Estimate Your Threat Profile

Introduction

Earlier than you dive into investing, there’s one key step you shouldn’t skip, understanding your threat profile.

Consider your risk profile as a information that helps you decide the correct funding technique for you.

- For those who’re somebody who will get nervous about shedding cash (what we name “risk-averse“), you wouldn’t need to leap into high-risk investments like shares that may be a rollercoaster.

- Then again, in the event you’re comfy taking larger dangers, you may discover safer choices, like fastened deposits or debt plans, too boring and never rewarding sufficient.

However we should additionally perceive that our threat profile shouldn’t be precisely black and white.

Most individuals aren’t on the excessive ends of being tremendous cautious or tremendous daring. As an alternative, the vast majority of us fall someplace within the center, in what’s known as a “reasonable threat profile.”

That’s the place plenty of buyers match.

For these of us on this reasonable zone, a balanced or “hybrid” portfolio, mixing safer investments with a little bit of riskier ones, often works greatest.

So, to sum it up, there are three essential sorts of threat profiles:

- Low (cautious),

- Reasonable (balanced), and

- Excessive (adventurous).

And since most of us are in that reasonable group, it’s an awesome start line for constructing a wise funding plan that fits our consolation stage.

Threat and Investing

Let’s face it, each time you make investments your cash, there’s an opportunity you may lose a few of it.

That’s why individuals typically say that threat and investing go hand in hand.

They’re like two sides of the identical coin. And that is one thing all of us want to know, particularly now, when increasingly individuals are leaping into the inventory market.

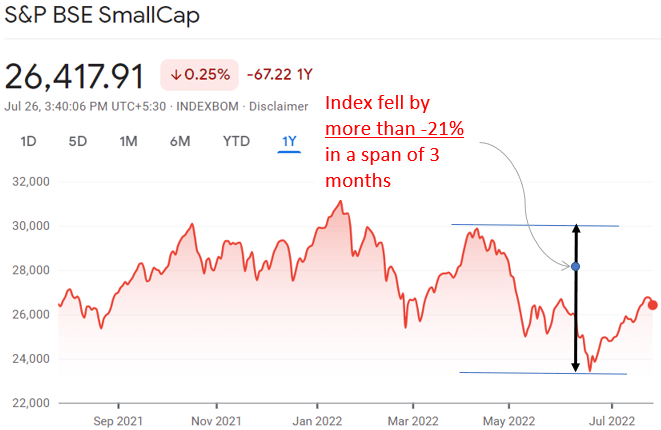

Shares might be thrilling, however they’re additionally one of many riskiest locations to place your cash.

Right here’s a incontrovertible fact that we should acknowledge. Earlier than the COVID pandemic hit in 2020, about 40 lakh new Demat accounts (which it’s essential commerce shares) had been opened every year. However after COVID, that quantity skyrocketed. Within the monetary yr 2022, a whopping 1 crore new Demat accounts had been opened, it’s an all-time report.

Meaning much more individuals are making an attempt their hand at inventory market investing.

That is nice information for the market, it reveals individuals are .

However there’s additionally a catch when many individuals strive their luck within the inventory market.

Many of those new buyers are leaping in with out actually understanding what they’re moving into. They’re shopping for and promoting shares with out figuring out the stability between threat and reward.

- For instance, some individuals’s threat profiles imply they need to solely have a small portion of their cash in shares. However as an alternative, their portfolios are filled with shares. What occurs if the market crashes? They may panic, promote every thing at a loss, and find yourself with a lot lower than they began with.

So, how will we keep away from this mess?

The secret’s to construct an funding portfolio that matches your threat profile. Meaning determining how a lot threat you’re really comfy with and creating a mixture of investments that matches you.

What’s the lesson I’ve realized after being out there for greater than 15 years? It’s so necessary to stay to what works in your threat stage, “don’t go overboard with dangerous investments in the event that they’re not best for you.” Interval.

Estimate The Threat Profile

What’s Your Threat Profile?

Have you ever ever puzzled, “What sort of investor am I?”

To determine that out, it’s essential perceive one thing known as threat profiling. Don’t fear, it’s not as difficult because it sounds.

Threat profiling is only a technique to measure how a lot threat you’re comfy taking once you make investments. It helps you discover the correct stability of threat that fits your character and monetary scenario.

When skilled funding managers work with purchasers, they create portfolios which are custom-made to match every particular person’s threat profile.

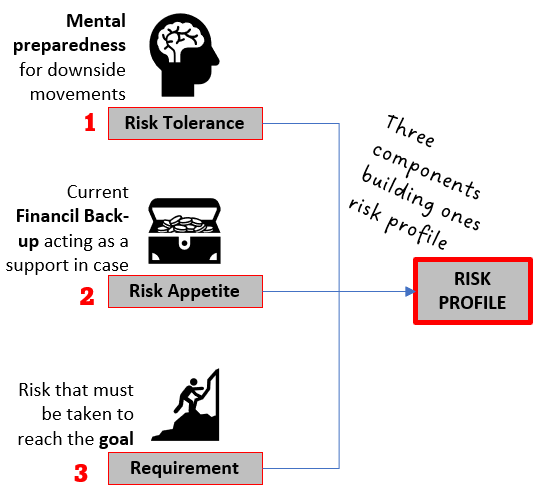

To do that, they have a look at three key issues:

- how a lot threat you want to take to fulfill your targets,

- how mentally ready you’re to deal with losses, and

- how sturdy your monetary scenario is true now.

The Three Items of Your Threat Profile

Consultants typically speak about two essential elements that make up your threat profile: threat tolerance and threat urge for food.

However I like so as to add a 3rd one, threat requirement, as a result of it’s simply as necessary.

Let’s have a look at every of them:

- Threat Requirement: That is about whether or not your monetary targets require you to take dangers. For instance, in the event you’re saving for a giant objective like retirement in 20 years, you may must take some dangers to develop your cash, even in the event you’re naturally cautious. On the flip facet, in the event you’re already rich and simply need to defend your cash, you may not must take any dangers in any respect, even in the event you may deal with them.

- Threat Tolerance: That is all about how properly you’ll be able to deal with the ups and downs of investing, mentally and emotionally. Think about your funding portfolio drops in worth. If a small dip of 5–6% makes you actually nervous, you most likely have low threat tolerance. However in the event you can keep calm even when your portfolio drops 30% or extra, that’s an indication of excessive threat tolerance.

- Threat Urge for food: This will depend on your present monetary scenario. For those who’ve acquired a strong monetary basis, like a gradual earnings and excessive financial savings, you may really feel okay taking extra dangers. This will probably be true even in the event you’re not tremendous comfy with losses. However in the event you’re in your early 20s and nonetheless constructing your monetary stability, you may not be able to take huge dangers but.

There are different elements that play a task in threat urge for food too, and we’ll dive into these later on this put up.

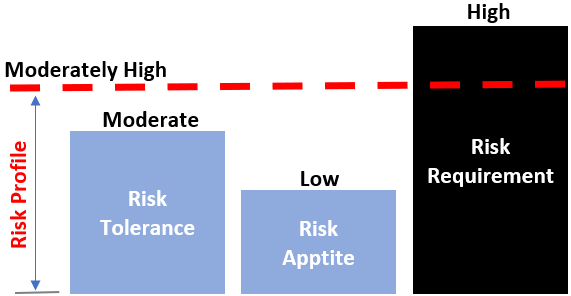

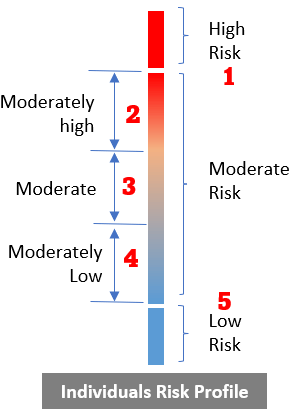

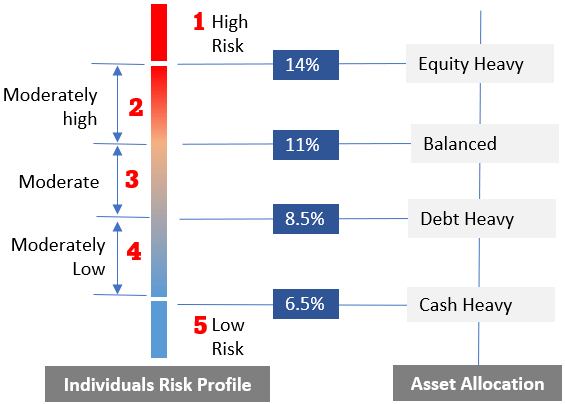

Based mostly on these elements, threat tolerance and threat urge for food, individuals typically fall into considered one of 5 sorts of threat profiles:

- Excessive Threat

- Reasonably Excessive Threat

- Reasonable Threat

- Reasonably Low Threat

- Low Threat,

We’ll discover these classes in additional element now.

Understanding Threat Tolerance and Threat Urge for food

A. Threat Tolerance: How You Deal with Losses Emotionally

Threat tolerance is all about how properly you’ll be able to emotionally cope with the thought of shedding cash, or truly seeing your investments drop in worth.

If you spend money on one thing dangerous, like shares, the worth of your portfolio can go up and down so much in a short while. Typically, it’d even drop by 30% or extra.

The way you react in these robust moments reveals your threat tolerance.

For those who keep calm and don’t stress out, that’s an indication of excessive threat tolerance. However in the event you panic and promote every thing to keep away from extra losses, which means you’ve got low threat tolerance.

So, what shapes your threat tolerance? Listed here are two huge elements:

- Your Previous Experiences: Your background and previous with cash can actually affect how you’re feeling about threat. For instance, in the event you grew up in a time when costs didn’t rise a lot (low inflation), you may really feel protected with easy investments like index funds. However in the event you had been raised in a fast-growing economic system, you is perhaps extra drawn to riskier choices like shopping for shares immediately. For those who or your loved ones misplaced some huge cash in a giant market crash, just like the one in 2008, you is perhaps further cautious and keep away from shares throughout robust instances, just like the COVID crash in 2020. Then again, in the event you noticed your dad and mom solely spend money on super-safe issues like insurance coverage, you may suppose shares or fairness funds are too dangerous for you.

- Your Pure Character (Perhaps It’s in Your Genes): Some individuals simply appear wired to deal with funding dangers higher, it’d even be of their DNA! These people see a market crash as an opportunity to purchase extra at decrease costs, quite than a cause to panic. They may really feel excited to spend money on shares or fairness funds throughout a downturn. Others may favor a safer combine, like hybrid funds, whereas extra cautious individuals, like our grandparents, may persist with financial institution deposits even when the market dips.

The way you behave throughout a market stoop says so much about your threat tolerance.

B. Threat Urge for food: How A lot Threat You Can Afford to Take

Threat urge for food is a bit totally different. It’s about how a lot threat you’ll be able to truly afford to take, primarily based in your monetary scenario.

Even in the event you’re not naturally comfy with threat, you may nonetheless be capable of take some probabilities when you’ve got more money to speculate. I consider anybody can develop their threat urge for food over time. For instance, I’ve constructed mine by ensuring I put aside cash to speculate proper at first of every month, earlier than I spend on the rest. I name it “paying myself first.”

Right here’s what influences your threat urge for food:

- Your Present Monetary Well being: For those who’re in a robust monetary place, you’ll seemingly really feel extra comfy taking dangers. So, what makes you financially secure? Let’s focus on in additional particulars:

- Regular and Additional Earnings: If in case you have a excessive, secure wage, you is perhaps extra prepared to take dangers in comparison with somebody like a freelancer with an unpredictable earnings. Additionally, in the event you dwell frugally and have more money left over every month, you’ll have the next threat urge for food. However in the event you have a tendency to spend so much, you may not have a lot spare money, which may make you extra cautious.

- Your Emergency Fund: An emergency fund is sort of a security internet, it consists of issues like money financial savings and insurance coverage. The larger your emergency fund, the safer you’ll really feel, which may make you extra open to making an attempt riskier investments.

- Your Present Investments: If you have already got a strong funding portfolio that’s doing properly, it may well enhance your confidence to take extra dangers. Not solely does it offer you expertise, however it additionally makes you’re feeling extra financially safe.

- How Lengthy You Plan to Make investments (Your Time Horizon): The longer you’ll be able to go away your cash invested, the much less you’ll fear about short-term ups and downs. For instance, in the event you’re investing for a objective that’s simply 3 years away, you’ll most likely play it protected with reasonable dangers. But when your objective is 20–25 years away, like saving for retirement, you’ll seemingly really feel extra comfy with riskier investments, figuring out you’ve got time to journey out any dips.

One very last thing, information issues.

The extra you understand about investing, like how shares, mutual funds, or bonds work, the higher you’ll deal with the dangers that include them.

That is very true for shares. If you perceive the fundamentals of the inventory market, you’re much less more likely to panic and extra more likely to make good decisions, even when issues get shaky.

Matching Your Threat Profile to an Funding Technique

Turning Your Threat Profile right into a Plan

Determining your threat profile is a good first step, however it’s solely half the job.

The actual magic occurs once you use that information to create an funding technique that matches you. Your threat profile can information you towards the correct mix of investments, and even offer you an concept of the returns you may anticipate.

For instance, let’s say you’ve got a reasonable threat profile (which, as we’ve talked about, is the place most individuals fall). You’d desire a portfolio designed to purpose for annual returns between 8.5% and 11%. That’s a candy spot that balances progress with a stage of security you’re comfy with.

Every threat profile, whether or not it’s Excessive Threat, Reasonably Excessive Threat, Reasonable Threat, Reasonably Low Threat, or Low Threat, might be paired with a goal return vary like this (see the above infographic) that will help you plan.

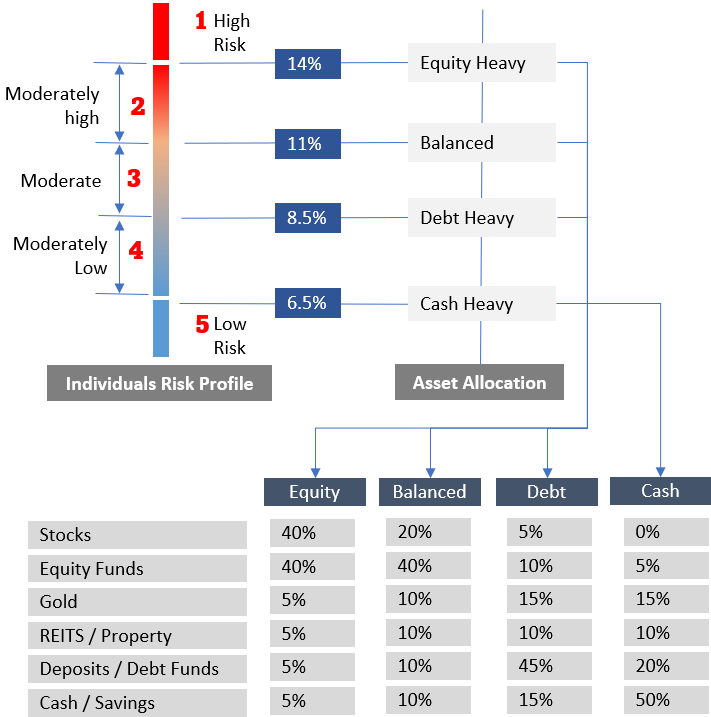

Constructing Your Portfolio: What Goes In?

Now that you understand your threat profile and goal returns, let’s speak about find out how to construct your portfolio (use the above on-line instrument to estimate your threat profile).

That is the place asset allocation is available in. It’s only a fancy method of claiming the way you break up your cash between various kinds of investments, like shares, bonds, gold, or actual property.

The objective is to create a combination that matches your threat profile and helps you hit these goal returns.

Right here’s a easy breakdown of the way you may divide your cash, relying in your threat profile:

- Excessive Threat: Focus closely on fairness (e.g., >40% shares, >40% fairness funds, <5% gold, <5% Reits, <5% deposits/debt funds, and <5% money) for increased returns, however anticipate extra ups and downs.

- Reasonably Excessive Threat: Nonetheless lean towards shares, however with a bit extra stability (e.g., 40% shares, 40% fairness funds, 5% gold, 5% Reits, 5% deposits/debt funds, and 5% money).

- Reasonable Threat: Go for a balanced combine (e.g., 20% shares, 40% fairness funds, 10% gold, 10% Reits, 10% deposits/debt funds, and 10% money) to purpose for these 8.5%–11% returns we talked about.

- Reasonably Low Threat: Shift towards safer choices (e.g., 5% shares, 10% fairness funds, 15% gold, 10% Reits, 45% deposits/debt funds, and 15% money).

- Low Threat: Stick principally to protected investments (e.g., 0% shares, 5% fairness funds, 15% gold, 10% Reits, 20% deposits/debt funds, and 50% money) to maintain your cash safe.

I’ll be trustworthy, this can be a simplified model of asset allocation. In actuality, it may well get extra complicated.

However the above illustration provides you a place to begin to know how your threat profile shapes your funding decisions.

A Observe for Newbies:

For those who’re new to investing and don’t know a lot about totally different asset varieties (like shares, gold, or actual property funding trusts – REITs), you’ll need to play it safer.

For inexperienced persons, it’s higher to place extra of your cash into low-risk choices, like bonds or fixed-income investments. This implies your portfolio will probably be “debt-heavy,” and your returns is perhaps decrease than somebody taking larger dangers.

However that’s okay, it’s all about beginning at a stage that feels best for you and constructing confidence as you be taught extra.

Conclusion

Why Your Threat Profile Issues

Earlier than you begin investing, taking the time to determine your threat profile can set you on the correct path. It’s like having a roadmap in your funding journey.

It’s going to make it easier to make smarter decisions that suit your consolation stage.

Whether or not you’re simply beginning out otherwise you’re an skilled investor, right here’s a tip, examine your threat profile at the very least each 5 years. Why?

As a result of as you get older, your priorities change. Perhaps you’ll grow to be extra cautious as you close to retirement, otherwise you’ll really feel braver after constructing some financial savings.

Both method, your threat profile will seemingly shift, and your investments ought to too.

For inexperienced persons, going by way of the method of determining your threat profile is a implausible technique to dip your toes into investing. It’s like a crash course in understanding your self as an investor. You’ll get a transparent image of how a lot threat you’re okay with, what sort of returns you’ll be able to anticipate, and find out how to break up your cash between totally different investments (like shares, bonds, or gold).

Right here’s slightly trick I used once I was a newbie to check my threat tolerance earlier than shopping for shares, I’d think about I had Rs.5,000 to speculate. Then I’d ask myself, “How a lot of this might I lose with out shedding sleep?” Again then, my reply was often Rs.500. So, I’d solely put Rs.500 into shares and make investments the remainder in safer choices like mutual funds.

It was a easy technique to ease into investing with out taking over an excessive amount of threat without delay—you’ll be able to strive it too!

Have a cheerful investing.