Tide Capital’s newest analysis reveals Bitcoin and Ethereum are redefining institutional finance frameworks. BTC shattered information above $120,000, whereas ETH’s structural shortage drives elementary revaluation. Converging macro coverage shifts and institutional adoption are forging a brand new crypto funding paradigm.

Institutional Capital Fuels Historic Bitcoin Breakthrough

Bitcoin’s $2.4 trillion market cap – surpassing Amazon because the world’s fifth-largest asset – displays deepening institutional conviction. Tide Capital confirms spot Bitcoin ETFs absorbed $10+ billion web inflows over two months, pushed by allocations from Goldman Sachs, Morgan Stanley, and the Michigan Retirement System.

A pivotal stress take a look at occurred when markets digested an 80,000 BTC ($10 billion) whale sell-off with solely a 2.5% dip to $117,000. This demonstrated unprecedented structural resilience in comparison with prior cycles.

Supply: TradingView

Tide Capital analysts straight attribute this stability to Bitcoin’s institutionalization: “The 30% year-to-date achieve amid international uncertainty and its mounted 21 million provide cap now place BTC as a core non-sovereign reserve asset.”

Macro Tailwinds Ignite Cross-Asset Rotation

CME FedWatch knowledge exhibits a 98% likelihood of ≥50bps Fed cuts by December 2025, unleashing capital into danger markets. Tide Capital paperwork how the Nasdaq’s historic 20,980-point excessive in July 2025 ignited a “U.S. equities → danger urge for food → crypto” capital transmission chain.

Supply: TradingView

Concurrently, sovereign debt dangers amplify Bitcoin’s attraction – IMF initiatives international authorities debt/GDP will hit 95% in 2025, with 38 nations exceeding 100%. This accelerates Bitcoin’s transition from idea to institutional portfolio actuality.

Ethereum’s Triple Engine: Establishments, Shortage, Worth Seize

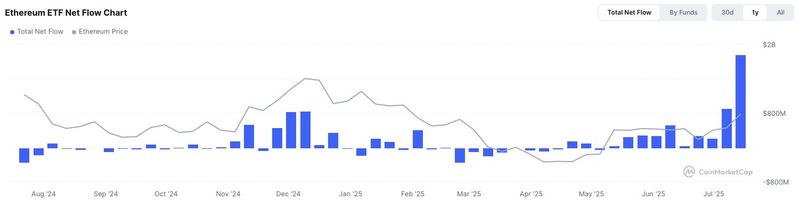

Institutional adoption reached an inflection level with 10 consecutive weeks of $5 billion ETH ETF inflows. Tide Capital highlights Normal Chartered’s landmark launch of ETH spot buying and selling on July 15, 2025 – the primary International Systemically Necessary Financial institution to supply such providers.

Supply: CoinMarketCap

Community mechanics now implement structural shortage: 36 million ETH ($130 billion) is staked, consuming 30% of circulating provide – double pre-Shanghai improve ranges. Critically, over 50% flows by compliant custodians (Coinbase, Kraken), signaling long-term institutional dedication.

Ethereum additional dominates the $251 billion stablecoin market with $140 billion (56%) hosted on its community. Primarily based on Tide Capital’s analysis, the stablecoin development straight fuels ETH worth seize by transaction payment burns and ecosystem growth.

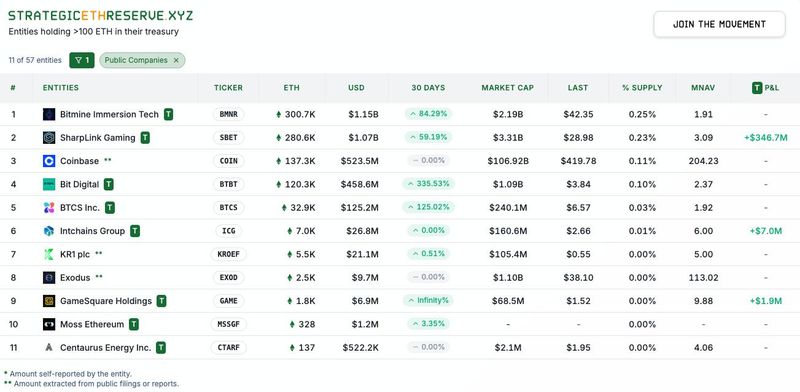

Company Treasuries Redefine Capital Technique with ETH

Public corporations are revolutionizing treasury administration by adopting ETH as a yield-bearing reserve asset. A rising variety of companies now designate ETH as a major treasury reserve, accumulating vital holdings with practically all tokens actively staked to generate yield.

Supply: Strategic ETH Reserve

“Their collective momentum creates a robust cluster impact: rising institutional participation enhances ETH’s liquidity, reduces volatility, and solidifies its standing as an investable asset—accelerating additional adoption,” famous Tide Capital.

Synergistic Property Reshape Institutional Portfolios

In keeping with Tide Capital, Bitcoin and Ethereum now ship complementary worth: BTC serves as a systemic hedge and financial reserve, whereas ETH powers productive on-chain economies by DeFi, tokenization, and stablecoins.

Tide Capital concludes this synergy is increasing international finance’s architectural prospects. Macro tailwinds and institutional adoption are irreversible accelerants, with $120,000 BTC and yield-generating ETH treasuries marking an inaugural section of institutional crypto integration.

Disclaimer: The knowledge supplied on this press launch shouldn’t be a solicitation for funding, neither is it supposed as funding recommendation, monetary recommendation, or buying and selling recommendation. It’s strongly really useful you follow due diligence, together with session with an expert monetary advisor, earlier than investing in or buying and selling cryptocurrency and securities.