Picture supply: Getty Photographs

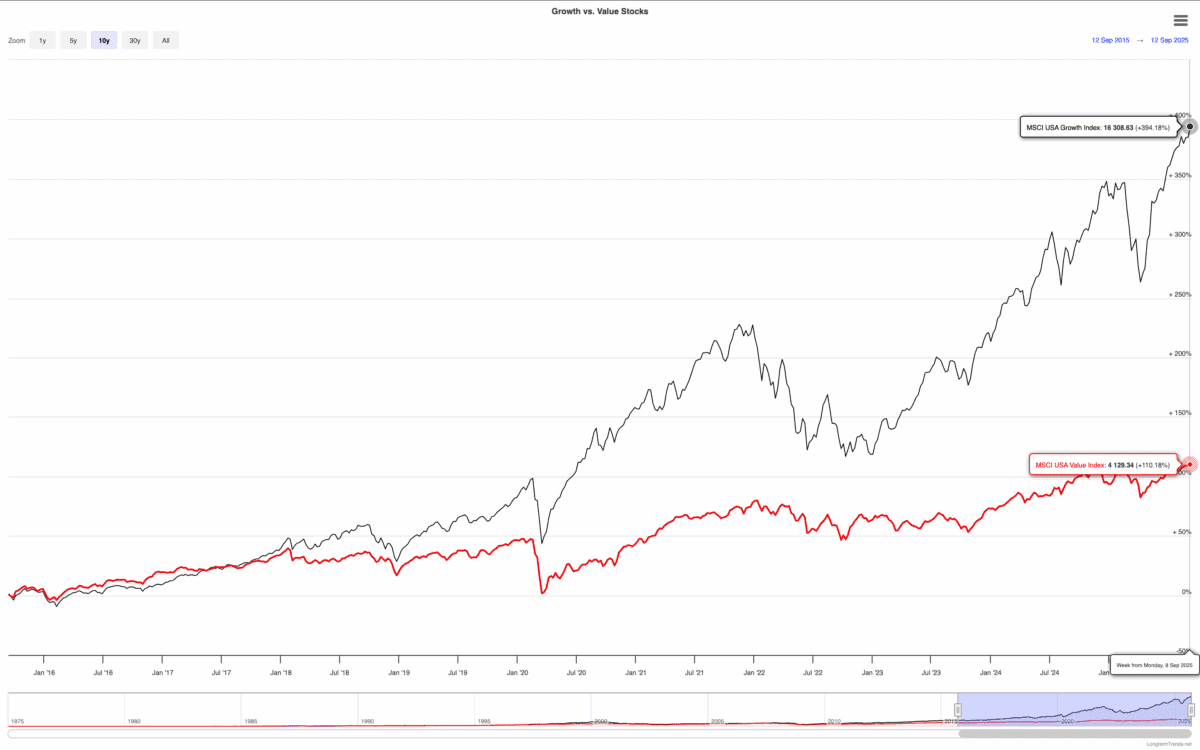

Over the past 10 years, progress shares have outperformed worth shares by some margin – particularly within the US. The MSCI USA Progress index is up 394%, whereas the MSCI USA Worth Index has climbed 110%.

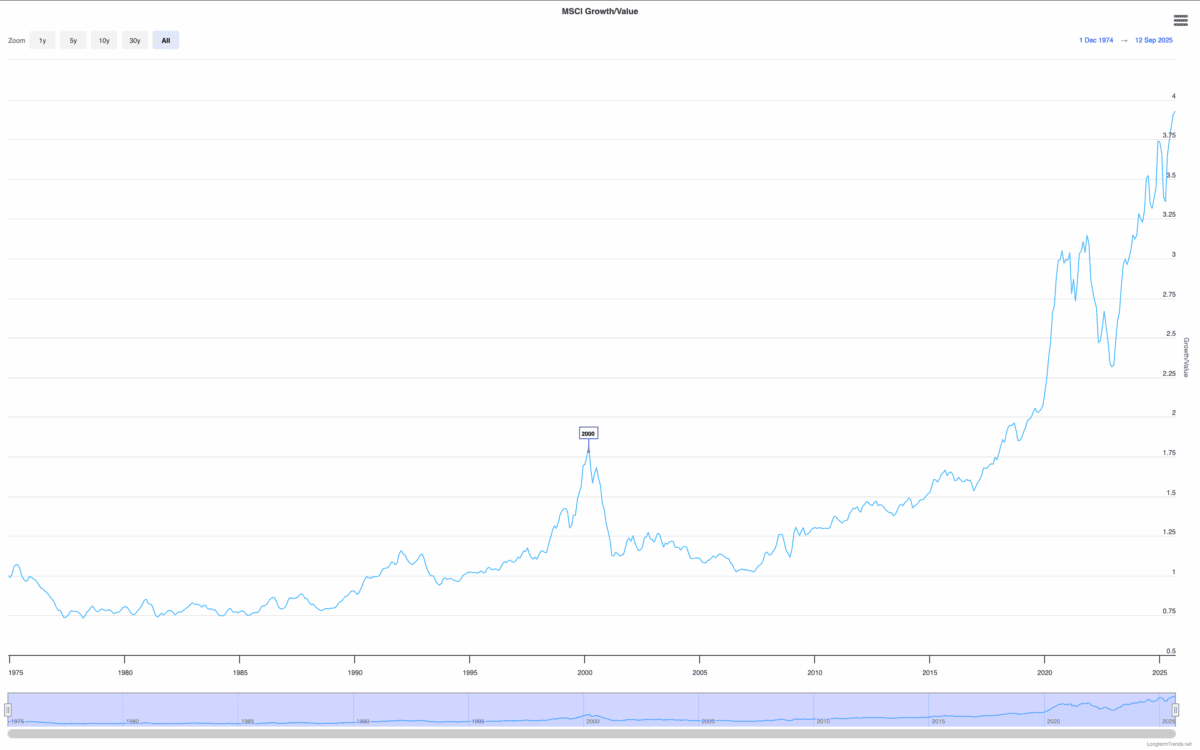

Proper now, the hole between progress and worth shares is traditionally vast. However is that this an indication of issues to come back, or an indication that worth shares are about to bounce again in a giant method?

Warren Buffett

In line with Warren Buffett, the distinction between progress and worth investments doesn’t make a lot sense. However it is a uncommon event (I can solely consider one different) the place I don’t agree.

Buffett’s level is that each one investing is about making an attempt to purchase shares for lower than they’re value. And determining the worth of a inventory entails taking a view in regards to the firm’s future progress.

I agree with all of this, however I don’t assume it means there’s no distinction between progress and worth. In my very own portfolio, I’ve shares that I personal for various causes.

I personal some shares as a result of I anticipate future money flows to be greater – these are progress shares. In others, it’s as a result of the share worth doesn’t mirror present earnings – these are worth shares.

Time for a correction?

In the intervening time, the hole between progress shares and worth shares may properly be the most important it has ever been. And when this has been the case prior to now, issues have usually corrected sharply.

I don’t assume, although, that this implies worth shares are set to catch up. Traditionally, the distinction narrowing has been the outcomes of issues which have brought on crashes within the inventory market usually.

The distinction in valuation may be unjustified (or it may not). However there’s no rule that claims that simply because it’s expanded it has to contract within the close to future.

I do assume, although, that the unusually vast discrepancy in valuations means it’s an attention-grabbing time to be worth shares. And some look attention-grabbing at right now’s costs.

A inventory to contemplate

Polaris (NYSE:PII) is one instance. Shares within the leisure automobile firm are down round 30% during the last yr because the agency has needed to take care of a numerous challenges – most notably, tariffs.

This has had an impact on each revenues (which have fallen) and web earnings (which has turned unfavourable). And the prospect of inflation within the US resulting in greater rates of interest is an ongoing danger.

I believe, nevertheless, that issues aren’t as unhealthy as they give the impression of being. The web earnings loss was as a consequence of non-cash impairment expenses, which may’t be ignored totally however ought to be one-off in nature.

The corporate’s robust manufacturers and intensive seller community ought to put it in a robust place when demand recovers. And with an unusually excessive 4.5% dividend yield, I believe it’s value contemplating.

Progress and worth

As progress shares have outperformed worth shares, the hole between the 2 has reached its widest stage in historical past. And the relative low cost is an indication the latter are out of vogue.

This doesn’t have to alter within the close to future, however long-term traders ought to take observe. Whereas not all worth shares are the identical, I believe Polaris is a top quality identify that’s value trying out.