Intrinsic Worth Calculator (Modified Ben Graham’s Components)

Introduction

Have you ever ever puzzled how some traders, like Warren Buffett, appear to choose successful shares repeatedly? It’s not magic or guesswork. It’s about understanding what an organization is really value.

That’s the place the thought of intrinsic worth is available in.

As an investor myself, I’ve all the time been interested by how the massive names make their strikes.

Right now, I wish to share with you a easy but highly effective instrument to determine a inventory’s actual worth, Benjamin Graham’s intrinsic worth components.

Let’s dive in and see the way it works, step-by-step.

What’s Intrinsic Worth?

Think about you’re at an area market, shopping for mangoes.

You recognize an excellent mango is value Rs. 50, however the vendor is promoting them for Rs. 40. You wish to seize just a few greater than your typical purchase, proper? Why? Since you are conscious that you just’re getting them at a discount.

Shares work in the same means. Intrinsic worth is the “actual” value of a inventory, primarily based on issues like how a lot the corporate earns (EPS) and how briskly it’s rising (g).

Some folks would possibly give this impression that shares are simply what individuals are keen to pay for it on the inventory market. It is just partially true. In actual fact, in a long run, what dominates the rise or fall of a inventory’s worth is its fundamenatals (earnings and future progress).

Whenever you purchase a inventory under its intrinsic worth, it’s like getting these mangoes on sale. Over time, if the market realizes the inventory’s true value, its worth goes up, and also you make a revenue.

For instance, if a inventory’s intrinsic worth is Rs. 200 but it surely’s buying and selling at Rs. 150, you would earn Rs. 50 per share when the worth catches up with its true worth.

Easy, isn’t it? However determining that intrinsic worth takes some effort. That’s what we’ll discover on this weblog submit.

Why Intrinsic Worth Issues

I keep in mind after I first began investing. I’d have a look at inventory costs leaping up and down and marvel, “What’s driving this?”

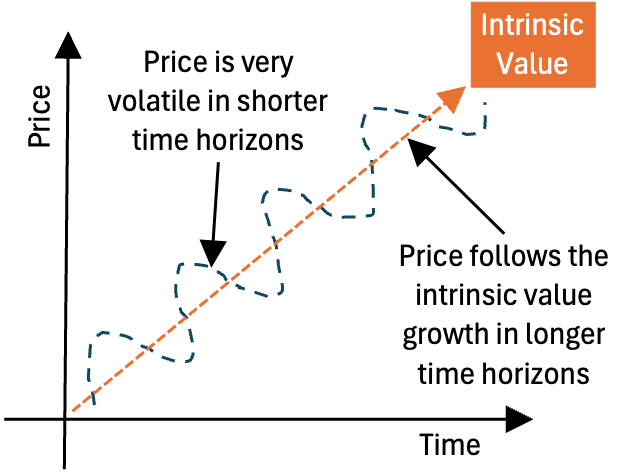

The reality is, briefly time period, market costs could be results of emotional calls. For instance, typically they’re too excessive as a result of everybody’s feeling excited and bullish concerning the Indian inventory market. In different instances they are often too low as a result of individuals are in panic and desires to promote (like in 2008 disaster, 2020 COVID, and so on).

So, when a brand new investor, who doesn’t know concerning the idea of intrinsic worth, will beleive that inventory worth is all the time irrational. They solely behave irrationally as they’re pushed by feelings. However in long-run, the impact of feelings tames down significantly. What issues extra are the basics of the corporate (earnings and progress).

In long run, the worth of the inventory typically follows the intrinsic worth growth or contraction.

The data of the intrinsic worth cuts by means of that noise. It provides you a stable quantity to determine if a inventory is an effective purchase or not.

I’ll ask you to consider the intrinsic worth like this.

Should you’re shopping for a flat, you wouldn’t pay Rs. 2 crore simply because another person did, proper? You’d test the worth of comparable properties close by to gauze it precise worth. Shares are not any completely different. Realizing the intrinsic worth helps you keep away from overpaying and spot alternatives others would possibly miss.

Who’s Benjamin Graham

He’s the numerous behind potential the primary intrinsic worth components.

Now, let’s speak about Benjamin Graham. He’s not simply any identify, he’s known as the father of worth investing. Warren Buffett, one of many world’s richest traders, was his pupil.

Graham believed in shopping for shares which might be cheaper than their true value.

The concept of the intrinsic worth sounds sensible, proper? To assist traders, he got here up with a components to calculate intrinsic worth. It’s not excellent, but it surely’s an excellent start line.

Graham’s thought was easy, give attention to an organization’s earnings and progress.

We should get swayed by market hype. His components has stood the check of time as a result of it’s sensible and logical.

Let’s see what the Ben Graham’s components appears to be like like.

Understanding Ben Graham’s Components

Graham’s unique components is simple. Right here it’s:

V = EPS × (8.5 + 2g)

What does this imply? Let me break it down.

- V is the intrinsic worth of the inventory, what we’re looking for.

- EPS is earnings per share, or how a lot revenue the corporate makes per share.

- g is the anticipated progress fee of these earnings over the following 7-10 years.

- 8.5 is the P/E ratio Graham used for an organization with no progress.

- 2g doubles the expansion fee to consider future progress potential which is “g.”

Don’t fear if it appears to be like a bit mathematical at first. It’s simpler than it appears. Later, Graham tweaked this components to account for rates of interest. The recised components appears to be like like under:

V = [EPS × (8.5 + 2g) × 4.4] / Y

Following the extra parameters added to the unique components:

- 4.4 was the typical yield of top-quality US company bonds again in 1962, and

- Y is the present bond yield.

This model adjusts the worth primarily based on how a lot you would earn from protected investments like bonds. For now, let’s keep on with the less complicated one and adapt it for India.

Making It Work for Indian Shares

Graham constructed his components for the US market, so we have to tweak it a bit for India.

The large query is, how will we deal with the rate of interest half?

Within the up to date components, Ben Graham used US bond yields. For us, the yield of 10-year Indian authorities bonds makes extra sense. It’s like our model of a “protected” funding fee.

However to maintain issues easy, I typically begin with the fundamental components:

V = EPS × (8.5 + 2g)

Then, I take into consideration whether or not the outcome is sensible in right now’s Indian market. For instance, bond yields in India are normally increased than within the US, round 6-7% as of late. That impacts how we worth shares.

Let’s see it in motion with an instance.

A Actual-World Instance

Say we’re an organization, let’s name it “ABC Ltd.”

It’s obtained an EPS of Rs. 20, and we anticipate it to develop at 8% per yr for the following 7-10 years.

How do we discover its intrinsic worth?

- First, calculate the expansion half: 8.5 + 2 × 8 = 8.5 + 16 = 24.5.

- Then, multiply by EPS: 20 × 24.5 = Rs. 490.

So, the intrinsic worth is Rs. 490.

If ABC Ltd. is buying and selling at Rs. 400, it could be a discount. But when it’s at Rs. 550, possibly it’s overpriced.

Now, let’s strive the up to date components

V = [EPS × (8.5 + 2g) × 4.4] / Y

- Suppose the present 10-year authorities bond yield is 7%.

- Utilizing V = [20 × (8.5 + 16) × 4.4] / 7, we get: [20 × 24.5 × 4.4] / 7 = [2,156] / 7 = Rs. 308.

So you’ll be able to see, the usage of the up to date components is yielding a decrease intrinsic worth than the unique components. This reveals how bond yields can change the image.

Which one must you use? I’d say, use each. First begin with the fundamental components. Then go on to make use of the up to date components. Each the components’s provides you with two numbers of the intrinsic worth. Contemplate them as a variety. The precise intrinsic worth will lie someplace within the center (say).

The place to Get the Enter Information

You could be questioning, “The place do I discover EPS and progress charges?” Good query.

- EPS is simple, test monetary web sites like Moneycontrol or the corporate’s annual report and even my Inventory Engine.

- For progress fee, it’s trickier. Have a look at the corporate’s previous 5-year EPS progress or what analysts predict. Be cautious, although, don’t assume loopy excessive progress except there’s stable proof.

- For bond yields, the Reserve Financial institution of India’s web site or monetary information like Financial Instances can inform you the present 10-year authorities bond fee. It adjustments, so use the most recent determine if you calculate.

Limitations of This Components

I’ve been utilizing this components for greater than 10 years now. As a newbie I discovered it eye-opening.

However right now, I’ll say it’s not flawless.

- For one, it assumes 8.5 is the proper P/E for a no-growth firm. In India, P/E ratios can fluctuate quite a bit, some sectors like tech, defence, renewable power, and so on may need 30 because the minimal PE. Different sectors like like metal could be at 10 and even decrease (cyclical sector).

- Guessing the expansion fee is one other powerful half. The issues develop into much more troublesome if the corporate in consideration is cyclical (like metal, cement, and so on).

- Plus, the components additionally ignores different necessary metrics like debt within the stability sheet, high quality of competitors, or administration high quality, and so on.

An organization would possibly look low cost on paper however have enormous loans dragging it down.

That’s why I’ll all the time dig deeper within the firm’s stability sheets and do the checks. I’ll additionally learn concerning the trade wherein the corporate in working. Thought of those examine needs to be to get a clue if the corporate has a powerful edge or not.

There are literally thousands of firms listed in our inventory alternate. Why to accept a weak or a median firm. Our aim shall be to choose the perfect withing the sector or an trade.

Past The Components

Graham’s components is sort of a torch, it lights the way in which however doesn’t present the entire path.

For a fuller image, I’d pair it with different instruments. What instruments?

These strategies take extra time, however they’re value it for large selections.

Once I first discovered about intrinsic worth, it modified how I noticed shares. All of the sudden, it wasn’t nearly worth, it was about worth.

However I additionally discovered no components can do all of the work. You’ve obtained to suppose exhausting and analysis properly.

How Warren Buffett Makes use of It

Warren Buffett took Graham’s concepts and ran with them.

He doesn’t simply calculate intrinsic worth, he appears to be like for a “margin of security.” Which means shopping for a inventory means under its intrinsic worth, so even when he’s improper, he’s nonetheless protected.

Say the intrinsic worth is Rs. 500, he would possibly look ahead to it to drop to Rs. 350. Sensible, proper? It’s a reminder that self-discipline issues as a lot as the maths.

Ben Graham’s Components Up to date for India

The Ben Graham’s components has many limitations.

Consultants of basic evaluation of shares choose going into extra detailed calculations to estimate intrinsic worth. Learn extra about doing detailed inventory evaluation in MS Excel.

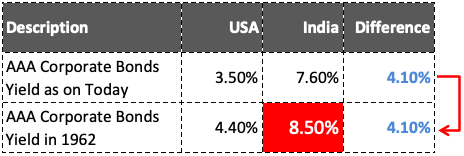

Within the above components of Benjamin Graham, there’s a issue of “4.4”. This makes it appropriate for shares buying and selling solely within the US. There have to be a special issue for Indian shares, proper? Why?

As a result of within the denominator there’s a issue of “Y”. What’s Y? Rate of interest of AAA company bonds working in a rustic (for us it’s India). Therefore, the numerator should even be tweaked for India.

Therefore, I assumed to make use of a barely completely different type of this components for my inventory evaluation. However the issue was, nowhere I may discover the yield of AAA Company bonds of India in 1962. So I assumed to make use of the under assumption to reconfigure the multiplying issue:

Therefore the revised Benjamin Graham’s intrinsic worth components appears to be like like this:

Conclusion

So, what have we discovered?

Intrinsic worth is your information to discovering shares which might be value greater than they price.

Ben Graham’s components, whether or not the fundamental V = EPS × (8.5 + 2g) or the up to date model, provides you a stable start line.

For Indian shares, tweak it with our bond yields and market realities.

However don’t cease there. Use it as a primary step, then dive into the corporate’s story, its earnings, its dangers, its future. I

nvesting isn’t simply numbers; it’s about understanding what you’re shopping for.

Comfortable investing.

Handpicked Articles: