ELSS Funding Calculator

Plan your ELSS investments, estimate returns, and see tax financial savings!

Abstract:

- Explores ELSS as a tax-saving and wealth-building funding. We’ll examine it with ULIPs, NPS, Flexi Cap, and Giant Cap funds to spotlight its distinctive stability of excessive returns, brief 3-year lock-in, and Part 80C advantages for learners and long-term traders. Test this comparability instrument to check ELSS with Ulip, NPS, and so forth.

Introduction

It’s not straightforward for learners to decipher the place to half their hard-earned cash. Do you have to go for one thing that saves tax? Or concentrate on constructing wealth for the long run? Ideally, it shall be a mixture of each, proper?

I’ve been down that rabbit gap, and at present, as a result of somebody in his early 20s requested me this pointed query: save tax or construct wealth – which is the popular choice for her. So, on this submit I’ll speak about one such funding plan.

It’s ELSS (Fairness Linked Financial savings Scheme). We’ll discover if it actually that nice an funding choice because it’s made out to be?

We’ll examine it with different choices to know the way it stack up towards different standard selections. We’ll additionally discover shut alternate options like ULIPs, NPS, Flexi Cap funds, and so forth?

Let’s dig deeper into ELSS funds and perceive what makes it an fairness product price exploring, particularly for the learners.

Why ELSS Will get So A lot Consideration

When persons are scrambling to save lots of tax earlier than the monetary 12 months ends (March finish), they discover that ELSS is a wonderful choice to save tax and in addition construct wealth.

For those who’ll ask your CA (find out how to save tax), he can even ship you a listing of 80C choices, PPF, NSC, fastened deposits, after which there will certainly be ELSS.

Not like the others, ELSS guarantees not simply tax financial savings but additionally the potential for prime returns. Sounds thrilling, proper?

ELSS is a kind of fairness mutual fund that qualifies for a tax deduction of as much as Rs. 1.5 lakh beneath Part 80C.

This implies for those who’re within the 30% tax bracket, it can save you as much as Rs.46,800 a 12 months in taxes.

ELSS, invests a minimum of 80% of its corpus in equities. It signifies that it portfolio holdings are majorly tied to the inventory market. That’s why it’s typically pitched as a “tax-saving plus wealth-building” choice.

What makes ELSS stand out is its lock-in interval. At simply 3 years, it’s the shortest amongst tax-saving investments.

Let’s examine the lock-in interval of ELSS with different choices:

| Lock-in Periof | Years |

|---|---|

| ELSS | 3 |

| PPF | 15 |

| NSC | 5 |

| ULIPs | 5 |

This distinction will let you know why many individuals, who hate lock-in durations, discover ELSS extra interesting.

However does this brief lock-in and fairness publicity make it a one-size-fits-all answer (tax financial savings + wealth generator)?

Let’s discover additional.

Who Ought to Contemplate ELSS?

I’ve met two sorts of traders in my life.

- First, there’s the tax-saver, like Anil, who invests solely to chop his tax invoice.

- Then there’s the wealth-builder, like Priya, who doesn’t care about tax advantages however needs her cash to develop over a long time.

Can ELSS work for each?

For tax-savers, ELSS is a no brainer.

You make investments Rs. 1.5 lakh, save Rs. 46,800 in taxes (for those who’re within the 30% bracket), and get publicity to the inventory market. Traditionally, ELSS funds have delivered 12-15% annualized returns over 10 years.

Examine this return with different tax financial savings choices like PPF’s 7-8% or NSC’s 6.8%, it’s manner higher.

Even for those who redeem simply after 3 years, you’ve saved tax and probably earned first rate returns.

For wealth-builders, ELSS is simply as compelling

It’s basically a diversified fairness fund, investing throughout massive, mid, and small-cap shares. Nowadays we name it multi-cap funds.

Check out these prime returns producing ELSS funds:

| SL | Funds | Expense Ratio (%) | Internet Belongings (Cr) | Return (10Y) % |

|---|---|---|---|---|

| 1 | Quant ELSS Fund (D) | 0.50 | 10,873 | 20.67 |

| 2 | Motilal Oswal ELSS Fund (D) | 0.70 | 3,897 | 17.72 |

| 3 | DSP ELSS Fund (D) | 0.75 | 16,218 | 16.92 |

| 4 | Financial institution of India ELSS Fund (D) | 0.95 | 1,324 | 16.37 |

| 5 | JM ELSS Fund (D) | 1.03 | 189 | 15.97 |

| 6 | Kotak ELSS (D) | 0.71 | 6,077 | 15.27 |

| 7 | Tata ELSS Fund (D) | 0.61 | 4,405 | 15.27 |

| 8 | Bandhan ELSS Fund (D) | 0.69 | 6,806 | 15.23 |

| 9 | Canara Robeco ELSS Fund (D) | 0.56 | 8,516 | 15.00 |

| 10 | SBI Lengthy Time period Fairness Fund (D) | 0.95 | 28,506 | 14.89 |

Funds like Quant ELSS or Motilal Oswal ELSS have posted 10-year returns of 20% and 17%, respectively. That’s not far off from prime Flexi Cap funds. In the identical interval (10-Years), flexi cap funds like Quant Flexi Cap (D) and Parag Parik Multi cap have generated 19.7% and 18% returns, respectively.

The three-year lock-in in ELSS additionally forces us to remain invested. That is what makes our EPSS a fantastic for driving out market ups and downs, for every type of traders.

Buyers who’re planning for his or her dream dwelling in subsequent 20 years, may simply hold her ELSS investments going lengthy after the lock-in.

Whether or not we’re loojing for tax financial savings or dreaming of a giant corpus, ELSS appears to tick each containers.

However is it the best choice on the market?

Let’s examine it with ULIPs, NPS, Flexi Cap funds, and Giant Cap funds to seek out out extra.

ELSS vs. ULIP

A Comparability

| Parameter | ELSS | ULIP |

|---|---|---|

| Objective | Wealth creation With Tax Saving | Life insurance coverage, Fairness publicity With Tax Saving |

| Funding Sort | Pure Fairness Publicity – minimal 80% | Premium break up between life insurance coverage and investments in fairness, debt, or hybrid funds. |

| Lock-in Interval | 3 years | 5 years |

| Returns Potential | 15-18% CAGR in 10-12 months Interval | 8-10% CAGR in 10-12 months Interval |

| Tax Advantages | Deduction as much as Rs. 1.5 lakh beneath Part 80C. Lengthy-term capital positive factors (LTCG) above Rs. 1.25 lakh taxed at 12.5%. | Deduction as much as Rs. 1.5 lakh beneath Part 80C. Maturity proceeds tax-free beneath Part 10(10D) |

| Expenses | Expense ratio sometimes 0-1% (Direct Plans) and 1-2% (Common Plans) | Max 2.25% over a 10-12 months interval. |

| Flexibility | Restricted flexibility; fastened fairness focus with no choice to change to debt or hybrid funds. | Excessive flexibility; permits switching between fairness, debt, or hybrid funds primarily based on market situations. |

| Danger Stage | Larger danger | Average danger |

| Liquidity | Liquidity after 3 Years lock-in | Liquidity after 5 Years lock-in |

| Transparency | Portfolio holdings very seen | Portfolio holdings, vert low visibility |

| Who Ought to Purchase | Buyers in search of excessive returns with a tax saving additionally as their aim | People who find themselves in on the lookout for life insurance coverage (for tax saving) purchase additionally needs some returns |

ULIPs (Unit Linked Insurance coverage Plans) are one other Part 80C prime contender, like ELSS.

ULIPs mix funding and insurance coverage. It seems like a neat bundle. However let’s be trustworthy, after I first checked out ULIPs, I bought too confused by way of jargon in it. Premium allocation costs, mortality costs, fund administration charges, it was form of a distractor. It felt like a puzzle and therefore probabilities of ignoring a ULIP turns into too excessive.

Neverthless, it’s a honest funding choice, so permit me to elucidate how ULIPs work:

- First, you pay a premium.

- Part of your premium will purchase the life insurance coverage for you.

- The remainder is invested in fairness, debt, or hybrid funds.

Like ELSS, ULIPs qualify for a Rs. 1.5 lakh tax deduction. The most effective a part of a ULIP is, the maturity quantity is tax-free beneath Part 10(10D).

However there may be additionally a catch. ULIPs include a 5-year lock-in and excessive costs. Within the first few years, charges can eat up 10-20% of your premium, leaving much less cash to develop.

Speaking about returns, ULIPs sometimes ship 7-12% over 5 years, a lot decrease than ELSS’s 15-20%.

My neighbor invested in a ULIP 10 years in the past, hoping for a giant payout. He was dissatisfied to see his corpus barely beat inflation after charges.

ELSS, direct plans, with its decrease expense ratios (0.5-1%), leaves extra of your cash working for you.

ULIPs would possibly make sense for those who want insurance coverage and funding in a single go. However for pure wealth-building and even tax-saving, ELSS is the clear winner.

Why pay for insurance coverage you would possibly have already got by way of a time period plan?

ELSS vs. NPS

A Comparability

| Parameter | ELSS | NPS |

|---|---|---|

| Objective | Wealth creation With Tax Saving | Retirement Planning With Tax Saving |

| Funding Sort | Pure Fairness Publicity – minimal 80% | Customized Portfolio: Mixture of fairness, company bonds, and authorities securities |

| Lock-in Interval | 3 years | Till retirement (age 60); partial withdrawals allowed after 3 years beneath particular situations. |

| Returns Potential | 15-18% CAGR in 10-12 months Interval | 8-12% CAGR in 10-12 months Interval |

| Tax Advantages | Deduction as much as Rs. 1.5 lakh beneath Part 80C. LTCG above Rs. 1.25 lakh taxed at 12.5%. | Deduction as much as Rs. 1.5 lakh beneath Part 80C + Rs. 50,000 beneath Part 80CCD(1B). 60% withdrawal tax-free at maturity |

| Expenses | Expense ratio sometimes 0-1% (Direct Plans) and 1-2% (Common Plans) | und administration charges capped at 0.09% |

| Flexibility | Restricted flexibility; fastened fairness focus with no choice to change to debt or hybrid funds. | Customise fairness/debt) or auto (lifecycle-based) plans |

| Danger Stage | Larger danger because of fairness publicity; appropriate for medium to excessive danger urge for food. | Average danger; diversified throughout asset lessons, with choice for conservative debt-heavy allocation. |

| Liquidity | Liquidity after 3 Years lock-in | Locked till 60 Withdrawal allowed solely beneath particular situations after 3 years |

| Transparency | Portfolio holdings very seen | Portfolio holdings very seen however updates are much less frequent. |

| Who Ought to Purchase | Buyers in search of excessive returns with a tax saving additionally as their aim | Individuals who needs authorities backed (secure) retirement planning with fairness publicity (for increased returns than EPF) |

Subsequent we are going to examine ELSS with NPS (Nationwide Pension System).

The NPS has been particularly designed as a retirement product. Therefore, it has gained good traction from salaried folks.

NPS lets us allocate your cash throughout fairness, debt, and various property, with as much as 75% in equities. It’s additionally tax-friendly because the contribution to NPS are deductible from Rs. 1.5 lakh u/s Part 80C. A further deduction of Rs. 50,000 beneath Part 80CCD(1B) can also be obtainable for NPS contributors.

For people who find themselves within the 30%, full NPS contribution can save about Rs. 62,400 every year.

However NPS comes with a giant trade-off: it’s locked till you flip 60.

For those who’re 35, that’s a 25-year dedication. At maturity, 60% of your corpus is tax-free, however 40% should be used to purchase an annuity, which is taxable. Annuities typically yield low returns, round 5-6%, which isn’t thrilling for long-term wealth-building.

Returns-wise, NPS fairness funds have delivered 10-12% over 5 years. It’s stable however not as excessive as ELSS.

Individuals like me, who all the time noticed my EPF develop at about 7.5% ranges, NPS giving even 10% returns continues to be a giant thumbs-up. However the identical NPS seen from the ELSS perspective, dosen’t look as thrilling.

ELSS vs. Flexi Cap and Giant Cap Funds

Flexi Cap and Giant Cap mutual funds don’t provide tax advantages, however are glorious for wealth creation.

- Flexi Cap funds make investments throughout massive, mid, and small-cap shares, very similar to ELSS.

- Giant Cap funds keep on with the highest 100 firms. This fashion, their NAVs are much less risky however probably much less rewarding (in phrases increased returns).

Flexi Cap funds, like JM Flexi Cap fund has given a return of 16% in final 10 Years. In final 5 years, its CAGR is about 28% each year. It has barely outperformed ELSS..

However we should not neglect that ELSS additionally provides us tax financial savings. If we take this into consideration, internet return of ELSS will probably be higher than reported.

For instance, for those who make investments Rs. 1.5 lakh in a Flexi Cap fund, you get no tax break. In ELSS, that very same funding saves you Rs. 46,800 in taxes, successfully decreasing your out-of-pocket value.

Giant Cap funds, like ICICI Prudential Bluechip has yileding 14.8% over final 10 years. In final 5 years, its return is about 25% each year (so excessive because of covid impact). In regular circumstances, massive cap funds can yield about sub 16% each year.

Giant cap funds are nice for conservative traders. I believe, individuals who don’t like NPS as a returement builder, massive cap funds is usually a higher various.

For people who find themselves comfy with some danger, ELSS or Flexi Cap funds may yield higher returns.

The most important benefit of Flexi Cap and Giant Cap funds? No lock-in. You possibly can redeem anytime, not like ELSS’s 3-year dedication.

However I believe, for long-term traders, that lock-in isn’t such a giant fear. Many shares in my portfolio has been there for 7-10+ years.

Are ELSS Funds Giant Cap or One thing Else?

A typical query I hear is whether or not ELSS funds are simply Giant Cap funds in disguise.

Not fairly. ELSS funds are mandated to take a position a minimum of 80% in equities, however they’re free to allocate throughout massive, mid, and small-cap shares.

In apply, most ELSS funds lean closely on massive caps for stability. Firms like Reliance or HDFC Financial institution, ICICI Financial institution, and so forth represent 50-60% of ELSS fund’s portfolio. However additionally they sprinkle in mid and small caps for progress.

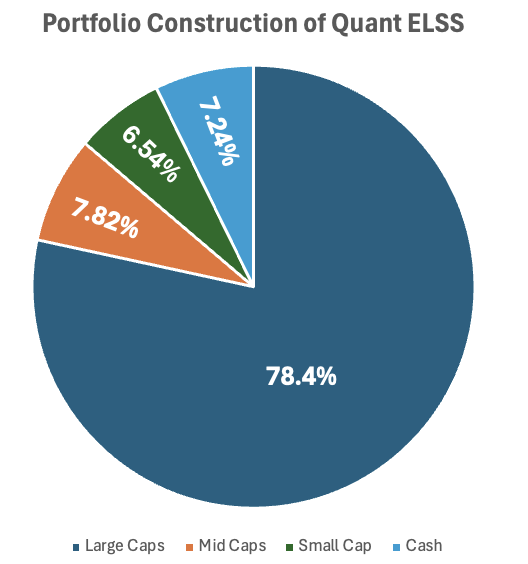

For instance, Quant ELSS Tax Saver has a mixture of 78.4% massive caps, 7.82% mid caps, and 6.54% small caps. This makes ELSS funds extra like Flexi Cap funds than pure Giant Cap funds.

Is ELSS Higher Than Different Mutual Funds?

ELSS is a kind of mutual fund, so evaluating it to “different mutual funds” is like evaluating apples to oranges.

- For those who’re fairness funds like Flexi Cap or Giant Cap, ELSS holds its personal with related returns (15-18% over 10 years) plus tax advantages.

- Towards debt funds or hybrid funds, ELSS is riskier however provides increased progress potential.

The actual query is whether or not ELSS matches your targets.

If you would like tax financial savings and fairness publicity, ELSS is difficult to beat.

For those who’ve already used up your Part 80C restrict or want liquidity, Flexi Cap or Giant Cap funds is likely to be higher.

It’s not about “higher” however about what fits your wants. In case you are a newbie who has full part 80Cw huge open to be used, ELSS turns into your best option. I believe, it is going to even beat direct inventory investing.

To make issues crystal clear, right here’s a side-by-side comparability of those choices.

I’ve assumed you’re investing Rs. 1.5 lakh per 12 months for 20 years, within the 30% tax bracket, aiming for wealth creation.

ELSS Comparability Instrument

Who Ought to Select ELSS?

Think about you’re somebody in 30-year-old age bracked and a salaried skilled incomes about Rs. 1 lakh a month.

Your aim is to purchase a home within the subsequent 20 years. Until date, You haven’t used your Part 80C restrict, and also you’re okay with some market danger. What’s the most effective choose?

For me, ELSS stands out. It’s like getting two birds with one stone, tax financial savings of Rs. 46,800 a 12 months and a possible corpus of Rs. 2.6 crore in 20 years.

The three-year lock-in is brief sufficient to present us the pliability, and the fairness publicity aligns with long-term wealth targets.

- ULIPs? They’re too pricey and underperform for wealth-building.

- NPS is nice for retirement-focused of us, however the lock-in until 60 appears like a cage if one needs the entry sooner.

- Flexi Cap funds are implausible for prime returns and liquidity, however with out tax financial savings, I believe they fall simply in need of ELSS.

- Giant Cap funds are safer however received’t develop our cash as quick.

For those who’ve already maxed out Part 80C, Flexi Cap funds could possibly be a wiser choose.

Conclusion

ELSS is one funding choice that may boost our monetary plan.

It would provide tax financial savings and wealth-building in a single go.

In comparison with ULIPs, NPS, Flexi Cap, or Giant Cap funds, it strikes a novel stability of flexibility, returns, and tax advantages.

However we should additionally keep in mind that no single choice is ideal for everybody. Our targets, danger urge for food, and monetary scenario matter.

So, take a second to replicate. Are you saving for a dream dwelling? Planning for retirement? Or simply making an attempt to chop your tax invoice? No matter it’s, ELSS could possibly be a fantastic place to begin.

Have a contented investing.