At the moment I’ll inform you about foreclosed properties and how one can purchase them for decrease than the market value.

What’s the that means of Foreclosed Property?

Many instances, banks seize the properties when their homeowners fail to pay their EMI funds for a very long time. These properties are referred to as “foreclosed properties” and banks put them on the market within the public sale with a view to get better again their dues. As soon as the properties are seized by banks, they’re the rightful homeowners of the property beneath the Sarfesi Act and so they have 100% authorized rights to unload these properties.

These properties are primarily bought beneath the market value as a result of the concentrate on banks is usually to get better financial institution their dues and to not make income. So you may strike an excellent deal in case you are able to undergo the method of shopping for foreclosed properties.

Benefits of Shopping for a Foreclosed Property

- Value Benefit: Public sale properties are roughly 20-25% cheaper than the market value.

- Authorized and Secure: Banks / Monetary Establishments approve loans after verification of all of the authorized features solely. Financial institution Auctions are legally protected and fall beneath the SARFAESI Act and DRT Act.

- Fast Course of: Your entire transaction can be over in lower than 2-3 months interval. Possession can be transferred inside a month’s time.

Disadvantages of Foreclosed Property

- No Assure of high quality or inner situation: Financial institution can not present any disclosures as to property historical past/situation points. If there may be any injury to the property then the banks is not going to restore and provides. Property circumstances is likely to be suspect on account of injury finished by upset owners.

- Heavy preliminary Cash requirement: Solely severe patrons are entertained as it’s important to put an enormous quantity as a assure

- Tedious Course of: To some folks, the method might appear to be tedious and daunting.

Easy methods to discover a foreclosed property?

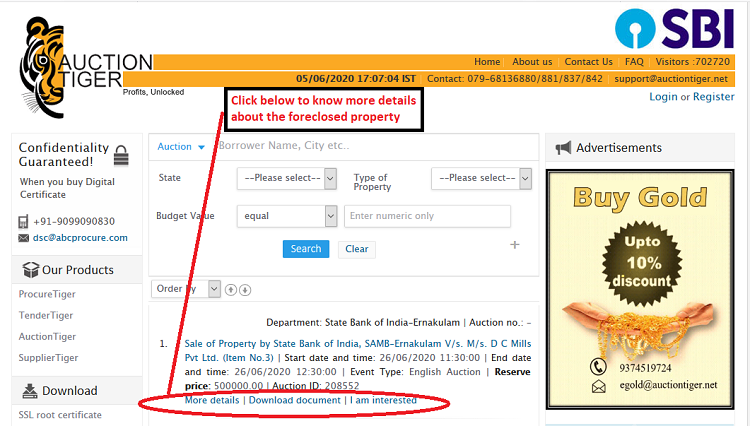

The info and details about foreclosed properties are fairly fragmented. There is no such thing as a single central database of data however divided quite a bit. Listed here are some methods yow will discover details about foreclosed properties

Subsequent step after shortlisting the foreclosed property?

When you get the preliminary details about an public sale, you may go to the property together with the foreclosing financial institution’s official.

All actual details about the property is given on the web site such because the title of the borrower of the property, the property belongs to which state and metropolis, what’s the reserve value of the property, actual time and date of the public sale of the property and so forth

What do I must do, If I wish to take part within the public sale?

To take part within the public sale, you have to to submit an utility and KYC (know your buyer) paperwork, together with the bid worth which may vary from 5-20% of the reserve value, to the financial institution.

Then on the principle bidding day, whoever is the best bidder wins and so they need to then pay the remainder of the cash to safe the property. There could also be some advance to be made and the remaining cash must be paid in just a few weeks. So you may go together with a house mortgage if required, however bear in mind that you’ll want to have a good quantity in your hand to take part within the public sale anyhow.

Beware of those small points with the foreclosed property

Do not forget that the foreclosed property is coming into your fingers from one other proprietor who was financially distressed, and there’s a good likelihood that there is likely to be some

- Pending property taxes

- Pending Maintainance to Society

- Pending Electrical energy invoice/gasoline payments and so forth

Banks should not going to get better these and these are your headache, however even after paying these, you could be getting an amazing deal.

Is it price shopping for a financial institution auctioned property?

Beneath is a brief video that solutions your query.

3 precautions to take earlier than taking a Foreclosed Property

- Do rent a lawyer so that each one the authorized papers may be checked totally particularly if the quantity concerned could be very massive.

- Don’t purchase a really outdated property as that will require main renovations.

- The possibility of earlier homeowners staying in the home is much less as a result of banks often ask them to vacate earlier than auctioning the property. Nevertheless, if the property is already set free, the tenants could also be nonetheless staying in the home and it turns into your duty to evict them. Liberating a home of its tenant is troublesome, particularly if the tenant has been staying there for an extended. One of the best technique is to keep away from a home that’s already occupied by tenants.

This was all that I needed to share on this article. When you’ve got any queries put up them within the remark part.