Standard knowledge dictates that if an investor is studying a few main enterprise occasion, the underlying alternative has already handed. In that context, food-and-beverage big PepsiCo Inc PEP won’t look like an alluring thought, provided that the corporate not too long ago acquired prebiotic soda model Poppi. Nonetheless, there could also be much more to PEP inventory than a buyout.

To make certain, PepsiCo’s acquisition of Poppi — a deal value $1.95 billion — is a big transfer. Essentially, demand for prebiotic drinks is rising. In 2023, the worldwide marketplace for probiotic sodas reached $242.1 million in 2023. Analysts undertaking that by 2031, the sector might be value $422.4 million, implying a compound annual development fee of seven.1%. To notice, probiotics discuss with dwell microorganisms whereas prebiotics assist keep the stability of those microorganisms.

Politically, PepsiCo’s acquisition additionally helps align the corporate with the Trump administration’s broader public well being coverage, as framed by Robert F. Kennedy, Jr. who will lead the Division of Well being and Human Companies (HHS). All through the 2024 marketing campaign path, Kennedy promoted the drive to enact stricter well being and vitamin laws.

On a extra cynical stage, although, PEP inventory might doubtlessly rise primarily based on present financial challenges. It is no secret that households have been struggling underneath the burden of accelerating costs and rising uncertainty amid escalating commerce wars. Subsequently, headlines akin to hovering gold costs and recession fears have dominated the enterprise information cycle.

As a result of customers are struggling, PepsiCo may benefit from the trade-down impact. Primarily, households might steadily cut back discretionary expenditures by redirecting towards cheaper options. As an illustration, households might select to eat out much less, thereby growing journeys to the grocery retailer. That might profit PepsiCo as one of many leaders of mass-produced, low-cost drinks.

Bullish Sentiment Might Be Returning To PEP Inventory

In fact, anybody can wax poetic a few blue-chip model like Pepsi. On the finish of the day, an funding is simply viable if it really delivers constructive outcomes — a painfully apparent level. In that regard, PEP inventory is compelling because the market has basically drawn a line within the sand.

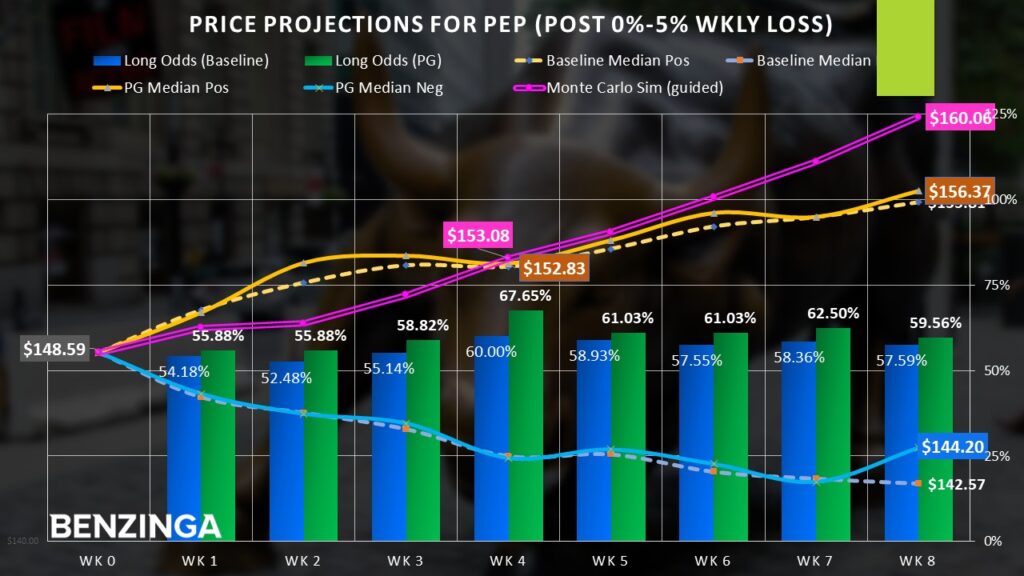

From a technical perspective, PEP has charted what seems to be a double-bottom formation. Earlier this 12 months, the bears tried to drive the worth beneath the $142 stage. Nevertheless, the bulls moved in, sending the fairness above $155. One other distinctively bearish effort emerged, which noticed PEP fall to round $143. After some tight negotiations, the safety resolved upward once more.

Taking a look at a longer-term chart, the principle goal for the bulls seems to be the $160 stage, the place sturdy resistance lies. Remember the fact that analysts from a consensus view are forecasting that PEP inventory will attain $174. Subsequently, $160 would appear a rational goal.

It should be mentioned, although, that as a blue chip, PEP won’t profit from substantial kinesis as one may count on from a high-flying tech inventory. For swing merchants, decreasing the anticipated value goal might be simpler. Happily, PEP enjoys an upward bias, making hypothesis with choices a extra snug strategy, comparatively talking.

Utilizing pricing knowledge from January 2019, a protracted place held for an eight-week interval statistically has a 57.59% likelihood of being worthwhile. That is a stable baseline to financial institution on. Even higher, there’s proof that buyers admire modest dips.

Final week, PEP inventory fell 4.7%. Following a one-week lack of as much as 5%, an eight-week lengthy place has a 59.56% likelihood of rising, barely higher than the baseline. Additionally, the lengthy odds peak at 67.65% 4 weeks following modest volatility, which is somewhat conspicuous.

Plotting A Bullish Technique For PepsiCo Speculators

Primarily based available on the market intelligence above, optimistic merchants might think about the 150/155 bull name unfold for the choices chain expiring April 25. This commerce assumes that PEP inventory will barely exceed the brief strike value at expiration, thus triggering the utmost payout.

Transactionally, the speculator would purchase the $150 name (at a time-of-writing ask of $560) and concurrently promote the $155 name (at a bid of $284). The credit score acquired from the brief name would partially offset the debit paid of the lengthy name, leading to a web money outlay of $276. Ought to the commerce go as deliberate, the max reward is $224, or a payout of about 81.2%.

The rationale for the late April expiration date is that traditionally, PEP inventory, whereas it might profit from a better chance of upside, doesn’t profit from magnitude of development. Nonetheless, merchants can select to take the danger of a shorter path to expiration for the opportunity of higher rewards.

For instance, if a dealer needs to play the fourth-week chance enhance talked about earlier, the 150/155 bull unfold for the April 11 expiration date is accessible. This commerce bumps the payout to 99.2%. Statistically, although, PEP inventory could be projected to achieve just below $153 at expiration, which might solely make this unfold partially worthwhile.

Picture: Shutterstock

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.