The continuing COVID-19 pandemic has prompted lots of concern and nervousness in our lives as a result of there aren’t any vaccines or any remedy obtainable for this sickness. If anybody will get COVID +ve there are possibilities that there could also be large medical payments working into lakhs of Rupees.

In case you don’t have massive medical insurance, you possibly can go for a particular coverage referred to as “Corona Kavach Coverage” which acquired launched not too long ago out there.

IRDAI has come up with an ordinary COVID targeted primary medical insurance coverage often known as “Corona Kavach Coverage”, which I will likely be reviewing on this article.

Options of Corona Kavach Coverage

- This coverage is accessible on a person in addition to a household floater foundation.

- The minimal and most sum assured provided by the coverage are Rs. 50,000 to Rs. 5,00,000.

- An individual aged between 18 yr to 65 yrs can buy this coverage.

- This coverage might be bought for self, partner, mother and father, parents-in-law, and dependent youngsters as much as 25 yrs of age.

- 2 sorts of cowl -Base Cowl on Indemnity Foundation which covers COVID Hospitalization cowl and Non-obligatory Cowl on Profit Foundation which covers Hospital Day by day Money.

- This coverage has a ready interval of 15 days from the acquisition of the coverage.

- The tenure of the coverage is 3 ½ months, 6 ½ months, 9 ½ months together with ready interval.

- Premium Cost Mode is Single.

- Tax Exemption on the premium paid u/s 80D.

What all is roofed below this coverage?

a) Hospitalization Cowl –

If an individual has examined COVID +ve in a authorities licensed diagnostic middle then the medical bills and bills incurred on therapy of any comorbidity together with the therapy for COVID as much as the Sum Insured will likely be lined below this coverage supplied the insured is hospitalized for greater than 24 hrs within the hospital.

Allow us to see what all comes below hospitalization cowl –

- Room Hire, Nursing Bills, ICU, and ICCU prices will likely be lined.

- Surgeon, Anesthetist, Medical Practitioner, Consultants, Specialist Charges whether or not paid on to the treating physician/surgeon or to the hospital will likely be lined below the coverage

- Bills on anesthesia, blood, oxygen, operation theatre prices, surgical home equipment, ventilator prices, medicines and medicines, prices in the direction of diagnostics, diagnostic imaging modalities, PPE Equipment, gloves, masks, and so on.. will likely be lined below this coverage.

- Ambulance prices as much as Rs 2000 will likely be lined below this coverage per insurer provided that the ambulance has been availed in relation to COVID Hospitalization. This additionally contains the price of the transportation of the Insured Individual from one hospital to a different hospital as prescribed by a medical practitioner.

b) Residence Care Therapy Bills –

If an individual is examined COVID +ve in a authorities licensed diagnostic middle and is getting therapy at residence which regular course would require care and therapy at a hospital however is definitely taken at residence most as much as 14 days per incident, then residence care therapy bills will likely be lined supplied below the next circumstances –

- If the medical practitioner has suggested the insured particular person to bear therapy at residence with a steady energetic line of therapy with is being monitored by a medical practitioner for every day by means of the period of the house care therapy.

- The insured or the member of the family ought to keep a day by day monitoring chart which incorporates information of therapy administered and duly signed by the treating physician.

- Cashless or reimbursement facility shall be provided below homecare bills topic to assert settlement coverage disclosed.

The bills made associated to the therapy of COVID will likely be lined below this coverage. They’re as follows –

- Diagnostic exams underwent at residence or on the diagnostics facilities.

- Medicines prescribed in writing

- Session prices of medical practitioners

- Nursing prices associated to medical employees

- Medical procedures restricted to parenteral administration of medicines

- Value of a Pulse oximeter, Oxygen cylinder, and Nebulizer

c) Pre and Submit Hospitalization Medical Bills –

Pre-Hospitalization medical bills of 15 days previous to admission into the hospital and Submit-Hospitalization bills of 30 days after getting discharged from the hospital will likely be lined below this coverage.

d) Hospital Day by day Money –

Hospital Day by day Money profit comes below an extra cowl if the insured has opted for Non-obligatory Cowl on Profit Foundation. Beneath this profit, the insured will get 0.5% of the sum insured per day as much as a most of 15 days.

From the place can I buy this coverage?

This medical insurance coverage might be bought from 30 Normal and Well being Insurance coverage Firms. The checklist of those firms is as follows –

[su_table responsive=”yes”]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[/su_table]

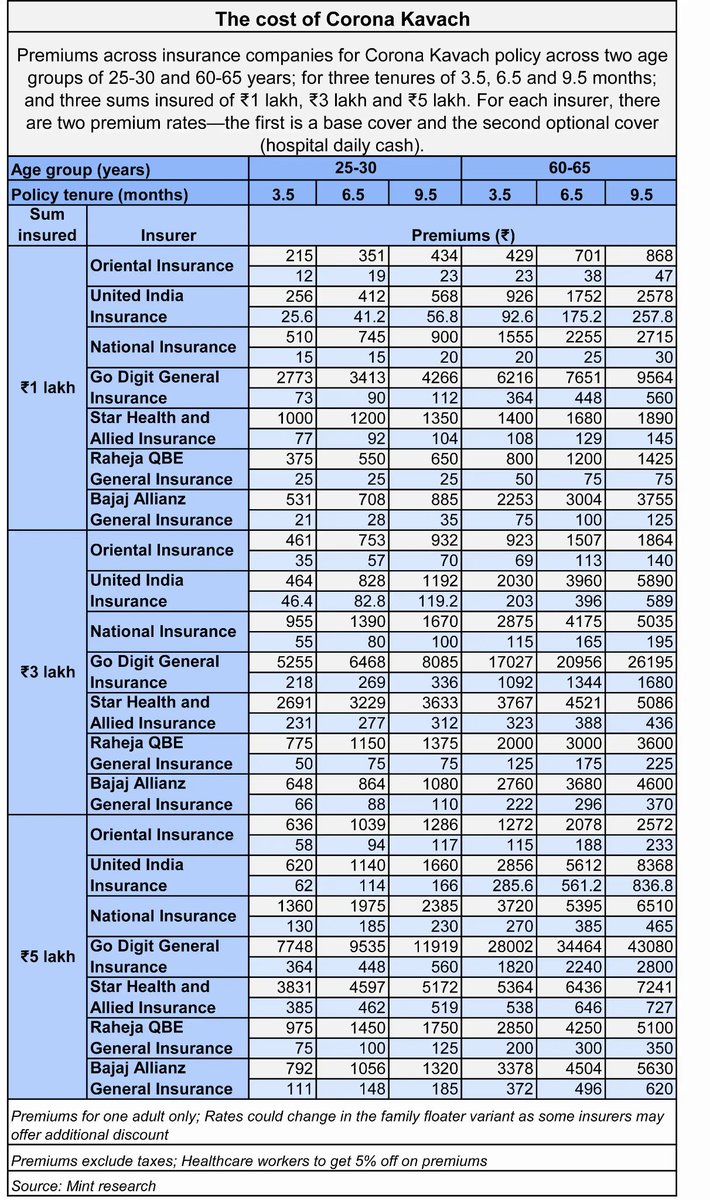

Premium for Corona Kavach Coverage

Livemint Analysis has finished an in depth examine of Premium for varied firms. Take a look at the premium desk under.

Exclusion below this coverage –

- If there are any diagnostic bills made which aren’t associated to COVID, then that bills is not going to be lined on this coverage.

- If an individual is examined COVID +ve earlier than the beginning of the coverage, then this particular person can’t file a declare to the corporate.

- Bills incurred in daycare therapy and OPD therapy will likely be excluded from this coverage.

- If a COVID +ve particular person is getting therapy exterior India, then the bills incurred within the therapy is not going to be lined below this coverage.

- If any bills incurred on un-proven therapy, procedures, or provides associated to COVID which lacks medical documentation to help its effectiveness is not going to be lined on this coverage.

- If an individual is getting testing finished associated to COVID in diagnostic facilities that aren’t licensed by the federal government then the bills incurred is not going to be lined below this coverage.

- Bills made on dietary dietary supplements and substances that are bought with out prescription is not going to be lined below this coverage.

A brief video evaluate of Corona Kavach Coverage –

All options talked about on this coverage are referred from IRDAI notification.

Conclusion –

So this was all that I wished to share on this article when you’ve got any queries you possibly can put it within the feedback part.