Numerous individuals in India wish to purchase land, particularly traders from massive cities as land is a scarce commodity and it sounds wonderful to construct your personal home on a bit of land as a substitute of staying in flats.

Nonetheless, do keep in mind that there aren’t any particular loans available for purchase agricultural land. The one loans available for purchase the plot are for “residential plots”, which signifies that in case you take these “plot loans”, you must additionally assemble a home inside 2-3 yrs of shopping for the plot. You may’t simply purchase a residential plot and skip constructing the home.

Nonetheless, many individuals do this. Some deliberately and a few out of ignorance.

- What precisely occurs once you dont construct the home on a plot taking over a mortgage?

- Is there a penalty?

- Can there be any actions towards you?

What occurs in case you dont construct the home on the plot?

Whenever you take a plot mortgage, it comes at a decrease rate of interest as a result of the belief is that you can be constructing the home on that land inside 2-3 yrs. However in case you fail to do this and dont submit the required paperwork (completion certificates) to the lender on time, your mortgage will probably be transformed to a standard mortgage and the rates of interest will probably be elevated by 2-3% with a retrospective beginning date as per the settlement between you and the lender.

Because of this your mortgage excellent quantity will go up by some quantity as a result of this transformation and you’ll have to now pay that extra quantity. On the finish of three yrs, the financial institution will ask you for the proofs of development, and in case you fail to submit them, you’ll have to pay an extra quantity.

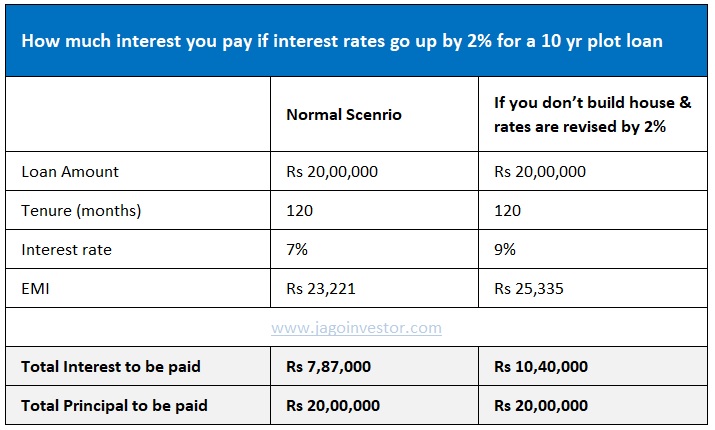

Right here is an instance of a Rs 20 lacs plot mortgage which is taken for 10 yrs @7% rate of interest. The curiosity to be paid on this case will probably be 7.87 lacs other than the 20 lacs principal quantity.

Now if the rates of interest are revised to 9% (2% improve) the curiosity, on this case, will improve to 10.4 lacs, which is 2.53 lacs greater than the unique quantity.

Is there a single mortgage for plot and home price?

Some banks like SBI (as instructed to me by a consultant) first problem a plot mortgage after which after 2-3 yrs problem one other house mortgage for the aim of developing the home (two separate mortgage account numbers), whereas some banks might problem a single mortgage itself for each functions and it is going to be talked about within the settlement (for instance 40% quantity is for plot and 60% for home development).

Word that you could avail of 80C advantages as these loans are issued as house loans (the a part of the mortgage which will probably be used for home development).

Mistaken data was given by the financial institution representatives

Many instances chances are you’ll get unsuitable and deceptive data from the financial institution consultant. They could inform you that “Nothing will occur after 3 yrs, dont fear” or “These are all simply formalities..” primarily as a result of he’s fascinated by getting the mortgage accredited as a result of their targets. That is unsuitable and makes certain you dont imagine them. At all times depend on what’s written within the settlement.

Word that the loans are given at a less expensive charge for plots as a result of there’s a greater agenda of RBI and govt that everybody shall entry to housing. In case you are shopping for the residential plot just because you may promote it off in future for income you then cant get the good thing about the decrease rates of interest.

For you, the rates of interest will probably be revised as a result of you’ll have to assemble a home on the plot after 2-3 yrs as per guidelines.

Some options of plot mortgage

- The age requirement is between 18-70 yrs.

- A CIBIL Rating of 650 or above is required (typically)

- As much as 60% to 70% of the property value is given as a mortgage relying on the financial institution.

- These loans are given for a most of 15 yrs tenure

Factors to recollect earlier than going for the plot mortgage

Ensure you take these plot loans solely in case you’re actually fascinated by constructing the home. You can too ask the financial institution to first disburse solely the mortgage quantity for the plot and later launch extra quantity on the time of home development. It’s actually not price taking part in round with financial institution and taking part in tips as it’s going to principally waste your time and also you gained’t acquire a lot in case you dont wish to construct the home.

Listed below are some extra essential factors which have been shared by our reader Jayaprakash Reddy

- Usually, banks calculate plot worth based mostly on the sale deed worth, many of the circumstances sale deed worth is lesser than the market worth. Additionally, as talked about above, banks like SBI will solely contemplate sale deed worth however some non-public banks may additionally have a look at market worth in that space and which will probably be derived by way of their licensed valuers. SBI will give a mortgage on plot buy (Home development in future is meant) as much as 60% of the sale deed worth and it’s the identical with even non-public banks however that will probably be on market worth.

- There isn’t a readability even with bankers about what occurs in case you promote the plot inside a yr or two with out development, many of the representatives instructed me that it is going to be like closing a house mortgage however I assume that’s a false assertion and is dependent upon the financial institution and settlement if talked about particularly in it.

- The entire mortgage once more is dependent upon the development worth in that space. For instance within the space the place you’re buying a plot, the development price may very well be 1500/sqft. Then based mostly on the sqft you’re planning to assemble the entire mortgage quantity will probably be derived. Let me put it in numbers:

Plot Space: 300 sq yards. – SBI financial institution mortgage – Sale deed worth is 10000/sqyd – 30 lacs. For plot buy – 60% of 30lacs will probably be given to you as a mortgage. 18lacs mortgage will probably be offered by the financial institution, that is given as cheque cost on to the vendor. For the development of the home, they’ll present it based mostly on the sqft permission you bought. For instance, in a 300sqyrd plot in case you are developing G+2, you then would possibly get permission to construct ~3000sft (not an actual quantity). So the development worth of the home will probably be 3000*1500 = 45lacs, out of this financial institution offers you as much as 80% mortgage, which once more is dependent upon your credit standing.

In whole, you will get a 63 lacs (18+45) mortgage, offered you’re eligible for such a mortgage based mostly in your earnings. - To forestall malpractices, within the case of a house mortgage, the financial institution retains the sale deed of the plot. With paperwork not out there, one can’t legally promote the plot. There is usually a phrase of mouth settlement whereby the client may give cash to the vendor to launch the mortgage and paperwork after which buy.

Additionally, here’s a guidelines earlier than shopping for a plot in India in case you’re planning to purchase one!

Do tell us in case you have any questions