At the moment, there was a information about 3 months moratorium (which suggests a short lived reduction) profit on all form of loans and the way traders gained’t must pay their EMI for 3 months. Nonetheless it was celebrated by traders with out understanding it absolutely.

So I considered clarifying some doubts relating to it and to share with you that it’s really not a really large profit and why many of the traders shouldn’t OPT for it.

Let me make clear on what’s the EMI moratorium which means and the way does it apply to you?

Which means of EMI Moratorium

Lots of people in our nation would possibly get impacted as a result of coronavirus and this 21 day lockdown and their incomes and salaries would possibly get impacted. Lots of people might discover it very robust to service their EMI on time and there was a necessity of the hour for some reduction. Therefore govt has given permission to banks, NBFC’s and housing finance firms to think about an EMI moratorium and cross on the profit to the purchasers

Which merely signifies that it’s not a pressured rule, however solely a permission given to banks in the event that they need to do it. RBI is not going to depend these missed EMI funds as “defaults” and never depend it as NPA (non-performing belongings) and likewise directed banks to not report it to CIBIL and different beaureu

Now it’s as much as financial institution on how they wish to implement it. Banks would possibly cross on the profit to ALL or some prospects. Listed here are the precise RBI notification wordings you would possibly need to learn.

Will your EMI deducted cease ?

No, appears to be like like you’ll have to apply for this profit in case you want to and solely while you apply for it, the EMI will then not get deducted. In case you simply don’t take any motion, then the EMI might get auto deducted as all the time.

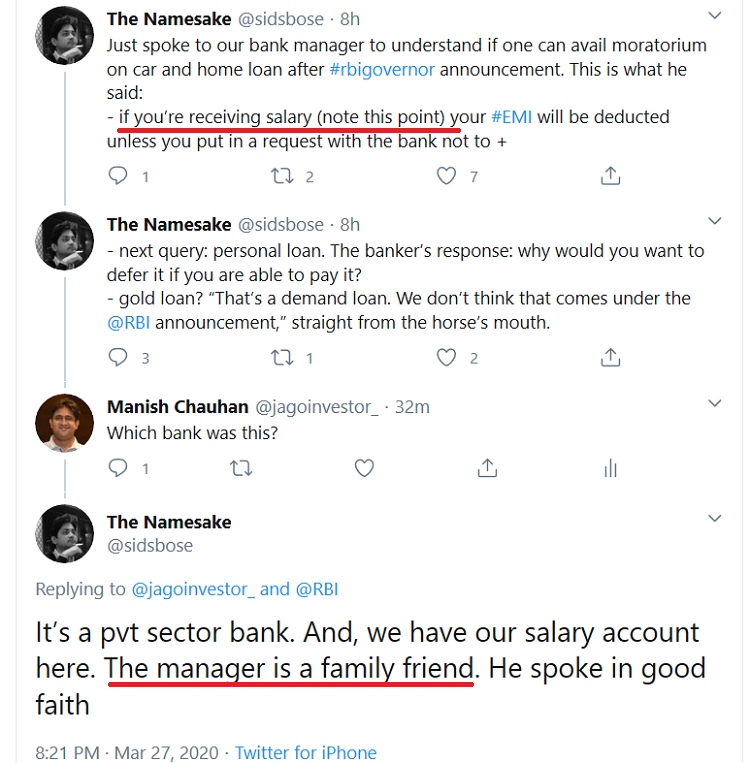

A man names Siddharth informed me on twitter that his financial institution would possibly deduct the EMI (is not going to cross the profit) if wage is credited within the account. Right here is the dialog snapshot

As I mentioned, it will solely occur if you happen to get this profit out of your financial institution and financial institution agrees for it. Checkout the tweet beneath the place an investor requested his financial institution about it and financial institution individual informed that it may not be relevant to him if he will get the wage.

Will I pay any curiosity for these 3 months of moratorium ?

A number of traders are displaying their happiness about this RBI notification and feeling like they’re getting some very large profit. Nonetheless in actuality it’s reverse and it’s instructed so that you can NOT take this profit.

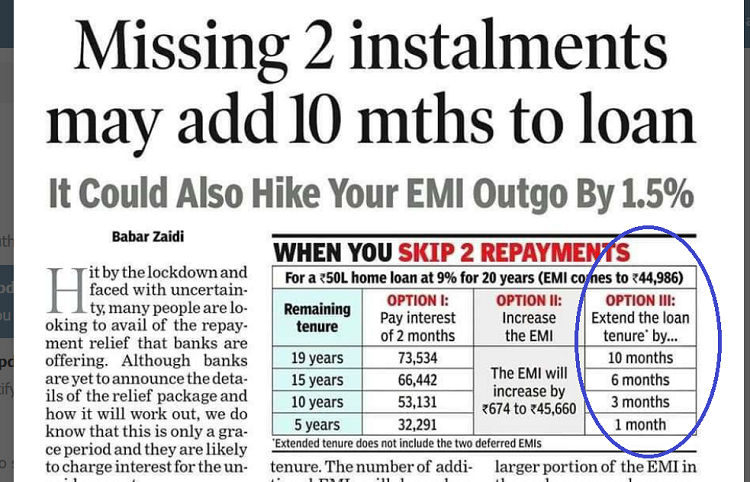

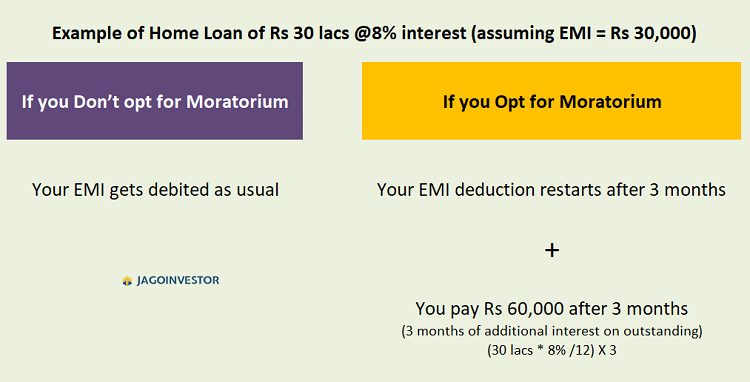

If somebody takes this moratorium profit, they curiosity will probably be accruing on the excellent steadiness and you’ll have to pay the curiosity on the finish of three months. Their EMI will begin getting deducted after 3 months.

What it means is that assume somebody has a 30 lacs of residence mortgage, and an EMI of 30,000 (only a random assumption) and rate of interest is 8% , then one month curiosity will probably be Rs 20,000 (30 lacs * 8% = 2.4 lacs yearly .. Divide that by 12 to get month-to-month curiosity = 20,000)

And for 3 months, will probably be Rs 60,000 extra easy curiosity. This extra curiosity will probably be added to your excellent steadiness and your tenure will go up.

Similar is true for excellent steadiness on bank cards.

The one profit you’re going to get right here is that you’ll not be paying any form of penalty and it gained’t be reported to CIBIL.

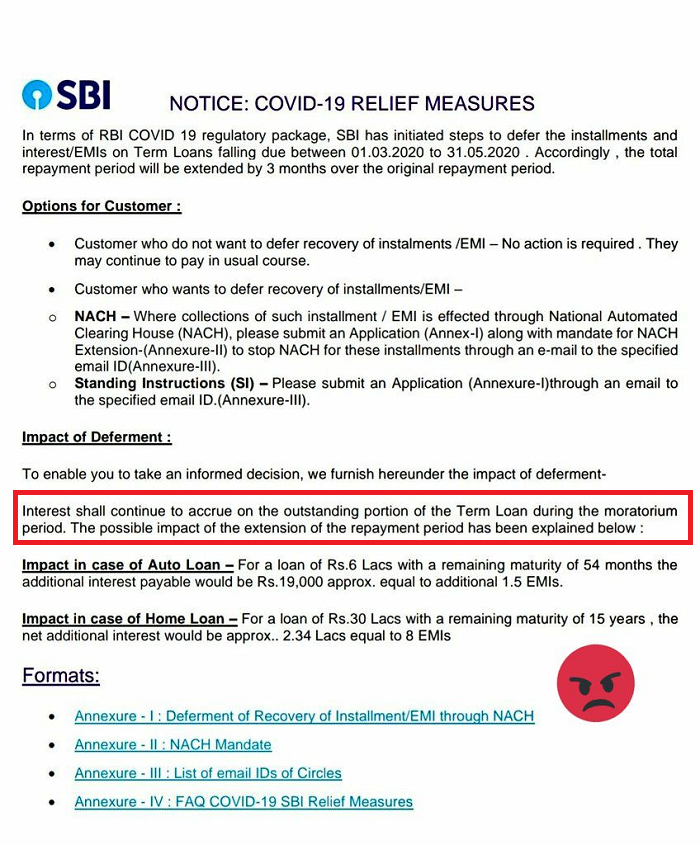

Replace from varied banks

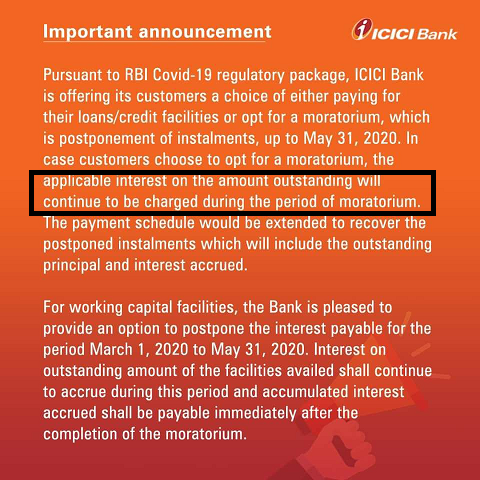

Here’s a notification from SBI financial institution and ICICI financial institution to its prospects that curiosity will nonetheless be charged on the excellent steadiness if one desires to avail this profit.

A lot of the banks have additionally clarified that to take this profit, one has to contact the financial institution and ask for this profit. In case you don’t take any motion, then the EMI will get deducted as regular.

Must you go for EMI Moratorium profit?

By now, it’s essential to have understood that this profit isn’t for somebody who isn’t dealing with extreme monetary crunch or whose revenue/wage goes to go down as a result of coronavirus impression. So if you happen to can simply repay your EMI’s, then please achieve this and don’t go for this moratorium profit.

It’s just for somebody who’s going to see wage loss, job loss and is dealing with very exhausting time financially as a result of this lock down. They’re getting TIME from financial institution aspect and nothing else.

Do tell us what you’re feeling about it in feedback part.

![Siemens India Share Value Motion: Value Drops Over 9% in Single Day [Explained] Siemens India Share Value Motion: Value Drops Over 9% in Single Day [Explained]](https://i3.wp.com/getmoneyrich.com/wp-content/uploads/2024/12/Siemens-India-Share-Price-Action-ABB-vs-Siemens-India.png?w=150&resize=150,150&ssl=1)