Picture supply: Video games Workshop plc

For a lot of the final two years, development shares have taken a again seat. Excessive inflation, rising rates of interest, and nervous buyers drove a shift in the direction of worth and defensive sectors. However with inflation now easing and fee hikes probably close to their peak, are UK development shares lastly staging a comeback?

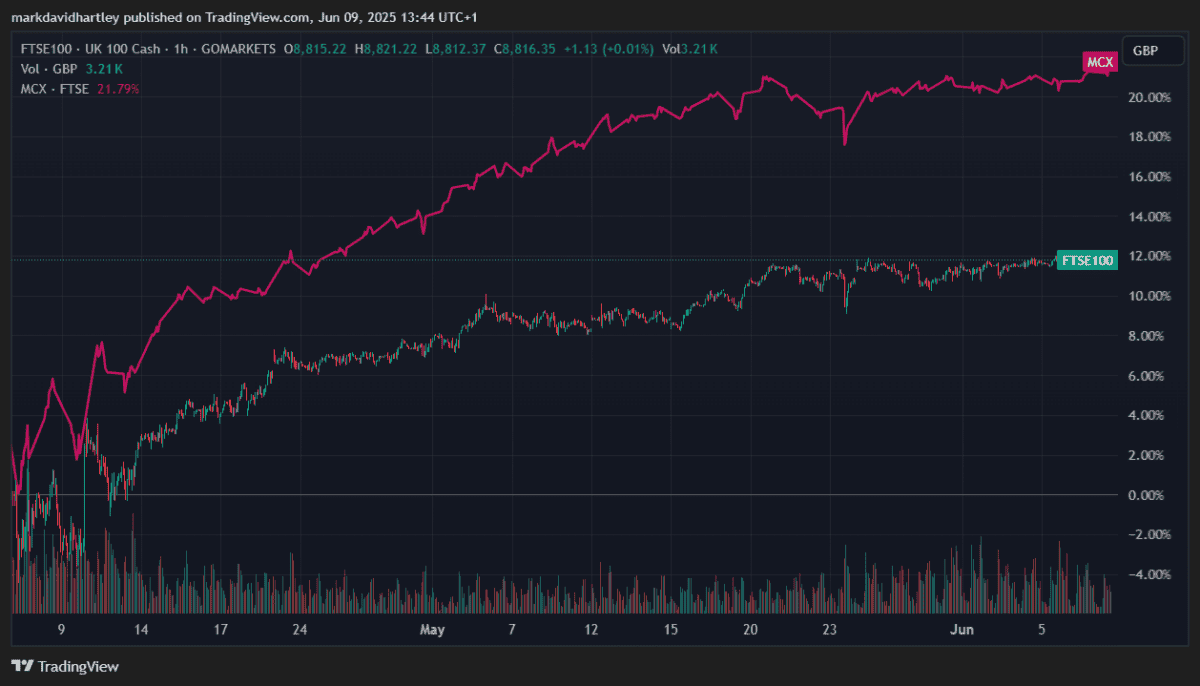

It’s nonetheless early days, however the indicators are encouraging. The FTSE 250, house to a lot of Britain’s greatest development names, has begun to outperform the FTSE 100 in latest months. That’s usually an indication that buyers are beginning to favour riskier, faster-growing companies once more.

Why development shares struggled

Development shares typically promise sturdy future earnings, however a lot of that worth’s tied up in projections. When rates of interest rise, these future earnings are discounted extra closely, making development shares look much less enticing in comparison with regular, dividend-paying options. That’s a key purpose why tech and client discretionary companies underperformed throughout 2022 and 2023.

However now UK inflation’s dropped to below 3%, and the Financial institution of England’s anticipated to additional minimize charges later this 12 months. If borrowing turns into cheaper, development firms could discover it simpler to lift capital, make investments, and ship on these long-term forecasts.

Indicators of restoration

Latest outcomes from a number of high-growth UK companies have been stable. For instance, the vastly common FTSE 250 firm Video games Workshop (LSE: GAW) reported record-breaking income and revenue in its newest replace, with worldwide enlargement persevering with to drive momentum. Its shares are up over 20% 12 months to this point.

With full management over mental property, product growth and licensing of the more and more common Warhammer franchise, its future appears promising.

Income’s grown steadily, supported by a loyal fan base, new product releases and increasing retail and on-line channels. Latest outcomes confirmed double-digit revenue development, with royalty revenue from media offers including a profitable income stream. Regardless of its area of interest market, worldwide demand continues to rise.

Nonetheless, there are dangers. The shares commerce at a price-to-earnings (P/E) ratio of 30, leaving little room for development. If outcomes fail to impress, it may result in short-term losses. Development’s additionally tied to client spending, which may fluctuate in downturns.

Nonetheless, with a cash-rich steadiness sheet and rising international enchantment, the inventory’s price contemplating for long-term development.

One other FTSE 250 inventory that’s seen renewed development these days is excessive road tech retailer Currys. The inventory’s surged 30% this 12 months after a powerful efficiency led by gross sales of synthetic intelligence (AI)-integrated laptops. Final month, the corporate raised its revenue forecast for the third time this 12 months after its share worth hit a four-year excessive. And with a P/E ratio of solely 7.5, it appears prefer it nonetheless has a lot of room to develop.

Alternative forward

The tide could also be turning for UK development shares. Falling inflation and a attainable shift in financial coverage have created extra beneficial circumstances for long-term capital appreciation. However selectivity stays key.

Whereas the FTSE 100 tends to favour revenue and stability, there are nonetheless loads of thrilling alternatives for development within the FTSE 250 and AIM markets. For buyers prepared to do their homework — and abdomen a bit volatility — now may very well be the best time to reintroduce some development publicity right into a balanced portfolio.