Picture supply: Getty Photos

Taking a Shares and Shares ISA from £20,000 to £1m is bold however theoretically attainable. For instance, if a mean development fee of 12% a 12 months may very well be sustained for 35 years, a seven-figure portfolio would end result.

In actual fact, since September 2020, the share value of the FTSE 100’s Endeavour Mining (LSE:EDV) has grown by a mean of 13.4% a 12 months. If that fee held regular, somebody may turn into an ISA millionaire inside 32 years.

Nevertheless, a double-figure development fee is the exception somewhat than the norm. And previous efficiency shouldn’t be relied upon to foretell future returns.

An asset for unsure instances

However Endeavour, one of many world’s main gold producers and the most important in West Africa, has achieved this feat on the again of hovering costs. Throughout instances of financial uncertainty, traders are likely to swap different monetary belongings for gold.

Because the desk under reveals, the common value acquired by the group in the course of the second quarter of 2025 was 62% larger than within the final quarter of 2023. Over this era, prices have additionally risen however much less shortly. The group claims to have the fourth-lowest all-in sustaining value within the trade (AISC). The result’s larger earnings and a hovering share value.

In 2024, by a mixture of share buybacks and dividends, Endeavour reckons it returned $251 to shareholders for each ounce of gold it produced. For the primary half of 2025, the equal determine was $338.

| Quarter | Realised gold value ($/oz) | AISC ($/oz) |

|---|---|---|

| This fall 2023 | 1,945 | 947 |

| Q1 2024 | 2,041 | 1,186 |

| Q2 2024 | 2,287 | 1,287 |

| Q3 2024 | 2,342 | 1,287 |

| This fall 2024 | 2,590 | 1,141 |

| Q1 2025 | 2,783 | 1,129 |

| Q2 2025 | 3,150 | 1,458 |

Taking benefit

To attempt to capitalise on this curiosity within the treasured steel, the World Gold Council, the commerce physique for the trade, has made a documentary referred to as Elton John: Touched by Gold. Throughout the movie, the well-known singer describes the steel as “timeless” in addition to representing one thing that’s “inspirational, awe-inspiring and joyous”.

Anybody who has invested in Endeavour over the previous few years will in all probability agree with Sir Elton. However I doubt whether or not a 26-minute “unique entry” documentary that includes plenty of gold boots, glasses, and jewelry – in addition to his assortment of gold discs — may have a lot of an impression on costs. Economists reckon world financial institution demand and inflation, notably within the US, may have extra of an affect.

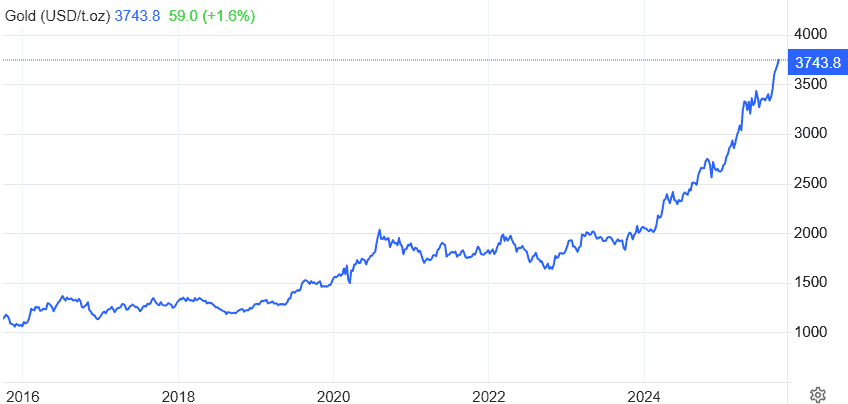

However there are challenges that Endeavour should take care of. Because the chart under reveals, costs will be unstable. If gold begins to fall, there’s more likely to be a big pullback within the group’s share value.

As well as, mining is operationally difficult, notably in rural Africa the place its principal belongings are positioned. Currencies on the continent may also fluctuate considerably and, in the event that they go within the unsuitable route, may adversely impression earnings.

Wanting forward

Nevertheless, in the meanwhile, there’s no signal of a slowdown in gold costs and most observers imagine the rally’s not over but.

The present (26 September) value is round $3,750. And on account of geopolitical issues, tensions between President Trump and the US Federal Reserve, and “strong” central financial institution purchases, UBS is predicting $3,800 by the top of 2025 and $3,900 by mid-2026.

Deutsche Financial institution is extra bullish and reckons it may break by the $4,000-barrier someday in 2026. Trade specialists seem to agree that present market situations make a pointy correction unlikely.

On this foundation, as a long-term hedge in opposition to world uncertainty, I reckon Endeavour Mining is a inventory to contemplate.