Avanse Monetary Companies IPO Particulars 2025

Avanse Monetary Companies Restricted, a rising pressure in India’s schooling financing sector, is getting ready to go public with a ₹3,500 crore IPO. The supply consists of a ₹1,000 crore contemporary situation and ₹2,500 crore offer-for-sale by current shareholders like Olive Vine Funding Ltd, IFC, and Kedaara Capital. As India’s second-largest non-banking monetary firm (NBFC) within the schooling mortgage area, Avanse instructions a big presence within the high-growth abroad schooling financing market.

This text analyzes the corporate’s monetary monitor report, progress technique, threat profile, and aggressive positioning that will help you make an knowledgeable determination about investing within the Avanse Monetary Companies Companies IPO.

Avanse Monetary Companies IPO Evaluation

Monetary Efficiency (FY2020–FY2024)

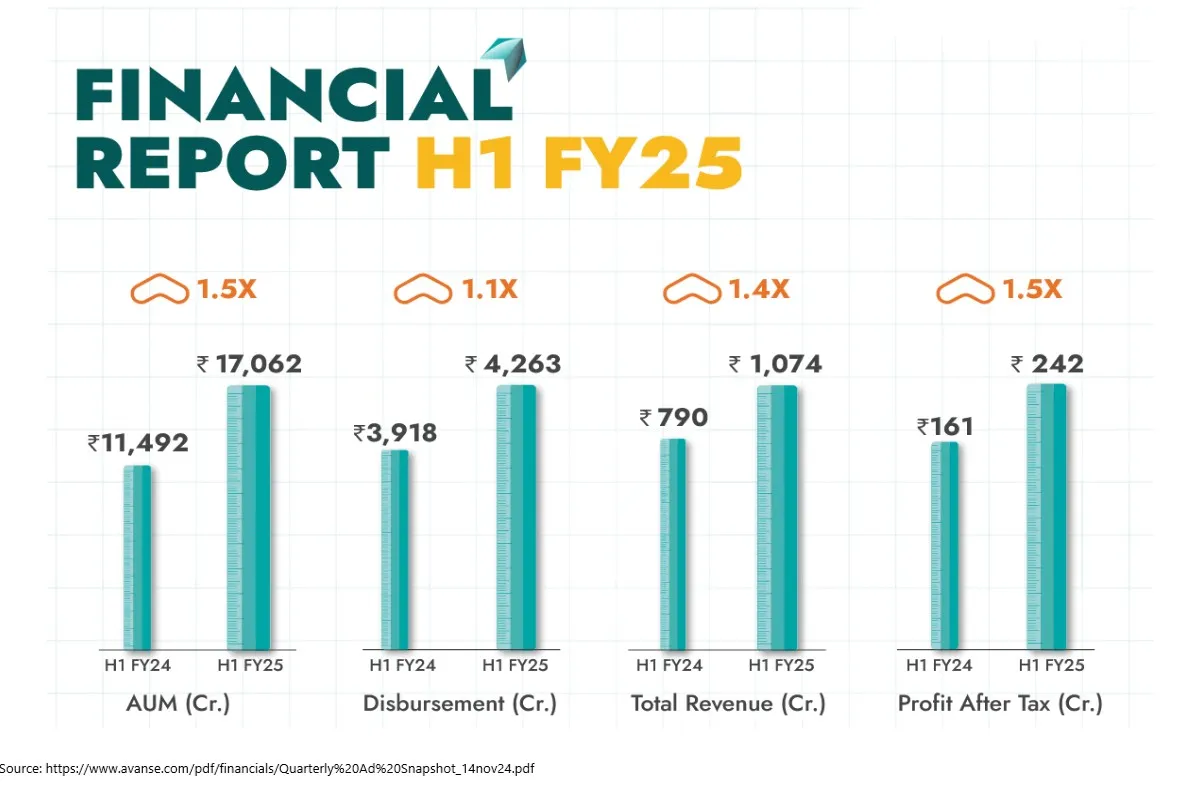

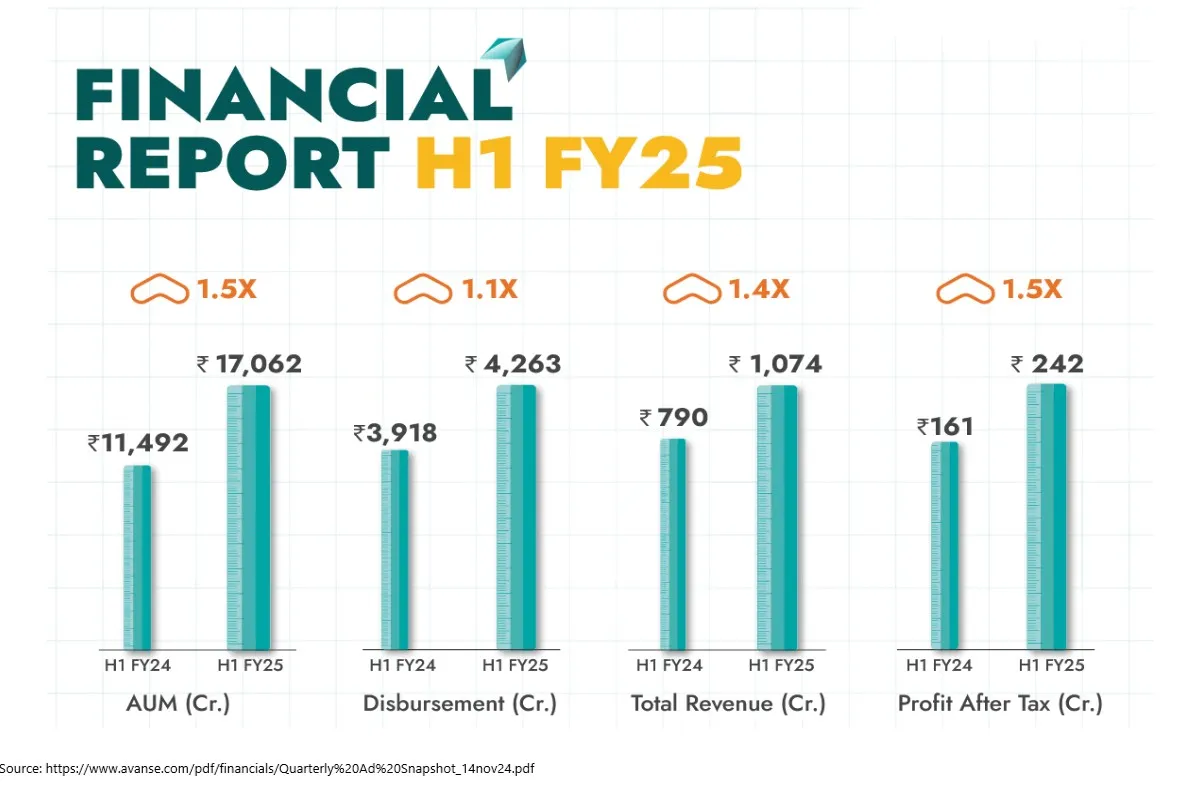

Over the previous 5 years, Avanse has demonstrated constant progress throughout core metrics:

- Property Below Administration (AUM): Grew from ₹2,993 crore in FY20 to ₹ ₹13,303 crore in FY24 — over 4.5x enhance.

- Disbursements: Elevated from ₹1,060 crore in FY20 to ₹6,335 crore in FY24.

- Income (Complete Earnings): Jumped from ₹ 508.8 crore in FY22 to ₹ 1,728.8crore in FY24, a CAGR of ~39%.

- Web Revenue: Rose from ₹63.2 crore in FY22 to ₹ 342.4 crore in FY24.

The majority of AUM is in pupil loans for worldwide schooling, which comprised 78% of the guide by FY24. These loans are sometimes unsecured, longer-tenured, and contain a moratorium — making underwriting high quality and borrower outcomes important.

Key Monetary Ratios and Trade Comparability

- Gross Stage 3 (GS3) loans: Diminished from 1.29% in FY22 to simply 0.43% in FY24.

- Web Stage 3 (NS3) loans: Right down to 0.13% in FY24.

- Return on Property (ROA): Rose to 2.8% in FY24.

- Return on Fairness (ROE): Improved to 11.75%.

| FY 2022 | FY 2023 | FY 2024 | |

| Income | 508.8 | 989.6 | 1,728.8 |

| Bills | 423.08 | 778.91 | 1,269.51 |

| Web Revenue | 63.21 | 157.71 | 342.4 |

| Margin (%) | 12.44 | 15.94 | 19.83 |

| Mortgage Guide | 4,790.00 | 8,463.64 | 12,520.86 |

| GNPA (%) | 1.7 | 1.4 | 1.2 |

| Web Value | 1,009.66 | 2,149.72 | 3,676.72 |

In comparison with different monetary providers friends:

- Bajaj Finance: ROE ~24%, GNPA < 1.2%

- HDFC Credila (now merging into HDFC Financial institution): ROE ~13–14%, related GNPA

- Muthoot Finance: ROE ~20%, however centered on secured lending

Avanse monetary providers restricted’s ROE of 11.75% is spectacular for an NBFC centered on unsecured, long-tenure schooling loans. It’s capital adequacy and asset high quality are considerably stronger than most non-prime lenders.

Earnings Per Share (EPS)

Avanse monetary providers restricted’s EPS over the previous few years (approximate figures):

- FY22: ~₹8.8 per share

- FY23: ~₹12.5 per share

- FY24: ~₹14.4 per share

This constant upward pattern displays working effectivity, rising guide, and management prices. With the Avanse Monetary Companies IPO set to usher in ₹1,000 crore in contemporary fairness, EPS might briefly dilute, however the capital will doubtless gas AUM progress and additional ROE enlargement, serving to maintain EPS trajectory over time.

Information Supply for Avanse monetary providers Restricted Newest replace

Information Middle Associated Articles

Avanse Monetary Companies IPO Particulars

| Avanse Monetary Companies IPO date | |

| Itemizing Date | |

| Face Worth | |

| Situation Worth Band | |

| Lot Measurement | |

| Avanse Monetary Companies IPO Measurement | |

| Recent Situation | |

| Provide for Sale | |

| IPO Open Date | |

| IPO Shut Date | |

| Tentative Allotment | |

| Initiation of Refunds | |

| Credit score of Shares to Demat | |

| Tentative Itemizing Date |

Use of Avanse Monetary Companies IPO Proceeds and Strategic Alignment

In keeping with the DRHP, the ₹1,000 crore contemporary situation might be used for:

- Augmenting capital base for lending (main objective)

- Enhancing capital adequacy for regulatory compliance

- Common company functions

This immediately aligns with Avanse’s progress technique:

- Develop lending to high-potential abroad college students.

- Deepen attain into schooling infrastructure loans.

- Proceed scaling by means of department and partnership fashions.

Given their low NPA monitor report and growing demand for worldwide schooling loans, this capital infusion positions Avanse monetary providers restricted to scale sustainably.

Avanse Monetary Companies IPO Evaluation Key Dangers

Operational Dangers

- Heavy focus in unsecured, long-tenure loans with moratoriums.

- Low portfolio seasoning (newer loans are but to see full compensation cycles).

Regulatory Dangers

- NBFCs are topic to RBI rules which will evolve.

- Any opposed transfer on rate of interest caps, provisioning norms, or capital necessities might impression operations.

Aggressive Dangers

- Banks like SBI and ICICI and NBFCs like InCred and Prodigy Finance compete in the identical area.

- Fintech-led disbursement fashions might erode market share.

Geopolitical Dangers

- 91% of the worldwide schooling mortgage guide is uncovered to the US, UK, and Canada — any visa, coverage, or employment disruptions in these nations can have an effect on compensation.

Moreover:

- Foreign money Publicity: Whereas loans are in INR, college students repay primarily based on earnings in overseas foreign money. A sudden devaluation of INR might stress compensation capability if jobs overseas are delayed or denied.

- AI & EdTech Disruption: A shift towards distant, shorter-duration on-line programs might change the mortgage profile and cut back common ticket sizes.

- Over-concentration on the Worldwide Market: Although worthwhile, an over-reliance on international schooling tendencies (that are prone to coverage and macro shocks) reduces diversification.

Trade Overview: India’s Booming Training Mortgage Market

India’s schooling financing panorama is present process a profound transformation. Fueled by rising aspirations for international schooling and supported by NBFCs like Avanse, the schooling mortgage section is poised for accelerated progress. This transformation is ready towards the backdrop of one of many fastest-growing economies on this planet, with India’s GDP projected to develop at 6.8% in FY2025, outpacing international friends.

Training Mortgage Market Measurement and Development

The Indian schooling mortgage market is increasing quickly, pushed by robust demand for larger schooling — notably abroad. As of FY2024:

- Training loans excellent stood at ₹1.07 lakh crore.

- Non-Banking Monetary Firms (NBFCs) are enjoying a rising position, with a CAGR of 34% of their mortgage guide over the past 5 years.

- The abroad schooling mortgage section alone is anticipated to develop 2.5x by FY2031, reaching roughly ₹1.6 lakh crore from ₹65,000 crore in FY2024.

NBFCs like Avanse, which focus on unsecured loans for abroad schooling, are uniquely positioned on this fast-expanding area of interest, providing differentiated threat underwriting fashions primarily based on future employability, course outcomes, and college profiles.

Avanse monetary providers restricted has constructed a database of over 3,000 universities and programs globally, enhancing underwriting precision. This sector-specific experience has allowed NBFCs to seize a 35%+ share within the abroad schooling loans section — a pattern anticipated to strengthen.

Regulatory and Market Tailwinds

A number of macro and coverage tendencies are supporting the sector:

- The Authorities’s Nationwide Training Coverage 2020 emphasizes gross enrollment enlargement and talent improvement.

- RBI’s give attention to digital lending has improved entry and compliance.

- Rising family incomes and middle-class progress are broadening the client base.

- Growing acceptance of co-lending fashions and capital markets entry for NBFCs enhances scalability.

Challenges within the Sector

Regardless of the optimistic outlook, the schooling mortgage section faces some structural dangers:

- The unsecured nature of loans will increase default potential, notably in financial downturns.

- Restricted portfolio seasoning, particularly in newer disbursements, leaves credit score high quality untested over longer cycles.

- Geopolitical threat tied to visa coverage adjustments and worldwide relations.

Ultimate Phrases on Avanse Monetary Companies IPO

Strengths

- Quick-growing, high-ROE enterprise in a distinct segment however increasing section.

- Glorious asset high quality metrics and credit score underwriting requirements.

- Aligned progress technique with capital-efficient enlargement mannequin.

- Backed by credible buyers: Warburg Pincus, IFC, Kedaara, and Mubadala.

Dangers

- Geopolitical publicity within the mortgage guide.

- Longer-term NPA tendencies are untested for current disbursements.

- New capital might barely dilute EPS within the quick time period.

If the Avanse monetary providers IPO is priced inside a P/B of ~2.5x or P/E of ~20–22x, this can be a robust long-term alternative. It presents entry to a well-managed, high-growth NBFC in an under-penetrated, education-focused credit score market — a uncommon discover.

Avanse Monetary Companies Head Workplace

Company and Registered Workplace Tackle

Avanse Monetary Companies Restricted

4th Ground, E Wing, Instances Sq.,

Andheri – Kurla Rd, Gamdevi,

Marol, Andheri East,

Mumbai, Maharashtra 400059

Administrative Workplace

Avanse Monetary Companies Ltd.

fifth Ground, Unit Half C, VKG Company Centre,

Marol Pipeline Rd, Ajit Nagar,

J B Nagar, Andheri- East

Mumbai 400059, Maharashtra