Meet Rahul: 35 years previous, ₹1.2 lakh month-to-month wage, ₹3 lakh in bank card debt, ₹16 lakh private mortgage, and nil belongings. From the skin, he’s the image of middle-class success – good condo, newest smartphone, weekend brunches. However peel again the Instagram filter, and also you’ll discover a monetary time bomb ticking. I’m positive in the event you’re trustworthy with your self, possibly part of Rahul’s story sounds acquainted to you or somebody you already know personally.

This isn’t an exception – it’s the harmful norm for hundreds of thousands of city Indians at present. The scariest half? They don’t even notice they’re drowning.

Most individuals blame exterior components—low earnings, unhealthy luck, or household pressures—for not constructing wealth. However extra usually, the actual motive is silent and harmful: an informal, detached angle towards cash.

I name it the Casualness Lure.

It took me almost ten years to comprehend this after working with hundreds of shoppers and a whole lot of our workshop contributors

People who find themselves informal about their funds often present the identical angle in different areas of life. They usually run late, make guarantees they don’t preserve, and carry a sure “chalta hai” mindset—the idea that issues will one way or the other kind themselves out.

How Delaying Choices Can Derail Your Wealth

This isn’t about folks being reckless or deliberately careless. It’s in regards to the small methods we let essential issues slide, the best way we keep away from trying on the uncomfortable truths, and the way we push massive choices to the longer term as a result of they really feel overwhelming at present.

In relation to cash, this casualness reveals up in phrases we’ve all heard—and even mentioned ourselves.

- “I’ll begin saving as soon as my wage goes up.”

- “I don’t want to trace my spending; I’ve a tough thought.”

- “I’m nonetheless younger; I’ll take into consideration investing later.”

- “Life is for dwelling—I’ll take pleasure in now and determine issues out down the highway.”

These don’t sound like monetary sins. They sound…regular. Relatable. Even innocent.

However that’s precisely what makes this entice so harmful. It’s not rooted in unhealthy intentions—it’s rooted in delay, in inertia, in dwelling on autopilot. And wealth doesn’t get constructed on autopilot. It’s constructed whenever you act with intention. And when that intention is lacking, yearly that goes by turns into a missed alternative.

Usually, this mindset isn’t totally your fault—it’s inherited. Many people develop up in households the place cash isn’t mentioned brazenly, planning isn’t prioritized, and monetary choices are pushed by emotion or urgency, not technique. In case your mother and father lived paycheck to paycheck, averted threat, or handled cash as a taboo matter, it’s probably you absorbed a few of that pondering. With out even realizing it, their informal strategy turns into your default setting—till you select to interrupt the sample.

Why the Casualness Lure Destroys Your Future

Casualness feels secure within the second. You keep away from robust conversations with your self. You don’t should confront how little you’re saving or how unstructured your funds actually are. However life, as everyone knows, has a manner of shaking you up whenever you least count on it.

- Perhaps you lose your job.

- Perhaps somebody in your loved ones wants sudden medical care.

- Perhaps an sudden invoice lands in your lap.

And that’s when the cracks present.

There’s no emergency fund to dip into. No investments to fall again on. No plan that will help you via.

So what occurs?

You swipe the bank card, take a private mortgage, possibly even borrow from family and friends. And similar to that, stress multiplies, strain builds, and monetary anxiousness turns into a part of your each day life.

What makes this worse is that these conditions aren’t uncommon. They occur on a regular basis—to hundreds of thousands of individuals. And in the event you’re caught off guard, it’s not simply your cash that suffers—it’s your confidence, your peace of thoughts, and generally even your relationships.

However the greatest loss? Time.

Time that might have been used to construct. To develop. To compound.

As a result of as soon as compounding is off the desk, catching up turns into 10X instances tougher.

You Begin to Really feel Misplaced, Behind, and Defeated

This entice doesn’t simply have an effect on your pockets—it impacts your id. Deep down, folks caught on this loop start to really feel like they’re failing at life. Like they’re the one ones not getting forward. That creeping feeling of being left behind by your friends—regardless of working simply as laborious—begins to take root. And shortly, you begin shedding religion in your skill to vary your state of affairs.

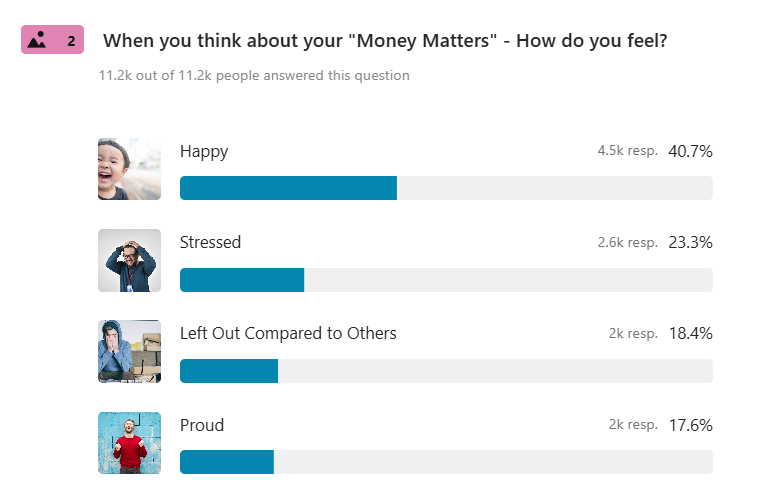

In our 25 questions monetary well being checkup, we ask folks how do they really feel about their cash issues and round 1 out of 5 folks mentioned they really feel “Left Out In comparison with Others” .. That’s such a heavy feeling!.

However right here’s the reality: it’s not too late. Not in the event you select to behave.

Step one is recognizing this sample. The second is having the braveness to interrupt it.

Why Good-Revenue Alone will not be sufficient

Numerous educated, city professionals fall into the entice of pondering they’re “doing positive” simply because their wage is growing. However wealth isn’t about how a lot you earn—it’s about how a lot you retain, how correctly you make investments, and the way patiently you let it develop.

With out budgeting, with out safety (like insurance coverage), with out long-term planning, you’re simply burning gasoline with out course. Revenue rises, however so do bills. And also you stay financially weak, simply at the next way of life degree.

The Emotional Value of Casualness

Many individuals consider finance as a chilly, logical space of life. However let me let you know—it’s deeply emotional. Dwelling paycheck to paycheck, dreading the first of the month, avoiding financial institution statements, worrying about each expense—these experiences depart scars.

The remorse of not beginning earlier, the disgrace of not figuring out the place your cash went, the concern of monetary instability—they’re actual. They usually’re painful.

The Casualness Lure might really feel innocent at first, however its penalties are far-reaching and long-lasting. It’s straightforward to disregard at present’s monetary choices, pondering they’ll look ahead to tomorrow, however tomorrow isn’t promised. The excellent news is, it’s by no means too late to interrupt free from this sample. By changing into intentional about your cash—beginning at present—you’ll be able to flip the tide.

It’s not about incomes extra, however about doing extra with what you might have. The secret is making acutely aware, proactive selections that construct the muse for a safe, affluent future. So, cease letting “later” dictate your life and take cost of your monetary future now. Your time—and your wealth—are far too treasured to waste.

Wealth isn’t constructed by grand gestures—however by killing the ‘Chalta hai’ voice in your head, one intentional alternative at a time.

If this piece struck a chord, possibly it’s time to cease delaying and begin deciding. For some, DIY works. For others, skilled steering brings readability and velocity. For those who’re within the second group, we’ve helped hundreds such as you construct methods that stick. Do refill this type and lets Discuss!