections, residing life in your phrases.

Why fear about some far-off future when there’s a lot to expertise proper now?

We inform ourselves, “I’ve a lot time forward to plan, save, and do what’s essential.”

However if you happen to ask most individuals of their 40s, they’ll chuckle at that 25-year-old’s confidence. By then, they’ve skilled how briskly time actually flies, and the way life throws challenges and complexities that demand fixed consideration. Managing a profession, household, well being, and unexpected occasions eats up years rapidly.

The most important remorse many individuals of their 50s share is that they began “late.” They at all times thought they’d get to necessary monetary and private targets “later.” With out setting agency deadlines, the longer term retains transferring away: at 25 you say later, at 28 later, at 30 perhaps at 35, at 35 you’re busy with youngsters and work, and at 40 you notice you’re solely midway — however the clock retains ticking. By the point you hit your 50s, you notice you’re already behind.

This delusion of getting “loads of time” is one other entice of current bias. It results in procrastination and underestimating the ability of compounding—whether or not in investments, well being, or relationships. It’s simple to defer necessary actions if you consider you have got infinite tomorrows, however time waits for nobody.

Understanding that point is restricted—and appearing early and intentionally—is likely one of the most important steps towards constructing lasting wealth and a satisfying life.

What’s the best way out?

When you’re younger, you simply need to make a small begin — after which construct on it.

Even saving 5–10% of your earnings is sufficient to start with. If you happen to earn ₹50,000, begin a SIP of ₹5,000. Then slowly enhance it to ₹7,500 and ₹10,000 over the following 2–3 years. What issues most isn’t how a lot you begin with, however that you just begin early and keep constant. That’s how wealth — and peace of thoughts — is constructed.

Last Ideas: Construct Significant Wealth, Not Only a Quantity

If you happen to’ve learn this far, take a second to mirror on the 4 errors we mentioned above.

Every of them — immediate gratification, blind extrapolation, overconfidence in future earnings, and the parable of loads of time — quietly eats away at your potential to construct lasting wealth.

These aren’t simply monetary missteps. They’re psychological frameworks that cease individuals from creating the life they really need.

However the purpose isn’t simply to get wealthy.

The purpose is to not win some imaginary race and get up at some point with cash within the financial institution — however unhealthy well being, damaged relationships, and a deep sense of vacancy.

Create your Wealth with Jagoinvestor Crew

If you happen to’re severe about reworking your monetary life and avoiding these pricey errors, the Jagoinvestor Crew is right here to information you. We’ve helped 1000’s construct significant wealth with readability, self-discipline, and a confirmed roadmap. If you happen to’re prepared for actual progress — not simply info — be part of arms with us. Replenish this way and let’s begin your wealth journey the precise approach, with the precise assist

Wealth isn’t the top. It’s the enabler. It’s the device that offers you freedom, choices and safety.

It’s what lets you handle your family members, take pleasure in life in your phrases, and age with dignity — not dependence.

So sure, repair your errors. Begin taking your monetary future severely. Create techniques that assist you develop your cash with self-discipline and readability. However don’t lose your soul within the course of.