Finances 2020 was an enormous occasion.

For final so many days earlier than the funds, there was this noise and expectations round elevating 80C limits, change in tax slabs, and reversal of Long run capital beneficial properties tax on fairness or at the least giving the good thing about Indexation in fairness taxation.

Nevertheless, nothing like that occurred.

Infact, issues have change into extra difficult for buyers whereas I believe the government intention was to make it easy. So let me jot down all of the related factors and essential information objects.

1. New Tax Slabs vs Outdated Tax Slabs

A brand new (and non-obligatory) tax slab is launched now which has decrease tax charges in comparison with previous one. The investor may have alternative of both staying with the previous slabs together with numerous exemptions and deductions they used to get pleasure from, or they’ll shift to new slabs with none exemptions/deductions.

New Earnings tax slab charges

[su_table responsive=”yes”]

Tax Slab | Tax Charge |

| Under 2.5 Lacs | No Tax |

| 2.5 Lacs- 5.0 Lacs | 5% |

| 5.0 Lacs- 7.5 Lacs | 10% |

| 7.5 Lacs – 10.0 Lacs | 15% |

| 10.0 Lacs – 12.5 Lacs | 20% |

| 12.5 Lacs – 15.0 Lacs | 25% |

| Above 15 Lacs | 30% |

[/su_table]

- Schooling cess @4% on the tax quantity

- Surcharge of 10% relevant if revenue > 50 Lacs and 15% if revenue > 1 Cr

Outdated Earnings tax slab charges (for these under 60 yrs.)

[su_table responsive=”yes”]

Tax Slab | Tax Charge |

| Under 2.5 Lacs | No Tax |

| 2.5 Lacs- 5.0 Lacs | 5% |

| 5.0 Lacs- 10 Lacs | 20% |

| Above 10 Lacs | 30% |

[/su_table]

Which tax slab is healthier?

Mainly the brand new tax slabs are of not a lot to those that take profit of assorted deductions and advantages in any case, as a result of they can deliver down their taxable revenue by some first rate margin. Solely those that have revenue vary of 6-9 lacs and don’t take good thing about any exemption/deduction will profit from the brand new slabs.

Instance 1 – Let’s see an instance right here and calculate the tax to be paid below previous and new system.

- Earnings : Rs 15,00,000

- 80C – Rs 1,50,000

- Dwelling Mortgage Curiosity – Rs 2,00,000

- Medical Insurance coverage – Rs 20,000

- Customary Deduction – Rs 50,000

Calculation of Tax below OLD SLABS

You possibly can see that right here, the taxable revenue will come down by 4.2 lacs instantly. So below the previous slab system, the taxable revenue will likely be Rs 10.8 Lacs (15 lacs – 4.2 lacs)

Let’s see tax calculations

[su_table responsive=”yes”]

| Slab | Slab Larger Quantity | Earnings Tax Charge | Taxable Earnings below Slab | Tax |

| 0 – 2.5 Lacs | 250000 | 0% | 250000 | 0 |

| 2.5 – 5 lacs | 500000 | 5% | 250000 | 12500 |

| 5 – 10 Lacs | 1000000 | 20% | 500000 | 100000 |

| Above 10 lacs | No Restrict | 30% | 80000 | 24000 |

| Earnings Tax | 136500 | |||

| Schooling Cess @4% | 5460 | |||

| Surcharge | 0 | |||

| Complete Tax | 141960 |

[/su_table]

Calculation of Tax below NEW SLABS

In new slab, there isn’t any approach of getting any deductions/advantages , so let’s instantly bounce into the tax calculations

[su_table responsive=”yes”]

| Slab | Slab Larger Quantity | Earnings Tax Charge | Taxable Earnings below Slab | Tax |

| 0 – 2.5 lacs | 250000 | 0% | 250000 | 0 |

| 2.5 – 5 lacs | 500000 | 5% | 250000 | 12500 |

| 5 – 7.5 Lacs | 750000 | 10% | 250000 | 25000 |

| 7.5 – 10 lacs | 1000000 | 15% | 250000 | 37500 |

| 10 – 12.5 Lacs | 1250000 | 20% | 250000 | 50000 |

| 12.5 – 15 Lacs | 1500000 | 25% | 250000 | 62500 |

| Above 15 lacs | No Restrict | 30% | 0 | 0 |

| Earnings Tax | 187500 | |||

| Schooling Cess @4% | 7500 | |||

| Surcharge | 0 | |||

| Complete Tax | 195000 |

[/su_table]

Which tax system is healthier – Outdated or New?

- Outdated slab tax is Rs. 1,41,960

- New slab tax is Rs. 1,95,000

- Distinction of Rs. 53,040

We are able to clearly see that the tax is lesser within the older system, in comparison with the newer system.

Necessary Factors

- You possibly can select annually which tax system you need to select from – New vs Outdated. Nevertheless this alternative is just these, who wouldn’t have a BUSINESS INCOME. For many who have any sort of enterprise revenue, will be unable to modify again to the opposite system as soon as they’ve carried out it.

- Bear in mind, that there’s a tax rebate below sec 87A in each new and previous tax slabs the place an individual incomes as much as Rs 5 lacs will get a tax rebate of Rs 12,500, which technically signifies that if somebody’s taxable revenue is lower than 5 lacs, then they should not pay any tax.

2. No Deductions or Exemptions below New Tax Regime

I’ve already talked about this, but when one chooses the brand new tax regime, they will be unable to take good thing about following issues

- 80C investments (PPF, ELSS, EPF, Life Insurance coverage Premium)

- Medical Insurance coverage Premium

- Dwelling Mortgage Curiosity

- HRA

- LTA

- Customary Deduction of Rs 50,000

- Additional 50,000 deduction for NPS (other than 80C restrict)

- Donations below 80G

- Schooling Mortgage Curiosity

Observe you could nonetheless put your cash in all these 80C funding merchandise and medical insurance coverage and so on., however you will be unable to take tax advantages (not for individuals who persist with previous system)

Nevertheless, the employer contribution to NPS and EPF continues to be tax free as much as 7.5 lacs per yr. So you may ask your employer to contribute extra in your behalf in these two issues.

3. NRI definition change + Taxation Rule

There was an excessive amount of confusion round new guidelines for NRI’s for the entire day and twitter noticed many individuals debating if many NRI’s particularly from Center east should pay taxes in India or not.

Here’s what the brand new rule says –

“If an individual isn’t resident of any nation, then they’re deemed to be a resident of India and they are going to be taxed on their world revenue”

There are a variety of residents of India, who keep in several nations for small time frame and technically are usually not resident of any nation and therefore don’t pay any taxes. These buyers is not going to need to pay the TAX in India for his or her world revenue.

That is completely different than these buyers who’re dwelling in nations like UAE and so on. the place there’s ZERO tax. As a result of they’re a “tax resident” of those nations. They’re simply not paying tax as a result of the legislation is like that. So these sorts of buyers don’t have to fret in any respect, and nothing modifications for them. Try the video clarification from officers

Now as per the brand new rule, an individual has to remain out of India for greater than 240 days to qualify as an NRI, in opposition to the previous restrict of 182 days.

4. Dividends will likely be taxable within the palms of buyers

The DDT (dividend distribution tax) is now abolished and the dividends will now be taxed within the palms of buyers as per their slab charges.

Until now the DDT charges for firms was 20.35%. So each investor who received any sort of dividend took that sort of hit not directly (even thought it was tax free in buyers palms).

This isn’t nice information for individuals who are in larger tax bracket, as a result of they’ll pay larger tax now in comparison with what they paid earlier and now there will likely be further headache to trace and point out all dividend revenue whereas submitting tax returns.

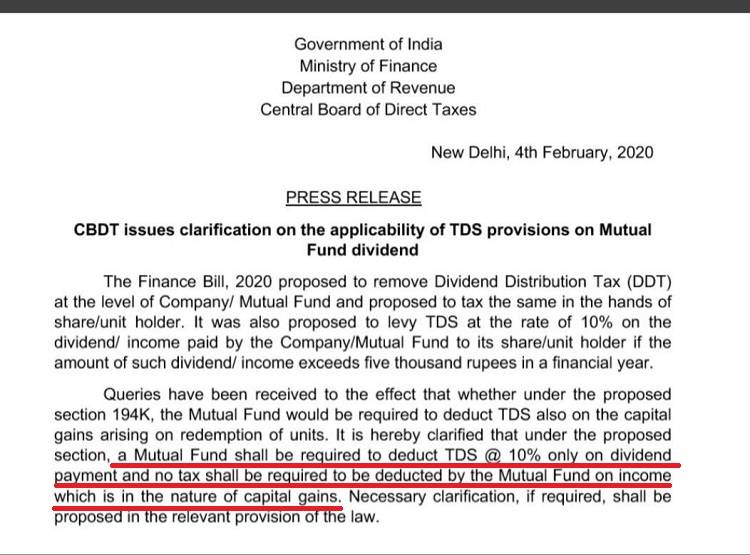

There will likely be TDS @10% deducted by mutual funds, if the dividend to be given is greater than Rs 5,000 in a monetary yr to an investor.

Necessary Replace : There was an enormous confusion round buyers and advisors group that TDS of 10% will even be relevant on redemption from mutual funds or not? However the govt has already clarified that the TDS is just relevant on mutual funds dividend and nothing else. Any redemptions you do from mutual funds, that won’t entice any TDS for residents (for NRI’s , the TDS is already there since very long time)

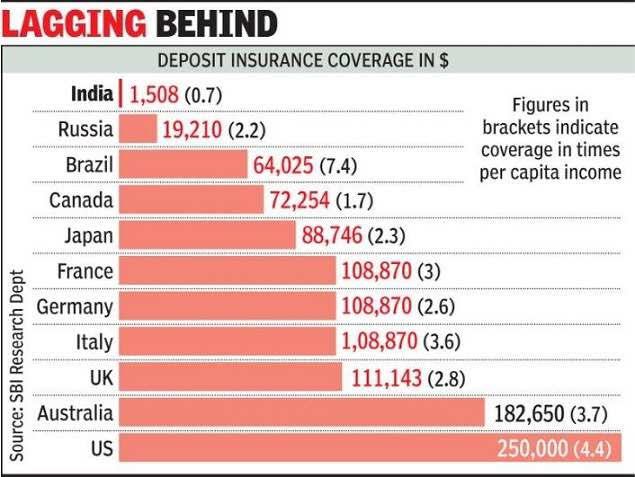

5. Banks Deposit Insurance coverage raised from 1 lacs to Rs 5 lacs

The insurance coverage in your financial institution deposits have gone up from Rs 1 lacs to Rs 5 lacs. This was a lot wanted change and at last it’s carried out. Lately we noticed the issues in PMC financial institution (the financial institution isn’t but closed or shut, therefore the insurance coverage will nonetheless not apply there)

Conclusion

As govt stated, they need to simplify taxation guidelines in long term and I really feel over subsequent 5-6 yrs, they’ll slowly attempt to take away the previous system of deductions and exemptions with lesser tax charges coming in.

Nevertheless I really feel, a lot of the buyers wants that carrot of “tax saving” for investments in any other case they don’t do it.

Whereas, its appropriate that one ought to make investments in any case whether or not there’s tax profit or not, however while you go to floor stage and see, the fact is that folks want that nudge to take a position. We have to trick them for their very own profit, else they won’t consider investments.

From that time, it could be a foul information.

Additionally, for some years, we are going to see this confusion of previous vs new tax guidelines and which one ought to we be selecting, however this could’t proceed endlessly and ultimately we may have a single tax system and also you guess it proper, it will likely be the brand new one.

Let me know what are your feedback on this funds and the way do you see it?