Final Up to date on Jun 4, 2025 by Aishika Banerjee

Basic evaluation is a holistic method to understanding and finding out a enterprise. It helps in figuring out basically robust corporations. When you’re planning to put money into an organization for the long run, you have to examine it from varied views. Basic evaluation additionally helps you identify a inventory’s truthful market worth. However how? Let’s discover out.

What’s Basic Evaluation?

It’s a methodology of evaluating the true worth of an organization or an asset. It does so by analysing the elements that might affect the worth sooner or later. Basic evaluation is in distinction with technical evaluation. Whereas elementary evaluation is the corporate’s financials, exterior occasions, influences, and trade traits, technical evaluation derives the knowledge from charts. The previous is used for long-term investments, whereas the latter is often used for buying and selling.

Observe: The true worth of an organization is also called truthful worth and intrinsic worth.

Significance of Basic Evaluation

Basic evaluation helps in figuring out the truthful worth of any inventory. It additionally evaluates the well being and efficiency of an organisation with the assistance of its financials and main financial indicators. Basic evaluation of inventory additionally helps in understanding the enterprise mannequin of an organization, the working methods of the administration, and its strengths and weaknesses. You may predict future worth actions and decide if the inventory is undervalued or overvalued.

Forms of Basic Evaluation

Basic evaluation is split into two classes:

Qualitative evaluation

Because the title suggests, qualitative evaluation considers the qualitative elements of an organization, reminiscent of goodwill, demand, shopper behaviour, firm recognition within the broader market, aggressive evaluation, and model worth. It additionally goals to find out how the administration is, the impression of their selections available on the market, and depicts their socio-economic place. Qualitative evaluation is often thought-about subjective.

Quantitative evaluation

Quantitative evaluation is expounded to the measurable traits of a enterprise. Therefore, the largest supply of quantitative evaluation is monetary statements. Quantitative evaluation is about statistics, stories, and information. It considers statements, stability sheets, money flows, debt, quarterly efficiency, and plenty of monetary ratios to grasp the corporate’s general monetary well being and decide the share’s worth.

Distinction Between Basic Evaluation and Technical Evaluation

Basic evaluation and technical evaluation are removed from one another. Let’s perceive how.

| Factors of distinction | Basic evaluation | Technical evaluation |

| That means | It’s a detailed examination of the elements that affect the trade, firm, monetary statements, competitors, and extra. | It consists of the examination of charts for making predictions on the share worth. It’s data-driven and used to grasp the patterns within the share worth of a inventory. |

| Perform | Funding-related | Buying and selling-related |

| Timeframe | long-term | short-term |

| Goal | To determine the true worth of the inventory | To determine the precise time to enter or exit the market |

| Focuses on | Each previous and current information | Previous information solely |

| Type of information used | Monetary statements, financial stories, information occasions, trade statistics, administration processes, and so forth. | Evaluation of charts |

| Methodology | Examination of ongoing trade traits, financial outlook, competitor corporations’ efficiency, and monetary information. | Examination of the market psychology in addition to worth actions. |

| Indicators | Indicators used are bills, revenues, belongings, liabilities, debt-equity ratio, return on fairness ratio, and so forth. | Indicators used are worth information, RSI, MACD, easy transferring common, and so forth. |

Execs of Basic Evaluation

- It’s helpful for the long-term funding method.

- With elementary evaluation, you get data on the place and when to put money into producing excessive earnings over a long-term interval.

- Basic evaluation consists of each – qualitative and quantitative evaluation. It helps in offering a whole perception into the corporate’s efficiency.

Cons of Basic Evaluation

- It’s a time-consuming course of which requires a number of areas of study, making the method extraordinarily sophisticated.

- The quantitative evaluation is subjective as a result of the information is just not quantifiable.

Who makes use of Basic Evaluation?

Though most traders are inclined to utilise elementary evaluation, the individuals most definitely to make use of it are:

- Worth or long-term traders: It helps them discover out the underlying worth of the inventory and development potential, generate pricing targets, and verify whether or not the inventory is definitely worth the worth they’re paying.

- Company managers and accountants: They use it to gauge and enhance an organisation’s profit-making capacity by streamlining its operations. It additionally helps them perceive the place they stand in opposition to the competitors.

Basic Evaluation Methodology

Qualitative evaluation

Step one in elementary evaluation is to analyse the corporate qualitatively. For this goal, the solutions to the next questions are decided.

- How environment friendly is the corporate by way of operations?

- What’s the high quality of its key administration personnel?

- How does the model worth of an organization seem?

- Does the corporate use any unique (proprietary) expertise?

- What socially accountable initiatives is the corporate enterprise?

- What’s the firm’s imaginative and prescient for the longer term?

After figuring out the solutions to those questions and contemplating the solutions are good, you progress on to the following step.

Quantitative evaluation

There are numerous elements which are analysed in quantitative evaluation. Let’s have a look at all of them step-by-step.

Examine monetary statements

There are quite a few monetary statements of an organization. Nonetheless, there are three major monetary statements that an organization presents to show its efficiency.

1. Revenue and loss assertion

The revenue and loss assertion is often known as the earnings assertion, P&L assertion, operation assertion, and earnings assertion. It often consists of –

- The income of the corporate for a sure time interval (quarterly or yearly)

- Tax and depreciation

- The Earnings Per Share (EPS) quantity

- The bills incurred to generate the revenues

It offers you perception into an organization’s profitability and articulates the corporate’s backside line. There are numerous parameters in a P&L assertion. Relying on the trade, we measure totally different parameters. Nonetheless, the primary parameters that we measure for all corporations to test the profitability are income, Revenue Earlier than Curiosity and Tax (PBIT), and internet earnings.

For a profitable firm, these three elements ought to at all times respect. After analysing these three elements, you too can analyse the pattern in internet revenue for the final 5-10 yrs and working revenue to have a deeper understanding of the P&L assertion.

2. Steadiness Sheet

A stability sheet shows an organization’s belongings, liabilities, and shareholder’s fairness at a particular time limit. In a stability sheet, at any time limit, the overall belongings of an organization ought to at all times be equal to the corporate’s liabilities, together with shareholder’s fairness. Therefore, the title ‘stability sheet’.

If they don’t seem to be balanced, there could also be some points, together with incorrect or misplaced information, miscalculations, or alternate fee or stock errors. Therefore, in a stability sheet,

Belongings = Liabilities + Shareholders’ Fairness

A stability sheet tells what an organization owns, what it owes, and what it’s value as an organization. To find out if an organization is value investing in, we have a look at the overall belongings and whole liabilities of the corporate.

If an organization’s belongings are larger than the liabilities, you possibly can mark the corporate as ‘good for additional evaluation’. Nonetheless, if the liabilities are larger, it’s often thought-about ‘not value investing’. For a deeper evaluation of the stability sheet, varied monetary ratios, reminiscent of debt to fairness ratio, return on fairness, and so forth., are used.

3. Money-flow Assertion

A money circulation assertion exhibits the motion of cash out and in of enterprise. A cash-flow assertion determines an organization’s monetary well being. It helps you in analysing an organization’s liquidity. The money circulation assertion exhibits the web change in money, which is often divided into money from working actions, investing actions and financing actions.

For the evaluation goal, we test the issue ‘Free Money Stream’. A optimistic money circulation signifies that the corporate’s belongings are rising from the place they began. In distinction, a unfavourable money circulation signifies in any other case.

You may test all these monetary statements of an organization on Tickertape. Utilizing the search bar, enter the corporate you want to analyse. Click on on ‘Monetary Statements’ from the inventory web page to entry the earnings assertion evaluation, stability sheet, and money circulation.

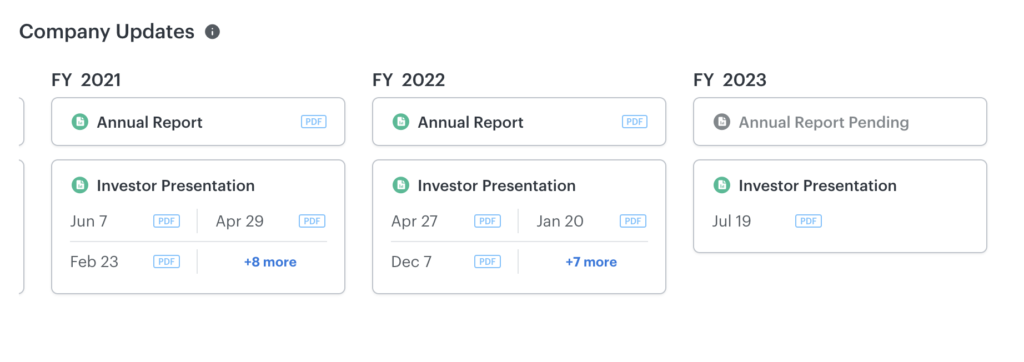

Annual Report and Buyers’ Presentation

An annual report is a complete doc that an organization should present to all its shareholders yearly. It describes their operations all year long. You may decide the corporate’s monetary well being with the assistance of an annual report.

The intent of an organization’s annual report is to offer public disclosure of its operations and monetary actions over the previous 12 months. There are quite a few elements of an annual report. As an investor, you must search for the enterprise overview, monetary/efficiency highlights, Administration Dialogue and Evaluation (MD&A), Director/Board’s report, notes to accounts, auditor’s report, Chairman’s assertion, and debt state of affairs. The annual report gives helpful data which you should use to analyse the corporate completely.

Buyers’ presentation consists of information in regards to the firm, speedy gross sales development alternatives, trade evaluation, administration group, all-round efficiency, improvements, future plans and extra. You will need to notice that not each firm gives traders displays to its shareholders. Buyers’ presentation is a short, clear, informative useful resource to grasp the enterprise.To get annual stories and traders’ displays of an organization, click on on ‘Monetary Statements’ of inventory on Tickertape and scroll right down to the underside. You’ll get the corporate’s annual stories and traders’ displays.

Development over the interval of three and 5 yrs

After analysing the monetary statements and annual stories, you possibly can analyse the expansion within the share worth of a inventory for 3-yr and 5-yr intervals. If an organization has proven optimistic development in all of the earlier steps, it’s extremely possible that it has had an upward pattern in its inventory worth for the earlier 3 yrs and 5 yrs. For the aim of elementary evaluation, we at all times analyse the long-term development of the share worth.

Monetary ratios

Monetary ratios are useful in figuring out the efficiency of an organization. They’re the most effective methods to analyse monetary statements. Benjamin Graham, popularly often called the daddy of elementary evaluation, has made the usage of monetary statements widespread. The ratios assist in the aggressive evaluation of an organization. Additional, you too can analyse an organization’s efficiency by analysing its monetary ratios pattern.

A. Profitability ratios

Because the title suggests, profitability ratios decide the profitability of an organization. The ratios reveal the efficiency of an organization by way of producing income. Additionally they convey the competitiveness of the administration. There are numerous profitability ratios. For the aim of elementary evaluation, listed here are 4 profitability ratios.

1. PAT margin

Revenue After Tax (PAT) margin is calculated by deducting all firm bills from its whole income. It identifies the general profitability of an organization. The system to calculate the PAT margin is,

PAT margin = [PAT / Total revenue]*100

The upper the PAT revenue margins, the higher the profitability of an organization. It’s known as Web Revenue Margin (NPM). It must be in contrast with the earlier years’ traits or opponents to grasp extra deeply.

2. Return on Fairness (ROE)

It’s a important ratio that assesses the return earned by the shareholders on each unit of capital invested. ROE is helpful in measuring the corporate’s capacity to generate income from the shareholders’ investments. It represents the effectivity of an organization in producing income for its shareholders. It’s calculated as,

ROE = [ Net income / Shareholders’ equity ] * 100

To calculate the shareholders’ fairness, subtract an organization’s whole liabilities from its whole belongings. You will get this data from the stability sheet.

Shareholders’ fairness = Complete belongings – Complete liabilities

Excessive ROE signifies good money technology by the corporate, conveying a great efficiency by administration, whereas low ROE signifies in any other case. ROE of an organization can be in contrast with its opponents and previous years’ traits to get a greater understanding.

3. Return on Belongings (ROA)

It’s a profitability ratio that measures the profitability of an organization in relation to its whole belongings. It exhibits if the corporate is utilizing its belongings effectively to generate income. To calculate the ROA, divide an organization’s internet earnings by its whole belongings.

ROA = Web earnings / Complete belongings

The upper the ROA, the extra environment friendly administration is in utilising the financial sources. Each ROE and ROA replicate how nicely an organization utilises its sources. Nonetheless, there’s one key distinction which is the best way they deal with an organization’s debt. ROA captures how a lot debt an organization carries as its whole belongings embody every kind of capital. Then again, ROE leaves out all of the liabilities and solely measures the return on an organization’s fairness.

If an organization has extra debt, its RoE can be larger than its ROA.

4. Return on Capital Employed (ROCE)

It’s helpful in understanding how nicely an organization is utilising its capital to generate income. It takes into consideration every kind of capital, together with debt. To calculate ROCE, divide Revenue Earlier than Curiosity and Tax (PBIT) by the overall capital employed.

ROCE = PBIT / Complete capital employed

The place the overall capital employed = Fairness + short-term debt + long-term debt

PBIT is also called Earnings Earlier than Curiosity and Tax (EBIT). You’ll find this data within the earnings assertion of an organization.

A better ROCE suggests environment friendly administration by way of capital employed. Nonetheless, a decrease ROCE could point out a variety of money available as money is included in whole belongings. In consequence, excessive ranges of money can typically skew this metric.

B. Leverage ratios

Sometimes called solvency ratios, leverage ratios measure an organization’s capacity to maintain its day-to-day operations in the long run. It measures an organization’s monetary well being by figuring out its capacity to satisfy its long-term debt obligation. Let’s have a look at two leverage ratios that may assist us decide the potential firm to put money into:

1. Debt-to-equity ratio

It is among the distinguished ratios in elementary evaluation and is also known as the chance ratio. The debt-to-equity ratio calculates the load of an organization’s whole debt in opposition to whole shareholders’ liabilities. It’s calculated as

Debt-to-equity ratio = Complete debt / Shareholders’ fairness

The place the overall debt = short-term debt + long-term debt + mounted cost obligations

A worth of 1 on this ratio signifies that there’s an equal quantity of debt and fairness capital. A better ratio (greater than 1) signifies larger leverage, whereas a decrease than 1 signifies a comparatively larger fairness base with respect to debt. The utmost acceptable debt-to-equity ratio for a lot of corporations is between 1.5-2 or much less. For bigger corporations, debt to fairness ratio of two or larger is appropriate. In the end, a perfect debt-to-equity ratio varies throughout corporations based mostly on the sector they belong to.

2. Curiosity protection ratio

Sometimes called the debt service ratio or the debt service protection ratio, it offers insights into how simply an organization can repay the curiosity on its excellent debt. The curiosity protection ratio determines the time (usually variety of quarters or years) for which curiosity cost might be made with the corporate’s present out there earnings. It’s calculated as

Curiosity protection ratio = EBIT / Curiosity expense

The decrease the ratio, the extra the corporate has a debt burden. The corporate’s capacity to pay again the debt is questionable when the curiosity protection ratio is only one.5 or decrease. The analysts often choose an curiosity protection ratio of two or extra.

C. Working ratios

Sometimes called exercise ratios, they measure the effectivity at which a enterprise can convert its belongings into revenues. Working ratios assist us perceive the effectivity of an organization’s administration. Profitability ratios convey the corporate’s effectivity, which is mostly decided by measuring the working ratios. Therefore, it’s tough to categorise these ratios.

1. Working capital turnover

To run an organization’s day-to-day operations, working capital is required. The working capital turnover ratio measures how a lot income an organization generates for each unit of working capital. It’s generally known as internet gross sales to working capital. The system to calculate it,

Working capital turnover ratio = Income / Common working capital

The upper the working capital turnover ratio of an organization, the higher gross sales it may well generate compared with the funds they’ve used to execute the gross sales.

2. Complete belongings turnover

This ratio signifies an organization’s capacity to generate revenues with the given quantity of belongings. It’s a ratio of the overall gross sales or income of an organization to its common belongings. The whole belongings turnover ratio is calculated yearly. It’s calculated as

Asset turnover ratio = Working income / Common whole belongings

A better whole belongings turnover ratio conveys that an organization is utilizing its belongings effectively to generate extra gross sales, whereas a decrease ratio signifies an organization’s incapacity to make use of its sources successfully.

This ratio tends to be larger in sure sectors. For instance, sectors like retail often have small asset bases however larger gross sales. Therefore, they’ve the very best asset turnover ratio. Conversely, sectors like actual property and utilities have massive asset bases, thus, low asset turnover.

D. Valuation ratios

Inventory valuation ratios measure an organization’s value. It analyses whether or not an organization’s present share worth is perceived as its true worth. It compares the price of safety with the perks of proudly owning the inventory. Let’s discover some valuation ratios.

1. Worth-to-Earnings ratio (P/E ratio)

It’s a widespread ratio that analyses an organization’s share worth to its earnings per share. As a consequence of its reputation, it’s typically known as a ‘monetary ratio famous person’. It helps in figuring out if a inventory is undervalued or overvalued.

P/E ratio = Market worth per share / Earnings per share (EPS)

To find out if a inventory is undervalued or overvalued, the P/E ratio of that inventory is in contrast with different shares of the identical trade and/or with the sector P/E. A excessive P/E ratio may imply that the inventory worth is comparatively larger than its earnings and probably overvalued. In distinction, a low P/E ratio may point out the inventory’s worth is low relative to earnings and maybe undervalued.

2. Worth to Gross sales ratio (P/S ratio)

It compares the inventory worth of an organization to its income. It helps in figuring out how a lot an investor is keen to pay per rupee of gross sales. The system for the P/S ratio is

P/S ratio = Present share worth / Gross sales per share

The place the gross sales per share = Complete revenues / Complete variety of shares

It’s higher to match the P/S ratio of comparable corporations in the identical trade to get a deeper understanding of how low-cost or costly the inventory is. The upper the P/S ratio, the upper the valuation of the corporate. Conversely, a low ratio signifies the inventory is undervalued.

3. EV/EBITDA ratio

Enterprise Worth (EV) measures an organization’s whole worth. It’s in contrast with an organization’s EBITDA to find out how typically an investor has to pay EBITDA in the event that they have been to accumulate all the enterprise.

Much like the P/E ratio, the decrease the EV/EBITDA, the lesser the corporate valuation. A excessive EV/EBITDA signifies that an organization is extremely prone to be overvalued. This ratio is utilized in comparability with different corporations in the identical sector. Therefore, cross-sector comparability received’t be useful. It’s generally used to determine what a number of an organization is at present buying and selling at.

Conclusion

Basic evaluation is step one you are taking if you end up searching for long-term investments in belongings like shares. It’s an intensive course of however gives you along with your potential long-term funding plan. Therefore, take your time in understanding the monetary statements, inventory development of an organization, and evaluating the essential monetary ratios. Tickertape is your full vacation spot for elementary evaluation. From getting monetary statements to ratios, including shares to the watch checklist, to investing in them straight, every little thing might be finished right here. Begin your funding journey now!

Regularly Requested Questions About Basic Evaluation

1. Can we use each elementary and technical evaluation of shares?

Basic evaluation makes use of monetary and financial information of the corporate for a long-term funding method, whereas technical evaluation takes the worth and buying and selling worth for short-term buying and selling. Relying on the funding interval, you should use the approaches.

2. Ought to the elemental evaluation of shares be used solely by the specialists?

No. The basic evaluation of shares is just not restricted to specialists. Any investor could make use of this firm evaluation earlier than investing in shares for the long run.

3. do a elementary evaluation of shares?

Basic evaluation and funding evaluation is a holistic method to understanding and finding out a enterprise. It helps in figuring out basically robust corporations. Right here’s how one can do it in short.

– Perceive the corporate, their enterprise mannequin, administration construction, and so forth.

– Use monetary ratios like PE ratios to guage the corporate.

– Research the monetary stories of the corporate.

– Discover the opponents and examine them. Search for aggressive benefits within the firm.

– Examine the corporate’s debt and evaluate it with rivals.

– Analyse the corporate’s future prospects.

– Overview all of the points once in a while.

4. get a Tickertape Professional membership?