The telecom and monetary companies have drastically modified during the last 15-20 yrs. and because of this you are able to do a number of issues over your telephone now. You don’t have to go to financial institution for the whole lot. Now your cellular itself is a financial institution and it’ll allow you to switch cash to anybody and transact with only a click on of the button.

Whereas that is fantastic information, it’s additionally a nasty information as a result of numerous type of cyber frauds have began taking place from previous few years. Immediately I’m going to share about one such fraud referred to as as “SIM Swap Fraud”

I additionally requested one among individual I do know personally who really misplaced cash due to this fraud, and I requested him to jot down what precisely occurred and steps they took after the fraud occurred.

What’s SIM Swap Fraud?

SIM swap fraud is a really refined sort of cyber fraud, the place the attacker first blocks your sim card, after which will get a replica sim issued and will get entry to all OTP/SMS that are required to make the transactions. This additionally signifies that they put a request to your cellular firm with cast paperwork or on-line and you probably have not secured your knowledge/paperwork – it’s not very robust to get it completed.

On high of it, if you don’t act quick or take issues frivolously – the possibilities of fraud getting profitable could be very excessive.

Individuals have misplaced quantities starting from few Lacs to few crores. Simply take a look on the under screenshot

The sim swap frauds are also referred to as SIM splitting, SIM jacking, SIM hijacking, or port-out scamming in several nations.

An actual life case of an NRI who misplaced cash from his checking account

So just a few weeks again, one of many NRI readers of this weblog mailed me asking for assistance on a fraud which occurred in his checking account and he misplaced cash.

Fortunately the quantity was simply in hundreds. I checked out his electronic mail and shortly realized that it is a case of SIM SWAP fraud. Whereas he has not received the cash until now, I requested him to share your complete incident with all of us in order that we will study from this incident.

Please undergo his expertise which I received by electronic mail.

Hey Manish,

Greetings and admire your thoughtfulness to create consciousness to this fraud,

So the story goes this fashion

My spouse has a financial savings account in ICICI and me being NRI she travels to go to me for greater than 5 months in a yr as such I had linked my Sisters Cellphone quantity for internet banking and all was going properly. as native numbers don’t work within the nation I stay.

Just lately my sister was having points with thought sim card and she or he had registered a grievance with thought, and she or he was instructed a buyer care will coordinate together with her. then there was the lockdown and curfew and banks outlets and many others all closed.

Sooner or later an individual referred to as her and mentioned he was from thought buyer care and she or he must improve her sim from 3G to 4G and to do this she must textual content him a code and a sim card no a 20 digit quantity, attributable to lockdown since thought heart is closed that is her possibility, which she did, she received a name again saying it’ll take about 4 hours for this improve and she or he could not get protection till then.

my electronic mail was linked to that ICICI account and I received an electronic mail that there was a failed try to entry my on-line account.

I replied to ICICI buyer care and there was no reply. ( Bought reply after two days, Normal written electronic mail don’t share otp, password and many others with anybody and if suspicious report back to ICIC buyer care)

However I used to be in a position to log into internet banking and didn’t discover something suspicious.

The following day I used to be off and was not on-line to examine emails for full day within the night I noticed 8 emails from ICICI auto emails, password modified, new beneficiary added, OTP despatched to Registered cellular, quantity transferred to beneficiary account. steadiness in my account is now zero.

Now it’s a Saturday financial institution is closed, Lockdown can not exit, buyer care strains are busy and on maintain for 25 min, and eventually when she received on line with buyer care they mentioned she shouldn’t be calling from registered cellular they usually can not assist us.

The injury was completed. The hacker took management of the sim and was getting OTP and had reseted the password utilizing registered telephone quantity.

The complaints we made

Sister went to thought and narrated the incident and thought mentioned this usually doesn’t occur this fashion and solely licensed individual in thought can do the sim swap and mentioned they’ll examine it

Spouse went to police to complain, they’re clueless on this matter and had been extra on understanding the fraud for his or her private cause and difficult spouse stating what she was telling can by no means occur they usually by no means heard of such case and there should me one thing else which has occurred and never sim swap. however when my spouse raised her tone they took the grievance and mentioned they’ll ahead it to cyber department.

Until date no optimistic lead.

Spouse went to financial institution to complain, they noticed the log and located the transaction is completed via right channel and there’s no fraud, Password modified by registered cellular, otp despatched to registered cellular and all issues completed legally with out breach..

Nonetheless as there was a police complain they traced the beneficiary account and put a freeze and lien on that account (In case he deposits cash that cash will probably be instantly transferred to my account).

We modified the cellular quantity and now my spouse gave her new native quantity, they usually mentioned to not use the account for a while until the investigation is over.

that evening spouse get a name from ICICI buyer care saying we now have registered your complain and your cash will probably be transferred to your account tomorrow.

Spouse goes to ICIC and meets supervisor she say no this case shouldn’t be solved and usually it takes greater than 15days for this and this name shouldn’t be from us.

Surprise how the hacker received this quantity which was simply given to ICICI, additionally although ICICI mentioned they deleted the outdated telephone quantity and registered the brand new telephone quantity my sister continues to be getting messages after we complain to ICICI they are saying it can’t be and when proven proof by way of display screen photographs mentioned we are going to ahead to our IT dept.

So until date that is the ultimate abstract

Concept cellular operator claims no duty of harm completed to checking account however their duty is to provide management of the sim card again to my sister in 24 hours they usually did it

Financial institution doesn’t take any duty because the transaction was completed by the registered cellular quantity

Police claims it was out carelessness to provide the 20 digit quantity to the hacker they usually can do nothing

I Learnt an excellent lesson and will probably be extra cautious in these issues.

Jerry

From the actual life incident of the above, I can see that it’s a little bit of the whole lot. Some dangerous luck, some carelessness, some ignorance and numerous good work by fraudster. These sim swap frauds aren’t simple to realize as there are many issues which must occur.

Allow us to now have a look at precisely what are the steps that are concerned into Sim swap fraud.

4 Steps of Sim Swap Fraud – The way it can occur to you?

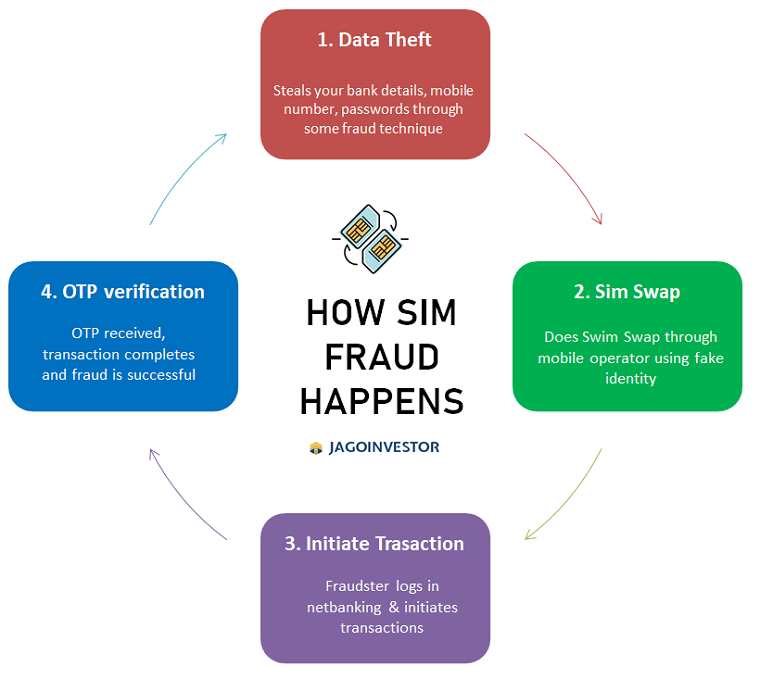

Let’s perceive how precisely a sim swap fraud occurs via 4 steps course of

Step 1 – Fraudster steals your necessary knowledge

On this first step, the fraudster will get your private data like your PAN quantity, Checking account quantity, telephone quantity, your internet banking password, and every other particulars that are important for a web-based transaction. These items may be acquired utilizing numerous strategies like E mail/Cellphone/SMS frauds or by hacking into your private units .

Generally there may be knowledge theft by gaining access to your paperwork which is perhaps mendacity with somebody (think about you give your laptop computer for restore and a few file has all the information or think about you allow your financial institution assertion at a Xerox store)

Step 2 – Putting a request for SIM Swap together with your SIM firm

The following step is kind of necessary and the principle step, the place the fraudster locations the request for sim swap together with your sim firm by posing a faux id and giving all related paperwork or via on-line mode.

Right here the individual may additionally name you to tell you about you posing because the sim firm consultant and tells you a lie that your sim will probably be lively in a while as there may be an improve occurring or one thing like that.

You’ll typically get a sms or electronic mail from sim firm telling you that your sim swap request will probably be full quickly.

DONT IGNORE THIS SMS at any value. That is precisely the place a buyer thoughts presence is required and you must act quick. Lots of people who don’t perceive how factor work on-line fall prey to it. Think about in case your 70 yr outdated father will get this type of sms, he won’t perceive precisely what it’s!

Step 3 – Doing the transaction

As soon as the sim swap request is processed, the sport is sort of over as a result of the fraudster now has all of the login particulars and the principle factor – THE NEW PHONE NUMBER which is linked to the web banking/card.

Now all they should do is add a beneficiary and full the transaction

Step 4 – The fraud occurs

And eventually, the OTP involves the brand new telephone quantity and the transaction is full. That is the purpose, the place you free the cash and getting it again it fairly robust. I strongly counsel that you just learn these 21 suggestions you must observe to safe your banking transactions

Some Security Suggestions which might stop you from such Frauds –

- In case your community is misplaced for a really very long time like greater than 20-30 min, be alert and enquire about it out of your cellular operator

- In the event you ever get a sms/electronic mail alerting you that your sim swap request is acquired, ensure you contact your financial institution instantly and report this incident. If doable login to your internet banking and alter your passwords the identical second

- By no means share your the 20 digits talked about on the again of sim card to anybody ever on name. This 20 digits are required for a profitable sim swap

- Don’t entertain anybody asking for any type of OTP or your accounts particulars

- Register for Alerts (SMS and E mail) in order that each time there may be any exercise in your checking account you’ll obtain an alert.

- At all times examine your financial institution statements and on-line banking transaction historical past repeatedly to assist determine any points or irregularities.

- Have sturdy passwords in your telephone and computer systems. Don’t preserve easy passwords which may be guessed by others

- If there may be any cyber fraud, instantly inform the cyber cell or the perfect factor is to file a FIR in native police station.

- Don’t root your telephone, if you’re not a tech skilled.

- Don’t set up unverified apps in your cellular or laptop computer. Quite a lot of these applications can learn your pc or telephone knowledge

- Don’t go away your necessary paperwork Xerox right here and there. At instances we really feel, nothing will occur – however dangerous issues occur!

Do watch this video on stopping sim swap fraud!

Don’t be over assured that it could possibly’t occur to you

Each time we come to listen to about these kind of frauds any type of fraud, the primary thought as an investor involves our thoughts is that it doesn’t matter what occurs, I cannot fall prey to any such frauds.

That is nothing however overconfidence. Be alert and at all times take note of small indicators which is perhaps pointing to this type of frauds, particularly whenever you preserve an excessive amount of cash in your checking account.