Have you ever ever thought what occurs to all these unclaimed dividends, shares or any cash which was misplaced in scams or frauds?

It may additionally occur that your grandparents or mother and father have made some investments and you aren’t aware of it? discover it out and declare it again?

The reply is IEPF, which is Investor Training Safety Fund Authority (IEPF) by the Ministry of Company Affairs, Authorities of India. This can be a physique setup by govt, the place all these unclaimed cash will get transferred and buyers can declare them again by following a process.

Just lately IEPF authority recovered again Rs 1,514 Crores from Peerless finance which had completed a fraud in previous the place a lot of buyers misplaced their hard-earned cash.

What precisely will get transferred to IEPF?

One thing which is unclaimed for a interval of seven yrs., goes into IEPF, instance are ..

- Unclaimed shares mendacity in demat accounts from years

- The applying moneys acquired by firms for allotment of any securities and due for refund

- Matured debentures with firms

- Matured financial institution deposits

- Unpaid dividends by firms

- Curiosity accrued on above issues

- Any buyers cash which is recovered from fraudulent firms

In case the dividend for any 12 months is claimed or acquired by the shareholder over the last seven consecutive years, the shares is not going to be transferred to Investor Training and Safety Fund.

The under chart exhibits the unclaimed or unpaid cash (in lakhs) transferred to IEPF (from 2001 to 2018) –

seek for unclaimed and unpaid quantities?

With the intention to get a refund, step one it to seek out out that there’s any unclaimed quantity for your self/mother and father/grandparents and so on. There’s a facility offered by IEPF the place an investor can discover out the quantities which they’re liable to get again.

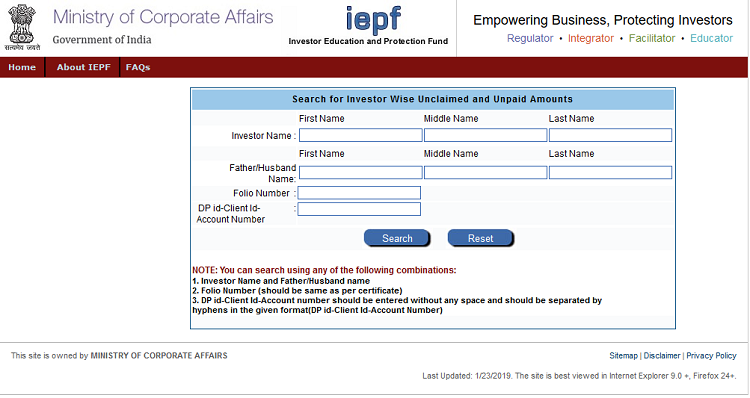

The investor can seek for their unclaimed and unpaid quantity by filling in sure particulars corresponding to investor title, father or husband title, folio quantity and so on. by Clicking on this hyperlink.

The below-attached picture exhibits how the investor can seek for the unclaimed and unpaid quantity.

Notice that it’s a bit difficult and cumbersome to do the search. Please be affected person and take a look at all form of combos.

Tip : I counsel you placing all attainable combos of your title, your father/mom or grandparents’ title. A number of occasions, our mother and father/grandparents spend money on shares or have some deposits which we aren’t even aware of. That is how we will dig deeper and discover out!

Technique of getting Refund from IEPF?

Right here I’m writing maintaining in thoughts refund for shares, however the course of is just about similar for different issues as properly.

- Go to IEPF Web site and fill in IEPF Kind 5 and use the choice type add. You may be redirected to Ministry of Company Affair (MCA) for type Add.

- Login utilizing your ID and Password (if present or else register your self by clicking on register and getting into the required particulars).

- After login, click on on regular add.

- Click on on Browse and fasten the shape. Click on on Submit.

- SRN can be generated and you’ll ask for a cost choice (Pay Now or Pay later).

- Although Price can be zero however click on on Pay now choice solely to generate the acknowledgement.

- After clicking on Pay Now, you need to click on on End when the zero-fee web page can be proven. The acknowledgement can be generated.

What’s the process after making use of for Refund?

The investor has to ship the attachments prescribed under to Nodal Officer (IEPF) of the corporate at its registered workplace in an envelope marked “declare for a refund from IEPF Authority” for initiating the verification for a declare.

a) Print out of duly stuffed and uploaded declare type IEPF-5; with claimant signature and if joint holders are concerned than the Kind needs to be signed by all of the joint holders.

b) Copy of acknowledgement generated after importing the declare Kind IEPF-5

c) Indemnity Bond (authentic) with claimant signature (As per format given in Annexure-II) to be executed :

- On a non-judicial Stamp Paper of the worth as prescribed beneath the Stamp Act (Based on state) if the quantity of the declare is Rs 10, 000 or extra. Please guarantee to enter date, place and Signature of claimant and witness.

- On a plain paper if the quantity claimed doesn’t exceed Rs.10,000.

- In case of a refund of shares, on a non-judicial Stamp Paper of the worth as prescribed beneath the Stamp Act.

d) Advance Stamped receipt (authentic) with the signature of the claimant and two witnesses. (Format is given at Annexure I)

e) In case of a refund of matured deposit or debenture, or bonds, or the place shares (in bodily type) are claimed authentic certificates thereto

f) Copy of Aadhaar Card of the claimant and if joint holders are there, Copy of Aadhar card of all of the joint holders

g) Proof of entitlement (certificates of share/Curiosity warrant/dividend warrant, Software No. and so on.)

h) Authentic Cancelled Cheque leaf (it should bear the title of the claimant and the cheque leaf have to be of the identical account of which particulars are given within the Kind IEPF-5).

i) Self-attested copy of Passport, OCI and PIO card in case of foreigners and NRI

j) Self-attested copy of PAN Card (necessary in case of a declare for shares)

ok) Self-attested Shopper Grasp Record of De-mat A/c of the claimant

l) In case any Joint holder is deceased, Copy of Loss of life certificates to be hooked up.

m) Different non-compulsory paperwork, (if any)

The corporate shall, inside fifteen days from the date of receipt of the declare, ship a verification report back to the Authority within the format specified by the Authority together with all of the paperwork submitted by the claimant. The Nodal officer could approve or reject the Kind and enclosures submitted, topic to verification.

How will I get my cash or shares from the IEPF Authority?

For a financial refund, IEPF initiates e-payment as per the principles. If shares are reclaimed, the shares can be credited to the claimant’s Demat account by the Investor Training and Safety Fund.

I hope you understood how one can profit from IEPF and declare again your cash if there’s any. Do let me know your queries!

&w=150&resize=150,150&ssl=1)