Picture supply: Getty Photographs

It’s uncommon to discover a UK inventory that has excellent potential for each development and dividend traders. And it’s virtually unattainable to search out it buying and selling at a cut price value.

Tristel (LSE:TSTL) nonetheless, may be such a inventory. It’s at a 52-week low, however the enterprise is rising properly and the corporate simply elevated its dividend by 8% – with extra to come back.

What’s Tristel?

Tristel’s a inventory that traders in all probability aren’t paying a lot consideration to. However I believe they may very well be lacking out in the event that they don’t at the least take a more in-depth look.

The corporate makes disinfectant merchandise for medical tools. And what units it aside is its use of chlorine dioxide – somewhat than chlorine – in its merchandise.

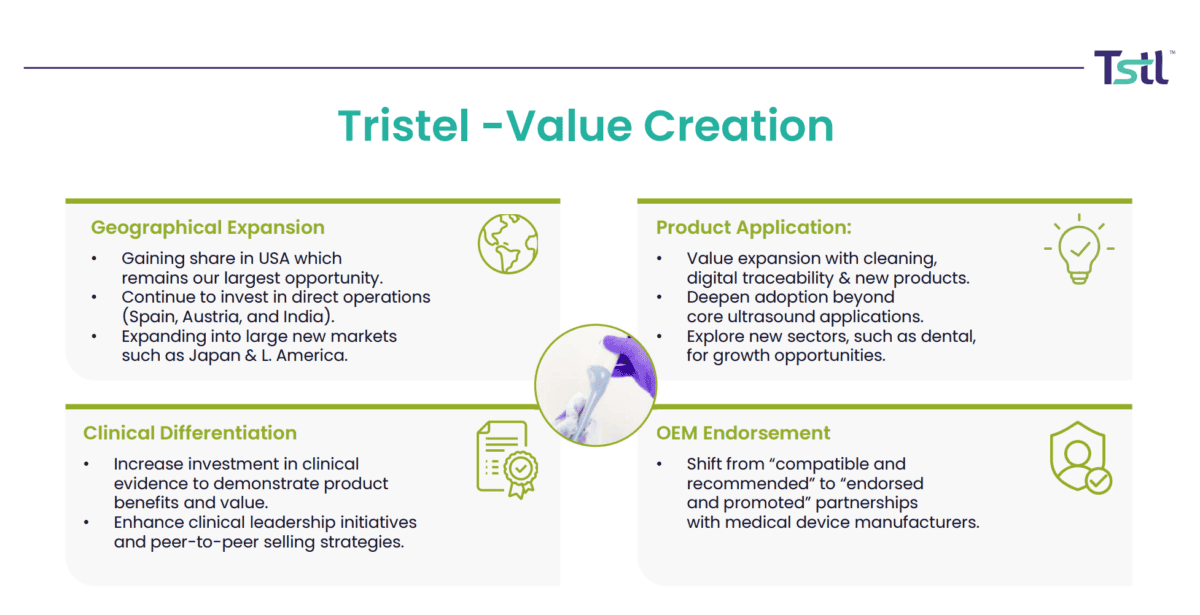

Supply: Tristel Investor Presentation February 2025

Chlorine dioxide (CIO2) has just a few benefits over chlorine (CI2). Microorganisms can’t construct resistance to CIO2, it’s extra environment friendly than CI2, and it doesn’t produce dangerous by-products.

In brief, Tristel’s merchandise are each efficient and require a variety of technical data. And I believe this may very well be a robust mixture going ahead.

Outlook

Tristel’s been profitable within the UK disinfection market. However the massive alternative is it’s making an attempt to make progress with is the US, which may very well be enormous for a enterprise at present valued at £165m. This nonetheless, isn’t simple.

The corporate’s options are costly and convincing hospitals to vary from trusted suppliers providing cheaper merchandise may be troublesome. Regardless of this, Tristel’s made progress. Its disinfectant for ultrasound probes has been given regulatory approval and the agency has issued a submitting for its ophthalmic gadgets therapy.

It’s value noting that, whereas the US is a big potential market, it’s not the one development avenue. The corporate has additionally recognized Spain, India, and Austria as potential alternatives for 2025.

Dividends

With a number of worldwide growth prospects in progress, it’s pure to assume Tristel isn’t more likely to be returning money to shareholders any time quickly. However that will be an enormous mistake. The corporate at present distributes just below 14p per share in dividends – a yield of 4% at at present’s costs. And it’s dedicated to growing this by 5% a yr going ahead.

Given the uncertainty round its worldwide growth, which may appear considerably cavalier. If its plans go as hoped, Tristel must make investments money to assist its development.

The corporate nonetheless, has no debt and the money on its stability sheet‘s rising. And its newest 8% improve in its interim dividend is in step with the expansion from the underlying enterprise.

Dangers and rewards

Over the past 5 years, Tristel’s share value has been in every single place as pandemic-driven demand gave solution to unusually excessive stock ranges. However that volatility ought to be previously.

With the inventory at a 52-week low, I believe traders ought to think about it. Enlargement into the US brings a variety of uncertainty, however the share value affords good worth for the dangers concerned.

If issues go properly, a £10,000 funding in Tristel at present may be producing important passive earnings 10 years from now. And the inventory may very well be value much more as properly.