Picture supply: Getty Pictures

Money ISAs had slipped out of the headlines just lately. However they’ve bounced again into the highlight this week, amid information that adjustments to annual allowances are simply across the nook.

On Monday (30 June), hypothesis that the £20,000 yearly restrict shall be sliced again gained momentum. On that day, authorities officers mentioned a shake-up might come later in July.

Chancellor of the Exchequer Rachel Reeves will announce adjustments at her upcoming Mansion Home speech on 15 July, these sources informed the Monetary Occasions.

A rebasing within the allowance to round £5,000 a yr is broadly tipped, although sources mentioned a last determine hasn’t but been settled upon.

Good thought?

Personally, I don’t just like the ‘stick’ method the Chancellor is taking to scale back Brits’ reliance on financial savings accounts. I feel the ‘carrot’ is a greater strategy to encourage individuals to take a position, by higher incentives (just like the elimination of Stamp Obligation on most UK shares) and wider monetary training.

Nonetheless, the rationale to make individuals suppose extra about investing is sound. Like Reeves, I imagine financial savings accounts just like the Money ISA serve an essential position in portfolio diversification, and as a strategy to maintain momentary money.

However prioritising money financial savings as a part of a retirement plan may be disastrous. During the last decade, the typical Money ISA investor has reported a mean annual return of 1.21%, in line with Moneyfacts.

That’s far beneath the 9.64% that Shares and Shares ISA customers have usually loved.

Primarily based on these figures, somebody investing £300 a month in a Money ISA would have £130,127 after 30 years (excluding buying and selling charges). In the event that they’d put that in an investing ISA as a substitute, they might have turned that into £628,215.

Speaking trusts

The principle downside right here appears to be misconceptions across the hazard to people’ capital. Individuals fearing ISA adjustments may not need to be frogmarched into taking over unacceptable ranges of threat.

The excellent news is that we don’t must, given the vary of investments on supply with a Shares and Shares ISA.

People can diversify throughout lots of of investments to unfold threat throughout areas and sectors in the event that they need to. They will additionally obtain publicity to completely different asset courses like gold, money, and bonds in addition to equities.

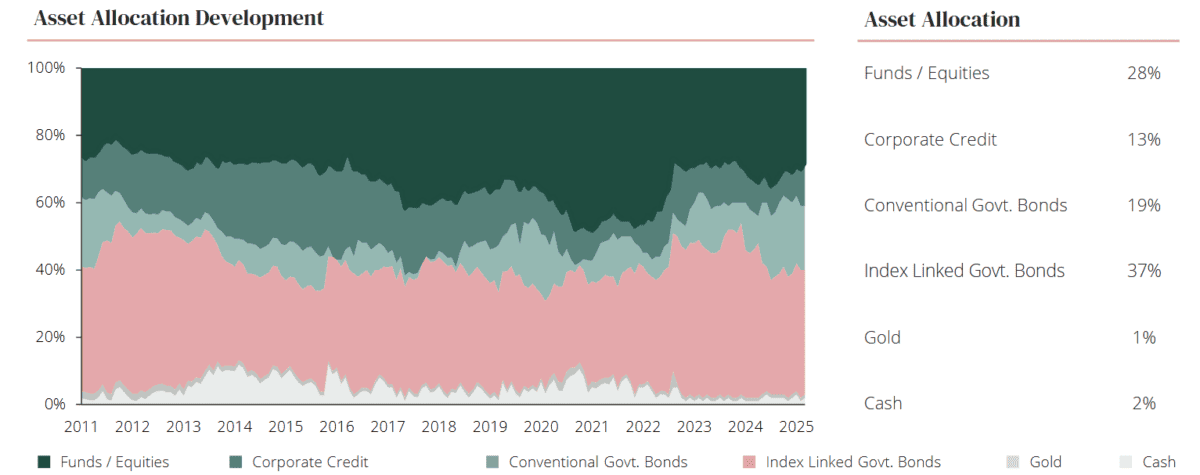

Funding trusts just like the Capital Gearing Belief (LSE:CGT) are arrange for this goal. With a mission assertion “to protect and over time develop shareholders’ actual wealth“, it invests in equities, bonds, commodities, and money. And it doesn’t entertain dangerous methods like utilizing gearing (borrowed funds) or brief promoting to realize it.

At the moment, the belief has 190 completely different holdings. These embody higher-risk shares and equity-based funds. However as you’ll be able to see, lower than 30% of its capital is tied up in such belongings. The lion’s share is in company and authorities bonds, with some gold and money added in for additional diversification.

Since 2015, Capital Gearing Belief has delivered a mean annual return of 4.6%. That’s beneath the typical returns that Shares and Shares ISA buyers have loved. However it nonetheless sails above the 1.21% {that a} Money ISA would have supplied.

This is only one of many trusts and exchange-traded funds (ETFs) Brits can purchase to focus on robust returns while nonetheless limiting threat. It’s why I don’t suppose money savers must concern upcoming adjustments to the ISA regime.