”Are we wealthy; or are we poor ?”……..

This was the query my daughter framed when she was sufficiently old to hunt pocket-money. As a substitute, we selected to maintain cash in a secure spot for ALL bills together with family and my job was to maintain replenishing it.

It was tough to disclaim them a hard and fast quantity with peer-pressure from extra prosperous classmates. When there was a brand new doll in shops, a go to to a wholesale market helped them perceive the price of impulse purchases and buying-convenience. My spouse until date doesn’t know what was my wage at any stage and we spent cash fastidiously all alongside.

The mindset developed helped the household is just not searching for one of the best vehicles, or keep on in my father’s home within the upmarket a part of town.

NOTE : It is a private cash story of Mr. Vijay, an everyday reader of this weblog.

Somewhat bit about my household

My mother and father landed in Delhi from Pakistan after 1947 and my father took up a job in a revered college. Funds had been simply sufficient to satisfy fundamental wants and did properly sufficient in research to have a alternative of engineering schools. Opted for an area one to avoid wasting on bills and on commencement joined a number one Indian engineering firm.

As a gross sales engineer for a product that went to all massive industries, bought a great publicity to the perception of companies and economic system. Working in a extremely diversified firm meant interplay with colleagues serving different industries within the age when monetary newspapers solely reached senior folks.

That was a great grounding for the stage when it’s a must to select between tons of of listed firms and there was solely market grapevine to go by.

Funding in insurance policies and loans I had taken

Other than the life insurance coverage insurance policies taken very early in profession, by no means checked out this avenue for financial savings or funding. This was concerning the time previous MNCs had been pressured to go public and have held on to lots of the purchases made in that period. As soon as the potential appeared seen, branched out to the secondary market to plough financial savings.

Extra usually have gone for non-family firms, however not essentially worldwide MNCs. In all probability essentially the most profitable investments have been in Indian firms that grew to achieve success within the creating international locations.

The one time I took any loans was towards LIC insurance policies within the period when you can simply withdraw a great share of your 12 months’s contribution at low charges, and the cumulative determine simply lowered the maturity quantity. Such had been the quantities which went into fairness and there was by no means even considered taking a mortgage to accumulate belongings.

My first capital buy of Rs.3500 for a Vespa got here out of mortgaging with my father a yearly scholarship for engineering research.

How my spouse construct her personal portfolio

Within the days when folks made uncles & aunties open financial institution accounts to place a most variety of IPO purposes, my spouse’s portfolio began build up. Resisting stress for short-term good points, constructed additional on it by capitalizing gifted funds from the household. When the valuation reached lacs, made her buy the flat we had been residing in to have a gentle rental revenue.

She constructed a portfolio once more after which invested within the put up workplace/financial institution FD’s to get tax-free revenue. As soon as we might see surplus funds, I made a decision to go for forced-savings by opening Recurring Deposit accounts each April. This has been a serious benefit as I’ve future financial savings incomes curiosity at 9 – 9.5 % and maturing to present me tidy sums for holidays internationally and even gifting it for our grandchildren’s schooling.

The following section of my life

When in my fifties, salaried folks turned higher off and I bought the chance to move a small MNC’s Indian operations. There was extra to avoid wasting or we might have raised our lifestyle. We selected to calibrate life at what we might assist after retirement, for which I had an age of 58 in thoughts. And that was precisely once I left my final 9 to five job to work on quick tasks and supported NGOs from my financial savings.

In stock-selection, now we have taken the route the place long run economic system is necessary, not the market. Taking part in opposite to “100 minus your age in Fairness ” has assumed that investments are for the household, not particular person. Accordingly, self and spouse have Demat accounts with a partner as 2nd and one daughter every as third holder.

At 72, I ought to nonetheless be capable of handle issues for one more 10 years however this is able to enable us to move on the investments to them by a change within the order of names. It may be at a stage once we wish to go into the following stage of retirement, or earlier if any of them want over Rs. 4 Crore every of their accounts.

My portfolio churn is proscribed to beneath 5% over a 12 months; extra usually when FDs are maturing and fairness could also be doing higher. I prune a holding which has achieved properly and its weightage in whole could be introduced down.

Figuring out a BUY candidate for a ‘change ‘ transaction, would monitor the motion of the 2 shares, disregarding index actions, and select the time to modify. Most such transactions have occurred when good firms have dissatisfied for some transient purpose.

If I might return into time, just like the characters of science fiction films, would I do issues any in another way?

On the micro-level, I might have picked up an extra 50 M&M shares at Rs.27 within the Nineteen Seventies. I had requested for 50 however the dealer picked 100 by mistake, and I had no funds to spare.

That Rs.1350 would have been value about Rs.8 Lacs immediately. On the macro stage, I really feel that my occupation as a undertaking supervisor has made me suppose forward of main selections. As soon as having achieved that, second ideas have restricted area.

I wished to share another factor. After I obtained almost Rs 5 Cr from the sale of household property, allotted all of it to my daughters. For one, a bought a flat whereas the second bought it in money. Since I’ve sufficient to stay on , felt that it needs to be invested by them to go well with their wants

And what extra I want to do?

Too many people are too busy on the top of a profession to develop pursuits that can maintain them usefully occupied within the latter half of their retired life. Going to the financial institution or put up workplace is now not an possibility and you can’t journey on a regular basis.

So folks of their late fifties have to be helped by their employers to find the traits that can maintain them from coming in the way in which of their housemaids. I might be pleased to be a part of such an initiative.

There may be the acute failure of economic planning amongst folks within the fifties and would like to be a part of teams analyzing the fundamentals of inflation and the impact of longer life-spans on financial savings.

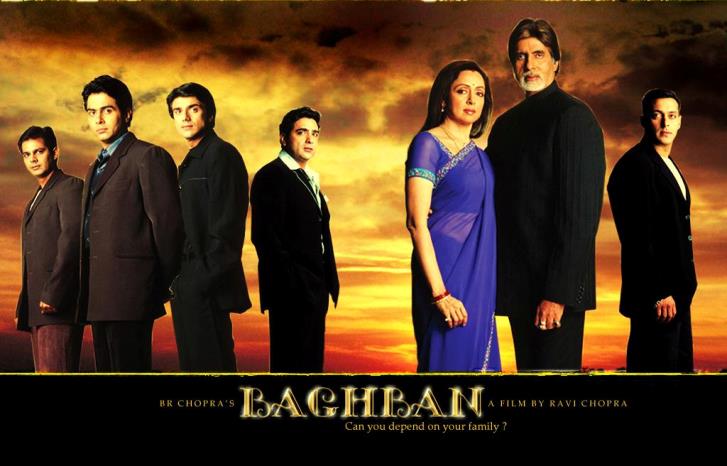

The peak of it’s the Bollywood blockbuster of 2003 (Baghban) exhibiting a retired financial institution supervisor splitting from his spouse as that they had no roof over their heads after serving to youngsters with their financial savings.

–

Tell us when you have any ideas developing after studying this cash story?