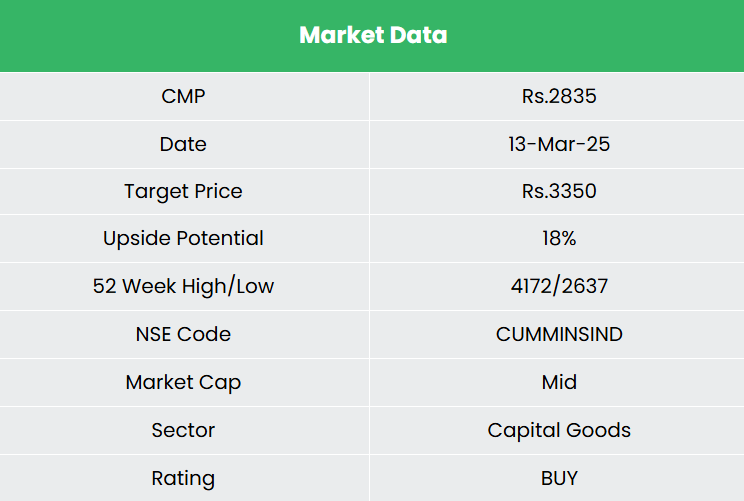

Cummins India Ltd – Energy, Progress, Potentialities.

Based in 1962 and headquartered in Pune, Cummins India Ltd. is a number one producer of diesel and pure fuel engines within the nation. The corporate focuses on designing, producing, distributing, and servicing engines and associated applied sciences, together with gasoline methods, air dealing with, filtration, emission options, and electrical energy technology methods (gensets). As of FY24, the corporate operates 5 factories, 1 elements distribution centre, 480+ service touchpoints and 120 retail touchpoints serving industries akin to building, compressor, mining, marine, railway, oil and fuel, pumps, defence and energy technology. With a broad world presence, the corporate serves markets together with Nepal, Bhutan, the USA, Europe, Mexico, Africa, the Center East, and China as its key locations.

Merchandise and Providers

The corporate’s merchandise are categorised throughout 4 enterprise segments:

- Engine Enterprise – Manufactures engines from 60 HP for on-highway industrial automobiles and off-highway industrial tools trade spanning building and compressor.

- Energy Techniques Enterprise – Manufactures excessive horsepower engines for marine, railways, defence and mining functions in addition to energy technology methods comprising of built-in generator units.

- Elements enterprise – Consists of 4 companies akin to Filtration, Turbo Applied sciences, Emission Options and Electronics and Gasoline Techniques.

- Distribution enterprise – Gives merchandise, packages, providers and options for uptime of equipments.

Subsidiaries: As of FY24, the corporate has 1 subsidiary, 1 affiliate firm and 1 three way partnership.

Funding Rationale

- Development methods – The corporate has at present localized 70-75% of its product and is working to extend this share, which might improve margins, pricing energy, and profitability, whereas strengthening its market place. The corporate’s industrial section has achieved sturdy efficiency pushed by sturdy demand in building section and railways. Whereas administration stays cautious as a result of cyclical nature of the development trade, they’re optimistic about order inflows within the railway and mining sectors. The corporate has additionally launched merchandise within the US markets which has related emission norms as that of India. Optimised capability utilisation has additionally led to a lower within the lead time from 60 days to 30 days. The corporate can be advancing its HELM Know-how (Excessive Effectivity, Decrease Emissions, Multi-fuel expertise), which can permit engines to run on quite a lot of fuels, together with propane, biogas, and hydrogen, amongst others. It’s also specializing in increasing its reconditioning and distribution enterprise.

- Market chief – In FY24, the Central Air pollution Management Board (CPCB) launched the newest and most stringent requirements for diesel mills in India, changing the CPCB II norms with the CPCB IV+ laws. These new CPCB IV+ norms are anticipated to considerably scale back dangerous pollution akin to NOx, CO, HC, and PM. Cummins India was among the many first corporations within the nation to obtain regulatory approval for manufacturing CPCB IV+ compliant gensets. The corporate’s merchandise have already been effectively obtained out there, and by Q3FY25, CPCB IV+ gensets accounted for roughly 40% of whole genset gross sales for the corporate. The administration believes that pricing for CPCB IV+ merchandise would take 2-3 quarters to stabilise.

- Q3FY25 – Throughout the quarter, the corporate generated income of Rs.3,096 crore, a rise of twenty-two% in comparison with the Rs.2,541 crore of Q3FY24. Exports improved by 43% whereas home gross sales elevated by 18%. Working revenue elevated from Rs.543 crore of Q3FY24 to Rs.598 crore of Q3FY25, a development of 10%. The corporate reported web revenue of Rs.558 crore, a rise by 12% YoY in comparison with Rs.499 crore of the corresponding interval of the earlier 12 months.

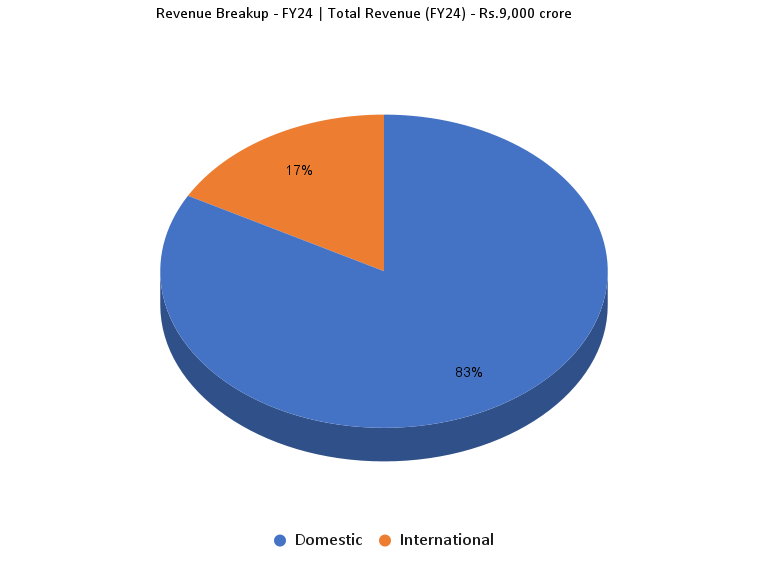

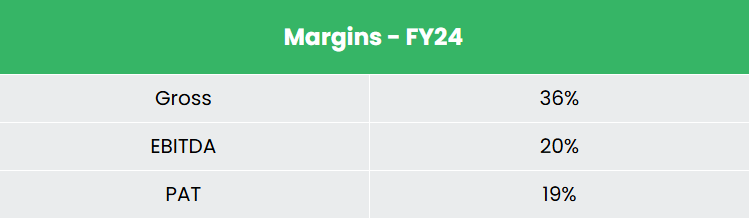

- FY24 – Throughout the FY, the corporate generated income of Rs.9,000 crore, a rise of 16% in comparison with the FY23 income, aided by a 31% development in home gross sales. Working revenue is at Rs.1,761 crore, up by 42% YoY. The corporate reported web revenue of Rs.1,721 crore, a rise of 40% YoY.

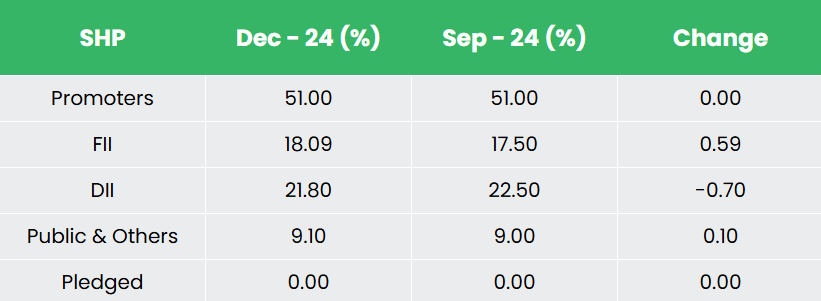

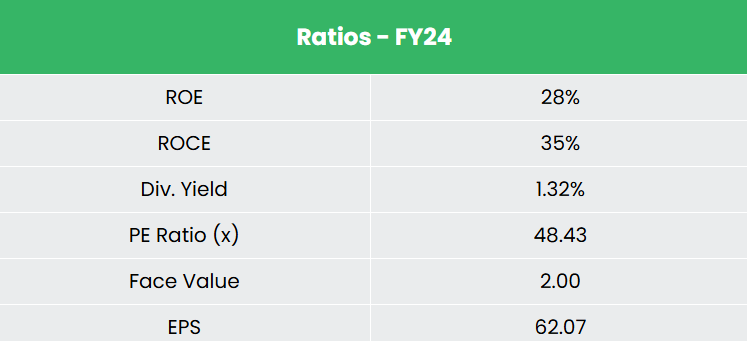

- Monetary Efficiency – The three-year income and web revenue CAGR stands at 27% and 37% respectively between FY21-24. The corporate has sturdy steadiness sheet with none debt in its capital construction. Common 3-year ROE and ROCE is round 23% and 28% for FY21-24 interval.

Business

India’s capital items sector is a robust development driver, fuelled by authorities investments in infrastructure and a concentrate on manufacturing, presenting substantial funding alternatives. {The electrical} tools market in India is projected to develop from US$ 52.98 billion in 2022 to US$ 125 billion by 2027, reflecting a powerful compound annual development charge (CAGR) of 11.68%. The expansion of the engineering sector is being considerably supported by numerous insurance policies and initiatives from the Indian authorities. Incentives aimed toward increasing energy technology capability will additional increase the demand for electrical equipment.

Development Drivers

- The federal government has de-licensed the engineering sector with 100% FDI permitted.

- The home demand is predicted to be sturdy because the adoption of CPCB IV+ norms picks up.

- The ‘Make in India’ initiative, together with the federal government’s emphasis on bettering the benefit of doing enterprise, is predicted to create quite a few alternatives within the engineering and capital items sectors within the coming years.

Peer Evaluation

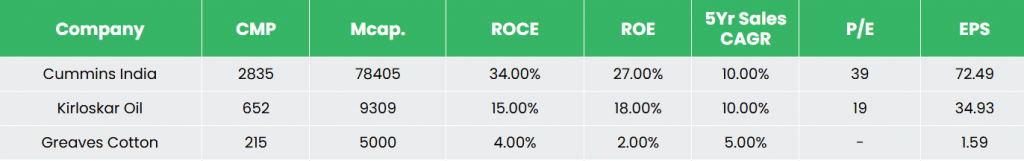

Opponents: Kirloskar Oil Engines Ltd, Greaves Cotton Ltd, and so forth.

Among the many above opponents, Cummins has higher return ratios and secure income development, indicating the corporate’s monetary stability and its effectivity to generate earnings and returns from the invested capital.

Outlook

It’s encouraging to notice that the corporate has achieved constant segmental efficiency YoY, with home genset gross sales growing by 18%, the distribution enterprise rising by 13%, industrial home gross sales rising by 24%, and exports in each HHP and LHP rising by 47%. Presently the corporate has a sturdy portfolio of CPCB-IV+ compliant merchandise to fulfill the shopper demand throughout your complete product vary. Its ongoing efforts in provide chain enhancements and worth additions is predicted to enhance the market penetration. The corporate has efficiently reversed the earlier downward pattern in export gross sales, with notable development primarily coming from the Center East and Latin American markets. By assembly CPCB IV+ requirements, we imagine the corporate is positioned to be a key participant within the Indian energy technology market, providing cleaner and extra environmentally pleasant diesel mills. The corporate has additionally projected double-digit gross sales development for FY25.

Valuation

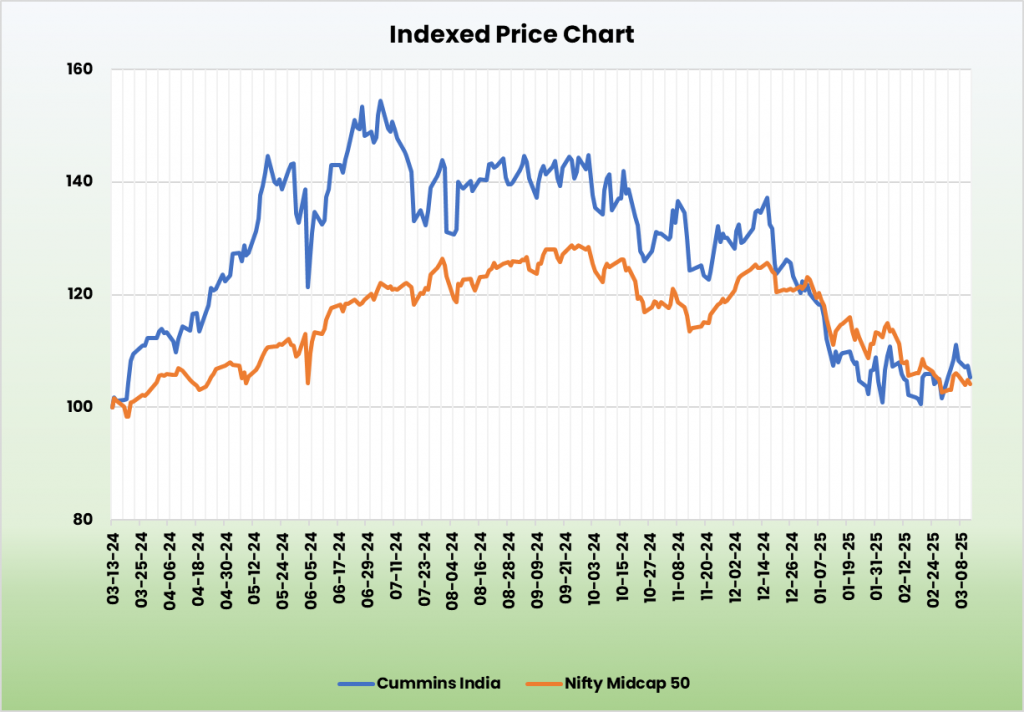

We imagine the corporate is predicted to develop in tandem with the nation’s elevated infrastructure spending. We advocate a BUY score within the inventory with the goal value (TP) of Rs.3,350, 31x FY26E EPS.

Danger

- Geopolitical instability – Altering coverage dynamics and provide chain disruptions as a consequence of geopolitical conflicts may adversely impression the corporate’s operations.

- Foreign exchange Danger – The corporate has important operations in international markets and therefore is uncovered to foreign exchange danger. Any unexpected motion within the foreign exchange market can adversely have an effect on the corporate.

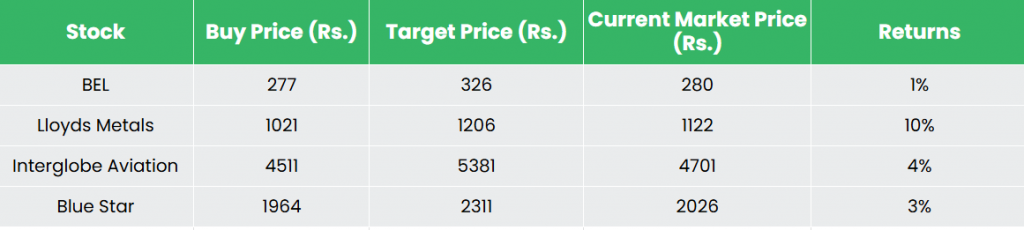

Recap of our earlier suggestions (As on 13 March 2025)

Bharat Electronics Ltd

Lloyds Metals & Vitality Ltd

Interglobe Aviation Ltd

Blue Star Ltd

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork rigorously earlier than investing. Securities quoted listed here are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please notice that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing. Registration granted by SEBI, and certification from NISM by no means assure the efficiency of the middleman or present any assurance of returns to traders.

For extra particulars, please learn the disclaimer.

Different articles it’s possible you’ll like

Put up Views:

66