Picture supply: Getty Photos

At 344.4p per share, Worldwide Consolidated Airways (LSE:IAG) shares have risen a wholesome 13.4% within the yr so far. Regardless of turbulence rising on transatlantic journey and geopolitical upheaval in different locations, the FTSE 100 enterprise has continued to climb.

Broader weak point in shopper spending and decreased enterprise exercise on ‘Trump Tariffs’ haven’t disrupted the British Airways proprietor both. The post-pandemic journey growth stays in play, and revenues at IAG, because it’s identified, popped 9.6% increased in quarter one. Working revenue surged 191%, beating forecasts.

Given this resilience, can buyers anticipate the corporate’s shares to proceed rising?

Value forecasts

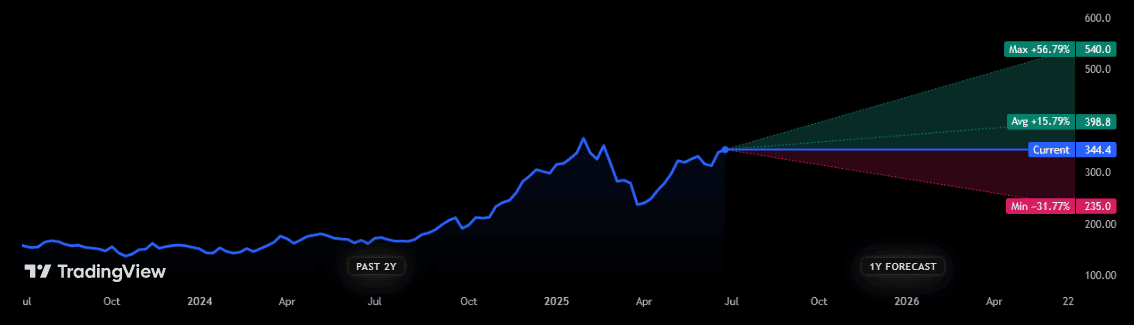

Metropolis analysts broadly suppose so. Of the 25 analysts with rankings on IAG, the consensus is that they’ll rise to inside a whisker of 400p inside the subsequent yr.

As with all inventory, there are a selection of views on how the Footsie firm will fare. Nonetheless, buyers needs to be aware that the variations between some forecasts are substantial.

On the plus aspect, essentially the most optimistic dealer reckons the enterprise will rise as excessive as 540p over the interval. However a very bearish analysts thinks they’ll plummet all the best way again to 235p.

Dividend estimates

With income progress being sustained and its steadiness sheet mended, IAG paid its first dividend for 4 years in 2024, of 0.09 euro cents per share. On the power of current robust buying and selling Metropolis analysts expect money payouts to proceed rising over the quick time period.

They predict:

- A complete dividend of 1.09 euro cents per share in 2025.

- A money reward of 1.25 euro cents in 2026.

These projections imply the dividend yields on IAG is 2.7% and three.1% for 2025 and 2026, respectively.

Is IAG a purchase?

Ought to particular person and enterprise confidence start to say no, the model energy of IAG’s carriers like British Airways might nonetheless permit it to continue to grow income. The corporate’s publicity to each profitable transatlantic routes and the low-cost section might also assist help earnings.

But I’m not but satisfied sufficient to purchase IAG shares for my portfolio. I really feel the corporate’s behavior of reporting spectacular income could also be operating out of street, with shopper spending worsening in key markets and journey to the US from Europe weakening.

Arrivals to the US from the UK dropped 15% yr on yr in March, based on the US Division of Commerce.

There’s additionally the prospect of a contemporary surge in oil costs amid simmering tensions within the Center East. Gas prices account for round 28% of IAG’s whole prices. These geopolitical points additionally threaten disruption on its routes.

The enterprise additionally has different extra lasting issues to deal with as effectively. These embody intense competitors within the airline trade, and the menace this poses to passenger numbers and revenue margins, and extreme operational disruptions at airports and air site visitors management techniques.

Simply right now (3 July), Ryainair and easyJet cancelled 400-plus flights because of air site visitors controller strikes.

So whereas I wouldn’t be shocked to see IAG’s share value continued rising, the dangers it nonetheless faces imply I’d quite purchase different shares as a substitute.