A particular sort of mutual fund known as an index fund is supposed to imitate the efficiency of a selected market index. With a passive funding strategy, these funds search to intently resemble index returns. They accomplish this objective by both proudly owning each safety within the index or a consultant pattern, offering traders with cost-effective investing choices, diversification benefits, and extensive market publicity. The indexes characterize a group of the highest firms listed on the Indian inventory market. So, if you spend money on an index fund, you might be buying a tiny proportion of all the businesses in that index.

Begin investing in index funds.

Index funds have turn into a well-liked channel of funding nowadays. As reported by Enterprise Commonplace, a survey by Motilal Oswal Asset Administration Firm signifies that index funds have gained reputation amongst Gen Z and Millennials (46-48% of traders beneath 43 assist them), in comparison with 35% of Gen X and Boomers.

The rising reputation of the index funds is because of their price effectivity and decrease expense ratios, obtained by monitoring market indices passively. They supply constant market-equivalent returns and prompt diversification throughout sectors, and make them engaging to each new and seasoned traders. The simplicity and transparency, coupled with the convenience of investing by way of different digital platforms and automatic instruments like Systematic Funding Plans (SIPs), have additional boosted Index funds’ attraction. You will need to additionally know that elevated monetary consciousness and international tendencies favoring passive investments have additionally contributed to index funds’ rise. Nonetheless, these funds could underperform throughout unstable markets in comparison with energetic funds. General, index funds are more and more seen as a dependable, low-cost choice for long-term investing.

Tell us a couple of top-performing index funds over the previous yr. These funds have primarily tracked the Nifty Subsequent 50 Index, reflecting robust development amongst large-cap firms. Amongst these, the Bandhan Nifty IT Index Progress Direct Plan has led with a 42.78% return over the previous one yr, whereas Edelweiss Nifty Subsequent 50 Index Progress Direct Plan provided a aggressive 42.66% return with the bottom Whole Expense Ratio (TER) of simply 0.09%. Different outstanding performers, akin to funds from UTI, SBI, Kotak, ICICI Prudential, DSP, and Axis Mutual Funds, delivered returns within the vary of 42.36% to 42.59% with TERs various from 0.11% to 0.37% respectively (as proven within the Desk 1). These funds spotlight the rising reputation of passive investing, combining low-cost constructions with market-linked efficiency, making them engaging to long-term traders looking for constant returns.

Prime 10 Index Funds with 1 yr return for 2024

| S. No. | Title of the Fund | 1 Yr return | TER (%) | Fund Home |

|---|---|---|---|---|

| 1 | Bandhan Nifty IT Index Progress Direct Plan | 42.78 | 0.37 | Bandhan Mutual Fund |

| 2 | Edelweiss Nifty Subsequent 50 Index Progress Direct Plan | 42.66 | 0.09 | Edelweiss Mutual Fund |

| 3 | UTI Nifty Subsequent 50 Index Progress Direct Plan | 42.59 | 0.36 | UTI Mutual Fund |

| 4 | SBI Nifty Subsequent 50 Index Progress Direct Plan | 42.58 | 0.33 | SBI Mutual Fund |

| 5 | Aditya Birla Solar Life Nifty Subsequent 50 Index Progress Direct Plan | 42.58 | 0.33 | Aditya Birla Capital Mutual Fund |

| 6 | Kotak Nifty Subsequent 50 Index Progress Direct Plan | 42.57 | 0.11 | Kotak Mahindra Mutual Fund |

| 7 | ICICI Prudential Nifty Subsequent 50 Index Progress Direct Plan | 42.56 | 0.31 | ICICI Prudential Mutual Fund |

| 8 | DSP Nifty Subsequent 50 Index Progress Direct Plan | 42.54 | 0.28 | DSP Mutual Fund |

| 9 | Motilal Oswal Nifty Subsequent 50 Index Progress Direct Plan | 42.50 | 0.35 | Motilal Oswal Mutual Fund |

| 10 | Axis Nifty Subsequent 50 Index Progress Direct Plan | 42.36 | 0.25 | Axis Mutual Fund |

Supply: Kuvera, as on 15/12/2024.

The Advantages of Index Funds in India

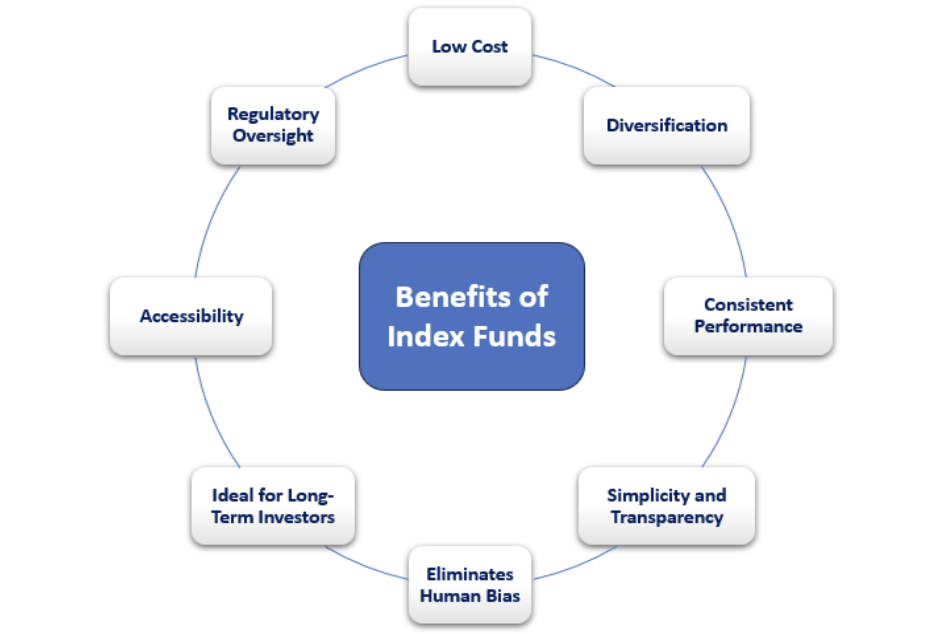

Describing the advantages of Index funds in India, we all know that they supply a low-cost, diversified, and clear funding choice by passively monitoring the market indices just like the Nifty 50 and Nifty Subsequent 50. With low expense ratios—for instance, Edelweiss Nifty Subsequent 50 Index Fund’s TER of 0.09%—they’re cost-efficient in comparison with actively managed funds. They provide broad market publicity, lowering threat via diversification, and ship constant returns by mirroring index efficiency. Platforms like Kuvera have simplified entry to index funds, enabling traders to automate investments via SIPs and begin with minimal quantities. Backed by SEBI’s laws, index funds are perfect for long-term wealth accumulation, akin to retirement planning or monetary targets. The advantages of index funds are proven within the following diagram:

Issues You Needs to be Cautious About Investing in Index Funds

Regardless that the index funds have numerous advantages, then too whereas investing in index funds you will need to take precautions to make sure they align together with your monetary targets and threat tolerance. The precautionary key concerns are:

1. Understanding the Index Being Tracked

As completely different index funds observe numerous indices, akin to Nifty 50, Nifty Subsequent 50, or sector-specific indices like Nifty IT, you need to select an index fund primarily based in your threat urge for food and desired market publicity. For example, Sectoral indices, like IT or banking, could also be riskier resulting from their lack of diversification, you probably have a threat aversion urge for food.

2. Evaluate the Whole Expense Ratio

Whereas index funds are typically low-cost, the Whole Expense Ratio (TER) varies throughout funds. Even a small distinction can affect your long-term returns, so go for funds with decrease TERs. For instance: Edelweiss Nifty Subsequent 50 Index Fund has a TER of 0.09%, making it extra cost-efficient amongst its opponents.

3. Monitoring Error

Moreover, you have to be conscious {that a} fund’s monitoring error signifies how intently it mimics its benchmark index. Poor efficiency compared to the index is indicated by a better monitoring error. For better alignment with market returns, you will need to choose funds with a low monitoring error.

4. Market Dangers

Index funds mirror market efficiency and are topic to market volatility. They could not defend you in opposition to downturns as a result of in contrast to energetic funds, index funds don’t goal to outperform the market. Subsequently, as an investor, you have to be ready for fluctuations throughout market corrections.

5. Lengthy-Time period Funding Horizon

Index funds work finest for long-term targets resulting from their means to generate regular returns over time. In case you are a short-term investor, looking for fast beneficial properties, you then would possibly discover market-linked volatility difficult.

6. Assess Fund Home Fame

It is best to select funds from established Asset Administration Firms (AMCs) with a strong observe file and robust administration to make sure environment friendly fund replication and minimal monitoring errors.

7. Keep away from Overlapping Investments

Investing in a number of index funds that observe the identical index (e.g., Nifty 50) can result in redundancy with out bettering diversification. Therefore, you need to go for funds monitoring completely different indices if wanted.

8. Tax Implications

Beneficial properties from index funds are topic to capital beneficial properties tax as prescribed by the regulatory authorities from time-to-time.

9. Overview Periodically

Whereas index funds are passive, periodic critiques of efficiency, expense ratios, and monitoring errors guarantee they continue to be aligned together with your targets.

Wrapping Up

Index funds is usually a higher choice for traders looking for low-cost, diversified, and clear funding choices. By monitoring market indices just like the Nifty 50, they provide constant, long-term returns with minimal administration charges. Nonetheless, one have to be cautious of things akin to expense ratios, monitoring errors, market dangers, and the necessity for a long-term funding horizon. Platforms like Kuvera make investing in index funds accessible and easy.

As John Bogle, the creator of the primary index fund, properly mentioned, “the fantastic thing about index funds is that they provide the broadest doable publicity to the market, whereas protecting prices low and administration easy. In essence, they make investing accessible and environment friendly for everybody.”

Fascinated about how we take into consideration the markets?

Learn extra: Zen And The Artwork Of Investing

Watch right here: Is UPI Killing the Toffee Enterprise?