Picture supply: Getty Photos.

Cathie Wooden’s ARK Innovation ETF (NYSEMKT:ARKK) rose to prominence throughout the pandemic bull market of 2020 to 2021. On the time, disruptive development shares have been on hearth and this exchange-traded fund (ETF) benefitted in a giant manner, delivering enormous returns for buyers. Can I purchase the product for my Shares and Shares ISA or SIPP right this moment? Let’s have a look.

The UK model of ARK

There’s a model of this ETF that’s accessible to UK buyers right this moment. Launched on the London Inventory Alternate (LSE) in April final yr, it’s known as the ARK Innovation UCITS ETF (LSE: ARCK) and it’s accessible on my funding platform, Hargreaves Lansdown, and some different platforms.

Like the unique US-listed product, the ETF seeks to put money into firms concerned in ‘disruptive innovation’ (outlined as firms introducing technologically-enabled new services or products that probably change the way in which the world works). Areas of focus embody synthetic intelligence (AI), robotics, power storage, multiomic sequencing, and public blockchains.

For the UK-listed ETF, bills are 0.75% a yr (comparatively excessive for an ETF). Buyers may have to pay buying and selling charges and platform costs.

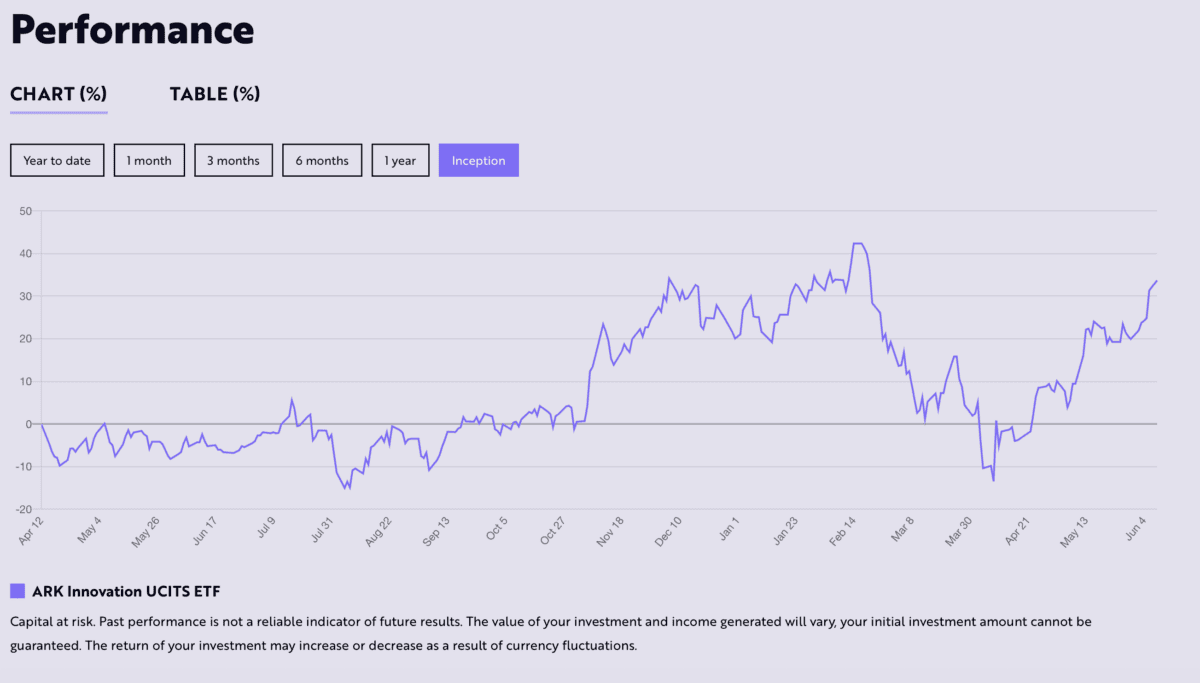

When it comes to efficiency, it has been sturdy since launch. Within the 14 months or in order that the ETF has been listed on the LSE, its worth has elevated about 30%.

Ought to I make investments?

So, the ETF is out there to UK buyers like myself. The query is – ought to I make investments?

I do just like the idea of an innovation ETF. As we speak, the world is experiencing an unbelievable know-how revolution and I wish to be capitalising on it.

With this ETF, I probably can. I like the truth that it gives publicity to themes reminiscent of AI, robotics, and fintech – these are all industries with enormous development potential.

Wanting on the holdings, nevertheless, the ETF appears to be like fairly dangerous to me. Presently, Tesla is about 9% of the portfolio. I’m not so eager on that inventory (I feel it’s manner overvalued at present costs). Different high holdings embody Roblox, Roku, and Palantir – three shares I see as excessive threat and fairly speculative.

One different factor that issues me a little bit is long-term efficiency. Over the past 5 years, the US-listed model of the ARK Innovation ETF has fallen about 9%. That compares to a achieve of over 20% for the UK-listed Scottish Mortgage Funding Belief, which has an identical focus (and a decrease ongoing charge).

I’ll level out that I have already got a decent-sized place in Scottish Mortgage in my portfolio. So, shopping for the ARK Innovation ETF as effectively would imply doubling up on my publicity to higher-risk disruptive development shares.

My ideas on ARK

Given the present holdings and underwhelming five-year efficiency, I’m going to maintain the ARK Innovation ETF on my watchlist for now. I’ll add it to my portfolio throughout the longer term however within the close to time period, I’m going to stay with Scottish Mortgage as my play on disruptive development shares.