Synopsis:

A number of Nifty 500 shares, together with Kirloskar Oil Engines, Apollo Tyres, and Maruti Suzuki, are exhibiting a MACD bullish crossover, signaling potential upward momentum and a optimistic short-term pattern of their inventory costs.

Technical indicators recommend a bullish pattern rising in sure Nifty 500 shares, because the MACD exhibits a bullish crossover, indicating rising shopping for momentum and potential short-term worth features.

Kaynes Know-how India Ltd is a number one electronics manufacturing companies (EMS) supplier headquartered in Mysuru, Karnataka, India. Established in 1988, the corporate provides end-to-end options throughout the electronics system design and manufacturing (ESDM) spectrum. Its companies embody conceptual design, course of engineering, built-in manufacturing, and life cycle assist for sectors together with automotive, aerospace, protection, medical, railways, IoT, and IT.

With market capitalization of Rs. 49,987 cr, the shares of Kaynes Know-how India Ltd are closed at Rs. 7,454 per share, from its earlier shut of Rs. 7,242 per share.

The inventory exhibits a bullish MACD crossover, signaling upward momentum, potential near-term worth enhance, and a potential shopping for alternative.

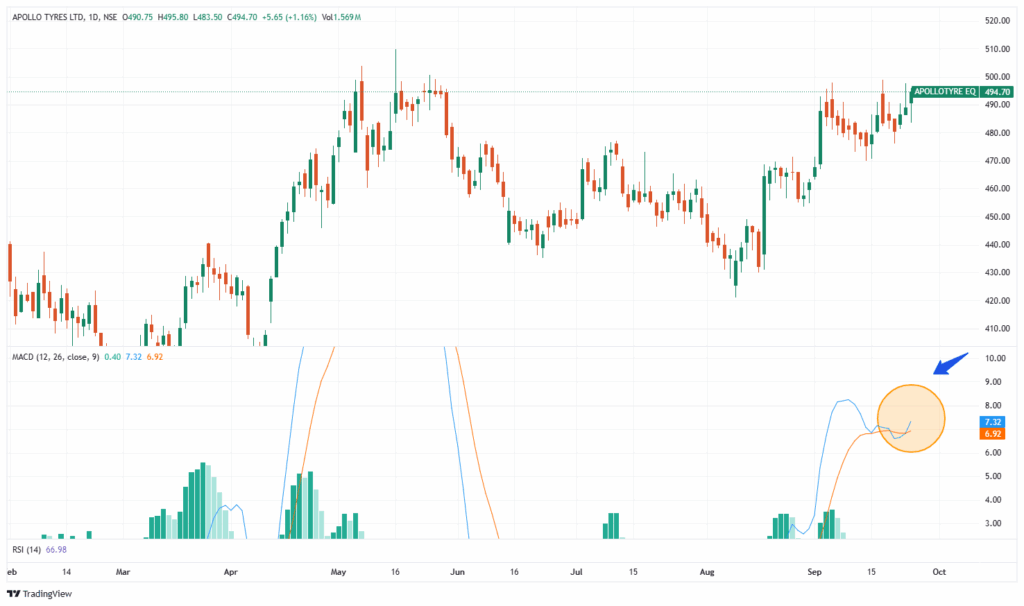

Apollo Tyres Ltd is a number one Indian tyre producer identified for producing a variety of tyres for automobiles, vans, buses, and two-wheelers. With a powerful presence each in home and worldwide markets, the corporate focuses on innovation, efficiency, and security in its merchandise.

With market capitalization of Rs. 31,301 cr, the shares of Apollo tyres Ltd are closed at Rs. 494.70 per share, from its earlier shut of Rs. 489.05 per share. A MACD bullish crossover seems on the inventory, indicating upward motion and potential near-term worth appreciation.

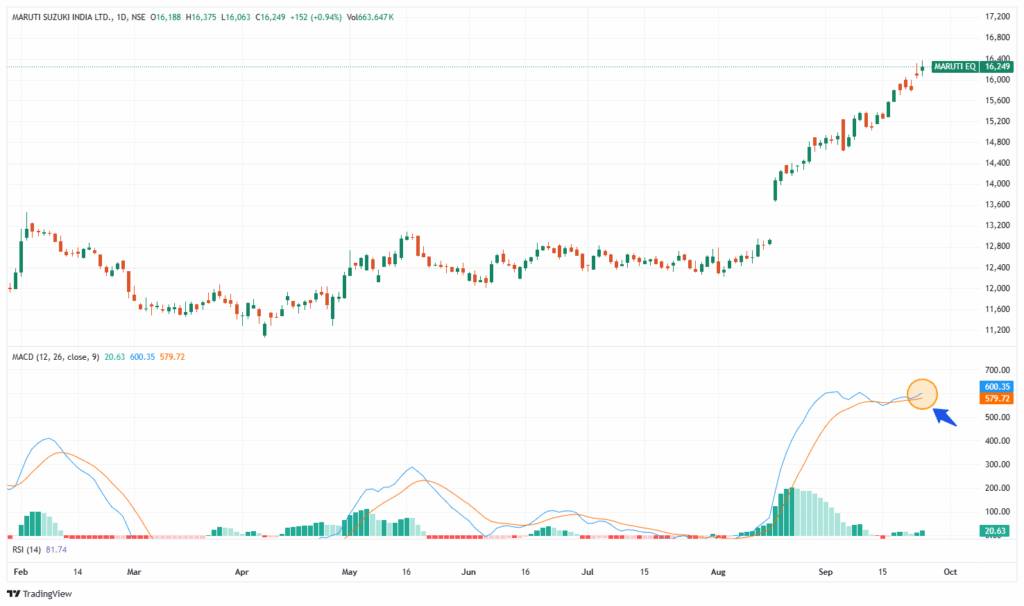

Maruti Suzuki Ltd is India’s largest passenger automobile producer, famend for its wide selection of automobiles that mix reliability, gas effectivity, and affordability. A subsidiary of Suzuki Motor Company, the corporate has a powerful presence throughout city and rural markets in India, providing merchandise from compact automobiles to premium fashions.

With market capitalization of Rs. 5,10,560 cr, the shares of Maruti Suzuki India Ltd are closed at Rs. 16,249 per share, from its earlier shut of Rs. 16,097 per share. The inventory is exhibiting a MACD bullish crossover, suggesting potential upward momentum and potential short-term worth features.

Written by Manideep Appana

Disclaimer

The views and funding ideas expressed by funding specialists/broking homes/score businesses on tradebrains.in are their very own, and never that of the web site or its administration. Investing in equities poses a danger of monetary losses. Traders should due to this fact train due warning whereas investing or buying and selling in shares. Commerce Brains Applied sciences Non-public Restricted or the creator are usually not accountable for any losses prompted on account of the choice based mostly on this text. Please seek the advice of your funding advisor earlier than investing.

Казино Cat